1. What is the projected Compound Annual Growth Rate (CAGR) of the Load Cell Display?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Load Cell Display

Load Cell DisplayLoad Cell Display by Type (Portable, Panel Mount, Other), by Application (Industrial, Laboratory, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

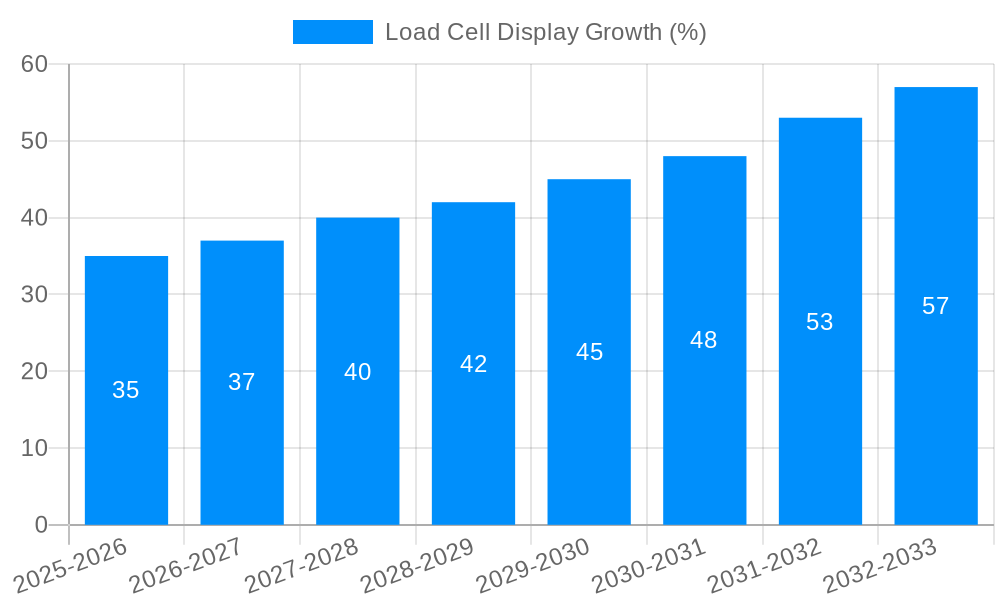

The global Load Cell Display market is poised for significant expansion, projected to reach an estimated $XXX million by 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% extending through 2033. This growth trajectory is fundamentally driven by the increasing demand for precise weight measurement and force monitoring solutions across a multitude of industries. The burgeoning industrial sector, characterized by the adoption of automated manufacturing processes and stringent quality control measures, is a primary catalyst. Furthermore, the growing sophistication of laboratory equipment, requiring accurate and reliable data for research and development, contributes substantially to this market's upward momentum. The evolution towards smart and connected industrial environments, where load cell displays are integral to real-time data acquisition and analysis, further amplifies market opportunities. Advancements in sensor technology, leading to more compact, durable, and cost-effective load cell displays, are also playing a crucial role in wider adoption.

The market's expansion is further buoyed by the inherent advantages of load cell displays, such as their ability to provide immediate and unambiguous readings, thereby minimizing human error and enhancing operational efficiency. Trends such as the miniaturization of electronic components and the development of wireless connectivity for load cell displays are opening new avenues for application in remote monitoring and challenging environments. However, potential restraints include the initial capital investment required for advanced systems and the need for specialized technical expertise for calibration and maintenance, particularly in smaller enterprises. Despite these challenges, the overarching trend towards industrial automation, the increasing focus on safety and compliance in handling heavy loads, and the continuous innovation in sensing technologies are expected to propel the Load Cell Display market to new heights in the coming years. The market is segmented by type into Portable, Panel Mount, and Other displays, with applications spanning Industrial, Laboratory, and Other sectors, indicating a broad scope for future growth.

