1. What is the projected Compound Annual Growth Rate (CAGR) of the Cosmetic Glass Container?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cosmetic Glass Container

Cosmetic Glass ContainerCosmetic Glass Container by Type (Jars, Narrow Mouth Bottle, Others), by Application (Skin Care Products, Perfume, Nail Polish, Essential Oil, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

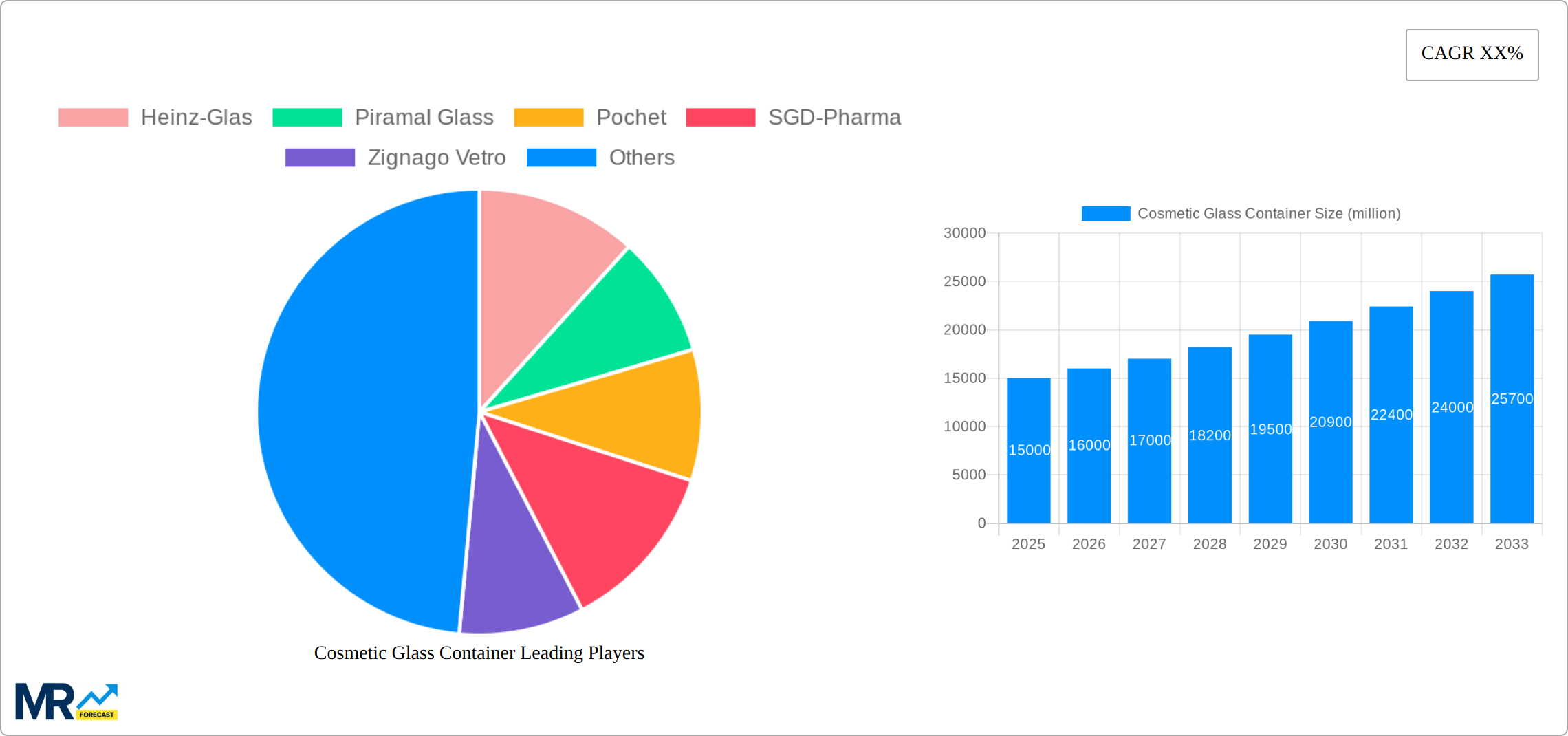

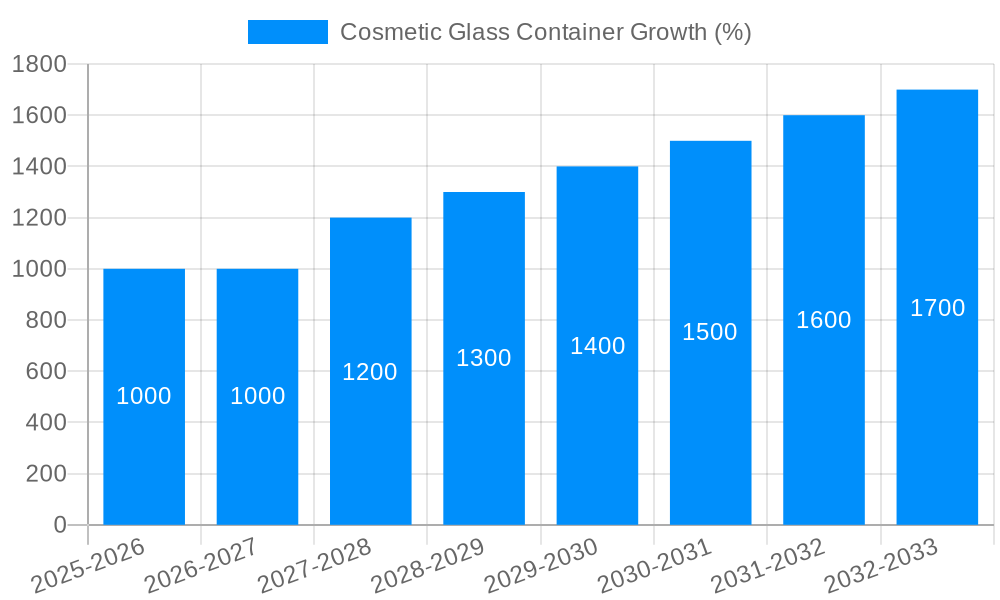

The global Cosmetic Glass Container market is poised for robust growth, projected to reach approximately $15,000 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This substantial expansion is fueled by a confluence of factors, most notably the escalating consumer demand for premium and sustainable beauty products. As awareness regarding the environmental impact of plastics grows, glass containers are increasingly favored for their recyclability and perceived luxury appeal, aligning perfectly with the "clean beauty" movement. The skincare products segment, in particular, is a significant driver, witnessing a surge in demand for elegant and protective packaging that enhances product integrity and brand perception. Perfumes and nail polish also contribute significantly to this growth, with glass bottles and jars offering the aesthetic appeal and chemical inertness crucial for these formulations.

