1. What is the projected Compound Annual Growth Rate (CAGR) of the Tamper-evident Labels for Packaging?

The projected CAGR is approximately 6%.

Tamper-evident Labels for Packaging

Tamper-evident Labels for PackagingTamper-evident Labels for Packaging by Type (PET, Paper), by Application (Food, Beverages, Cosmetic, Pharmaceuticals, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

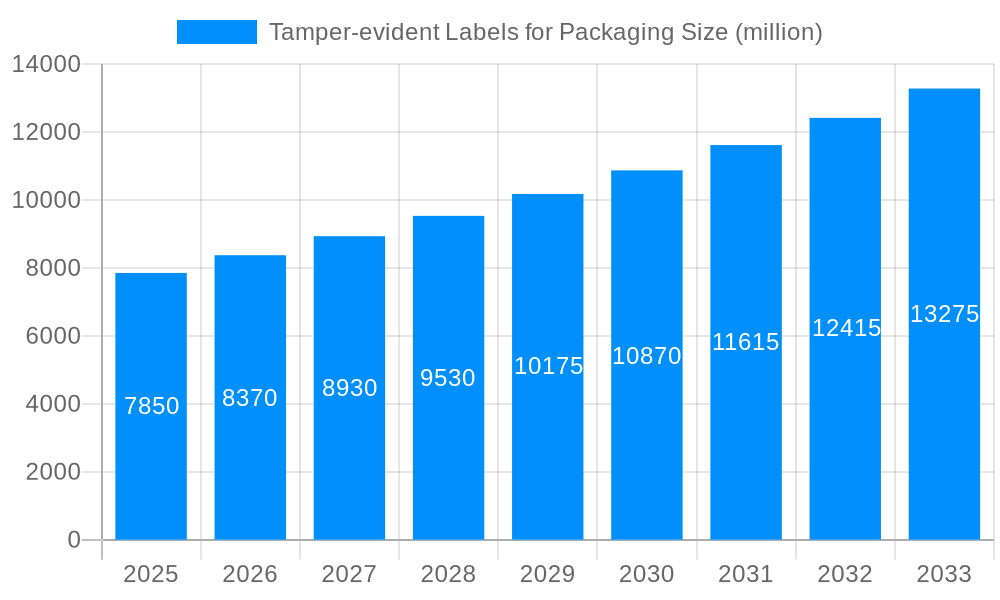

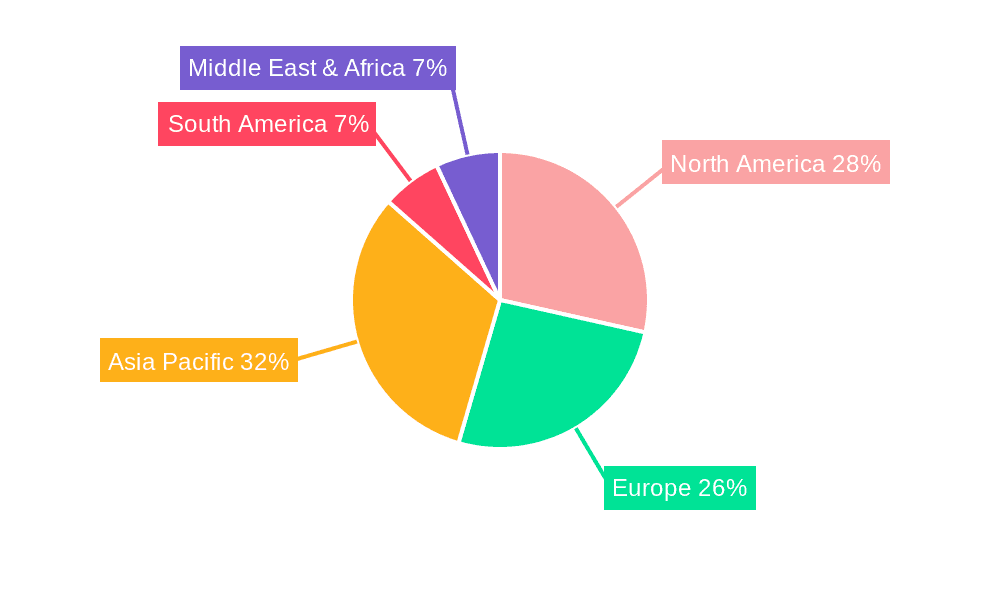

The global Tamper-Evident Labels for Packaging market is poised for substantial growth, projected to reach an estimated market size of approximately $7,850 million by 2025, expanding at a robust Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This expansion is fueled by a confluence of factors, most notably the escalating demand for enhanced product security and consumer trust across a multitude of industries. As regulatory bodies worldwide increasingly prioritize consumer safety and manufacturers seek to safeguard their brands from counterfeiting and product diversion, tamper-evident labels have emerged as a critical component of packaging solutions. The market's dynamism is further propelled by the rising adoption of these labels in the food and beverage sector, where maintaining product integrity and preventing contamination are paramount. Similarly, the pharmaceutical industry's stringent requirements for drug security and the cosmetic sector's focus on brand protection are significant drivers. Innovations in material science, such as the development of advanced PET and paper-based tamper-evident solutions offering superior durability and tamper-indication properties, are also contributing to market expansion. Emerging economies, particularly in the Asia Pacific region, are witnessing rapid industrialization and a growing middle class, translating into increased consumption of packaged goods and, consequently, a surge in demand for tamper-evident labeling.

