1. What is the projected Compound Annual Growth Rate (CAGR) of the Storage Disk Array?

The projected CAGR is approximately 13.6%.

Storage Disk Array

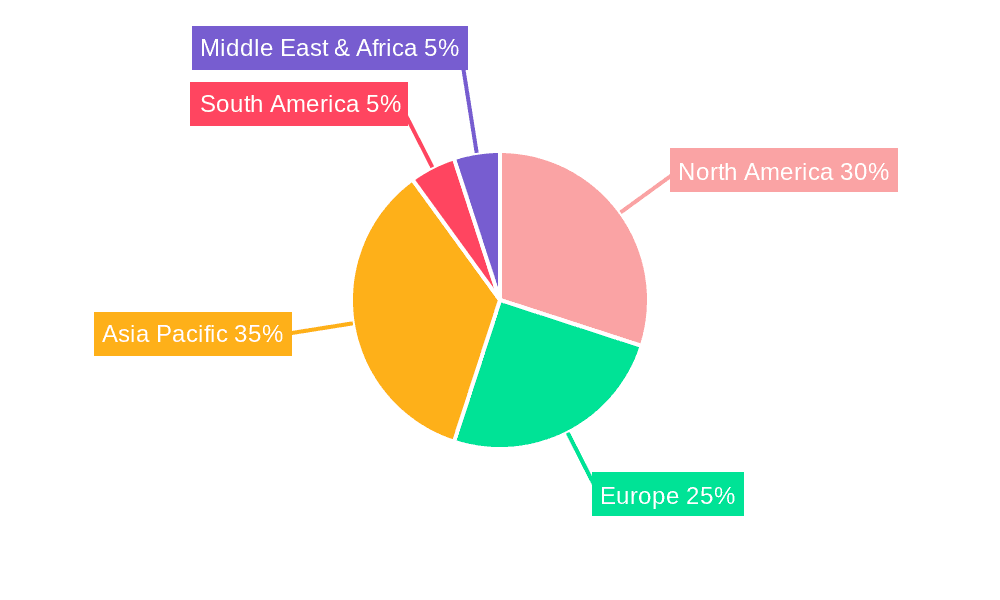

Storage Disk ArrayStorage Disk Array by Type (Controller Power Consumption: Less Than 60w, Controller Power Consumption: 60-90w, Controller Power Consumption: Above 90w, World Storage Disk Array Production ), by Application (High-Performance Computing, Server Storage, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

