1. What is the projected Compound Annual Growth Rate (CAGR) of the Enterprise-Level SSD Controllers?

The projected CAGR is approximately 20.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Enterprise-Level SSD Controllers

Enterprise-Level SSD ControllersEnterprise-Level SSD Controllers by Type (PCIe, SATA, World Enterprise-Level SSD Controllers Production ), by Application (Data Center, Cloud Computing, Others, World Enterprise-Level SSD Controllers Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

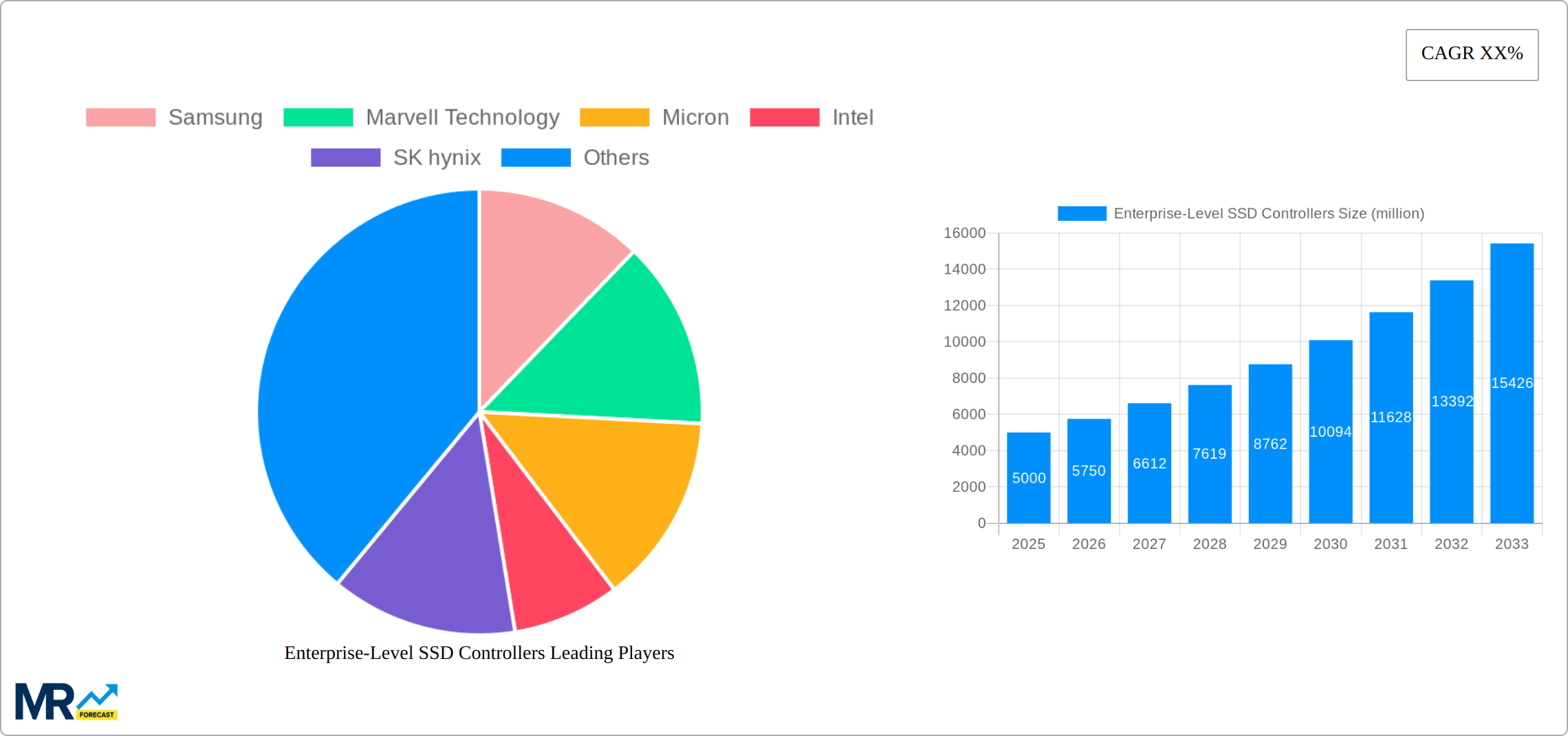

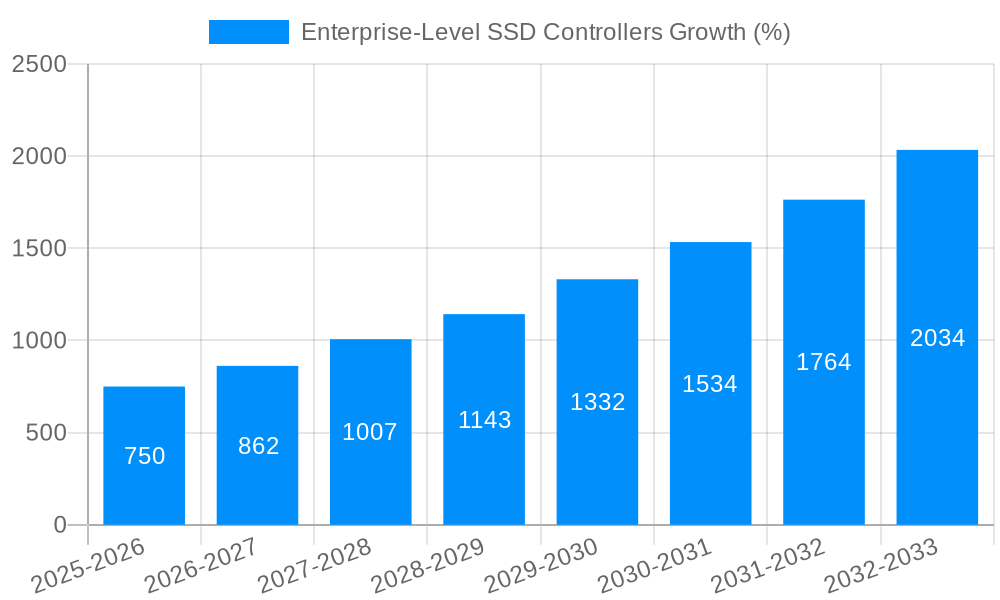

The global market for Enterprise-Level SSD Controllers is poised for remarkable expansion, projected to reach an estimated \$4,559.3 million. This growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 20.1%, indicating a dynamic and rapidly evolving landscape. The primary drivers for this surge are the escalating demand for high-performance storage solutions in data centers and cloud computing environments. As organizations increasingly rely on faster data access, reduced latency, and improved reliability for their critical operations, enterprise-level SSD controllers become indispensable. The continuous advancement in flash memory technology and the increasing complexity of data workloads further necessitate more sophisticated and efficient controller architectures. The market's robust trajectory is a testament to the fundamental shift towards solid-state storage in enterprise infrastructure, replacing traditional hard disk drives for mission-critical applications.

The enterprise-level SSD controller market is characterized by key segments that highlight its diverse applications and technological differentiations. Within the 'Type' segment, both PCIe and SATA interfaces are crucial, with PCIe gaining significant traction due to its superior bandwidth and performance, essential for high-demand enterprise workloads. The dominant 'Application' segments are Data Centers and Cloud Computing, reflecting the core of enterprise storage needs. These sectors require robust, scalable, and power-efficient solutions to handle massive data volumes and concurrent user access. Emerging trends include the integration of AI and machine learning capabilities within controllers for enhanced performance optimization and predictive maintenance, as well as a growing emphasis on security features to protect sensitive enterprise data. While the market is robust, potential restraints could emerge from supply chain volatilities for critical components or intense price competition among established and emerging players, although the high growth rate suggests that demand is currently outstripping these potential challenges.

This comprehensive report delves into the dynamic global market for Enterprise-Level SSD Controllers, offering an in-depth analysis of trends, drivers, challenges, and opportunities shaping this critical segment of the storage industry. The study encompasses a detailed examination of the market from the historical period of 2019-2024, a base year of 2025, and extends through an extensive forecast period of 2025-2033.

