1. What is the projected Compound Annual Growth Rate (CAGR) of the Air Bag Packaging?

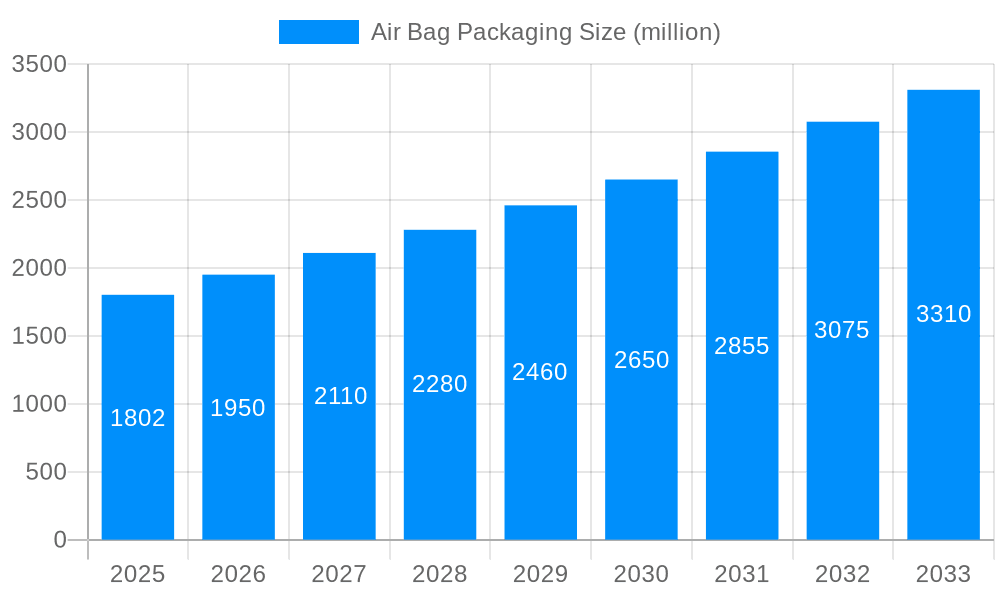

The projected CAGR is approximately 6.57%.

Air Bag Packaging

Air Bag PackagingAir Bag Packaging by Type (Bubble Wraps, Inflated Packaging Bags, Air Pillows, Others, World Air Bag Packaging Production ), by Application (Automotive, Electrical & Electronics, E-Commerce, Shipping & Logistics, Others, World Air Bag Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

The global air bag packaging market is projected for significant expansion, with an estimated market size of $4.35 billion in 2025. This growth is driven by robust demand from e-commerce, shipping, logistics, and the automotive sectors. The inherent protective qualities of air bag packaging, including bubble wraps, inflated bags, and air pillows, are essential for safeguarding goods during transit. The rapid growth of online retail necessitates efficient and cost-effective packaging solutions, directly benefiting this market. Additionally, the automotive industry's increasing focus on lightweight and protective component packaging further fuels market expansion. The emergence of sustainable and biodegradable air bag packaging materials is also gaining momentum, aligning with growing environmental consciousness and regulatory demands.

