1. What is the projected Compound Annual Growth Rate (CAGR) of the Degradable Lunch Box Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Degradable Lunch Box Packaging

Degradable Lunch Box PackagingDegradable Lunch Box Packaging by Type (Sugarcane Raw Material, Bamboo Raw Material, Corn Starch Raw Material, World Degradable Lunch Box Packaging Production ), by Application (Home, Commercial, World Degradable Lunch Box Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

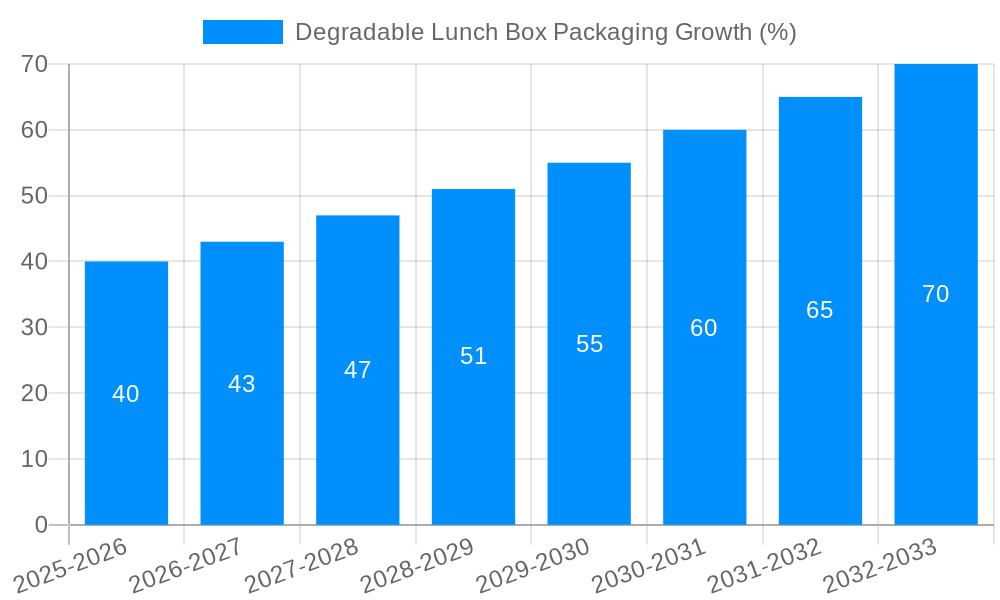

The global degradable lunch box packaging market is experiencing robust expansion, projected to reach an estimated XXX million by 2025, with a compound annual growth rate (CAGR) of XX% during the forecast period of 2025-2033. This significant growth is primarily fueled by a growing global consciousness regarding environmental sustainability and a concerted effort by governments and consumers to reduce plastic waste. The increasing adoption of eco-friendly alternatives by the food service industry, including restaurants, catering businesses, and food delivery platforms, is a major driver. Furthermore, stringent regulations enacted by various nations to curb single-use plastic pollution are compelling manufacturers to invest in and innovate degradable packaging solutions. Consumer preference for convenient, yet environmentally responsible food packaging is also playing a pivotal role in market expansion, leading to greater demand for lunch boxes made from materials like sugarcane bagasse, bamboo, and corn starch.

The market segmentation highlights the diverse applications and raw materials driving this growth. Sugarcane, bamboo, and corn starch-based lunch boxes are gaining traction due to their biodegradability and compostability, offering a sustainable alternative to traditional plastic and Styrofoam. The application segment demonstrates a strong demand from both commercial food service providers and home consumers, reflecting a widespread shift towards greener choices. While the market is poised for substantial growth, potential restraints such as higher production costs compared to conventional packaging and limited availability of large-scale industrial composting facilities in some regions could pose challenges. However, continuous innovation in material science and increasing economies of scale are expected to mitigate these concerns, paving the way for widespread adoption of degradable lunch box packaging globally. The competitive landscape features a mix of established packaging companies and emerging eco-friendly material providers, all striving to capture market share through product innovation and strategic partnerships.

