1. What is the projected Compound Annual Growth Rate (CAGR) of the Mini/Micro LED Driver Chip?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Mini/Micro LED Driver Chip

Mini/Micro LED Driver ChipMini/Micro LED Driver Chip by Type (Passive Matrix (PM) Drive, Active Matrix (AM) Drive, Semi-Active Matrix Drive, World Mini/Micro LED Driver Chip Production ), by Application (LED Direct Display Large Screen, TV And Computer, Car Display, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

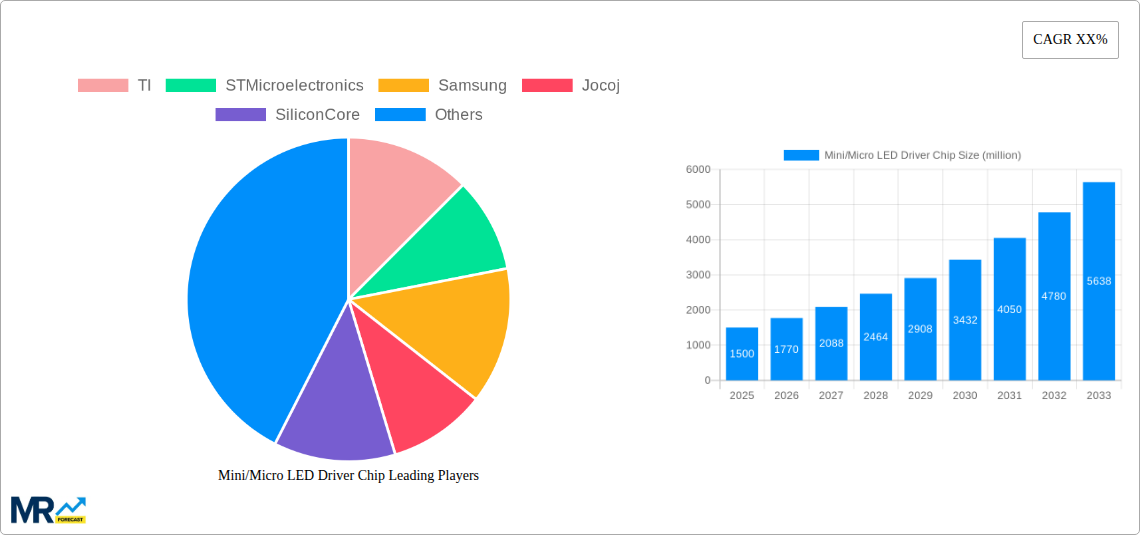

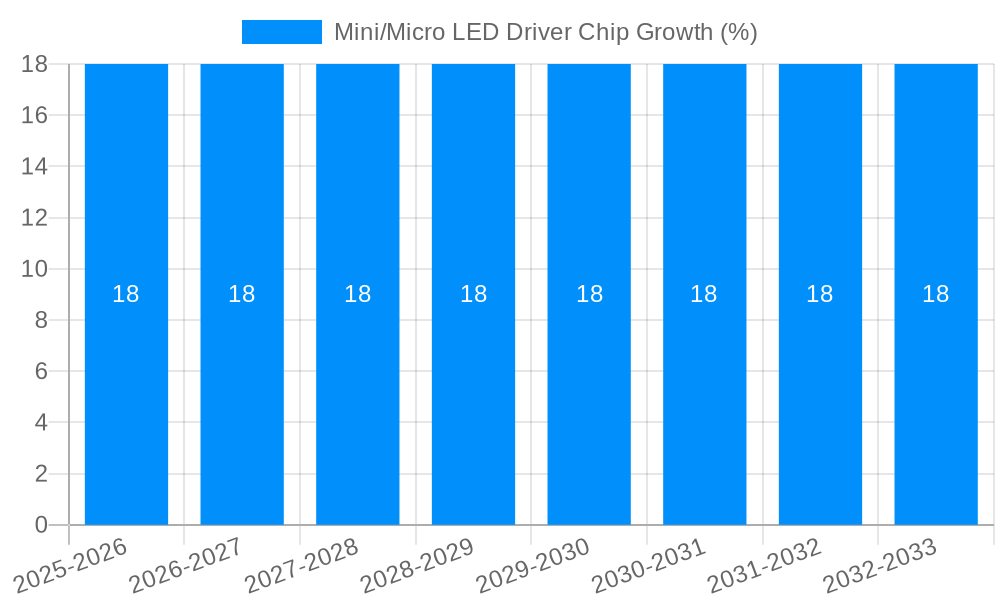

The global Mini/Micro LED driver chip market is poised for significant expansion, projected to reach an estimated $1.5 billion by 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 25% through 2033. This surge is primarily fueled by the escalating demand for ultra-high-definition displays across various applications, including large-format LED direct displays, premium televisions, advanced computer monitors, and increasingly sophisticated automotive infotainment systems. The inherent advantages of Mini/Micro LED technology, such as superior contrast ratios, exceptional brightness, faster response times, and improved power efficiency compared to traditional LED and OLED displays, are driving widespread adoption. The industry is witnessing a strong shift towards Active Matrix (AM) Drive technology due to its superior performance and scalability for complex display matrices, although Passive Matrix (PM) Drive and Semi-Active Matrix Drive segments will also continue to evolve to meet specific cost and performance requirements. Innovations in chip design, focusing on higher integration, reduced power consumption, and enhanced control for pixel-level dimming, are crucial for manufacturers to capitalize on this burgeoning market.

