1. What is the projected Compound Annual Growth Rate (CAGR) of the Contactor Accessories?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Contactor Accessories

Contactor AccessoriesContactor Accessories by Type (Protective Accessories, Auxiliary Accessories, Mounting and Enclosure Accessories, Others, World Contactor Accessories Production ), by Application (Industrial Use, Commercial Use, World Contactor Accessories Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

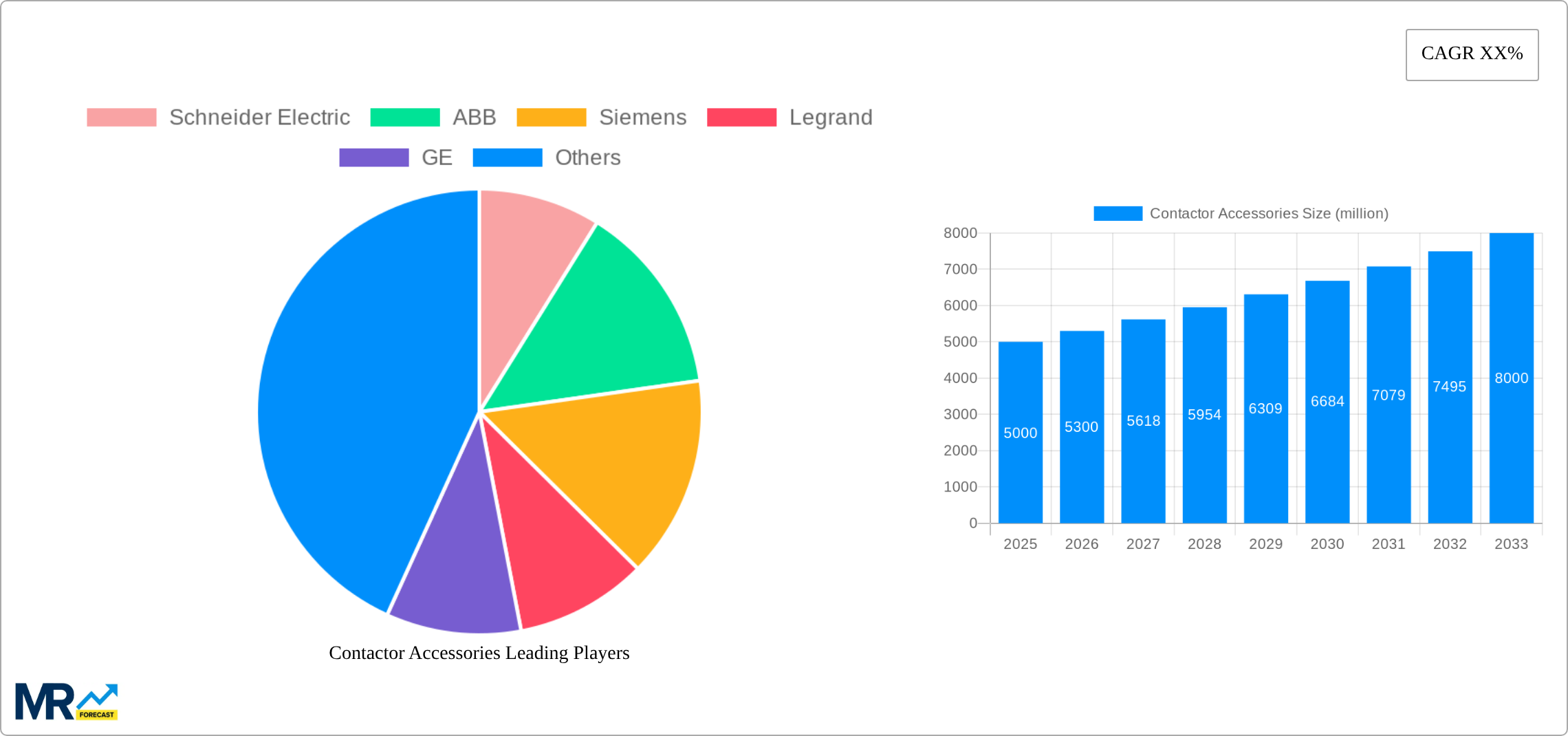

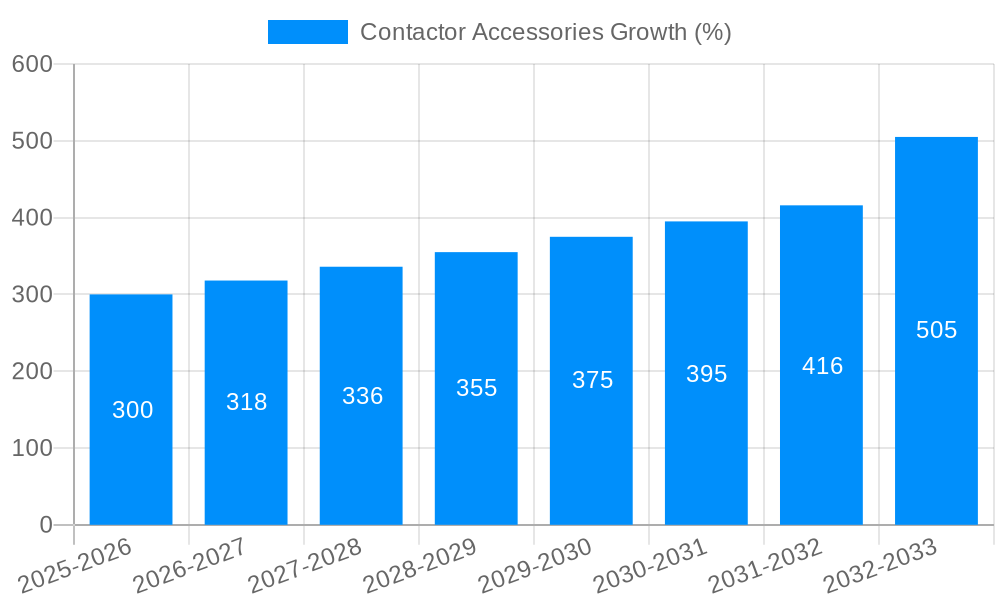

The global contactor accessories market is poised for significant expansion, projected to reach an estimated value of $1,200 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This growth is primarily fueled by the increasing industrialization and automation across various sectors, particularly in developing economies. The demand for enhanced electrical protection and control systems in manufacturing, infrastructure, and commercial buildings is a key driver. Protective accessories, such as surge suppressors and thermal overload relays, are expected to witness the highest demand due to stringent safety regulations and the need to safeguard sensitive electrical equipment from power fluctuations and overloads. Auxiliary accessories, including auxiliary contact blocks and timers, also play a crucial role in expanding the functionality of contactors, contributing to overall market growth. The "Others" segment, encompassing a range of specialized accessories, will also see steady progress as bespoke solutions become more prevalent.