The market is characterized by diverse applications and a competitive landscape featuring key players like Avery Dennison, 3M Company, and Tesa SE, alongside specialized providers such as HERMA and Tamperguard. These companies are actively investing in research and development to introduce innovative solutions, including smart labels with enhanced security features and more sustainable material options. While the market exhibits strong growth potential, certain restraints need to be considered. The initial cost of implementing advanced tamper-evident labeling systems can be a barrier for some smaller enterprises, and the development of sophisticated counterfeiting techniques poses an ongoing challenge. Nevertheless, the overarching trend towards heightened product security, coupled with evolving consumer expectations and stringent regulatory frameworks, ensures a promising trajectory for the tamper-evident labels for packaging market. The forecast period is expected to see continued innovation, with a greater emphasis on customized solutions and integrated security features that go beyond simple visual indicators, thereby solidifying the market's importance in ensuring the integrity of packaged goods.

This comprehensive report provides an in-depth analysis of the global Tamper-evident Labels for Packaging market, meticulously examining its evolution from 2019 to 2033. With a base year of 2025 and a forecast period extending from 2025 to 2033, this study leverages historical data from 2019-2024 to deliver actionable insights. The market is projected to witness substantial growth, with an estimated volume of 1,500 million units in 2025, escalating to an impressive 2,200 million units by 2033. The report offers a detailed breakdown of market dynamics, encompassing key trends, driving forces, challenges, regional dominance, growth catalysts, and a comprehensive overview of leading industry players and their significant developments.

The global Tamper-evident Labels for Packaging market is experiencing a transformative phase, driven by an escalating emphasis on product security, regulatory compliance, and enhanced consumer trust across diverse industries. A significant trend observed is the increasing adoption of advanced security features integrated into these labels, moving beyond simple void-message indicators. This includes the incorporation of holographic elements, micro-printing, UV-reactive inks, and even RFID or NFC tags that enable track-and-trace capabilities and provide consumers with verifiable product authentication. The Pharmaceuticals segment, in particular, is a frontrunner in this trend, driven by stringent regulations aimed at combating counterfeit drugs and ensuring patient safety. The sheer volume of pharmaceuticals requiring secure packaging, estimated to be in the hundreds of millions of units annually, directly fuels the demand for sophisticated tamper-evident solutions. Similarly, the Food and Beverages sectors are increasingly embracing these labels, not only for regulatory adherence but also to assure consumers of product integrity, particularly for premium or organic offerings. The growing awareness of food fraud and the desire for transparency are compelling manufacturers to invest in labeling technologies that can unequivocally demonstrate an unbroken supply chain. Furthermore, the Cosmetic industry, facing its own challenges with counterfeiting and brand reputation, is also witnessing a surge in demand for tamper-evident labels, seeking to protect brand integrity and consumer well-being. The shift towards sustainable packaging solutions is also influencing label design and material selection. Manufacturers are exploring eco-friendly substrates and adhesives that offer robust tamper-evidence without compromising environmental commitments. This confluence of security enhancements, regulatory pressures, and evolving consumer expectations is shaping a dynamic and rapidly expanding market for tamper-evident labels. The market's trajectory indicates a continuous innovation cycle, with the estimated volume set to grow significantly in the coming years, reflecting the indispensable role these labels play in modern packaging.

The burgeoning demand for tamper-evident labels for packaging is propelled by a potent combination of escalating regulatory mandates, a heightened consumer consciousness regarding product safety, and the relentless pursuit of brand integrity by manufacturers. Governments worldwide are implementing and tightening regulations across sectors like pharmaceuticals, food, and beverages to safeguard consumers from adulterated or counterfeit products. These regulations often mandate the use of tamper-evident features, making them a non-negotiable aspect of packaging. For instance, the pharmaceutical industry, with an estimated annual global market for medications in the trillions of dollars, faces particularly rigorous controls, necessitating tamper-evident solutions for a substantial portion of its packaging, potentially amounting to billions of units. This regulatory imperative directly translates into increased market penetration for tamper-evident labels. Simultaneously, consumers are becoming more discerning, actively seeking assurances of product authenticity and safety. A growing number of consumers are willing to pay a premium for products that offer verifiable evidence of being untouched before purchase. This consumer-driven demand for trust and transparency further incentivizes manufacturers to adopt these advanced labeling solutions. The sheer volume of consumer goods produced globally, estimated in the tens of billions of units annually, underscores the vast potential for tamper-evident label application. Moreover, brand owners are acutely aware of the reputational damage that can result from product tampering or counterfeiting. Protecting brand equity and maintaining customer loyalty are paramount, making tamper-evident labels a strategic investment in safeguarding their market position. The ongoing globalization of supply chains, while offering efficiency, also introduces vulnerabilities that tamper-evident labels effectively mitigate, further solidifying their importance.