The enterprise-level SSD controller market is experiencing a profound transformation, driven by the insatiable demand for higher performance, greater density, and enhanced reliability in data-intensive applications. XXX, the pivotal technology enabling this evolution, continues to push the boundaries of what is possible. The ongoing transition from SATA to PCIe interfaces represents a significant trend, with PCIe Gen5 and the upcoming Gen6 offering substantial improvements in bandwidth and latency, directly impacting the performance of data center operations. This shift is particularly pronounced in demanding environments like high-performance computing, AI/ML workloads, and real-time analytics. Furthermore, the increasing adoption of QLC (Quad-Level Cell) and PLC (Penta-Level Cell) NAND flash, while offering cost-per-gigabyte advantages, necessitates increasingly sophisticated controllers capable of managing the inherent complexities and endurance challenges. The report highlights that in the Base Year of 2025, the global production of Enterprise-Level SSD Controllers is projected to reach over 25 million units, a testament to the robust growth in this sector. By the Forecast Period's end in 2033, this figure is anticipated to surge, with projections indicating a market volume exceeding 70 million units annually. The rise of hyperscale data centers and the continuous expansion of cloud computing infrastructure are acting as major catalysts, fostering a consistent demand for advanced SSD controllers. Innovations in firmware, such as enhanced wear-leveling algorithms, advanced error correction code (ECC), and sophisticated power management features, are crucial for maximizing SSD lifespan and ensuring data integrity in mission-critical enterprise deployments. Security features, including robust encryption and secure erase capabilities, are also becoming non-negotiable requirements for enterprise SSD controllers, reflecting growing concerns around data protection and regulatory compliance. The development of specialized controllers tailored for specific workloads, such as those designed for NVMe-oF (NVMe over Fabrics) or persistent memory applications, further illustrates the market's segmentation and the drive towards optimized storage solutions. This intricate interplay of technological advancements and market demands is creating a fertile ground for innovation and sustained growth within the enterprise-level SSD controller landscape.

The relentless surge in data generation across all industries is the primary engine propelling the enterprise-level SSD controllers market forward. As businesses increasingly rely on data analytics, artificial intelligence, and machine learning, the need for faster, more efficient storage solutions becomes paramount. Enterprise SSD controllers are at the heart of this transformation, acting as the intelligent brains that orchestrate data flow to and from NAND flash memory. The exponential growth of cloud computing and the ever-expanding digital infrastructure of hyperscale data centers are creating an unprecedented demand for high-capacity, high-performance storage. These environments require SSDs that can handle massive read/write operations with minimal latency, making advanced controllers indispensable. Furthermore, the proliferation of edge computing and the Internet of Things (IoT) are generating vast amounts of data that need to be processed and analyzed closer to the source, further amplifying the need for robust and intelligent storage solutions. Government initiatives promoting digital transformation and the increasing adoption of big data technologies across sectors like healthcare, finance, and telecommunications are also significant drivers. The competitive landscape among SSD manufacturers also fuels innovation, pushing them to integrate the latest controller technologies to offer superior products that meet the evolving needs of enterprise customers.

Despite the robust growth, the enterprise-level SSD controllers market faces several inherent challenges and restraints. The escalating complexity of controller architectures, driven by the need to support advanced NAND technologies like QLC and PLC, along with sophisticated features such as NVMe 2.0, presents significant design and validation hurdles. This complexity can lead to longer development cycles and higher R&D costs. The intense competition within the controller market also puts pressure on profit margins, forcing companies to balance innovation with cost-effectiveness. Moreover, the rapid pace of technological advancement, particularly in NAND flash technology, requires continuous investment in controller upgrades to maintain compatibility and unlock new performance levels. Supply chain disruptions, as witnessed in recent years, can also impact the availability and cost of crucial components, thereby affecting production volumes and pricing strategies. Furthermore, the enterprise market demands extremely high reliability and longevity, which places stringent performance and endurance requirements on SSD controllers. Achieving these levels of robustness while managing costs and power consumption remains a persistent challenge. The market's dependence on the broader semiconductor industry, including the availability of advanced manufacturing nodes and specialized IP, also introduces external vulnerabilities.