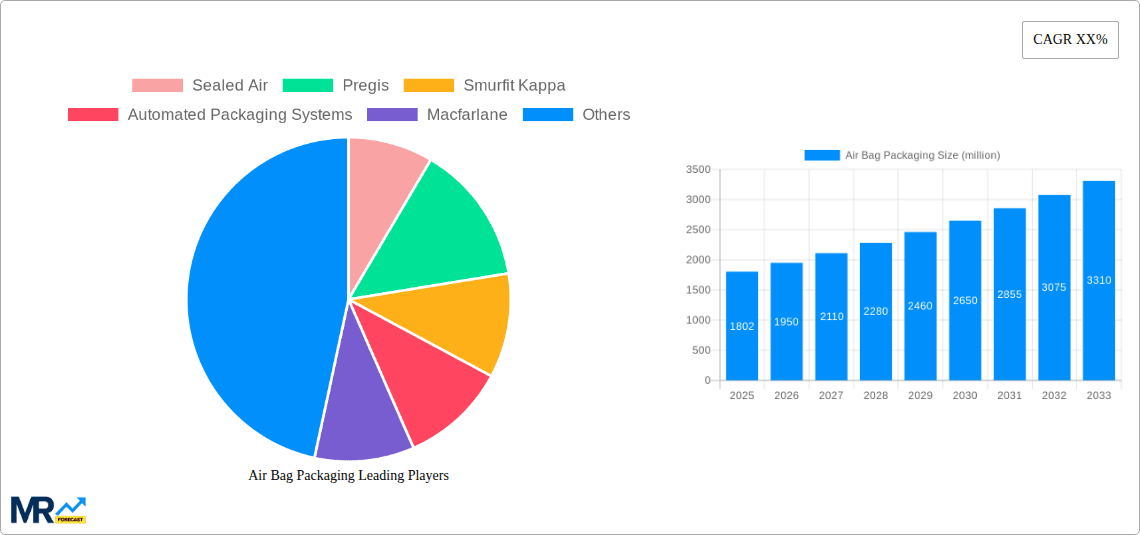

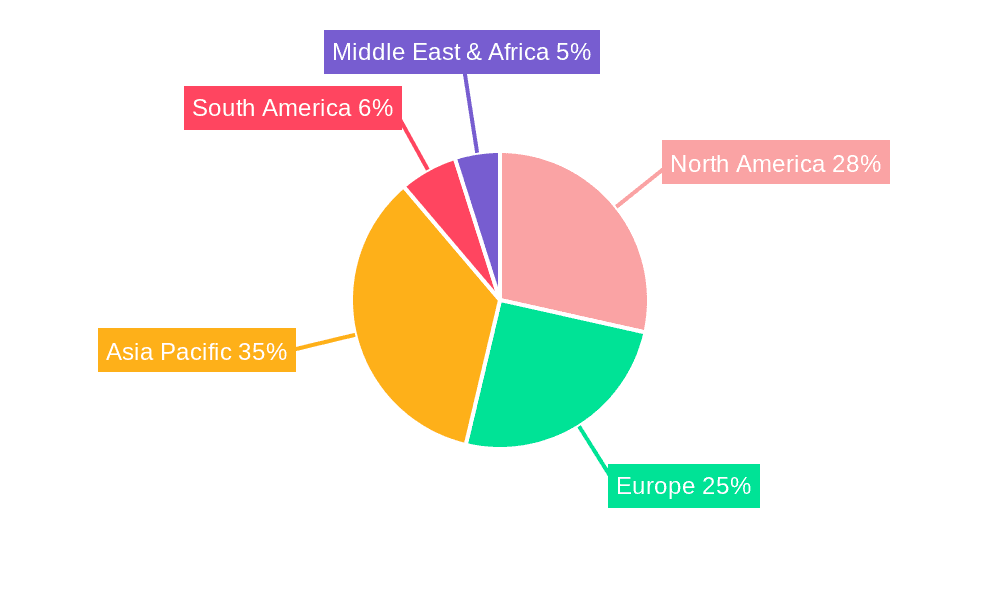

The projected Compound Annual Growth Rate (CAGR) of 6.57% over the forecast period of 2025-2033 indicates a dynamic trajectory for the air bag packaging industry. Leading companies such as Sealed Air, Pregis, and Smurfit Kappa are actively investing in research and development to deliver advanced solutions that meet evolving customer needs and environmental standards. While significant growth drivers are present, potential challenges include raw material cost volatility and intense market competition. However, the increasing adoption of automated packaging systems and the expanding global reach of e-commerce are expected to mitigate these factors. The Asia Pacific and North America regions are anticipated to hold substantial market share due to their advanced manufacturing capabilities and high e-commerce penetration.

This report offers an in-depth analysis of the global air bag packaging market, examining its evolution from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study provides critical insights into production volumes, key growth drivers, prevailing challenges, dominant market segments, and pioneering companies. The methodology incorporates historical data from 2019-2024 to ensure a comprehensive understanding of market dynamics. We project global air bag packaging production in millions of units across various segments and applications, offering a granular perspective on market trends.

