1. What is the projected Compound Annual Growth Rate (CAGR) of the DIP/SMD/SOP Packaged Thyristor Optocoupler?

The projected CAGR is approximately XX%.

DIP/SMD/SOP Packaged Thyristor Optocoupler

DIP/SMD/SOP Packaged Thyristor OptocouplerDIP/SMD/SOP Packaged Thyristor Optocoupler by Type (Zero Crossing Output, Non-Zero Crossing Output, World DIP/SMD/SOP Packaged Thyristor Optocoupler Production ), by Application (Industrial Control, Power Electronics, Automotive Electronics, Communication Equipment, Medical Equipment, Others, World DIP/SMD/SOP Packaged Thyristor Optocoupler Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

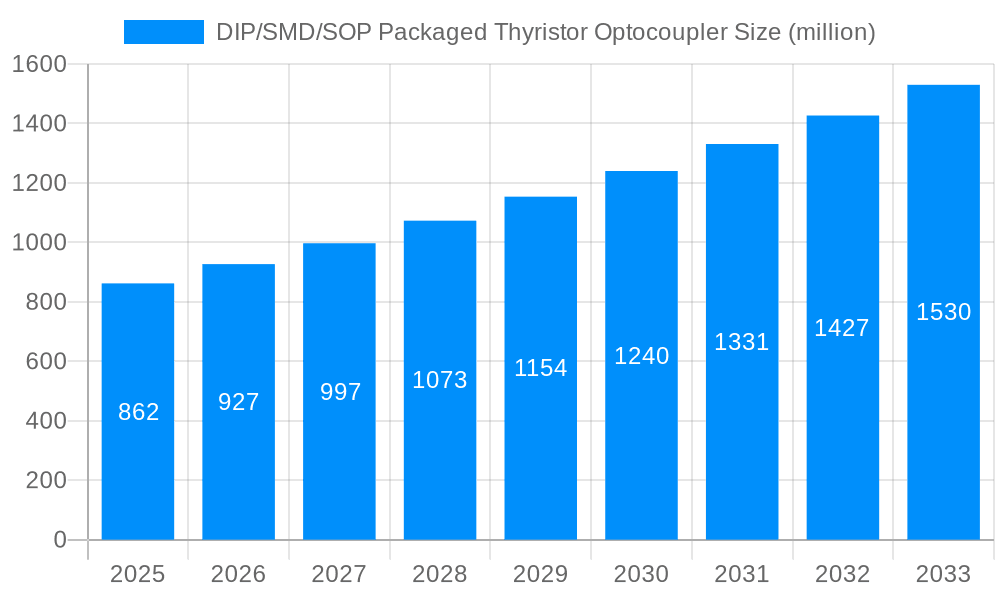

The global market for DIP/SMD/SOP packaged thyristor optocouplers is poised for significant expansion, driven by robust growth across key application sectors such as industrial control, power electronics, and automotive electronics. With a current market size estimated at $862 million in 2025, the industry is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025-2033. This sustained growth is underpinned by the increasing demand for efficient and reliable isolation and control solutions in modern electronic systems. The ongoing advancements in power semiconductor technology and the proliferation of smart devices further fuel the adoption of these optocouplers. Additionally, the stringent safety regulations and the need for enhanced electrical isolation in high-voltage applications contribute to the market's positive trajectory. The trend towards miniaturization in electronics also favors the adoption of compact SMD and SOP packages, while traditional DIP packages continue to serve established industrial applications.