Here's a report description on Degradable Lunch Box Packaging, incorporating your specified elements:

The global degradable lunch box packaging market is experiencing a significant transformative phase, driven by a confluence of escalating environmental consciousness, stringent regulatory landscapes, and evolving consumer preferences. This report delves deep into the market dynamics from 2019-2033, with a keen focus on the Base Year 2025 and the Forecast Period 2025-2033. During the Historical Period 2019-2024, the market witnessed nascent adoption, primarily driven by niche eco-conscious brands. However, the Estimated Year 2025 marks a turning point, with projections indicating a substantial surge in demand. Key market insights reveal a growing preference for materials derived from renewable resources, with sugarcane, bamboo, and corn starch-based packaging progressively capturing market share. The increasing urbanization and the resultant boom in the food service industry, encompassing both commercial establishments and a growing segment of home-based food providers seeking sustainable options, are pivotal drivers.

The report anticipates a market size of approximately 150 million units in 2025, with a projected Compound Annual Growth Rate (CAGR) of over 10% throughout the forecast period. This upward trajectory is underpinned by an increasing awareness of the detrimental impact of traditional plastic packaging on ecosystems. Consumers are actively seeking alternatives that offer comparable functionality without the prolonged environmental persistence. This trend is particularly pronounced in developed economies, where consumer education campaigns and corporate sustainability initiatives have fostered a more receptive market. Furthermore, the cost-competitiveness of degradable alternatives is gradually improving, narrowing the price gap with conventional plastics and making them a more viable option for a broader range of businesses. The diversification of product offerings, from intricate bento boxes to simple takeaway containers, further fuels market expansion, catering to a wide spectrum of culinary needs and consumer lifestyles. The market is thus poised for substantial growth, transitioning from a niche segment to a mainstream solution for food packaging.

The propulsion of the degradable lunch box packaging market is multifaceted, with environmental imperative standing as the foremost driver. A growing global population, coupled with an escalating demand for convenience food and on-the-go meals, has led to an exponential rise in single-use packaging waste. Traditional plastic packaging, notorious for its persistence in landfills and oceans for centuries, has come under intense scrutiny. This has catalyzed a paradigm shift towards sustainable alternatives that break down naturally, minimizing their ecological footprint. Governmental regulations and policies aimed at curbing plastic pollution, such as bans on single-use plastics and incentives for biodegradable materials, are playing a crucial role in shaping market dynamics. Companies are increasingly investing in research and development to produce more efficient and cost-effective degradable packaging solutions. Furthermore, a rising tide of consumer awareness and a desire to make environmentally responsible choices are influencing purchasing decisions, compelling food businesses to adopt greener packaging options to align with customer values and enhance their brand image.

Despite the promising growth trajectory, the degradable lunch box packaging market is not without its hurdles. A primary challenge remains the cost of production for many degradable materials, which can still be higher compared to conventional petroleum-based plastics. This price disparity can deter adoption, particularly among smaller businesses with tighter profit margins. Another significant restraint is the availability and scalability of raw materials. While sugarcane, bamboo, and corn starch are abundant, ensuring a consistent and sustainable supply chain to meet burgeoning global demand requires robust infrastructure and efficient agricultural practices. Consumers often possess limited understanding regarding the proper disposal of degradable packaging, leading to confusion and potential contamination if not composted or disposed of correctly, thus negating their environmental benefits. Furthermore, the performance characteristics of some degradable packaging, such as heat resistance and moisture barrier properties, may not yet match those of traditional plastics for all applications, requiring further innovation and product development. Public perception and education about the true 'degradability' and end-of-life options are critical to overcome these limitations.