XXX The global air bag packaging market is experiencing a period of sustained and robust growth, driven by an ever-increasing demand for protective and efficient packaging solutions across a multitude of industries. The historical period of 2019-2024 witnessed a significant upward trend, a momentum expected to continue and accelerate through the forecast period of 2025-2033. A key trend is the escalating adoption of air bag packaging within the e-commerce sector. As online retail continues its exponential expansion, the need for secure and lightweight packaging to protect goods during transit has become paramount. Air bag packaging, with its ability to cushion fragile items and minimize shipping costs due to its low weight, directly addresses these requirements. In 2025, it is estimated that the e-commerce segment will account for a substantial share of the world air bag packaging production, projected to reach well over 500 million units. This surge is further amplified by the inherent sustainability advantages that many air bag packaging solutions offer. Manufacturers are increasingly focusing on developing eco-friendly options, utilizing recyclable and biodegradable materials, which aligns with growing consumer and regulatory pressure for greener packaging alternatives. The shift towards these sustainable options is not just a trend but a fundamental reorientation of the industry.

Furthermore, the automotive sector remains a significant consumer of air bag packaging, leveraging its protective capabilities for delicate components and finished vehicles. Despite the cyclical nature of the automotive industry, the demand for reliable packaging to prevent damage during assembly and transportation ensures a steady market. In 2025, the automotive sector's contribution to world air bag packaging production is estimated to be around 300 million units. The electrical and electronics industry also presents a strong and growing demand for air bag packaging, driven by the increasing volume and value of electronic goods shipped globally. The inherent fragility of these products makes robust cushioning solutions indispensable. The "Others" segment, encompassing a broad range of applications like industrial equipment, pharmaceuticals, and consumer goods, is also showing promising growth, indicating the versatility and broad applicability of air bag packaging. The overall trend is towards customization and innovation, with companies developing specialized air bag solutions tailored to specific product needs and shipping environments. This includes advancements in material science, leading to stronger, more puncture-resistant, and even temperature-controlled air bag packaging options. The market is also seeing a rise in automated packaging solutions that integrate air bag deployment systems directly into the production line, enhancing efficiency and reducing labor costs. This integration is a critical trend that will define the market in the coming years.

The relentless expansion of e-commerce stands as the primary engine driving the global air bag packaging market forward. The sheer volume of goods being shipped directly to consumers necessitates highly effective, yet cost-efficient, protective solutions. Air bag packaging, with its unparalleled cushioning capabilities, ability to adapt to various product shapes, and lightweight nature, directly addresses the core needs of this booming sector. As online retail continues its ascent, the demand for these protective materials is set to escalate exponentially. Beyond e-commerce, the increasing emphasis on product integrity and damage prevention across all industries is a significant propellant. Businesses are acutely aware that damaged goods not only result in financial losses but also erode customer trust and brand reputation. Air bag packaging offers a reliable barrier against shocks, vibrations, and punctures during transit, thereby safeguarding investments and ensuring customer satisfaction.

The growing global consciousness towards environmental sustainability is another powerful force shaping the air bag packaging landscape. Manufacturers are actively investing in research and development to create air bag packaging solutions made from recycled, recyclable, and biodegradable materials. This commitment to greener alternatives resonates with both consumers and regulatory bodies, making eco-friendly air bag packaging increasingly attractive and, in some cases, a prerequisite for market access. Furthermore, advancements in material science and manufacturing technologies are continuously enhancing the performance and versatility of air bag packaging. Innovations in film extrusion, barrier properties, and deployment systems are leading to lighter, stronger, and more specialized products that cater to an ever-wider array of applications. The pursuit of operational efficiency within supply chains also plays a crucial role. Air bag packaging, particularly when integrated with automated systems, can significantly speed up packing processes, reduce material waste, and optimize shipping density, all of which contribute to cost savings and improved logistics.