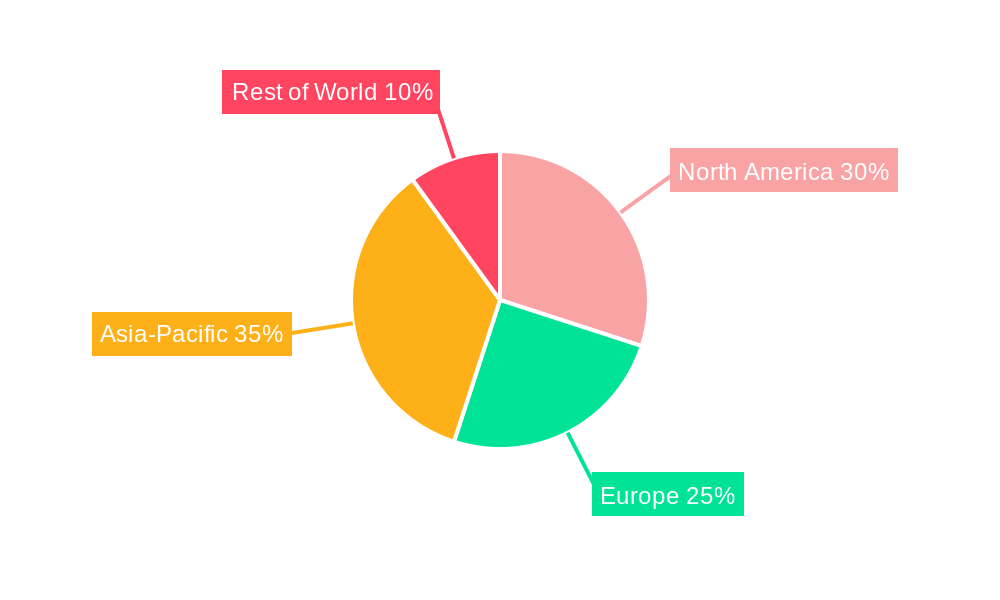

The market is characterized by strong growth in industrial applications, driven by the expansion of manufacturing facilities and the adoption of smart grid technologies. Commercial use, including in large buildings and data centers, is also a significant contributor. Geographically, Asia Pacific, led by China and India, is emerging as the fastest-growing region, owing to rapid industrial development and a burgeoning manufacturing base. North America and Europe, while mature markets, continue to exhibit steady growth driven by upgrades to existing infrastructure and the adoption of advanced contactor accessory technologies. Key players like Schneider Electric, ABB, Siemens, and Legrand are actively investing in research and development to introduce innovative solutions that enhance reliability, efficiency, and safety, further propelling market expansion. However, the market faces some restraints, including the initial cost of advanced accessories and potential supply chain disruptions, which could moderate growth in specific periods.

This comprehensive report delves into the dynamic global market for contactor accessories, a critical yet often overlooked segment of electrical infrastructure. With an estimated market size of $500 million in the base year 2025, the market is projected to experience robust growth, reaching an estimated $1.2 billion by 2033. The study meticulously analyzes the market landscape from the historical period of 2019-2024, providing deep insights into its evolution. The base year 2025 serves as a crucial pivot for projections, with the forecast period extending through 2033. This report employs a rigorous research methodology, incorporating primary and secondary data to deliver actionable intelligence for stakeholders across the value chain.

The analysis is structured to offer a holistic understanding of the contactor accessories market, encompassing key trends, driving forces, inherent challenges, and the geographical and segmental dominance. Leading players are identified, alongside significant developments and a detailed overview of the report's comprehensive coverage. The report caters to a diverse audience, including manufacturers, suppliers, distributors, system integrators, and end-users in both industrial and commercial sectors.

XXX The global contactor accessories market is experiencing a significant evolutionary phase, driven by an increasing demand for enhanced electrical system reliability, safety, and efficiency. In the historical period (2019-2024), the market witnessed a steady upward trajectory, with the production volume reaching approximately 300 million units in 2024. This growth was primarily fueled by the expansion of industrial automation and the burgeoning construction of commercial infrastructure worldwide. As we move into the base year of 2025, the market is poised for accelerated growth, with projections indicating a production volume of around 450 million units. A key trend defining this period is the escalating adoption of smart technologies within contactor accessories. This includes the integration of advanced sensing capabilities for real-time monitoring of operational parameters, such as temperature and current, enabling proactive maintenance and reducing unplanned downtime. The demand for accessories that facilitate remote diagnostics and control is also on the rise, aligning with the broader industry push towards Industry 4.0 principles. Protective accessories, particularly surge protection devices and overload relays, are gaining prominence as industries become increasingly sensitive to power quality issues and the need to safeguard sensitive electrical equipment. Auxiliary accessories, such as auxiliary contacts and mechanical interlocks, are seeing increased integration to enhance the functionality and flexibility of contactor systems, catering to complex control logic in sophisticated automation setups. The trend towards miniaturization and modularity in electrical components also extends to contactor accessories, allowing for more compact and adaptable electrical panels. Furthermore, the growing emphasis on energy efficiency is driving the development and adoption of contactor accessories that contribute to reduced energy consumption and improved power factor. The regulatory landscape, with its increasing focus on electrical safety standards, is also playing a pivotal role in shaping the market, necessitating the use of certified and high-performance accessories.

Several potent forces are synergistically driving the expansion of the global contactor accessories market. The relentless march of industrial automation, particularly in emerging economies, is a primary catalyst. As factories and manufacturing plants increasingly adopt sophisticated control systems and automated processes, the demand for reliable and feature-rich contactor systems, supported by a comprehensive range of accessories, surges. This includes everything from enhanced control capabilities provided by auxiliary contacts to robust protection offered by overload relays and surge suppressors, vital for maintaining operational continuity. The burgeoning construction sector, both for industrial facilities and commercial complexes, also plays a crucial role. New infrastructure development inherently requires extensive electrical installations, creating a consistent demand for contactor accessories. Furthermore, the global push for digitalization and the Internet of Things (IoT) is indirectly but significantly fueling market growth. The integration of smart technologies into electrical infrastructure necessitates contactor accessories that can support data acquisition, remote monitoring, and advanced diagnostics. This trend is particularly evident in the adoption of accessories with built-in sensing and communication capabilities. The increasing awareness and stringent enforcement of electrical safety regulations across various regions worldwide are also compelling end-users to invest in high-quality, certified contactor accessories that ensure the safe operation of electrical circuits, thereby preventing accidents and protecting valuable equipment. The need for greater system reliability and reduced downtime in critical industries such as power generation, petrochemicals, and data centers further amplifies the demand for advanced contactor accessories that offer enhanced protection and control features.

