1. What is the projected Compound Annual Growth Rate (CAGR) of the UV Resistant Ink?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

UV Resistant Ink

UV Resistant InkUV Resistant Ink by Type (1-2, 4-5, 6-7, World UV Resistant Ink Production ), by Application (Printing, Packaging, Others, World UV Resistant Ink Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

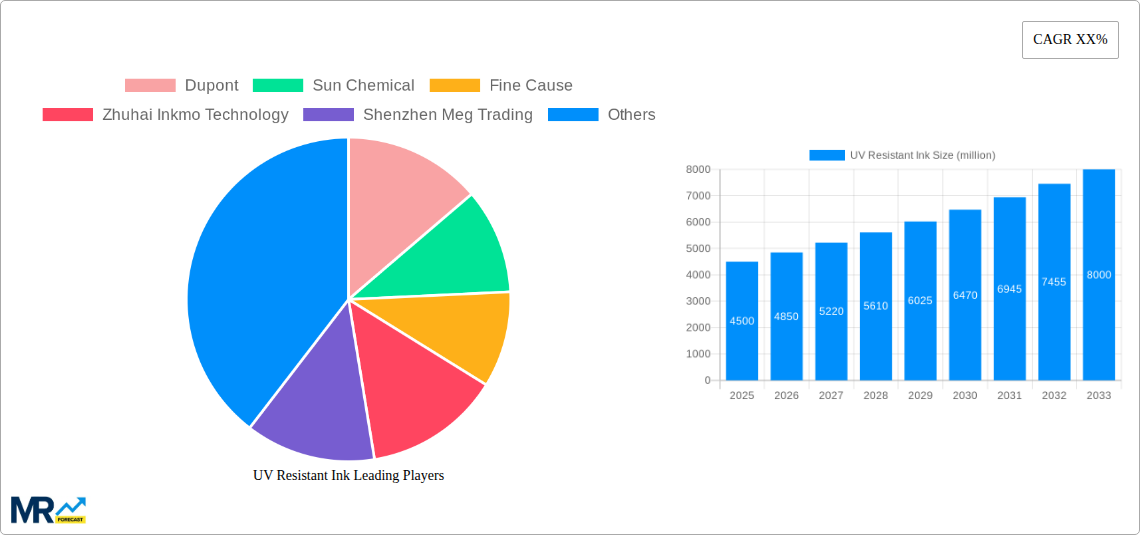

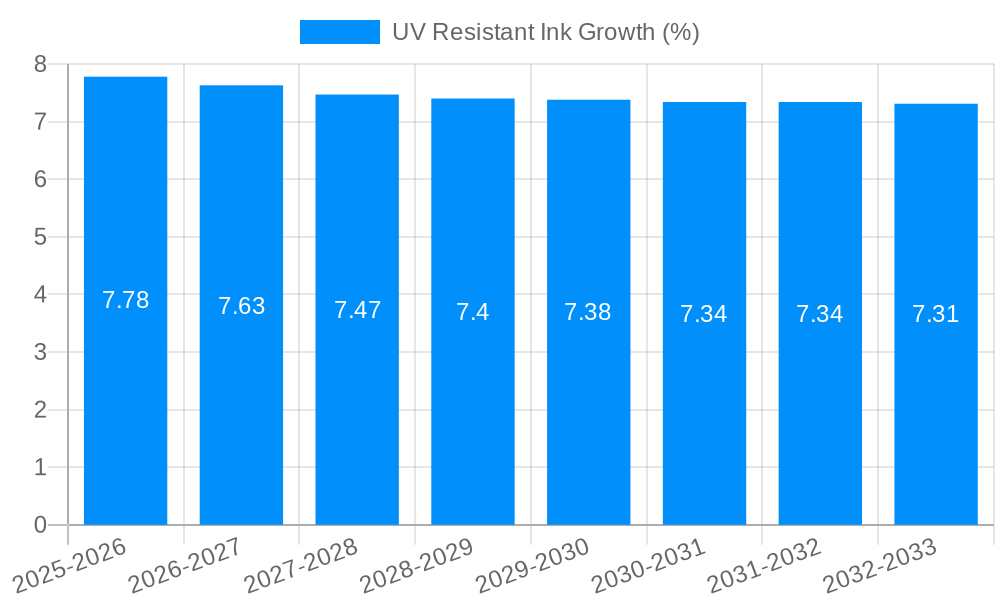

The global UV resistant ink market is poised for significant expansion, projected to reach a substantial market size of approximately USD 4,500 million by 2025. Driven by an estimated Compound Annual Growth Rate (CAGR) of 7.5% over the forecast period of 2025-2033, the market is expected to witness robust growth, culminating in a value unit of USD 8,000 million by 2033. This upward trajectory is primarily fueled by the increasing demand for durable and long-lasting printing solutions across various industries. Key drivers include the growing emphasis on product longevity, enhanced aesthetic appeal, and protection against environmental degradation, particularly UV radiation. The packaging sector, in particular, is a major beneficiary, with brands increasingly opting for UV resistant inks to maintain visual integrity and shelf appeal of their products under varied lighting conditions. Furthermore, advancements in ink formulations, offering improved adhesion, flexibility, and environmental compliance, are also contributing to market momentum.

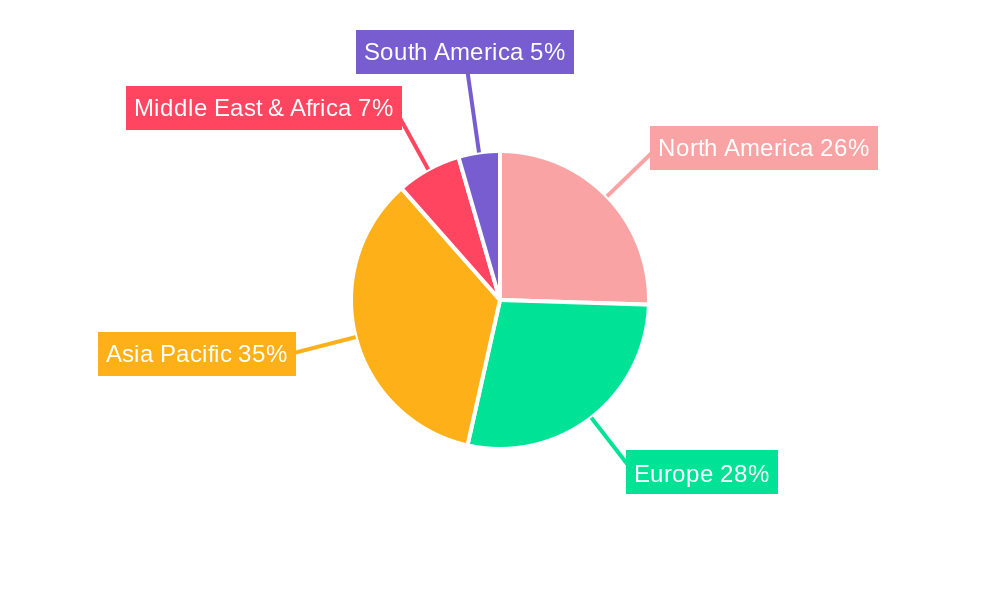

