1. What is the projected Compound Annual Growth Rate (CAGR) of the Motorized Zoom Lens?

The projected CAGR is approximately 7.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Motorized Zoom Lens

Motorized Zoom LensMotorized Zoom Lens by Type (Below 300mm, 300mm-1000mm, Above 1000mm, World Motorized Zoom Lens Production ), by Application (Border Defense, City Security, Highway, Others, World Motorized Zoom Lens Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

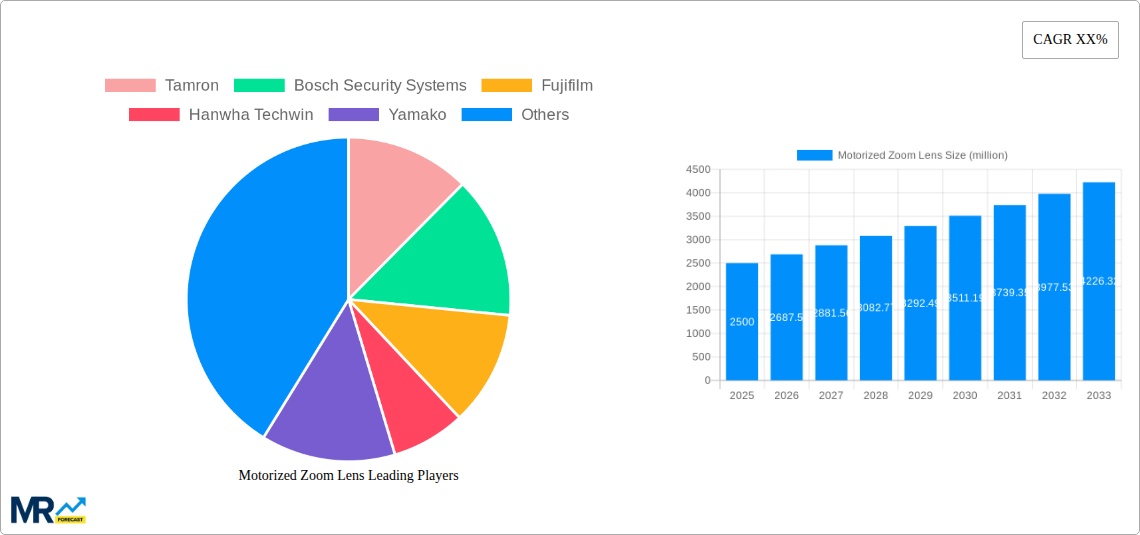

The global motorized zoom lens market is poised for substantial growth, with an estimated market size of $2.5 billion in 2025 and projected to expand at a Compound Annual Growth Rate (CAGR) of 7.5% through 2033. This robust expansion is driven by an increasing demand for advanced surveillance and imaging solutions across various sectors. Key growth catalysts include the escalating need for enhanced border defense systems, sophisticated city security networks, and efficient highway monitoring. The proliferation of smart city initiatives and the continuous upgrade of security infrastructure globally are directly fueling the adoption of high-performance motorized zoom lenses. These lenses, with their ability to provide precise and flexible focal length adjustments, are becoming indispensable for applications requiring detailed observation from a distance, such as long-range threat detection and comprehensive area surveillance.

Furthermore, technological advancements in optical engineering and sensor integration are enabling the development of more compact, powerful, and intelligent motorized zoom lenses. Innovations in image stabilization, low-light performance, and variable aperture control are key trends shaping the market, allowing for superior image quality in diverse and challenging environmental conditions. While the market benefits from strong demand, potential restraints such as high initial investment costs for advanced systems and the complexities associated with integration into existing infrastructure could pose challenges. However, the overwhelming benefits in terms of enhanced security, operational efficiency, and data accuracy are expected to outweigh these concerns, driving continued market penetration and innovation, particularly within the Asia Pacific region which is anticipated to be a significant growth hub.

This report offers an in-depth analysis of the global Motorized Zoom Lens market, providing crucial insights for stakeholders. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this comprehensive study delves into historical trends, current market dynamics, and future projections. The estimated market value is expected to reach several billion dollars by the end of the forecast period, showcasing significant growth potential. We meticulously examine the production, applications, and technological advancements that are shaping this dynamic industry.

The global motorized zoom lens market is undergoing a transformative phase, driven by relentless technological innovation and expanding application horizons. Over the historical period of 2019-2024, the market witnessed a steady upward trajectory, fueled by increasing demand from surveillance, industrial automation, and scientific imaging sectors. As we move into the forecast period of 2025-2033, the market is poised for accelerated growth, with projections indicating a significant expansion in market value, likely reaching well into the billions. Key trends include the miniaturization of motorized zoom lenses, enhancing their applicability in compact devices and drones. The integration of artificial intelligence (AI) and machine learning (ML) algorithms is also a defining characteristic, enabling smarter lens control, object recognition, and adaptive focusing, thereby augmenting operational efficiency in various applications. Furthermore, the increasing resolution and zoom capabilities of these lenses are pushing the boundaries of visual detail capture, making them indispensable for applications demanding high-fidelity imagery, such as advanced security systems and scientific research. The demand for robust, weather-resistant, and high-performance motorized zoom lenses is escalating, particularly for deployment in challenging environments like border defense and remote industrial sites. This surge in demand is directly contributing to the projected substantial growth in market revenue.