Despite the positive growth trajectory, the contactor accessories market is not without its impediments. One of the most significant challenges is the increasing price sensitivity of some market segments, particularly in price-competitive regions or for less critical applications. While advanced accessories offer substantial benefits, their higher initial cost can be a deterrent for cost-conscious buyers, leading them to opt for basic or standard configurations. This can limit the adoption of technologically superior solutions. Another considerable restraint is the complexity of product standardization and interoperability. The market comprises a multitude of manufacturers, each with their own product designs and specifications. Ensuring seamless compatibility between accessories from different vendors and across various contactor models can be a technical hurdle, potentially leading to integration issues and increasing installation time and costs for end-users. The rapid pace of technological evolution also presents a dual-edged sword. While it drives innovation, it also creates a risk of product obsolescence, requiring continuous investment in research and development to stay competitive. This can strain the resources of smaller manufacturers. Furthermore, supply chain disruptions, as witnessed in recent years, can impact the availability and cost of raw materials and finished goods, leading to production delays and increased expenses. The shortage of skilled labor for the installation and maintenance of complex electrical systems, including those incorporating advanced contactor accessories, can also hinder market growth in certain regions. Finally, the perceived low margin associated with some categories of contactor accessories compared to the contactors themselves can sometimes lead to a lack of focused attention from manufacturers, impacting innovation and market penetration.

The global contactor accessories market exhibits significant regional and segmental dominance, driven by a confluence of industrial development, regulatory frameworks, and technological adoption.

Regional Dominance:

Asia Pacific: This region is projected to emerge as the largest and fastest-growing market for contactor accessories.

North America: A mature yet significant market, North America continues to be a major consumer of contactor accessories.

Europe: Europe represents another key market characterized by stringent safety regulations and a strong emphasis on energy efficiency.

Segment Dominance:

Type: Protective Accessories: This segment is expected to witness the highest growth rate and significant market share.

Application: Industrial Use: This application segment will continue to be the largest revenue generator for contactor accessories.

The contactor accessories industry is propelled by several key growth catalysts. The escalating global adoption of automation and digitalization across various industries, particularly with the advent of Industry 4.0 principles, creates a sustained demand for advanced contactor accessories that facilitate smarter control and monitoring. The increasing emphasis on electrical safety and compliance with stringent international standards is another significant driver, pushing for the adoption of protective and reliable accessories. Furthermore, the continuous expansion of infrastructure projects worldwide, encompassing both industrial facilities and commercial buildings, directly translates into a growing need for electrical components, including a wide array of contactor accessories. The growing awareness and implementation of energy efficiency measures are also indirectly fostering growth, as accessories that contribute to optimized power management and reduced energy consumption become more desirable.

The global contactor accessories market is characterized by the presence of several prominent players who offer a comprehensive range of products and solutions. These industry leaders are instrumental in driving innovation and shaping market trends.

This comprehensive report provides an in-depth analysis of the global contactor accessories market, covering the period from 2019 to 2033. It meticulously details the market dynamics, including historical performance and future projections, with the base year 2025 serving as a critical benchmark. The report delves into the intricate trends shaping the industry, analyzes the primary driving forces behind market expansion, and critically examines the challenges and restraints that stakeholders may encounter. Furthermore, it identifies key regions and segments poised for dominance, offering strategic insights into market opportunities. The report also highlights significant growth catalysts and provides a detailed overview of the leading players in the market, alongside a chronological list of important developments and innovations within the sector. The extensive coverage ensures that stakeholders gain a holistic and actionable understanding of the contactor accessories landscape.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Schneider Electric, ABB, Siemens, Legrand, GE, Rockwell Automation, Omron.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Contactor Accessories," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Contactor Accessories, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.