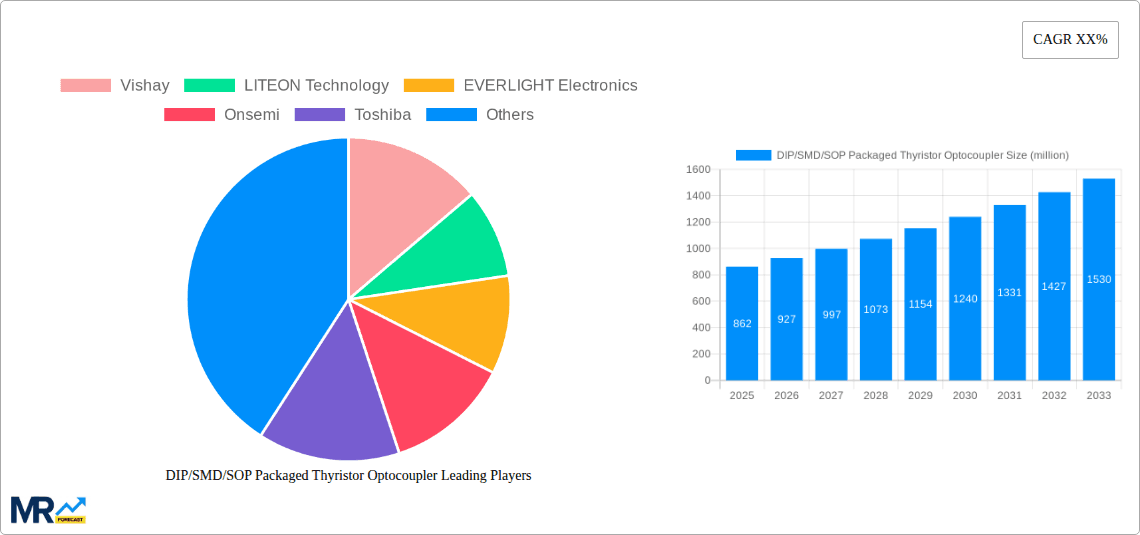

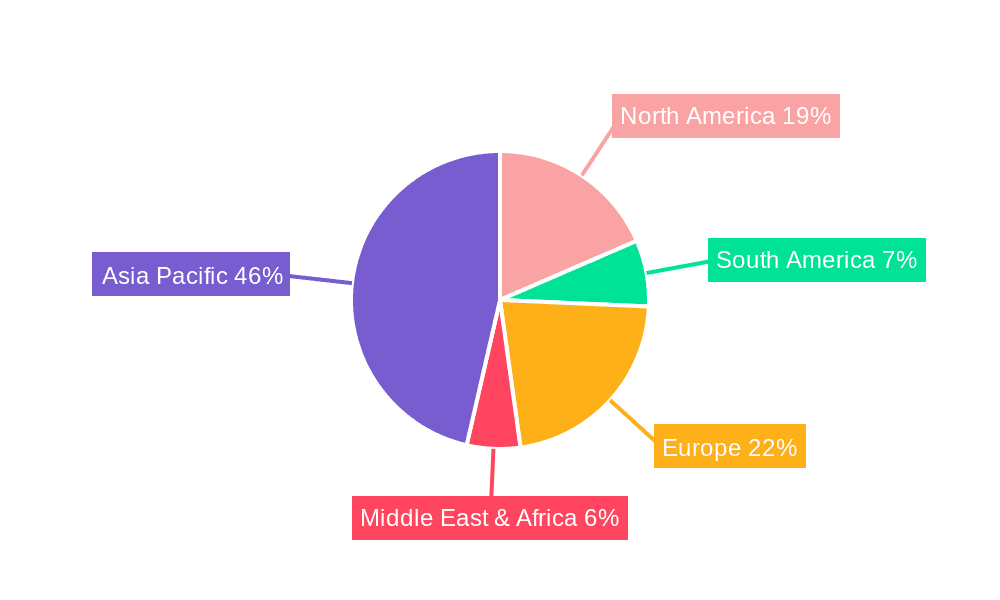

The market dynamics are characterized by a competitive landscape featuring established players like Vishay, LITEON Technology, and EVERLIGHT Electronics, alongside emerging contenders from Asia Pacific. Regional analysis indicates Asia Pacific, particularly China, as a dominant force in both production and consumption, owing to its extensive manufacturing base and rapid industrialization. North America and Europe represent mature yet consistently growing markets, driven by technological innovation and stringent quality standards in sectors like medical and communication equipment. Restraints to growth, such as the increasing competition from alternative isolation technologies and potential supply chain disruptions, are being actively addressed by manufacturers through product innovation and strategic partnerships. The market's segmentation by output type, with Zero Crossing and Non-Zero Crossing outputs catering to specific control requirements, reflects the nuanced demands of various applications.

Here's a unique report description on DIP/SMD/SOP Packaged Thyristor Optocoupler, incorporating the requested elements:

The global market for DIP/SMD/SOP packaged thyristor optocouplers is experiencing a dynamic evolution, marked by a steady upward trajectory and increasing adoption across a spectrum of critical industries. Throughout the historical period from 2019 to 2024, the market demonstrated resilience and consistent growth, driven by the fundamental need for reliable isolation and control in electronic systems. As we move into the base year of 2025, projections indicate a significant expansion in production volume, estimated to reach 550 million units in the current year, a testament to the growing demand. The study period, extending to 2033, foresees this market continuing its robust expansion, propelled by advancements in semiconductor technology and the relentless digitalization of industrial processes. The increasing complexity and power demands of modern electronic systems necessitate optocouplers that offer superior performance, safety, and efficiency, a niche where thyristor optocouplers excel. The market's structure is characterized by a diverse range of applications, from intricate industrial automation requiring precise control of high-power loads to the burgeoning automotive sector’s demand for robust and safe electrical systems. Furthermore, the communication equipment sector continues to be a significant consumer, leveraging these components for signal isolation in sensitive networking infrastructure. The COVID-19 pandemic, while presenting initial supply chain disruptions, ultimately underscored the critical importance of reliable electronic components, leading to a renewed focus on domestic production capabilities and supply chain diversification, which in turn has positively impacted the market for these essential devices. Looking ahead, the forecast period of 2025-2033 anticipates a compound annual growth rate (CAGR) that will drive production volumes to well over 800 million units by the end of the forecast horizon, reflecting sustained innovation and expanding market penetration. The development of more compact, higher voltage, and faster-switching thyristor optocouplers is also a key trend, catering to the ever-shrinking form factors and increasing power density requirements of modern electronic designs.

