1. What is the projected Compound Annual Growth Rate (CAGR) of the Ceramic Wine Bottle?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Ceramic Wine Bottle

Ceramic Wine BottleCeramic Wine Bottle by Type (Blue And White Porcelain Wine Bottle, Linglong Porcelain (Hollow Out Process), Color Glaze Based Ceramic Wine Bottle, Other), by Application (Household, Commercial), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

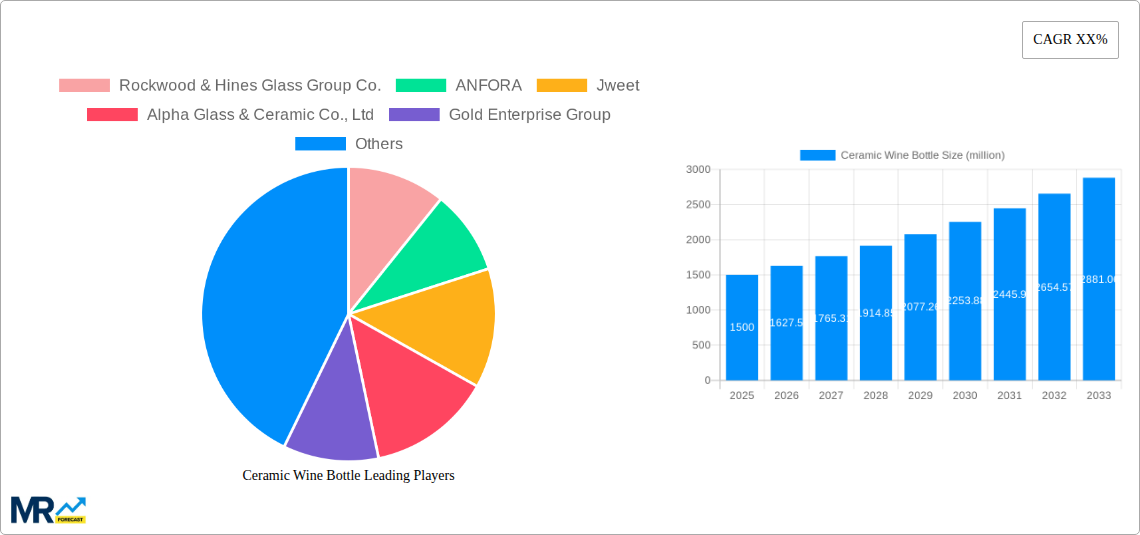

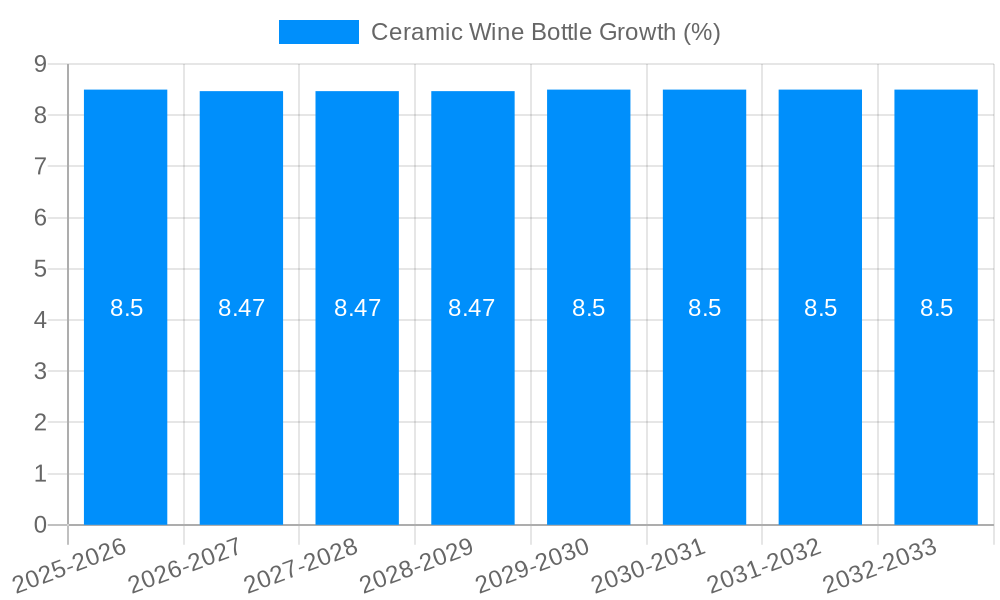

The global ceramic wine bottle market is poised for substantial growth, projected to reach an estimated USD 1,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.5% anticipated from 2025 to 2033. This upward trajectory is primarily fueled by the increasing consumer preference for premium and aesthetically pleasing packaging solutions for wine and spirits. The distinctiveness and artisanal appeal of ceramic bottles offer a unique selling proposition, elevating the perceived value of the contents within. Key drivers include the growing e-commerce sales of alcoholic beverages, where visually appealing packaging plays a crucial role in online purchasing decisions, and the rising demand for sustainable and reusable packaging alternatives. Manufacturers are increasingly innovating with intricate designs, decorative glazes, and novel forms, catering to both traditional and contemporary tastes. The market also benefits from the growing influence of gifting culture, where ceramic wine bottles serve as sophisticated and memorable presents.