The burgeoning demand for enhanced surveillance and security solutions stands as a primary driver for the motorized zoom lens market. As cities worldwide grapple with rising crime rates and the need for comprehensive public safety, the deployment of advanced CCTV systems equipped with motorized zoom lenses has become paramount. These lenses offer unparalleled flexibility, allowing operators to remotely adjust focal length and zoom in on specific details, thereby improving situational awareness and enabling effective monitoring. Furthermore, the escalating investments in border defense and national security initiatives across various nations are creating a substantial market for long-range, high-resolution motorized zoom lenses. These specialized lenses are critical for detecting and tracking potential threats at a distance, providing crucial intelligence for security forces. The rapid advancement of unmanned aerial vehicles (UAVs) and drones, coupled with their increasing integration into civilian and military operations, is another significant growth catalyst. Motorized zoom lenses are integral components of drone payloads, enabling aerial reconnaissance, inspection, and data collection with enhanced precision and flexibility. The expanding industrial automation sector, with its growing reliance on machine vision for quality control, inspection, and robotics, is also contributing to the market's expansion. These lenses facilitate detailed visual inspection of products and processes, ensuring high levels of accuracy and efficiency.

Despite the robust growth trajectory, the motorized zoom lens market faces several challenges and restraints that could potentially impede its full potential. The significant cost associated with developing and manufacturing advanced motorized zoom lenses, particularly those with high zoom ratios and specialized optical coatings, presents a barrier to entry for smaller players and can limit adoption in cost-sensitive applications. The complexity of integrating these lenses with existing control systems and software infrastructure can also be a deterrent, requiring specialized expertise and significant investment in R&D and implementation. Furthermore, the rapid pace of technological evolution in the imaging sector means that obsolescence can be a concern. Manufacturers must continuously innovate and invest in new technologies to stay competitive, which adds to development costs and can lead to shorter product lifecycles. The reliance on specialized raw materials and components, some of which may have limited supply chains, can also pose risks of price volatility and availability issues, impacting production costs and lead times. Cybersecurity threats associated with networked motorized zoom lens systems, especially in critical infrastructure applications like city security and border defense, represent another significant challenge, necessitating robust security protocols and ongoing vigilance.

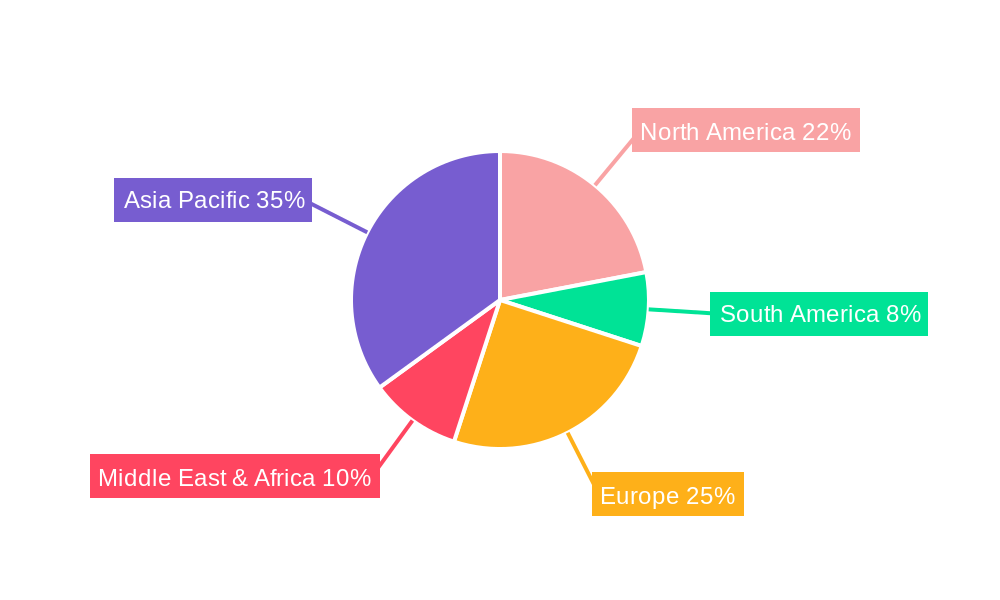

The global Motorized Zoom Lens market is expected to witness significant dominance from specific regions and segments, driven by a confluence of factors including technological adoption, application-specific demand, and economic development.