Despite the robust growth trajectory, the air bag packaging market faces several challenges and restraints that could temper its expansion. A significant hurdle is the perception and reality of plastic waste and its environmental impact. While advancements in biodegradable and recyclable options are being made, a substantial portion of existing air bag packaging still relies on traditional plastics, leading to concerns about landfill accumulation and pollution. Regulatory pressures, including potential bans or stricter controls on single-use plastics, could pose a considerable threat to market players who have not adequately transitioned to more sustainable alternatives. The initial investment required for automated air bag packaging machinery can also be a barrier, particularly for small and medium-sized enterprises (SMEs). While automation promises long-term cost efficiencies, the upfront capital expenditure might be prohibitive, slowing down adoption rates for some businesses.

The volatility of raw material prices, particularly for the petrochemical-based films used in air bag manufacturing, can impact profit margins and pricing strategies. Fluctuations in the cost of resin and other key components can create unpredictability in the supply chain and affect the overall competitiveness of air bag packaging compared to alternative cushioning materials. Competition from established and emerging alternative packaging solutions also presents a restraint. Materials like molded pulp, paper-based void fill, and foam packaging continue to evolve and offer their own unique advantages, potentially diverting market share from air bag packaging in specific applications. Consumer and business demand for customized solutions, while an opportunity, can also be a challenge. Developing and producing a wide range of specialized air bag packaging designs to meet diverse product and application needs requires significant investment in research, development, and manufacturing flexibility. This can be particularly demanding for smaller players.

The global air bag packaging market is characterized by distinct regional dynamics and segment dominance, with certain areas and product categories poised for significant leadership through the forecast period.

Dominant Regions/Countries:

Dominant Segments:

Type: Inflated Packaging Bags and Air Pillows: These segments are set to dominate the market due to their inherent versatility, cost-effectiveness, and superior cushioning properties, especially for e-commerce and shipping applications.

Application: E-Commerce and Shipping & Logistics:

World Air Bag Packaging Production: The total world air bag packaging production is projected to be in the billions of units. In the base year of 2025, our projections indicate a total production exceeding 2.5 billion units, with steady growth anticipated throughout the forecast period. This substantial volume underscores the critical role air bag packaging plays in the modern global supply chain. The continuous innovation in materials and designs, coupled with the increasing adoption across emerging economies, will ensure this production figure continues to climb, reaching potentially over 3.5 billion units by 2033.

The air bag packaging industry is propelled by several key growth catalysts. The relentless expansion of global e-commerce is the most significant, creating an insatiable demand for protective and lightweight packaging solutions. Growing consumer and regulatory pressure for sustainable packaging alternatives is fostering innovation in biodegradable and recyclable air bag materials. Advancements in automation and integrated packaging systems are enhancing operational efficiency for businesses. Furthermore, the increasing value and fragility of goods being shipped, particularly in the electronics and electrical sectors, necessitate robust cushioning solutions.

This report offers a comprehensive overview of the air bag packaging market, delving into its historical performance, current state, and future projections. It meticulously analyzes the key trends shaping the industry, including the dominant role of e-commerce and the increasing demand for sustainable materials. The report identifies and elaborates on the primary driving forces, such as product protection needs and operational efficiency gains, while also acknowledging the significant challenges and restraints that market players must navigate. Furthermore, it provides an in-depth examination of the leading regions and segments poised for market domination, offering granular insights into production volumes and market share within specific applications and product types. The report concludes by highlighting the pivotal growth catalysts and outlining the strategic importance of leading players and significant industry developments.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.57% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.57%.

Key companies in the market include Sealed Air, Pregis, Smurfit Kappa, Automated Packaging Systems, Macfarlane, Polyair Interpack, Inflatable Packaging, O F Packaging, Advanced Protective Packaging, Free-Flow Packaging International, A E Sutton, Easypack, Uniqbag, Green Light Packaging, Aeris Protective Packaging, .

The market segments include Type, Application.

The market size is estimated to be USD 4.35 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Air Bag Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Air Bag Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.