Despite the robust growth trajectory, the Tamper-evident Labels for Packaging market encounters several challenges and restraints that can influence its pace and adoption rates. One primary concern is the cost of implementation. Advanced tamper-evident technologies, while offering superior security, can be more expensive than conventional labels. This cost factor can be a significant barrier for small and medium-sized enterprises (SMEs) or for low-margin product categories where cost optimization is critical. The initial investment in specialized printing equipment and materials might deter some businesses, especially in emerging markets with sensitive price points. Furthermore, the complexity of application for certain high-security labels can pose a challenge. Some advanced labels require precise application techniques and specialized machinery to ensure their effectiveness, which can increase operational overhead and require staff training. This can be particularly problematic for companies with high-volume production lines where any disruption or slowdown can lead to substantial losses. For example, in the food packaging sector, where production speeds can exceed hundreds of units per minute, the integration of complex tamper-evident labeling without compromising efficiency is a significant hurdle. Another restraint is the potential for consumer confusion or inconvenience. If tamper-evident features are overly difficult to break or leave behind excessive residue, it can lead to negative consumer experiences. While the intent is security, an overly aggressive tamper-evident mechanism can frustrate consumers, potentially impacting brand perception. Moreover, the development of sophisticated counterfeiting techniques presents an ongoing arms race. As tamper-evident technologies advance, counterfeiters also evolve their methods to bypass these security measures. This necessitates continuous innovation and investment from label manufacturers, adding to the overall cost and complexity of the market. Finally, environmental concerns associated with certain label materials and adhesives, particularly those used for advanced tamper-evidence, can be a restraint as regulatory bodies and consumers push for more sustainable packaging solutions.

The global Tamper-evident Labels for Packaging market is poised for significant growth, with several regions and segments expected to exhibit dominant performance. Among the types of materials used for tamper-evident labels, PET (Polyethylene Terephthalate) is projected to emerge as a leading segment, holding a substantial market share. This dominance is attributed to PET's excellent durability, clarity, chemical resistance, and its ability to accommodate a wide range of security features, including intricate printing and holographic overlays. The estimated annual global demand for PET-based tamper-evident labels is expected to reach several hundred million units, driven by its versatility across various applications.

Key Segments Driving Dominance:

PET Labels:

Pharmaceutical Application:

Geographic Dominance - North America and Europe:

The synergy between the robust demand from the Pharmaceuticals application and the material advantage of PET labels, coupled with the strong regulatory push and consumer demand in regions like North America and Europe, will be the primary drivers for market dominance. The estimated volume of tamper-evident labels within these dominant segments is projected to be in the billions of units over the forecast period.

The Tamper-evident Labels for Packaging industry is experiencing significant growth catalysts that are accelerating its expansion. Foremost among these is the increasingly stringent global regulatory landscape, particularly in the pharmaceutical and food sectors, which mandates enhanced product security. Furthermore, a rising consumer demand for product authenticity and safety is compelling manufacturers to invest in reliable tamper-evident solutions. The growing concern over product counterfeiting and adulteration across various industries, estimated to impact billions of dollars in revenue globally, acts as a major catalyst, driving the need for robust security features. Finally, technological advancements in label materials and printing techniques are enabling the development of more sophisticated and cost-effective tamper-evident solutions, making them more accessible to a wider range of businesses.

This report offers a holistic view of the Tamper-evident Labels for Packaging market, providing a granular analysis of its multifaceted landscape. Beyond market size and forecasts, the report delves into the intricate dynamics shaping its future. It meticulously examines the technological innovations driving the evolution of tamper-evident solutions, including the integration of smart features and sustainable materials. Furthermore, the report provides insights into the competitive strategies of leading players and the impact of mergers and acquisitions on market consolidation. Understanding the nuanced interplay of these factors is crucial for stakeholders seeking to navigate and capitalize on the opportunities within this dynamic sector. The estimated market volume and its projected growth trajectory are underpinned by a thorough investigation of these underlying drivers and constraints, offering a robust foundation for strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6%.

Key companies in the market include HERMA, NADCO Tapes & Labels, Inc, Luminer, Tamperguard, Shosky, American Casting & Manufacturing Corp, Tesa SE, Avery Dennison, Dunmore, Adampak, Resource Label Group, 3M Company, Technicode Inc, Tailored Label Products, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Tamper-evident Labels for Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Tamper-evident Labels for Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.