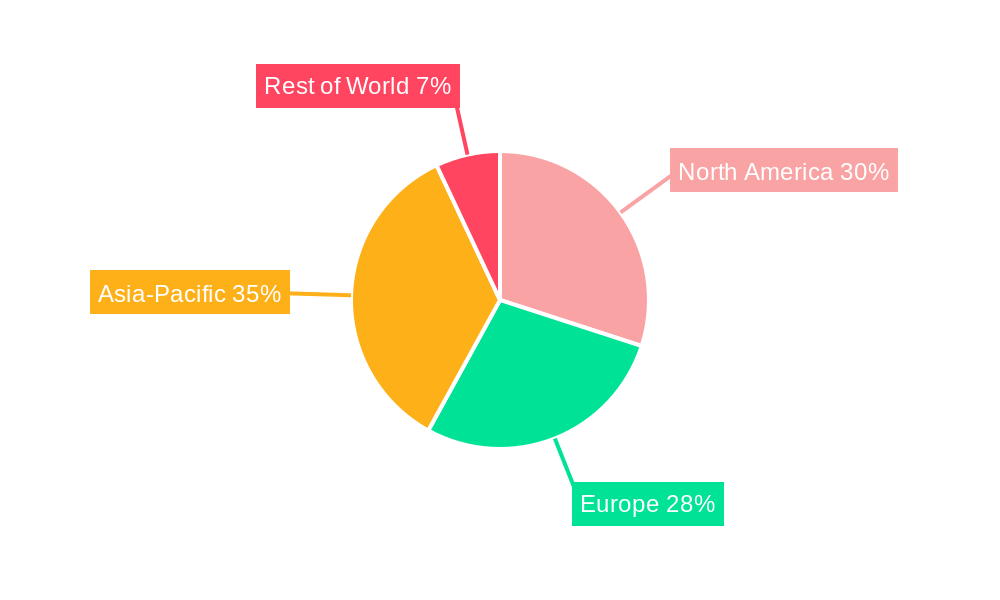

Further bolstering market expansion are key trends such as the increasing adoption of custom and innovative glass packaging designs by cosmetic brands seeking to differentiate themselves in a crowded marketplace. The rise of e-commerce and direct-to-consumer (DTC) models also plays a crucial role, as brands invest in visually appealing and durable packaging that can withstand shipping while maintaining a premium unboxing experience. Geographically, the Asia Pacific region is expected to exhibit the fastest growth, driven by a burgeoning middle class with increasing disposable income and a strong appetite for cosmetic products. While the market benefits from these strong drivers and trends, potential restraints include the higher cost of glass compared to plastic and the associated logistics challenges due to its fragile nature. Nevertheless, the inherent benefits of glass in terms of safety, premium feel, and sustainability are expected to outweigh these challenges, ensuring continued market dominance.

This report offers an in-depth analysis of the global Cosmetic Glass Container market, projecting robust growth and significant transformations between 2019 and 2033. The study, with a base and estimated year of 2025, provides a detailed examination of the market dynamics during the historical period of 2019-2024 and forecasts a compound annual growth rate (CAGR) for the forecast period of 2025-2033. The market is expected to reach $XX million by 2033, driven by evolving consumer preferences, technological advancements, and a growing emphasis on sustainable packaging solutions.

XXX: The global cosmetic glass container market is poised for a substantial expansion, fueled by an escalating consumer demand for premium and eco-conscious beauty products. A significant trend shaping this landscape is the increasing adoption of customizable and aesthetically pleasing glass packaging, reflecting the rising importance of brand identity and perceived value within the cosmetics sector. Consumers, particularly millennials and Gen Z, are demonstrating a strong preference for products housed in glass containers due to their perceived luxury, inertness, and recyclability. This shift is directly impacting the demand for various container types, with a notable surge in the popularity of elegantly designed jars and sophisticated narrow-mouth bottles, especially for high-value skincare formulations and artisanal perfumes. The industry is also witnessing a growing emphasis on innovative features such as integrated applicators, frosted finishes, and unique color infusions, all designed to enhance the user experience and elevate the product's appeal. Furthermore, the concept of refillable glass containers is gaining traction, aligning with the broader sustainability movement and appealing to environmentally aware consumers. This trend not only reduces waste but also fosters brand loyalty by encouraging repeat purchases and a deeper connection with the product. The market is also experiencing a surge in demand for smaller, travel-sized glass containers, catering to the ever-growing travel and tourism industry, as well as consumers who prefer to sample products before committing to larger sizes. The inherent safety and non-reactive nature of glass also make it a preferred choice for sensitive formulations like essential oils and certain skincare products, further broadening its application scope. Looking ahead, the integration of smart packaging technologies, such as QR codes for product authentication and ingredient transparency, within glass containers is expected to become a more prominent trend, offering a seamless blend of functionality and consumer engagement. The overall trajectory indicates a market that is not only growing in volume but also evolving in sophistication and sustainability, driven by a discerning consumer base and innovative manufacturers.

The cosmetic glass container market is experiencing a significant uplift driven by a confluence of powerful factors. Primarily, the unabated growth of the global beauty and personal care industry, valued at several hundred million dollars annually, serves as a foundational driver. As consumers increasingly seek premium and high-quality cosmetic products, the inherent elegance, perceived luxury, and inert nature of glass packaging become highly desirable. This aligns perfectly with the rising disposable incomes in emerging economies, allowing a larger segment of the population to invest in such offerings. Furthermore, the growing consumer consciousness regarding environmental sustainability is a monumental force. Glass, being infinitely recyclable and often made from abundant natural resources, offers a compelling alternative to single-use plastics. This eco-friendly attribute resonates deeply with a substantial portion of the consumer base, pushing brands to adopt glass packaging to align with their sustainability commitments and enhance their brand image. The aesthetic appeal of glass containers also plays a crucial role. Its transparency, ability to be molded into intricate shapes, and the potential for various finishes like frosting and embossing allow brands to create visually stunning and sophisticated packaging that enhances product shelf appeal and reinforces brand identity. Finally, the inertness of glass is paramount for preserving the integrity and efficacy of sensitive cosmetic formulations, such as those containing natural ingredients or potent active compounds, ensuring product quality and safety.