The market is segmented into distinct types, including UV curable inks (1-2), solvent-based UV resistant inks (4-5), water-based UV resistant inks (6-7), and specialized formulations for World UV Resistant Ink Production. Application areas are dominated by printing and packaging, with "Others" encompassing a range of niche uses such as industrial coatings, graphic arts, and electronic printing. Despite the strong growth prospects, the market faces certain restraints, including the initial cost of UV curing equipment and potential regulatory hurdles related to VOC emissions, though advancements in low-VOC and VOC-free formulations are mitigating these concerns. Key players like Dupont, Sun Chemical, Fine Cause, Zhuhai Inkmo Technology, and Shenzhen Meg Trading are actively innovating and expanding their product portfolios to cater to the evolving needs of this dynamic market. Geographic penetration is broad, with North America, Europe, and Asia Pacific leading the charge due to established industrial bases and increasing consumer demand for premium printed materials.

This comprehensive report delves into the dynamic global market for UV resistant inks, offering an in-depth analysis of its evolution and future trajectory. Spanning a study period from 2019 to 2033, with a particular focus on the Base Year of 2025 and a robust Forecast Period of 2025-2033, this report provides actionable insights for stakeholders. It meticulously examines the Historical Period of 2019-2024 to establish a foundational understanding of market trends, key drivers, and prevailing challenges. The report utilizes values in the million unit to quantify market sizes, growth rates, and investment opportunities, ensuring a data-driven perspective.

