1. What is the projected Compound Annual Growth Rate (CAGR) of the High-Precision Indoor Positioning Chip?

The projected CAGR is approximately 34.2%.

High-Precision Indoor Positioning Chip

High-Precision Indoor Positioning ChipHigh-Precision Indoor Positioning Chip by Type (Chips Based On Bluetooth Technology, Chips Based On Wi-Fi Technology, Others, World High-Precision Indoor Positioning Chip Production ), by Application (Manufacturing Industry, Medical Industry, Logistics Industry, Home Furnishing Industry, Others, World High-Precision Indoor Positioning Chip Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

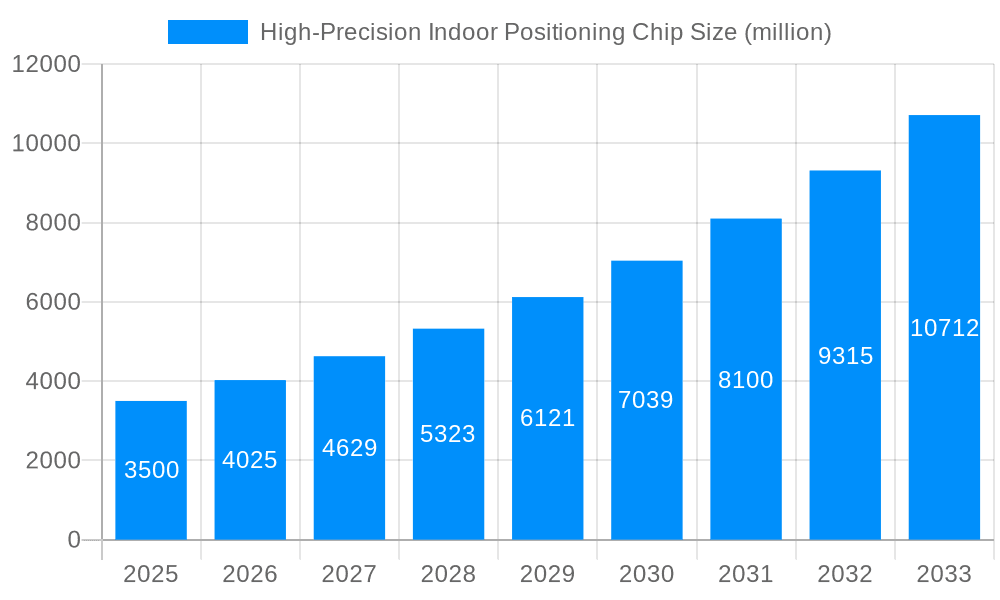

The global high-precision indoor positioning chip market is set for substantial growth, driven by the escalating demand for accurate location services across diverse industries. With an estimated market size of 32.18 billion in 2024, the sector is projected to achieve a robust Compound Annual Growth Rate (CAGR) of 34.2% through 2033. This expansion is fueled by the increasing adoption of IoT devices and the growing need for sophisticated location-aware applications in manufacturing, healthcare, and logistics. The manufacturing sector, in particular, is leveraging these chips for enhanced inventory management, asset tracking, and optimized production workflows, significantly boosting efficiency. Similarly, healthcare is increasingly utilizing precise indoor positioning for patient tracking, equipment management, and improving hospital operational efficiency.

The "Others" segment, encompassing emerging technologies beyond standard Bluetooth and Wi-Fi, is expected to exhibit notable growth as novel solutions emerge to address specific indoor positioning challenges. The logistics industry's demand for real-time tracking and supply chain visibility further supports the need for these advanced chips. While strong drivers propel market growth, challenges such as the high cost of implementing sophisticated indoor positioning systems and integration complexities with existing infrastructure persist. Nonetheless, continuous innovation in chip design, miniaturization, and power efficiency, alongside a growing ecosystem of supporting technologies, will drive market advancement. Asia Pacific is anticipated to lead, driven by rapid industrialization and technological adoption in China and India.