Here's a unique report description for Load Cell Displays, incorporating your specified elements:

The global load cell display market is projected for robust expansion, with an estimated valuation in the hundreds of millions by the end of the study period in 2033. This growth trajectory, meticulously analyzed from 2019 to 2033 with a specific focus on the base and estimated year of 2025, underscores a significant shift in how force measurement data is being interpreted and utilized across various sectors. During the historical period of 2019-2024, the market witnessed steady adoption driven by increasing automation and the need for precise real-time feedback. As we move into the forecast period of 2025-2033, several key trends are shaping this landscape. The increasing demand for high-precision, digital displays that offer seamless integration with IoT platforms and advanced data analytics is a paramount trend. Manufacturers are prioritizing user-friendly interfaces, multi-parameter display capabilities, and enhanced connectivity options, moving beyond simple numerical readouts to provide actionable insights. Furthermore, the miniaturization and ruggedization of load cell displays are enabling their deployment in increasingly demanding and remote environments, from heavy industrial machinery to portable laboratory equipment. The drive towards predictive maintenance and quality control, where load cell displays play a crucial role in monitoring operational parameters, is also fueling innovation. Expect to see more sophisticated algorithms embedded within these displays, offering not just measurements but also diagnostic capabilities and alerts. The market is also seeing a bifurcation, with high-end, feature-rich displays catering to critical applications and more cost-effective, standard models serving broader industrial needs. This nuanced market evolution indicates a maturing industry poised for substantial volumetric growth, estimated to reach over $700 million by 2033. The continuous refinement of display technologies, coupled with the ever-present need for accurate force measurement in an increasingly data-driven world, positions the load cell display as a critical component in the industrial and scientific ecosystem.

The burgeoning demand for load cell displays is intrinsically linked to the global surge in industrial automation and the relentless pursuit of enhanced operational efficiency. As manufacturing processes become more sophisticated and require increasingly precise control, the need for accurate and real-time force measurement becomes paramount. Load cell displays are the crucial interface, translating raw sensor data into understandable and actionable information. This is particularly evident in industries where quality control and safety are non-negotiable. The growing adoption of Industry 4.0 principles, emphasizing interconnected systems and data-driven decision-making, further amplifies the importance of these displays. They serve as the visible endpoint for sophisticated sensor networks, enabling operators to monitor critical parameters without direct intervention, thus reducing human error and improving productivity. Furthermore, the expanding applications of load cells in diverse fields, from material testing in laboratories to the precise weighing of goods in logistics, are creating a broader market for their accompanying displays. This widespread integration, coupled with an increasing emphasis on safety regulations that mandate accurate load monitoring, acts as a significant propellant for market growth, ensuring that load cell displays are becoming indispensable components across a vast spectrum of operations.

Despite the promising growth trajectory, the load cell display market is not without its hurdles. One significant challenge lies in the intense price competition within the industry. As more manufacturers enter the market, particularly from regions with lower manufacturing costs, there's a constant pressure to reduce prices, which can impact profit margins and hinder investment in cutting-edge research and development. Another restraint is the complexity of integration for certain advanced applications. While connectivity is improving, integrating sophisticated load cell displays with existing legacy systems or highly specialized industrial equipment can still be a time-consuming and costly process, requiring skilled technicians and custom solutions. Furthermore, the rapid evolution of display and sensor technologies presents a dual-edged sword. While it drives innovation, it also necessitates continuous investment in upgrading existing product lines and educating customers on new functionalities, which can be a significant financial and operational burden for smaller players. Finally, concerns regarding data security and electromagnetic interference in sensitive industrial or laboratory environments can also act as a restraining factor, demanding robust shielding and advanced software protocols that add to the overall cost and complexity of the displays.