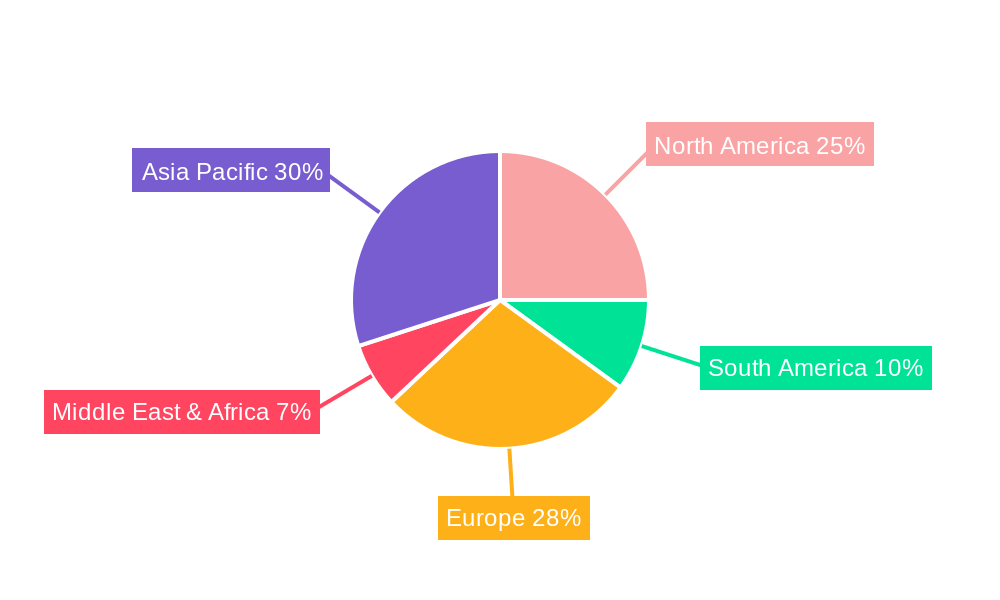

The market's segmentation reveals diverse opportunities across various product types and applications. Blue and White Porcelain wine bottles, with their timeless elegance, continue to hold significant appeal, while Linglong Porcelain (hollow-out process) and Color Glaze Based Ceramic wine bottles are gaining traction due to their intricate craftsmanship and visual richness. These product innovations are expected to drive market expansion. In terms of application, both household and commercial segments are showing healthy growth. The commercial sector, encompassing wineries, distilleries, and premium beverage brands, is a major contributor, leveraging ceramic bottles for brand differentiation and to enhance the luxury perception of their products. Geographically, the Asia Pacific region, led by China and India, is expected to dominate the market share, driven by a burgeoning middle class, increasing disposable incomes, and a rapidly expanding wine and spirits industry. Emerging economies are crucial growth pockets, while established markets in North America and Europe continue to exhibit steady demand driven by premiumization trends.