This report offers a comprehensive analysis of the High-Precision Indoor Positioning Chip market, projecting its growth from 2019-2024 to a forecast period of 2025-2033. The market, valued at 32.18 billion in 2024, is poised for significant expansion, driven by the increasing demand for precise spatial awareness in indoor environments. The analysis covers key trends, growth drivers, challenges, dominant market segments, and leading innovators shaping this dynamic sector.

The global High-Precision Indoor Positioning Chip market is experiencing a transformative period, characterized by a confluence of technological advancements and burgeoning application demands. From a market valuation in the millions during the historical period of 2019-2024, the sector is set to witness accelerated growth, reaching an estimated valuation in the tens of millions by the forecast period of 2025-2033. This expansion is largely fueled by the diminishing costs and improving accuracy of positioning technologies, making them increasingly accessible for a wider array of applications. The base year of 2025 serves as a crucial inflection point, from which sustained double-digit growth is anticipated.

Key market insights reveal a pronounced shift towards Ultra-Wideband (UWB) and advanced Bluetooth Low Energy (BLE) technologies as primary enablers of high-precision indoor positioning. While Wi-Fi-based solutions have long been present, their accuracy limitations are being outpaced by the granular precision offered by UWB, particularly in dynamic environments. The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is also a critical trend, enhancing the reliability and intelligence of positioning systems by enabling better signal processing, error correction, and context-aware location services. Furthermore, the miniaturization of these chips, coupled with their reduced power consumption, is facilitating their seamless integration into a multitude of devices, from wearable technology and smart home appliances to industrial sensors and asset trackers. The market is also witnessing a growing demand for chips that offer enhanced security features, protecting sensitive location data from unauthorized access. The overarching trend is a move towards ubiquitous, invisible, and highly accurate indoor positioning that seamlessly augments human experiences and automates industrial processes. The development of standardized protocols and interoperability frameworks is also emerging as a significant trend, aiming to foster a more cohesive and scalable indoor positioning ecosystem.

Several powerful forces are collectively propelling the growth of the High-Precision Indoor Positioning Chip market. Foremost among these is the escalating demand from various industries for enhanced operational efficiency and unprecedented levels of automation. The Manufacturing Industry, in particular, is a significant driver, leveraging these chips for real-time asset tracking, optimizing supply chain logistics, and enabling precise robotic navigation within factory floors. This translates to reduced downtime, improved inventory management, and enhanced worker safety, ultimately contributing to millions in cost savings.

The Medical Industry is another crucial sector, where high-precision indoor positioning is vital for tracking medical equipment, monitoring patient flow, and guiding staff within complex hospital environments. This not only improves patient care and safety but also optimizes resource allocation, leading to significant operational efficiencies. The burgeoning e-commerce landscape and the increasing sophistication of logistics operations are also fueling demand. In the Logistics Industry, these chips are indispensable for real-time tracking of goods within warehouses, optimizing picking and packing processes, and ensuring the timely delivery of shipments. The Home Furnishing Industry, though perhaps less apparent initially, is also showing burgeoning interest, with applications emerging in smart home integration for personalized experiences and efficient management of smart devices. The general trend towards the Internet of Things (IoT) and the proliferation of connected devices globally, valued in the millions, necessitates accurate indoor localization for seamless device interaction and data collection, acting as a fundamental underpinning for these connected ecosystems.

Despite the robust growth prospects, the High-Precision Indoor Positioning Chip market faces several significant challenges and restraints that could impede its full potential. One of the primary hurdles is the high implementation cost associated with deploying comprehensive indoor positioning systems, particularly in large-scale industrial or commercial settings. While the cost of individual chips is decreasing, the infrastructure required for accurate and ubiquitous coverage, including anchors, gateways, and specialized readers, can represent a substantial capital investment, running into millions of dollars for large deployments.