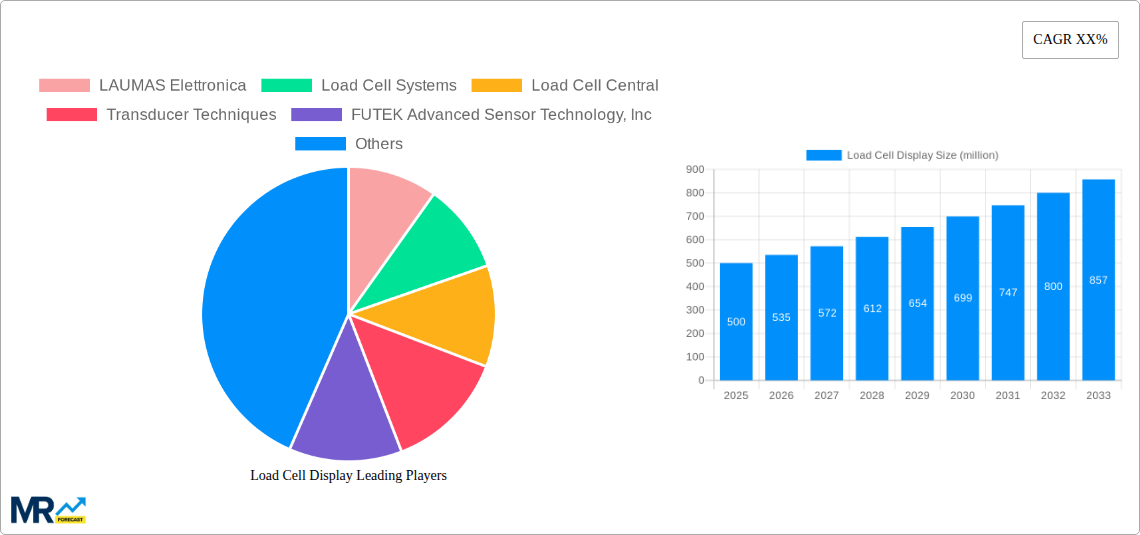

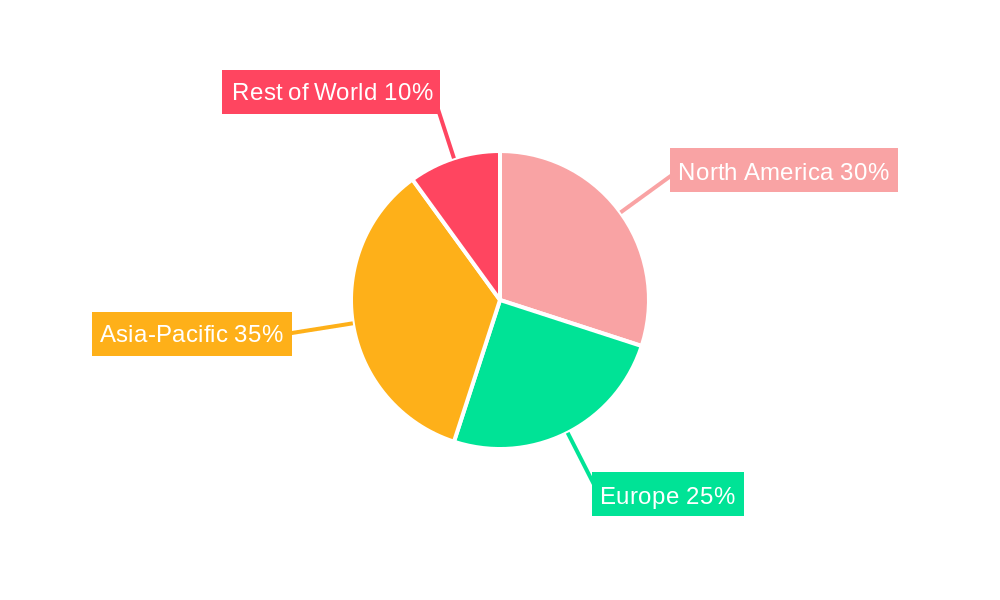

The Industrial segment is poised to dominate the load cell display market during the study period (2019-2033), driven by the pervasive need for precise force measurement and control across a multitude of manufacturing and production processes. This dominance is further amplified by the Asia-Pacific region, which is expected to emerge as the leading geographical market due to its robust manufacturing base, significant investments in automation technologies, and growing adoption of Industry 4.0 initiatives.

Within the Industrial segment, the following sub-segments are anticipated to contribute significantly to market growth:

Manufacturing and Processing: This is the largest sub-segment, encompassing industries such as automotive, aerospace, food and beverage, pharmaceuticals, and chemicals. Load cell displays are integral for quality control, process monitoring, batch weighing, and ensuring the safe operation of heavy machinery. The drive for higher throughput and reduced waste in these sectors directly translates to increased demand for reliable and accurate load cell display solutions. For instance, in automotive manufacturing, load cell displays are used in assembly lines to monitor the force applied during component fitting, ensuring precision and preventing damage. In the food and beverage industry, they are crucial for accurate ingredient dispensing and final product weighing to meet regulatory standards and minimize material costs. The sheer scale of these operations, coupled with the constant drive for efficiency and precision, solidifies manufacturing as the bedrock of the load cell display market.