Dominant Segments:

Type: Above 1000mm: This segment is poised for substantial growth and market dominance, particularly within the "Border Defense" and "City Security" application segments. The increasing global emphasis on enhanced surveillance and threat detection necessitates the deployment of lenses capable of capturing clear imagery from extreme distances. Governments and defense organizations are heavily investing in perimeter security and long-range monitoring capabilities, directly fueling the demand for lenses with focal lengths exceeding 1000mm. The technological advancements enabling higher resolutions and better optical clarity at these extended ranges are crucial enablers for this segment's leadership. For instance, in border defense, these lenses are critical for identifying individuals, vehicles, and potential incursions from miles away, providing actionable intelligence to security personnel. In city security, they are vital for monitoring vast public spaces, critical infrastructure, and potential public order issues without the need for constant physical presence.

Application: Border Defense: This application segment is a major revenue generator and is expected to maintain its leading position throughout the forecast period. The escalating geopolitical tensions, coupled with the ongoing global challenges of illegal immigration, smuggling, and terrorism, have made robust border security a top priority for nations worldwide. Motorized zoom lenses are indispensable tools in this domain, providing real-time, high-definition visual surveillance capabilities over vast and often challenging terrains. The ability to remotely zoom in and track targets with precision, combined with features like thermal imaging and low-light performance, makes these lenses a cornerstone of modern border protection strategies. The continuous investment in advanced surveillance technologies by defense ministries and border patrol agencies globally ensures a sustained and significant demand for motorized zoom lenses in this sector.

World Motorized Zoom Lens Production: The Above 1000mm type segment will significantly contribute to the overall World Motorized Zoom Lens Production value. The high unit cost of these specialized, long-focal-length lenses, coupled with their critical application in high-stakes scenarios like defense, means that even moderate production volumes can translate into substantial market revenue. The manufacturing of these sophisticated lenses requires advanced optical engineering, precision assembly, and stringent quality control, often involving specialized facilities and expertise. This concentration of production for high-end lenses further solidifies the financial impact of this segment on the total market production value.

Dominant Regions:

North America: This region is projected to maintain a strong market position due to its substantial investments in defense, homeland security, and advanced surveillance technologies. The presence of leading technology companies and a robust research and development ecosystem further fuels innovation and adoption of cutting-edge motorized zoom lenses. The extensive deployment of these lenses in critical infrastructure protection, smart city initiatives, and border security in countries like the United States and Canada underpins its market leadership.

Asia Pacific: This region is expected to experience the fastest growth rate in the motorized zoom lens market. Rapid urbanization, increasing smart city projects, and significant government spending on public safety and defense in countries such as China, India, and South Korea are key drivers. The burgeoning manufacturing capabilities within the region also contribute to its growing influence on production and supply chains. The expanding industrial sector, with its increasing adoption of automation and machine vision, further bolsters demand for motorized zoom lenses.

The growth of the motorized zoom lens industry is significantly propelled by the increasing adoption of AI and machine learning for enhanced image analysis and automated control. Furthermore, the rapid expansion of the drone and UAV market necessitates compact, high-performance motorized zoom lenses for aerial surveillance and inspection. Government initiatives focused on national security, border defense, and smart city development are also substantial growth catalysts, driving demand for advanced surveillance capabilities. The continuous miniaturization and cost reduction of these lenses are making them more accessible and applicable across a wider array of industries and applications.

This report offers an unparalleled depth of analysis into the global motorized zoom lens market, providing a holistic view of its current status and future trajectory. The study meticulously examines all facets of the market, from production methodologies and technological advancements to diverse application segments and regional market dynamics. With a keen focus on delivering actionable intelligence, the report leverages a robust research methodology to project the market’s evolution over the study period (2019-2033). Stakeholders can expect to gain comprehensive insights into key market drivers, potential challenges, growth opportunities, and the competitive landscape, enabling them to make informed strategic decisions and capitalize on the burgeoning opportunities within this dynamic industry. The report’s detailed segmentation by type, application, and region ensures a granular understanding of market nuances, empowering businesses to tailor their strategies for optimal success in the multi-billion dollar global motorized zoom lens market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.5%.

Key companies in the market include Tamron, Bosch Security Systems, Fujifilm, Hanwha Techwin, Yamako, CBC Computar, Tokina Corporation, ADL,Inc, Ophir Optronics (mks), Kowa Lenses, Myutron Co.,Ltd, 2B Security Systems ApS, Luster, Theia Technologies, Honeywell Security, Canon, Salvo Technologies, Edmund Optics, Navitar, SPACE Inc, Seikou Avenir, Goyo, Graflex Inc, Dongguan Pomeas Precision Instrument, Fuzhou ChuangAn Optics, Shenzhen Lingying Optics, Shenzhen Chuangwei Era Optoelectronics, Foctek Photonics.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Motorized Zoom Lens," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Motorized Zoom Lens, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.