Another key challenge is the complexity of deployment and integration. Achieving centimetre-level accuracy often requires meticulous site surveys, calibration, and integration with existing IT infrastructure. This complexity can be a deterrent for smaller businesses or those with limited technical expertise. Furthermore, environmental interference poses a significant problem. Factors such as signal obstruction by walls, metallic objects, and other electronic devices can degrade the accuracy and reliability of positioning signals, especially in dense or complex indoor environments. The need for continuous recalibration and maintenance to counteract these environmental factors adds to the operational burden and cost. The lack of standardization across different positioning technologies and vendors also creates interoperability issues, leading to vendor lock-in and hindering the seamless integration of solutions from multiple providers, which could otherwise unlock greater market potential valued in the millions. Finally, privacy concerns surrounding the collection and use of granular indoor location data remain a sensitive issue, requiring robust data protection measures and clear ethical guidelines to foster consumer and enterprise trust.

The High-Precision Indoor Positioning Chip market is experiencing a pronounced dominance by specific regions and segments, driven by a combination of technological adoption rates, industrial demand, and government initiatives. Among the various segments, Chips Based on Bluetooth Technology and Chips Based on Wi-Fi Technology are currently holding significant market share, primarily due to their widespread existing infrastructure and relatively lower cost of implementation. However, the fastest growth is anticipated in segments leveraging newer, more precise technologies.

In terms of regions, North America and Europe are expected to lead the market in the forecast period of 2025-2033, with a combined market value expected to reach tens of millions.

Within the application segments, the Manufacturing Industry is projected to be the largest and fastest-growing segment, with its market value anticipated to grow substantially into the millions over the forecast period.

While Chips Based on Bluetooth and Wi-Fi currently hold significant market share due to existing infrastructure, the market is witnessing a rapid rise in the adoption of Chips Based on Ultra-Wideband (UWB) Technology (categorized under 'Others' in this report's classification). Although the initial investment might be higher, the superior accuracy (centimetre-level) and robust performance of UWB in challenging environments are making it the preferred choice for critical applications in manufacturing, logistics, and even the medical industry. The market for UWB-based chips is expected to see exponential growth, potentially surpassing existing technologies in value in the coming years, reaching hundreds of millions in market size. The "World High-Precision Indoor Positioning Chip Production" also refers to the overall market size and production volume, which is expected to expand significantly, driven by the collective demand from these leading regions and application segments.

The High-Precision Indoor Positioning Chip industry is experiencing robust growth fueled by several key catalysts. The relentless pursuit of operational efficiency and automation across industries like manufacturing and logistics is a primary driver, with these chips enabling precise asset tracking and optimized workflows, leading to millions in cost savings. The burgeoning Internet of Things (IoT) ecosystem necessitates accurate indoor localization for seamless device interaction and data collection. Furthermore, advancements in chip miniaturization and power efficiency are making these technologies more accessible and integrable into a wider range of devices. The increasing demand for enhanced safety and security applications, particularly in industrial and healthcare settings, also acts as a significant growth catalyst.

This report provides an exhaustive analysis of the High-Precision Indoor Positioning Chip market, spanning the historical period of 2019-2024 and extending through a robust forecast period of 2025-2033, with 2025 as the base and estimated year. It offers deep insights into market dynamics, including trends, driving forces, challenges, and significant developments, painting a comprehensive picture of this rapidly evolving sector. The report meticulously examines key segments such as Chips Based on Bluetooth Technology, Chips Based on Wi-Fi Technology, and Others, alongside crucial application areas including the Manufacturing Industry, Medical Industry, Logistics Industry, and Home Furnishing Industry. With a projected market valuation in the millions, this analysis serves as an indispensable guide for stakeholders seeking to understand and capitalize on the immense opportunities within the global High-Precision Indoor Positioning Chip market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 34.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 34.2%.

Key companies in the market include Ubisense, Qorvo, NXP Semiconductors, Nordic Semiconductor, Broadcom, Location Services, Zebra Technologies.

The market segments include Type, Application.

The market size is estimated to be USD 32.18 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "High-Precision Indoor Positioning Chip," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the High-Precision Indoor Positioning Chip, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.