Logistics and Material Handling: With the exponential growth of e-commerce and global trade, efficient material handling and accurate weighing in warehouses and distribution centers are critical. Load cell displays are employed in forklifts, conveyor systems, automated guided vehicles (AGVs), and shipping scales to ensure accurate weight distribution, optimize payload capacity, and streamline inventory management. The need for real-time tracking and data logging in this sector further fuels the demand for smart and connected load cell displays. The ability to integrate with Warehouse Management Systems (WMS) makes these displays invaluable for operational oversight.

Construction and Infrastructure: In large-scale construction projects, load cell displays are used to monitor the load on cranes, lifting equipment, and structural components, ensuring safety and preventing catastrophic failures. They are also utilized in concrete batching plants and asphalt plants for precise material mixing. The ongoing global investment in infrastructure development, particularly in emerging economies, presents a significant opportunity for growth in this sub-segment.

Metal Fabrication and Machining: In these industries, load cell displays are essential for monitoring forces during cutting, stamping, pressing, and welding operations. This ensures process repeatability, tool longevity, and the quality of the finished product. The increasing use of advanced manufacturing techniques further enhances the need for precise force feedback provided by these displays.

The dominance of the Industrial segment is further reinforced by the Asia-Pacific region's strong performance. Countries like China, India, South Korea, and Japan are at the forefront of manufacturing innovation and adoption of automation. The presence of a vast industrial ecosystem, coupled with government initiatives promoting smart manufacturing and technological advancement, creates a fertile ground for load cell display market expansion. The demand for cost-effective yet high-performance solutions from this region will continue to shape global market trends and drive innovation in product development. While other segments like Laboratory will also see steady growth, the sheer volume and scale of industrial applications, particularly within the Asia-Pacific manufacturing powerhouse, will firmly establish them as the dominant force in the load cell display market for the foreseeable future.

The load cell display industry is experiencing significant growth catalysts, primarily driven by the global push for automation and the increasing adoption of Industry 4.0 technologies. The demand for enhanced precision and efficiency in manufacturing and logistics necessitates accurate real-time force measurement, a core function of these displays. Furthermore, the growing emphasis on safety regulations across various industries, particularly in handling heavy loads, mandates the use of reliable monitoring systems. The continuous innovation in sensor technology and digital display capabilities, leading to more user-friendly, connected, and feature-rich products, also acts as a significant growth driver, expanding their applicability into new and emerging sectors.

This comprehensive report offers an in-depth analysis of the global load cell display market, meticulously detailing its evolution from the historical period of 2019-2024 through to an estimated valuation of over $700 million by 2033. It delves into the intricate dynamics shaping the market, identifying key growth catalysts such as the pervasive drive for industrial automation and the burgeoning adoption of Industry 4.0 principles, which necessitate precise real-time force measurement. The report also addresses significant challenges, including intense price competition and integration complexities. Furthermore, it provides a detailed regional and segmental breakdown, highlighting the anticipated dominance of the Industrial segment, particularly within the rapidly expanding Asia-Pacific region, and projecting specific sub-segment growth within manufacturing, logistics, construction, and metal fabrication. With a focus on the Estimated Year of 2025 and the Forecast Period of 2025-2033, this report equips stakeholders with actionable insights to navigate the competitive landscape and capitalize on emerging opportunities within the dynamic load cell display sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include LAUMAS Elettronica, Load Cell Systems, Load Cell Central, Transducer Techniques, FUTEK Advanced Sensor Technology, Inc, Loadstar Sensors, ADI Artech Transducers Pvt, Tractel, Forsentek Co., Limited, Tacuna Systems, Changsha SUPMETER Technological Co, Applied Measurements.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Load Cell Display," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Load Cell Display, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.