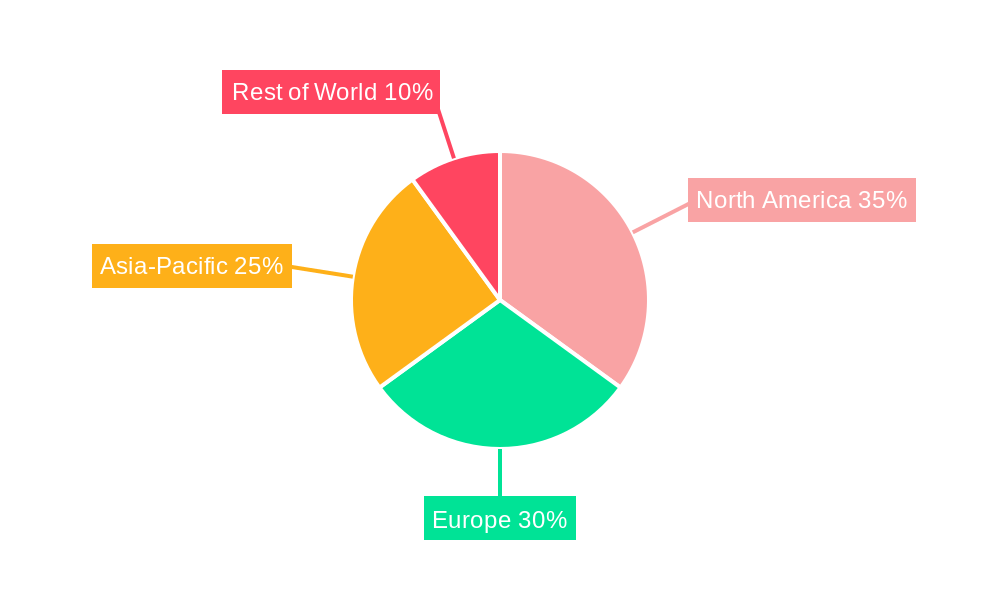

The global degradable lunch box packaging market is poised for significant regional and segmental dominance, with a particular emphasis on the Asia-Pacific region and the Sugarcane Raw Material segment.

Asia-Pacific: This region is set to emerge as a powerhouse in the degradable lunch box packaging market, driven by several converging factors. The sheer scale of its population, coupled with a rapidly growing middle class and an expanding food service industry, creates an enormous demand for packaging solutions. Countries like China, India, and Southeast Asian nations are witnessing a significant surge in disposable income, leading to increased consumption of convenience foods and takeaway meals. Simultaneously, these nations are increasingly recognizing the environmental challenges posed by plastic waste and are implementing policies and regulations to promote sustainable alternatives. For instance, China's "plastic ban" has significantly influenced the adoption of eco-friendly packaging. The presence of a robust manufacturing base further facilitates the production and distribution of degradable lunch boxes. The World Degradable Lunch Box Packaging Production volume in this region is expected to account for a substantial portion of the global output, estimated to reach over 70 million units by 2025. The report predicts a CAGR of approximately 12% for this region during the forecast period.

Sugarcane Raw Material Segment: Among the various raw material types, packaging derived from sugarcane bagasse is expected to exhibit exceptional growth and dominance. Sugarcane is a widely cultivated crop in many parts of the world, particularly in tropical and subtropical regions, ensuring a readily available and renewable source. The processing of sugarcane bagasse, a byproduct of sugar production, into compostable and biodegradable packaging offers an effective waste utilization strategy. This material is known for its excellent strength, heat resistance, and ability to withstand moisture, making it highly suitable for various food applications, from hot meals to cold salads. Its natural aesthetics also appeal to environmentally conscious consumers. The World Degradable Lunch Box Packaging Production utilizing sugarcane raw material is projected to reach around 50 million units in 2025, with a projected CAGR of over 11% during the forecast period. This segment's dominance is further amplified by its versatility across both Home and Commercial applications, where it can effectively replace traditional plastic containers for everyday use and large-scale food service operations. The report estimates this segment alone contributing to over 33% of the total global market value by 2033.

The Commercial application segment, encompassing restaurants, cafes, caterers, and corporate cafeterias, is anticipated to be the larger revenue generator within the degradable lunch box packaging market, surpassing the Home application. This is attributed to the bulk purchasing power of commercial entities and their increasing commitment to corporate social responsibility and sustainability initiatives.