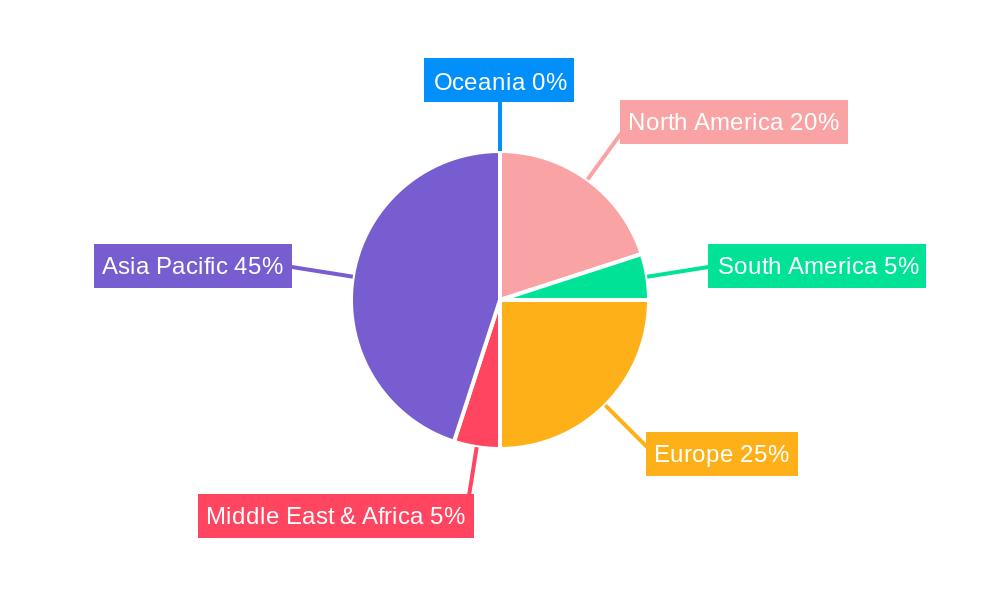

The market's growth trajectory is further propelled by relentless innovation and strategic investments from key players like Samsung, TI, STMicroelectronics, and Novatek Microelectronics. These companies are at the forefront of developing next-generation driver ICs that enable seamless integration of Mini/Micro LED technology into consumer electronics and automotive sectors. The expansion of manufacturing capabilities and the establishment of robust supply chains, particularly in the Asia Pacific region, are critical to meeting the increasing global demand. While the high cost of Mini/Micro LED manufacturing and the need for specialized driver chips present some initial restraints, ongoing technological advancements and economies of scale are expected to mitigate these challenges over the forecast period. The market's future is intrinsically linked to the continued miniaturization of LEDs and the development of more efficient and cost-effective driver solutions, making it a dynamic and highly competitive landscape.

Here's a unique report description for the Mini/Micro LED Driver Chip market, incorporating the requested information and structure:

The Mini/Micro LED driver chip market is poised for explosive growth, driven by the insatiable demand for superior display technologies across a multitude of applications. Our comprehensive report, spanning the Study Period of 2019-2033, with a keen focus on the Base Year of 2025 and a robust Forecast Period of 2025-2033, meticulously analyzes the intricate dynamics of this burgeoning sector. The Historical Period of 2019-2024 laid the groundwork, showcasing initial adoption and technological advancements. We project the Estimated Year of 2025 to be a pivotal moment, with the market witnessing significant unit sales, estimated to reach into the tens of millions globally. This growth is underpinned by the inherent advantages of Mini/Micro LEDs, including enhanced brightness, contrast ratios, color accuracy, and energy efficiency, which directly translate to improved visual experiences for consumers and professionals alike. The ongoing evolution of manufacturing processes and the increasing integration of these driver chips into consumer electronics, automotive displays, and commercial signage are key indicators of sustained expansion. Furthermore, the report delves into the nuanced trends of World Mini/Micro LED Driver Chip Production, highlighting the strategic shifts in manufacturing hubs and the increasing investments in research and development by key players. We foresee a significant upswing in the adoption of advanced driver chip architectures, enabling finer pixel pitch control and seamless integration with next-generation display panels. The market is also seeing a growing emphasis on miniaturization and power efficiency of these driver chips, a crucial factor for portable and high-performance devices.