Despite the robust growth potential, the cosmetic glass container market is not without its hurdles. A primary challenge revolves around the fragility of glass, which can lead to higher breakage rates during manufacturing, transit, and consumer handling. This necessitates more stringent packaging and logistics, potentially increasing overall supply chain costs. Furthermore, the weight of glass containers, when compared to plastic alternatives, translates into higher shipping costs and a larger carbon footprint during transportation, posing a counterpoint to its sustainability appeal for some. The higher manufacturing costs associated with glass production, including energy-intensive processes and specialized machinery, can also translate into higher per-unit packaging costs, potentially impacting the affordability of certain cosmetic products. For smaller or budget-friendly cosmetic lines, this can be a significant deterrent. The limited design flexibility compared to plastics, particularly for highly intricate or flexible packaging needs, can also present a constraint. While glass molding technologies are advancing, certain shapes and functionalities remain more readily achievable with plastic. Additionally, the availability and cost of raw materials, although generally abundant, can be subject to market fluctuations, impacting production costs. Finally, the recycling infrastructure in certain regions might not be as developed or efficient for glass as for other materials, which can undermine the perceived environmental benefits if not managed effectively throughout the product lifecycle.

The Asia Pacific region is projected to emerge as a dominant force in the cosmetic glass container market, driven by a burgeoning middle class, rapidly expanding beauty and personal care industries, and increasing consumer expenditure on premium cosmetic products. Countries like China, India, and South Korea are witnessing unprecedented growth in domestic and international cosmetic brands, leading to a substantial demand for high-quality glass packaging. The strong emphasis on skincare routines and the growing popularity of K-beauty and J-beauty aesthetics, which often favor elegant and sophisticated packaging, further solidify Asia Pacific's leading position.

Within the Application segment, Skin Care Products are anticipated to dominate the market. This dominance is fueled by several interconnected factors:

While other segments like Perfume also represent a significant market share due to the strong association of glass with luxury fragrance, and Essential Oils benefiting from glass's inertness and UV protection properties, the sheer volume and consistent demand for skincare products, coupled with the increasing emphasis on premium and sustainable options, position Skin Care Products as the leading application segment in the cosmetic glass container market.

The cosmetic glass container industry is fueled by several key growth catalysts. The escalating demand for luxury and premium beauty products, where glass packaging significantly enhances perceived value and brand prestige, is a primary driver. Furthermore, a growing consumer consciousness towards environmental sustainability is steering brands towards recyclable and reusable glass options, aligning with eco-friendly packaging trends. Advancements in glass manufacturing technologies, enabling intricate designs and innovative shapes, also contribute to market expansion.

This report provides a holistic understanding of the cosmetic glass container market, encompassing a detailed historical analysis from 2019-2024 and a robust forecast for 2025-2033. It delves into the intricate market dynamics, examining key trends, driving forces, and emerging challenges. The report highlights regional dominance and segment-specific growth, with a particular focus on the Skin Care Products application segment and the Asia Pacific region. It also identifies pivotal growth catalysts and meticulously profiles leading industry players, offering valuable insights into their strategies and market positions. Furthermore, the report documents significant industry developments and provides a comprehensive market overview, making it an indispensable resource for stakeholders seeking to navigate this evolving landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Heinz-Glas, Piramal Glass, Pochet, SGD-Pharma, Zignago Vetro, La Glass Vallee, Bormioli Luigi, Gerresheimer Group, Pragati Glass, Saver Glass, SGB Packaging Group, Stolzle Glass Group, Vidraria Anchieta, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Cosmetic Glass Container," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cosmetic Glass Container, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.