This comprehensive report provides an in-depth analysis of the global Ceramic Wine Bottle market, meticulously examining trends, driving forces, challenges, and future growth prospects. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025, the report leverages historical data from 2019-2024 to provide robust forecasts for the 2025-2033 period. The market landscape is dissected through a granular breakdown of key segments, including product types such as Blue and White Porcelain Wine Bottles, Linglong Porcelain (Hollow Out Process), Color Glaze Based Ceramic Wine Bottles, and Other variants. Furthermore, the report explores the market's penetration across Household, Commercial, and Industry applications. Insights into the competitive environment are bolstered by an exhaustive list of leading players, including Rockwood & Hines Glass Group Co., ANFORA, Jweet, Alpha Glass & Ceramic Co., Ltd, Gold Enterprise Group, Jingdezhen Jianyuan Ceramics Co., Ltd., Haoxiong Ceramics Co., Ltd., Jingdezhen Yunjie Ceramics Co., Ltd., Jining Jingyun Ceramic Products Co., Ltd., Jingdezhen Shuncheng Chuang Ceramics Co., Ltd., Qufu Art Ceramics Co., Ltd., Luzhou Maoyuan Ceramics Manufacturing Co., Ltd., Jingdezhen Haoxiong Ceramics Co., Ltd., Hejiang County Huayi Ceramic Products Co., Ltd., and Segments. Significant market developments and strategic initiatives undertaken by these entities are also highlighted, providing a holistic view of the market's trajectory. The report is poised to equip stakeholders with actionable intelligence to navigate this evolving market.

The global Ceramic Wine Bottle market is experiencing a dynamic shift, driven by a confluence of evolving consumer preferences, aesthetic aspirations, and a burgeoning appreciation for premium and artisanal beverage packaging. Over the study period from 2019 to 2033, with a focus on the base year 2025, the market has witnessed a discernible trend towards decorative and collectible wine bottles, moving beyond mere functional containers. This evolution is particularly evident in the growing demand for intricately designed Blue and White Porcelain Wine Bottles, which tap into a rich cultural heritage and appeal to consumers seeking unique, story-driven products. Similarly, the niche yet expanding market for Linglong Porcelain (Hollow Out Process) wine bottles showcases a sophisticated demand for craftsmanship and artistic expression. Color Glaze Based Ceramic Wine Bottles are also carving out significant market share, offering a vibrant and customizable aesthetic that aligns with modern branding strategies and personal gifting occasions.

The Household segment is a primary driver of these trends, as consumers increasingly seek visually appealing and conversation-starting pieces for their homes, transforming wine storage into an element of interior decor. This surge in demand is further amplified by the rise of e-commerce and direct-to-consumer models, which facilitate wider accessibility to these specialized products. The Commercial application, encompassing wineries, distilleries, and high-end restaurants, is also a significant contributor. Here, ceramic wine bottles are leveraged as premium packaging solutions to enhance brand perception, differentiate products in a crowded marketplace, and command higher price points. Wineries are increasingly adopting these bottles for limited editions, special vintages, and as part of gift sets, recognizing their potential to elevate the perceived value of the wine within. The historical period from 2019 to 2024 laid the groundwork for this growth, with an observable increase in interest for handcrafted and aesthetically superior alternatives to traditional glass. Looking ahead, the forecast period of 2025-2033 anticipates a sustained upward trajectory, fueled by ongoing innovation in ceramic artistry, sustainable packaging initiatives, and a global consumer base that prioritizes quality, exclusivity, and visual appeal in their beverage choices. The "Other" category, encompassing bespoke designs and specialized ceramic blends, also presents intriguing growth avenues, catering to niche markets and emerging trends in personalized beverage packaging.