The relentless pursuit of visual fidelity is the primary engine propelling the Mini/Micro LED driver chip market forward. As consumers increasingly demand displays with unparalleled contrast, vibrant colors, and exceptional brightness, manufacturers are turning to Mini/Micro LED technology. This translates directly into a higher demand for sophisticated driver chips that can precisely control millions of microscopic LEDs, ensuring optimal performance and image quality. The burgeoning adoption of Mini/Micro LED displays in premium television sets, high-end monitors, and advanced mobile devices is a testament to this trend. Moreover, the automotive industry's shift towards in-car displays that offer enhanced clarity and responsiveness, even under varying lighting conditions, is a significant growth catalyst. The increasing prevalence of AR/VR applications, which necessitate ultra-high resolution and low latency, further fuels the need for advanced Mini/Micro LED driver solutions. The ongoing technological advancements in LED manufacturing, leading to smaller and more efficient LED chips, are also creating a positive feedback loop, making Mini/Micro LED displays more commercially viable and accessible. This push for better visual experiences, coupled with the enabling capabilities of driver chip technology, is creating a self-reinforcing growth cycle.

Despite the promising outlook, the Mini/Micro LED driver chip market is not without its hurdles. The most significant challenge remains the high cost associated with the manufacturing of Mini/Micro LED displays, which directly impacts the cost of the driver chips. While significant progress has been made in optimizing production processes, the intricate nature of aligning and bonding millions of microscopic LEDs, alongside the complex driver circuitry, contributes to elevated manufacturing expenses. This cost barrier can hinder widespread adoption in price-sensitive market segments. Furthermore, the complexity of the driver chip design and fabrication itself presents a technical challenge. Developing chips capable of handling the immense data bandwidth and precise timing required for Mini/Micro LED panels demands cutting-edge semiconductor technology and substantial R&D investment. Ensuring reliability and long-term performance in such densely integrated systems is another critical consideration. Supply chain disruptions, particularly for specialized components and advanced fabrication services, can also pose a significant restraint, impacting production volumes and lead times. Lastly, the development of robust and standardized testing protocols for these highly sophisticated driver chips is an ongoing endeavor.

The Active Matrix (AM) Drive segment is unequivocally poised to dominate the Mini/Micro LED driver chip market, both in terms of unit production and revenue generation throughout the Study Period of 2019-2033. This dominance stems from the inherent superiority of active matrix addressing in enabling individual pixel control, which is crucial for the high resolution, refresh rates, and seamless integration required by advanced Mini/Micro LED displays. The ability of AM drive to minimize crosstalk and power consumption per pixel makes it the go-to technology for premium applications.

In parallel, East Asia, particularly China, is expected to be the dominant region in the Mini/Micro LED driver chip market. This leadership is driven by a confluence of factors including a robust semiconductor manufacturing infrastructure, significant government support for the display industry, and the presence of major display panel manufacturers. The region's prowess in scaling production, coupled with a rapidly growing domestic market for advanced displays, positions it as the epicenter of both production and consumption.

The Mini/Micro LED driver chip industry is experiencing significant growth catalysts. The relentless consumer demand for superior display quality in televisions, smartphones, and wearables is a primary driver. Advancements in automotive displays, requiring higher brightness and contrast for safety and user experience, are also contributing substantially. Furthermore, the increasing adoption of Mini/Micro LED technology in professional applications like digital signage, broadcasting, and industrial displays, where image fidelity is paramount, fuels further market expansion. The ongoing miniaturization of LED chips and driver ICs, alongside improvements in energy efficiency, makes them increasingly viable for a wider range of portable and embedded applications.

This comprehensive report offers an in-depth analysis of the Mini/Micro LED driver chip market, extending from 2019 to 2033. It meticulously dissects market dynamics, technology trends, and the competitive landscape, with a specific emphasis on the Base Year of 2025. The report highlights key market insights and trends, projecting significant unit sales into the tens of millions. It also explores the driving forces behind market expansion, including the relentless pursuit of superior visual fidelity across consumer electronics, automotive, and professional applications. Challenges and restraints, such as manufacturing costs and technical complexities, are thoroughly examined. Furthermore, the report identifies the dominance of the Active Matrix (AM) Drive segment and the leadership of East Asia, particularly China, in both production and consumption. It details the growth catalysts, leading players, and significant technological developments shaping the future of this dynamic industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include TI, STMicroelectronics, Samsung, Jocoj, SiliconCore, TOPCO, Finemad electronics, Focuslight, BOE HC SemiTek, Novatek Microelectronics, Macroblock, Chipone Technology (Beijing), Shixin Technology, Viewtrix Technology, Aixiesheng, Xiamen Xm-plus Technology, Shenzhen Sunmoon Microelectronics, Erised Semiconductor, Beijing Xianxin Technology, Shenzhen Sitan Technology, Kunshan Maiyun Display Technology, Light-Chip, TLi, Solomon Systech(International), Tianyi Microelectronics (Hangzhou), Sapien Semiconductor, Beijing Xinneng.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Mini/Micro LED Driver Chip," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Mini/Micro LED Driver Chip, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.