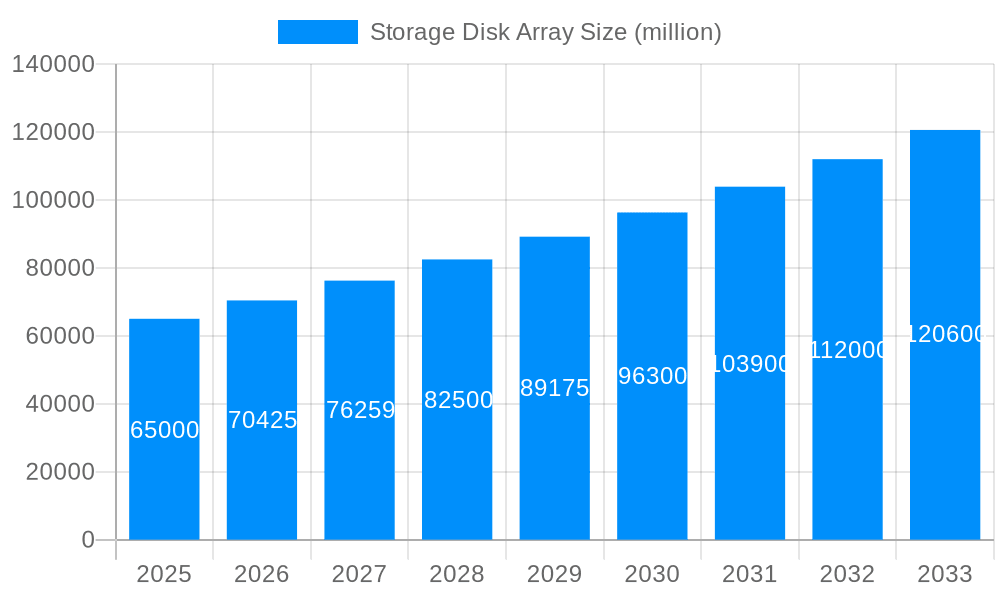

The global Storage Disk Array market is experiencing robust expansion, projected to reach a significant market size of approximately $65 billion by 2025, with an estimated compound annual growth rate (CAGR) of 8.5% during the forecast period of 2025-2033. This growth is primarily fueled by the insatiable demand for scalable and efficient data storage solutions across diverse industries. Key drivers include the escalating volume of data generated by big data analytics, the proliferation of cloud computing services, and the increasing adoption of high-performance computing (HPC) for complex simulations and research. Furthermore, the continuous evolution of storage technologies, such as the integration of NVMe SSDs and tiered storage strategies, is enhancing performance and reducing latency, making disk arrays indispensable for mission-critical applications. The market is also benefiting from the growing need for data backup, disaster recovery, and archiving solutions in an era of increasing cyber threats and regulatory compliance demands.

The market is segmented by controller power consumption, with solutions consuming less than 60W, 60-90W, and above 90W catering to different performance and energy efficiency needs. Applications span across critical areas like high-performance computing and server storage, where rapid data access and processing are paramount. Emerging trends include the rise of software-defined storage (SDS) architectures that offer greater flexibility and scalability, and the increasing incorporation of AI and machine learning for intelligent data management and optimization. However, the market faces restraints such as the high initial investment costs associated with advanced storage systems and the ongoing competition from cloud-based storage alternatives, which offer pay-as-you-go models. Despite these challenges, the sustained digital transformation initiatives and the growing reliance on data-intensive operations across enterprises worldwide are expected to sustain a healthy growth trajectory for the Storage Disk Array market.

Here is a unique report description for Storage Disk Arrays, incorporating your specifications:

The global storage disk array market is poised for substantial expansion, projecting a compound annual growth rate (CAGR) of approximately 6.5% between 2025 and 2033, reaching an estimated market size of over $45 million by 2025. The historical period (2019-2024) witnessed steady growth driven by increasing data generation and the rising demand for robust data management solutions across enterprises. This upward trajectory is set to accelerate, fueled by the insatiable appetite for data in emerging technologies such as artificial intelligence, machine learning, and the Internet of Things (IoT). As businesses continue to digitize operations and expand their cloud footprints, the need for scalable, high-performance, and reliable storage solutions becomes paramount.

A significant trend shaping the market is the shift towards hybrid and all-flash array solutions. While traditional hybrid arrays offering a balance of cost and performance will continue to hold a substantial market share, all-flash arrays are experiencing accelerated adoption, especially within the High-Performance Computing (HPC) and Server Storage segments. This surge is attributed to their unparalleled speed, lower latency, and improved power efficiency, which are critical for demanding workloads. The World Storage Disk Array Production is increasingly focusing on higher density, increased IOPS (Input/Output Operations Per Second), and enhanced data protection features. Furthermore, the rise of software-defined storage (SDS) architectures is enabling greater flexibility and agility, allowing organizations to abstract hardware complexities and manage storage resources more effectively. This paradigm shift is democratizing advanced storage capabilities, making them accessible to a wider range of businesses, including small and medium-sized enterprises (SMEs).

The proliferation of edge computing is another key trend. As data processing moves closer to the source, the demand for compact, resilient, and performant storage solutions at the edge is growing. This presents a new frontier for disk array manufacturers to innovate and cater to specific use cases. The integration of advanced analytics and AI capabilities directly into storage arrays is also gaining traction, enabling proactive monitoring, predictive maintenance, and automated data tiering. Looking ahead to 2033, the market is expected to see further consolidation and innovation, with a strong emphasis on sustainability, energy efficiency, and advanced cybersecurity features embedded within storage solutions. The increasing importance of data as a strategic asset will continue to drive investment in sophisticated storage infrastructure.

The relentless surge in data volume across all sectors is the primary engine powering the storage disk array market. From the vast datasets generated by scientific research in High-Performance Computing to the operational data of every enterprise server, the need to store, manage, and access this information efficiently is a constant imperative. The exponential growth of IoT devices, coupled with the increasing sophistication of AI and machine learning algorithms, is generating unprecedented amounts of data that require robust and scalable storage solutions. Businesses are increasingly recognizing data as a critical asset, driving investment in advanced storage infrastructure to gain competitive advantages through data analytics and informed decision-making.