Dominant Segments and Regions in the Enterprise-Level SSD Controllers Market:

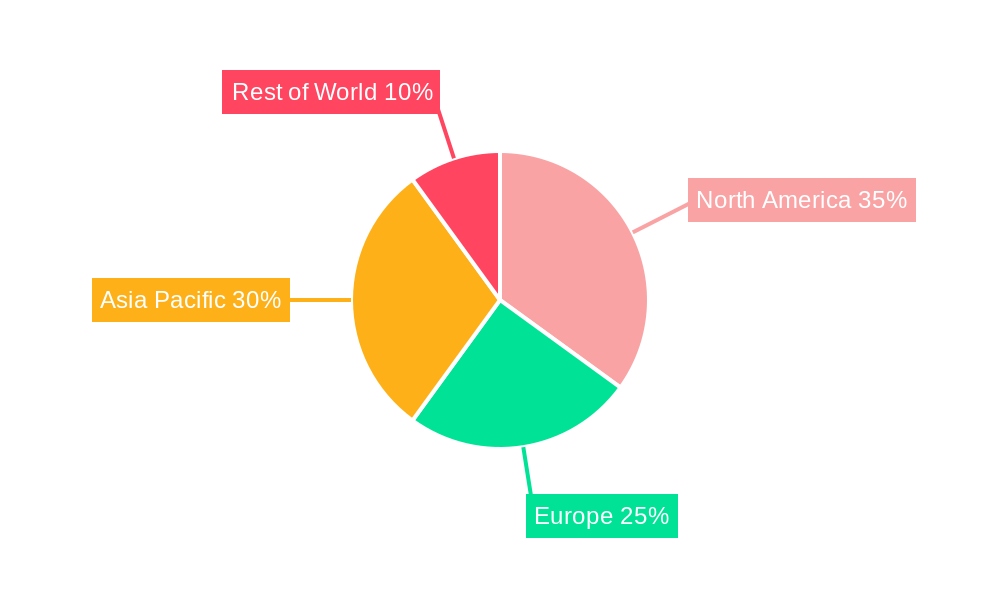

The enterprise-level SSD controllers market is characterized by specific segments and geographical regions that exert significant influence and are poised for continued dominance.

Segment Dominance: PCIe Interface

Dominant Application: Data Center

Dominant Region: North America

The enterprise-level SSD controllers industry is experiencing accelerated growth fueled by several key catalysts. The continuous exponential increase in data generation, driven by Big Data, AI, and IoT, mandates higher performance and capacity storage, directly benefiting advanced SSD controllers. The rapid expansion of cloud computing and hyperscale data centers, requiring robust and efficient storage solutions, is another significant growth engine. Furthermore, the ongoing adoption of PCIe Gen5 and the upcoming Gen6 interfaces offers substantial performance upgrades, pushing the demand for controllers capable of leveraging these speeds. The increasing integration of SSDs into edge computing devices and specialized enterprise applications also contributes to market expansion.

This comprehensive report provides an all-encompassing view of the enterprise-level SSD controllers market. It meticulously analyzes the market size and forecast, broken down by product type (PCIe, SATA), application (Data Center, Cloud Computing, Others), and region. The study delves into the intricate trends shaping the industry, identifying the key drivers propelling its growth, such as the exponential data growth and the expansion of cloud infrastructure. Simultaneously, it addresses the significant challenges and restraints that market players must navigate, including technological complexity and supply chain volatilities. The report offers valuable insights into the dominant regions and segments, highlighting where market activity is most concentrated and where future growth is expected. It also identifies key growth catalysts and provides an exhaustive list of leading players, alongside significant developments and innovations that have shaped and will continue to shape the sector. This detailed exploration ensures stakeholders have the necessary information to make informed strategic decisions within this critical market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 20.1%.

Key companies in the market include Samsung, Marvell Technology, Micron, Intel, SK hynix, KIOXIA, Western Digital, Seagate(Sandforce), Microchip, Silicon Motion, Phison Electronics, YEESTOR, InnoGrit, Maxio Technology, Hangzhou Hualan Microelectronique, Beijing Yixin Technology, DERA, DapuStor, Union Memory, Jiangsu Huacun Electronic Technology.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Enterprise-Level SSD Controllers," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Enterprise-Level SSD Controllers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.