The Ceramic Wine Bottle market is experiencing a significant uplift, propelled by a multifaceted array of factors that are reshaping consumer behavior and industry strategies. Paramount among these drivers is the escalating consumer demand for aesthetic appeal and unique packaging. In an era where visual presentation plays a crucial role in purchasing decisions, ceramic wine bottles, with their inherent artistry and decorative potential, stand out. This is particularly evident in the growing preference for Blue and White Porcelain Wine Bottles and Color Glaze Based Ceramic Wine Bottles, which offer a distinctive visual narrative that resonates with consumers seeking products that are not only functional but also aesthetically pleasing and collectible. This trend is amplified within the Household segment, where individuals are increasingly incorporating stylish wine bottles into their home décor and entertaining setups.

Furthermore, the growing emphasis on premiumization and the desire for exclusive, high-value products are acting as powerful catalysts. Ceramic bottles, often associated with traditional craftsmanship and artisanal production, lend an air of sophistication and exclusivity to the wine they contain. This perception allows brands to command premium pricing and differentiate themselves in a highly competitive market. The Commercial application, particularly within the spirits and wine industry, is actively leveraging this perception to enhance brand image and attract discerning consumers. The historical period of 2019-2024 saw a foundational growth in this area, with brands beginning to explore ceramic packaging more strategically. Looking towards the forecast period of 2025-2033, this trend is expected to accelerate as more companies recognize the marketing and branding advantages offered by ceramic wine bottles. Additionally, growing environmental consciousness, although sometimes a perceived challenge, can also be a driver, as certain artisanal ceramic production methods can be positioned as more sustainable or unique alternatives to mass-produced packaging, especially when focusing on reusability and long-term decorative value.

Despite the robust growth trajectory of the Ceramic Wine Bottle market, several inherent challenges and restraints can impede its full potential. One of the most significant hurdles is the cost of production. Ceramic wine bottles generally incur higher manufacturing costs compared to their glass counterparts due to specialized kilning processes, intricate design requirements, and the need for skilled craftsmanship. This increased cost can translate to a higher retail price for the final product, potentially limiting its mass market appeal, especially in price-sensitive segments. The durability and fragility associated with ceramic materials also present a considerable challenge. While offering aesthetic advantages, ceramic bottles are more susceptible to breakage during transportation, handling, and storage compared to glass. This fragility necessitates more careful packaging and logistics, adding to the overall supply chain expenses and potentially leading to higher product loss rates.

Moreover, the limited production capacity and scalability of highly customized or artisanal ceramic wine bottles can act as a restraint. While small-batch production caters to niche markets, scaling up to meet large-scale commercial demands can be challenging and time-consuming, potentially hindering widespread adoption by major beverage producers. The perception of traditionalism and limited innovation can also be a factor. Although there is a growing appreciation for traditional craftsmanship, some consumers might perceive ceramic bottles as less modern or versatile than other packaging materials, particularly for certain wine varietals or consumer demographics. The forecast period of 2025-2033 will likely see continued efforts to mitigate these challenges through advancements in ceramic technology, improved logistical solutions, and targeted marketing strategies that highlight the unique value proposition of ceramic wine bottles. The historical period of 2019-2024 has seen the market grappling with these issues, and future growth will depend on successfully addressing them.

The global Ceramic Wine Bottle market is poised for significant growth, with certain regions and segments demonstrating a pronounced propensity to dominate the landscape. Among the key segments, Blue and White Porcelain Wine Bottles are expected to emerge as a leading category, driven by a rich cultural heritage, sophisticated aesthetic appeal, and a growing appreciation for traditional craftsmanship. This segment is particularly resonant in regions with a strong historical connection to porcelain production and art, such as China, which is not only a major producer but also a significant consumer of these exquisite bottles. The intricate artistry, storytelling embedded in the designs, and the collectible nature of blue and white porcelain align perfectly with premium wine branding and gifting occasions. This segment caters extensively to the Household application, where consumers seek unique decorative pieces and conversation starters for their homes. The rise of affluent households and a growing interest in home entertaining further fuel this demand.