Furthermore, the digital transformation initiatives undertaken by organizations worldwide are fundamentally altering their IT infrastructure requirements. This includes the adoption of cloud computing, hybrid cloud strategies, and the expansion of data centers. As enterprises migrate their operations and workloads to these environments, the demand for high-capacity, high-performance, and cost-effective storage solutions escalates. The evolution of applications, particularly those requiring real-time data processing and low latency, such as financial trading platforms and real-time analytics for gaming, is also a significant driver. These applications necessitate storage arrays that can deliver exceptional performance, pushing the boundaries of traditional storage technologies and favoring solutions like all-flash arrays. The increasing adoption of hyper-converged infrastructure (HCI) and converged infrastructure solutions, which integrate compute, storage, and networking into a single system, also contributes to the market's growth by simplifying IT management and accelerating deployment.

Despite the robust growth trajectory, the storage disk array market faces several significant challenges that can temper its expansion. The ever-increasing demand for data storage necessitates continuous investment in new hardware, which can be a substantial financial burden for many organizations, especially SMEs. The total cost of ownership (TCO), encompassing initial purchase, maintenance, power consumption, and cooling, can become prohibitive, leading some businesses to explore alternative, albeit often less performant, storage strategies. The rapid pace of technological advancement also presents a challenge. As new storage technologies and standards emerge, organizations are faced with the dilemma of obsolescence and the need for frequent upgrades to remain competitive, adding to their capital expenditure.

Data security and compliance concerns are also critical restraints. With the growing threat landscape and stringent data privacy regulations, such as GDPR and CCPA, ensuring the security and integrity of stored data is paramount. Organizations must invest heavily in robust security measures, encryption, and data backup solutions, which can add complexity and cost to their storage infrastructure. The integration of new storage systems with existing legacy IT environments can also be a complex and time-consuming process, often requiring specialized expertise and significant effort. Furthermore, the skilled workforce required to manage and maintain advanced storage arrays is not always readily available, leading to operational bottlenecks and increased reliance on third-party support. The market also faces the challenge of managing data growth sustainably, considering the environmental impact of power consumption and e-waste generated by storage hardware.

The North America region is anticipated to maintain its dominance in the global storage disk array market throughout the forecast period, driven by a confluence of factors including its advanced technological infrastructure, the presence of leading technology companies, and a high rate of adoption of cutting-edge solutions. The region's strong emphasis on research and development, particularly in areas like High-Performance Computing and AI, fuels a continuous demand for high-capacity, low-latency storage. Major economies like the United States and Canada are home to numerous research institutions, financial services firms, and large enterprises that are at the forefront of data-intensive applications. These entities require sophisticated storage solutions to handle massive datasets for analytics, simulation, and predictive modeling.

In terms of segments, the Server Storage application is expected to be a primary growth engine. The ever-increasing number of servers deployed across enterprises for various functions, from web hosting and application delivery to database management and virtualization, necessitates robust and scalable storage solutions. The rise of cloud computing and hybrid cloud environments further amplifies this demand, as businesses require flexible and efficient storage that can seamlessly integrate with their existing server infrastructure. The Controller Power Consumption: Less Than 60w segment also presents a significant growth opportunity, particularly with the growing focus on energy efficiency and sustainability within the IT sector. As organizations become more aware of their environmental footprint and seek to reduce operational costs, disk arrays with lower power consumption for their controllers become increasingly attractive. This trend is particularly pronounced in environments where power and cooling are significant cost factors, such as large data centers and distributed edge computing deployments. The demand for such solutions is driven by a desire to optimize power usage effectiveness (PUE) and align with corporate sustainability goals. The World Storage Disk Array Production is increasingly geared towards developing more power-efficient controller designs to cater to this burgeoning market segment, offering a compelling combination of performance and reduced energy expenditure.