The degradable lunch box packaging industry is fueled by a potent combination of factors that are accelerating its growth. The escalating global concern over plastic pollution and its detrimental impact on marine life and ecosystems is a primary catalyst, driving both consumer and regulatory pressure for sustainable alternatives. Government initiatives, including outright bans on single-use plastics and favorable policies for eco-friendly packaging, are further incentivizing manufacturers and end-users. The growing awareness among consumers about environmental issues and their willingness to support brands with sustainable practices is creating a demand pull. Moreover, continuous technological advancements in material science are leading to the development of more cost-effective, durable, and versatile degradable packaging options, narrowing the gap with traditional plastics.

This comprehensive report offers an in-depth exploration of the global degradable lunch box packaging market, providing invaluable insights for stakeholders across the value chain. Spanning a study period from 2019-2033, it meticulously analyzes market dynamics, growth drivers, challenges, and future projections. The report presents detailed forecasts, with the Base Year 2025 serving as a critical reference point for understanding current market estimations and the Forecast Period 2025-2033 outlining expected trends. It offers a granular breakdown of market segmentation by type of raw material, including Sugarcane Raw Material, Bamboo Raw Material, and Corn Starch Raw Material, as well as by application, covering Home and Commercial use cases. Furthermore, the report highlights the World Degradable Lunch Box Packaging Production volume and key industry developments. The analysis is enriched with a thorough evaluation of leading companies, regional market dominance, and the overarching industry landscape, making it an essential resource for strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

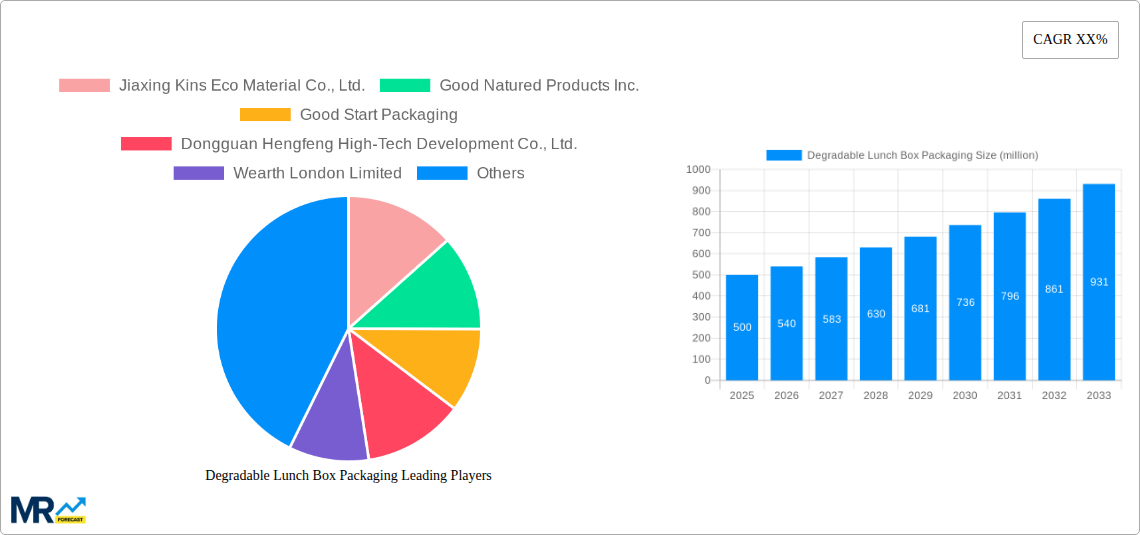

Key companies in the market include Jiaxing Kins Eco Material Co., Ltd., Good Natured Products Inc., Good Start Packaging, Dongguan Hengfeng High-Tech Development Co., Ltd., Wearth London Limited, TIPA Corp, Genpak, Easy Green, Cosmos Eco Friends, Be Green Packaging, Xiamen Lixin Plastic Packing Co., Ltd, Pappco Greenware, Sunways Industry Co., Ltd., Green Man Packaging, Guangzhou Jianxin Plastic Products Co., Ltd..

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Degradable Lunch Box Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Degradable Lunch Box Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.