The global UV resistant ink market is experiencing a significant upward trajectory, driven by an ever-increasing demand for enhanced durability and longevity across a multitude of applications. The World UV Resistant Ink Production is projected to witness robust growth, fueled by advancements in ink formulations that offer superior protection against the damaging effects of ultraviolet radiation. This protection is crucial for maintaining the visual appeal, integrity, and functional properties of printed materials and coated surfaces. For instance, in the Packaging segment, UV resistant inks are becoming indispensable for brand consistency and product shelf-life extension, particularly for goods exposed to sunlight or artificial light sources. The ability of these inks to prevent color fading, cracking, and degradation ensures that packaging remains visually appealing and informative throughout its lifecycle, thereby reducing waste and enhancing consumer trust. Similarly, the Printing industry is witnessing a surge in the adoption of UV resistant inks for outdoor signage, banners, vehicle wraps, and promotional materials, where exposure to harsh environmental conditions is a constant concern. The resilience of these inks translates into longer-lasting graphics and a reduced need for frequent reprints, offering a significant cost-saving benefit for businesses. Furthermore, the "Others" segment, encompassing applications such as electronics, automotive coatings, and architectural finishes, is also demonstrating considerable growth. As technology advances, novel applications requiring extreme UV protection are continuously emerging, further diversifying the market. The trend towards sustainable and eco-friendly solutions is also influencing the development of UV resistant inks, with a growing emphasis on low-VOC (Volatile Organic Compound) formulations and water-based alternatives that align with environmental regulations and consumer preferences. This shift not only addresses ecological concerns but also improves workplace safety. The overall market sentiment is optimistic, with continuous innovation in pigment technology, resin development, and curing mechanisms driving enhanced performance and wider applicability. The market is characterized by a keen focus on developing inks that offer a balance of protection, cost-effectiveness, and ease of application, making them an increasingly sought-after solution for businesses looking to invest in long-term visual and functional preservation. The Estimated Year of 2025 is expected to mark a pivotal point in this growth, with continued acceleration anticipated throughout the forecast period, underscoring the strategic importance of UV resistant ink technologies in modern manufacturing and branding.

The robust growth of the UV resistant ink market is underpinned by several powerful driving forces. Foremost among these is the escalating demand for product longevity and aesthetic preservation across various industries. Consumers and businesses alike are increasingly valuing materials that resist degradation from sunlight and artificial light, leading to a higher adoption rate of UV resistant inks in applications ranging from outdoor signage and vehicle graphics to packaging and consumer goods. This demand for durability directly translates into a reduced need for frequent replacements, offering long-term cost savings and environmental benefits. Furthermore, the expansion of the global packaging industry plays a pivotal role. With a growing e-commerce sector and an emphasis on visually appealing product presentations, the need for packaging that maintains its integrity and color vibrancy during transit and on store shelves is paramount. UV resistant inks are crucial in meeting these demands, protecting labels and graphics from fading and discoloration. The advancement of printing technologies, including digital printing, also contributes significantly. These technologies are becoming more sophisticated, enabling the use of specialized inks like UV resistant variants for intricate designs and high-quality finishes on a wider range of substrates. The development of improved UV curing systems, which offer faster drying times and enhanced ink adhesion, further supports the market's expansion by improving production efficiency. Additionally, increasing awareness regarding the detrimental effects of UV radiation on materials, leading to premature aging and failure, prompts industries to invest in protective solutions, with UV resistant inks being a cost-effective and efficient option.