Furthermore, the Controller Power Consumption: 60-90w segment will continue to capture a substantial market share, catering to a broad spectrum of enterprise workloads that demand a balance between performance and power efficiency. These solutions are versatile and find application in a wide range of scenarios, from mid-sized data centers to departmental servers, where high throughput is important but extreme low-latency is not always a critical requirement. The Controller Power Consumption: Above 90w segment, while potentially representing a smaller volume in terms of unit sales, is crucial for mission-critical applications and the most demanding High-Performance Computing workloads, where raw performance and the ability to handle extremely high IOPS are paramount, even at the cost of higher power consumption.

The rapid advancement and adoption of Artificial Intelligence (AI) and Machine Learning (ML) are significant growth catalysts. These technologies rely on vast datasets for training and operation, directly driving the demand for high-capacity and high-performance storage disk arrays. The continuous evolution of the Internet of Things (IoT) ecosystem, generating an exponential increase in data from connected devices, further fuels this demand for scalable storage solutions to manage and process this influx of information. The ongoing digital transformation across industries, prompting businesses to migrate to cloud and hybrid cloud environments, necessitates sophisticated storage infrastructure for seamless data management and accessibility.

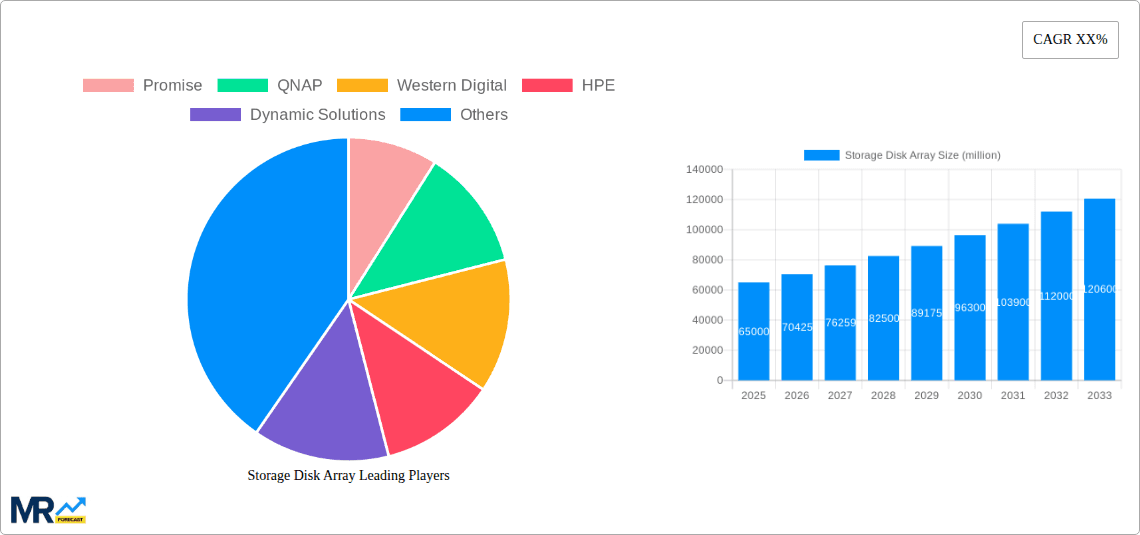

This report offers an exhaustive examination of the global storage disk array market, providing in-depth analysis for the study period (2019-2033), with a specific focus on the base year (2025) and the forecast period (2025-2033). It delves into the intricate dynamics of World Storage Disk Array Production, meticulously analyzing trends in Controller Power Consumption across various tiers: Less Than 60w, 60-90w, and Above 90w. The report also scrutinizes the market by Type and Application, with particular emphasis on High-Performance Computing and Server Storage, alongside exploring Other application areas. It identifies and elaborates on the key driving forces, challenges, and growth catalysts shaping the industry. Comprehensive profiles of leading players like Promise, QNAP, Western Digital, HPE, and NetApp, among others, are included, alongside a detailed breakdown of significant sector developments and regional market dominance. The report also offers valuable insights into market segmentation and competitive landscapes, equipping stakeholders with the knowledge to navigate this evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 13.6%.

Key companies in the market include Promise, QNAP, Western Digital, HPE, Dynamic Solutions, Fujitsu, Synology, Seagate, NetApp, Quantum, Oracle, IBM, Lenovo, USI, Power Leader, Tsinghua Unigroup, Digital China Group, Hikvision, Beijing Tengling.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Storage Disk Array," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Storage Disk Array, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.