The surge in demand for DIP/SMD/SOP packaged thyristor optocouplers is primarily fueled by the escalating pace of industrial automation and the increasing integration of smart technologies across various sectors. Industrial control systems, in particular, are a major impetus, as they rely heavily on the robust isolation and switching capabilities of thyristor optocouplers to safely manage high-voltage and high-current applications. The transition towards Industry 4.0, characterized by interconnected devices, data analytics, and automated manufacturing, necessitates components that can reliably handle complex electrical signals and ensure operational safety. Power electronics is another significant driver, with the growth in renewable energy systems, electric vehicles, and advanced power supplies demanding efficient and secure power management solutions, where thyristor optocouplers play a crucial role in protecting sensitive control circuitry. The automotive industry's electrification and the increasing adoption of advanced driver-assistance systems (ADAS) further contribute to this demand, as these components are vital for the safe and efficient operation of vehicle electrical systems. Moreover, the continuous development of communication equipment, from high-speed data centers to advanced telecommunications infrastructure, requires reliable optocouplers for signal integrity and isolation. The sheer volume of production needed to support these expanding industries is estimated to reach 600 million units in the base year 2025, with continued growth anticipated.

Despite the robust growth, the DIP/SMD/SOP packaged thyristor optocoupler market faces several challenges. The increasing competition from alternative isolation technologies, such as digital isolators and other types of optocouplers, poses a restraint, particularly in applications where speed and miniaturization are paramount. While thyristor optocouplers offer excellent high-power handling, the continuous drive for smaller and more integrated solutions can sometimes favor more compact alternative components. Fluctuations in raw material prices, particularly for silicon and other semiconductor manufacturing inputs, can impact production costs and profit margins, potentially affecting market growth. Furthermore, the stringent regulatory requirements and compliance standards in industries like medical and automotive electronics necessitate significant investment in testing and validation, adding to the overall cost of product development and market entry. The global supply chain complexities, exacerbated by geopolitical factors and trade tensions, can also lead to production delays and increased lead times, impacting the availability of these components and potentially hindering market expansion. The need for specialized handling and packaging to ensure product integrity throughout the supply chain also adds an operational layer of complexity. The market is also somewhat constrained by the specialized nature of thyristor optocouplers, which are not always a direct drop-in replacement for general-purpose optocouplers, requiring designers to specifically select them for their unique performance characteristics.

The global DIP/SMD/SOP packaged thyristor optocoupler market is characterized by distinct regional strengths and segment dominance, with Asia-Pacific poised to maintain its leadership position and the "Industrial Control" segment emerging as the primary growth engine.

Dominant Region/Country:

Dominant Segment:

The interplay between Asia-Pacific's manufacturing prowess and the insatiable demand from the Industrial Control sector, bolstered by the specific advantages of Zero Crossing Output optocouplers, creates a formidable market dominance. This dominance is expected to persist and strengthen throughout the study period, reaching an estimated production of over 700 million units in 2033, reflecting the continued importance of reliable isolation and control in the evolving global industrial landscape.

The growth of the DIP/SMD/SOP packaged thyristor optocoupler industry is significantly propelled by the escalating adoption of smart grid technologies and the increasing demand for robust power management solutions in the renewable energy sector. The electrification of transportation, with the surge in electric vehicles (EVs), also creates a substantial demand for these optocouplers in battery management systems and charging infrastructure. Furthermore, the continuous miniaturization of electronic devices across all sectors, while presenting some challenges, also drives innovation in creating smaller, more efficient thyristor optocouplers to fit within these compact designs. The increasing focus on industrial safety and the implementation of stringent regulations mandating electrical isolation in hazardous environments further fuel market expansion.

This comprehensive report provides an in-depth analysis of the global DIP/SMD/SOP packaged thyristor optocoupler market, offering detailed insights into its historical performance, current landscape, and future trajectory. The report meticulously examines market segmentation by type (Zero Crossing Output, Non-Zero Crossing Output) and application (Industrial Control, Power Electronics, Automotive Electronics, Communication Equipment, Medical Equipment, Others), providing estimated production volumes, such as 550 million units for the base year 2025. It identifies key growth drivers, including the burgeoning demand from industrial automation and the automotive sector, and crucial challenges like competition from alternative technologies and supply chain volatility. The report also highlights leading market players, significant technological advancements, and regional market dynamics, with a particular focus on the dominance of the Asia-Pacific region and the Industrial Control segment. Furthermore, it details industry developments and future trends anticipated over the study period of 2019-2033.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Vishay, LITEON Technology, EVERLIGHT Electronics, Onsemi, Toshiba, Panasonic, Sharp Corporation, IXYS, COSMO Electronics, CT Micro, Xiamen Hualian Electronics, Shenzhen Orient Components, JieJie Microelectronics, Shenzhen Kinglight, Shanghai Orient-Chip Technology.

The market segments include Type, Application.

The market size is estimated to be USD 862 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "DIP/SMD/SOP Packaged Thyristor Optocoupler," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the DIP/SMD/SOP Packaged Thyristor Optocoupler, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.