Despite the promising growth trajectory, the UV resistant ink market is not without its challenges. A primary restraint is the cost factor. While offering long-term benefits, the initial investment in UV resistant inks can be higher compared to conventional inks, which may deter smaller businesses or those operating on tighter budgets. This price sensitivity can limit market penetration in price-conscious segments or regions. Another significant challenge lies in the complexity of formulation and application. Developing UV resistant inks that meet specific performance requirements for diverse substrates and printing processes can be technically demanding. Achieving optimal adhesion, flexibility, and colorfastness while ensuring UV resistance requires specialized knowledge and advanced manufacturing capabilities, potentially creating barriers to entry for new players. Furthermore, the evolving regulatory landscape concerning chemical compositions and environmental impact can pose challenges. Manufacturers must continuously adapt their formulations to comply with ever-changing regulations related to VOC emissions and the use of certain chemical additives. This necessitates ongoing research and development, adding to operational costs. The availability of raw materials and their price volatility can also impact the market. Fluctuations in the cost of pigments, resins, and other key components can affect the overall production cost of UV resistant inks and, consequently, their market price. Lastly, the need for specialized curing equipment, such as UV lamps, can be a hurdle for businesses that do not currently possess this infrastructure, requiring significant capital expenditure for adoption. Addressing these challenges will be crucial for sustained and widespread market growth.

The Packaging segment, specifically within the Asia-Pacific region, is projected to be a dominant force in the global UV resistant ink market. This dominance stems from a confluence of rapidly expanding industrial sectors, burgeoning consumer markets, and a growing emphasis on product presentation and protection. The sheer volume of manufactured goods requiring durable and visually appealing packaging in countries like China, India, and Southeast Asian nations drives substantial demand for UV resistant inks. Asia-Pacific’s manufacturing prowess, particularly in electronics, consumer goods, and automotive components, necessitates packaging that can withstand varying environmental conditions during transit and storage, both domestically and internationally. The e-commerce boom across the region further amplifies this need, as goods are shipped across vast distances, often exposed to sunlight or artificial lighting in warehouses and delivery networks. Therefore, the ability of UV resistant inks to prevent fading, color shifting, and material degradation on packaging is paramount for maintaining brand integrity and product appeal. The World UV Resistant Ink Production originating from and serving this region is expected to be substantial.

Within the Packaging segment, specific sub-applications are particularly impactful:

The Type: 4-5 segment of UV resistant inks, referring to UV-curable inks specifically formulated with properties like enhanced flexibility and abrasion resistance, is anticipated to see significant adoption within the packaging sector. These inks are well-suited for the varied substrates used in packaging, such as flexible films, cardboard, and plastics, offering a balance of performance and cost-effectiveness. The increasing adoption of advanced printing technologies like flexography and gravure printing, which are compatible with these ink types, further supports this trend.

Looking at regional contributions, while the Asia-Pacific region is set to lead in terms of volume, North America and Europe are expected to exhibit steady growth driven by mature markets with a strong emphasis on high-performance applications and sustainability. These regions are characterized by a discerning consumer base and stringent quality standards, pushing manufacturers to adopt premium UV resistant ink solutions for specialized packaging needs, including high-end consumer goods and industrial products. The pursuit of extended product warranties and enhanced brand differentiation further fuels demand in these developed markets. The World UV Resistant Ink Production will thus see a geographically diverse demand, but the sheer scale of manufacturing and consumption in Asia-Pacific positions it for market dominance.

The UV resistant ink industry is experiencing robust growth, propelled by several key catalysts. The increasing demand for enhanced product longevity and aesthetic appeal across diverse applications is a primary driver. Consumers and businesses alike are recognizing the value of materials that resist degradation from UV radiation, leading to wider adoption in packaging, printing, and industrial coatings. Advancements in ink formulation and curing technologies are also playing a crucial role, offering improved performance, faster drying times, and greater compatibility with various substrates, thereby increasing production efficiency and expanding application possibilities.

This comprehensive report offers an in-depth exploration of the global UV resistant ink market, meticulously analyzing its trajectory from 2019 to 2033. With 2025 serving as the base and estimated year, and the forecast period of 2025-2033 providing a forward-looking perspective, the report leverages data in the million unit to quantify market dynamics. It thoroughly examines historical trends from 2019-2024, identifying key drivers, challenges, and opportunities across various segments like Type: 1-2, 4-5, 6-7, World UV Resistant Ink Production, and Application: Printing, Packaging, Others. This detailed analysis provides stakeholders with a holistic understanding of market potential and strategic imperatives for future growth.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Dupont, Sun Chemical, Fine Cause, Zhuhai Inkmo Technology, Shenzhen Meg Trading, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "UV Resistant Ink," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the UV Resistant Ink, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.