Beyond China, countries with a burgeoning luxury goods market and a strong wine culture, such as parts of Europe (e.g., France, Italy) and North America (specifically the US), are also showing increasing interest in premium ceramic wine bottles. In these regions, the demand is often driven by the Commercial segment, with wineries and distilleries utilizing these bottles to enhance brand perception, offer limited edition products, and create high-value gift sets. The Color Glaze Based Ceramic Wine Bottle segment is another strong contender for market dominance, offering a vibrant and customizable aesthetic that appeals to modern design sensibilities. This segment is likely to see significant traction in markets where customization and brand differentiation are paramount. The ability to create unique color palettes and finishes makes these bottles highly attractive for brand storytelling and marketing campaigns.

The Linglong Porcelain (Hollow Out Process) segment, while more niche, represents a segment driven by a demand for exceptional craftsmanship and artistic innovation. Its dominance will likely be tied to high-end luxury markets and specific gifting occasions where the intricate detail and unique process are highly valued. The Commercial application, particularly for premium spirit brands and artisanal wineries seeking to showcase their exclusivity, will be a key driver for Linglong porcelain.

Overall, China is expected to remain a powerhouse, not only in production but also in domestic consumption of ceramic wine bottles, particularly in the Blue and White Porcelain and Color Glaze categories for Household and Commercial use. However, Europe and North America will witness substantial growth, driven by increasing adoption in the premium Commercial sector and a sophisticated Household consumer base that values artistry and uniqueness. The interplay between traditional artistry and modern market demands will shape the dominant regions and segments in the coming years of the forecast period (2025-2033).

The Ceramic Wine Bottle industry is poised for accelerated growth, propelled by several key catalysts. The escalating consumer desire for premium and aesthetically appealing packaging serves as a primary growth engine. As individuals seek to elevate their home entertaining experiences and gift-giving occasions, the inherent artistry and unique visual appeal of ceramic bottles, especially Blue and White Porcelain and Color Glaze variants, become increasingly attractive. This trend is significantly amplified by the growing focus on product differentiation within the beverage sector, allowing wineries and distilleries to enhance brand perception and command premium pricing. Furthermore, the increasing prominence of artisanal and craft beverages creates a natural synergy with the handcrafted nature of ceramic wine bottles, fostering a demand for packaging that reflects the quality and uniqueness of the contents.

This report offers a holistic examination of the Ceramic Wine Bottle market, encompassing a detailed analysis of its present landscape and future trajectory. It delves into the intricate interplay of market trends, identifying key shifts in consumer preferences and industry strategies, with a particular focus on the aesthetic appeal of Blue and White Porcelain and Color Glaze Based Ceramic Wine Bottles. The report meticulously dissects the driving forces behind market expansion, highlighting the impact of premiumization and product differentiation on both household and commercial applications. Furthermore, it provides a candid assessment of the challenges and restraints, including production costs and fragility concerns, that the industry faces. Geographical and segmental analyses pinpoint regions and product categories, such as Linglong Porcelain, poised for significant market dominance. Crucially, the report identifies growth catalysts, such as the rising demand for unique packaging and the synergy with artisanal beverages, that will propel the industry forward in the forecast period of 2025-2033.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Rockwood & Hines Glass Group Co., ANFORA, Jweet, Alpha Glass & Ceramic Co., Ltd, Gold Enterprise Group, Jingdezhen Jianyuan Ceramics Co., Ltd., Haoxiong Ceramics Co., Ltd., Jingdezhen Yunjie Ceramics Co., Ltd., Jining Jingyun Ceramic Products Co., Ltd., Jingdezhen Shuncheng Chuang Ceramics Co., Ltd., Qufu Art Ceramics Co., Ltd., Luzhou Maoyuan Ceramics Manufacturing Co., Ltd., Jingdezhen Haoxiong Ceramics Co., Ltd., Hejiang County Huayi Ceramic Products Co., Ltd..

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Ceramic Wine Bottle," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Ceramic Wine Bottle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.