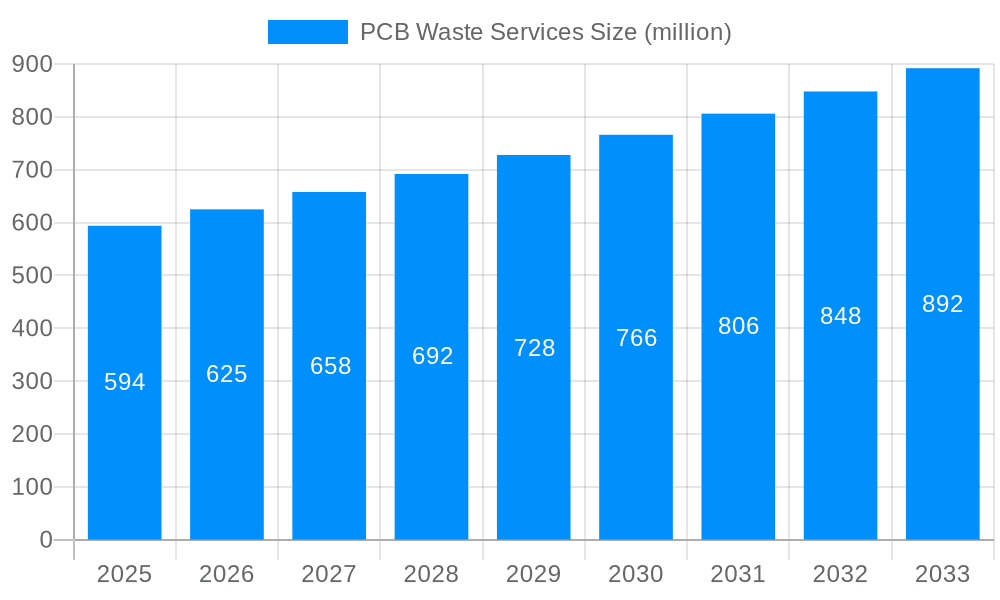

1. What is the projected Compound Annual Growth Rate (CAGR) of the PCB Waste Services?

The projected CAGR is approximately 5.4%.

PCB Waste Services

PCB Waste ServicesPCB Waste Services by Type (Abandoned Device Containing PCBs, PCBs Liquid Waste, Wastewater Contaminated with PCBs, Soil Contaminated with PCBs, PCBs Items (Manufactured with PCBs), Other Wastes Contaminated with PCBs), by Application (High Temperature Combustion, Chemical Destruction, Landfilling), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

The global market for PCB Waste Services is projected to reach a substantial valuation, with an estimated market size of $594 million in 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 5.4% through 2033. This growth is underpinned by an increasing awareness of the environmental and health hazards associated with polychlorinated biphenyls (PCBs) and the escalating volume of waste generated from their legacy use and disposal. Key drivers for this market expansion include stringent environmental regulations across major economies, compelling industries to adopt compliant and sustainable waste management practices. Furthermore, the ongoing decommissioning of older industrial facilities, containing significant amounts of PCB-contaminated materials, directly contributes to the demand for specialized PCB waste handling and disposal services. The market is also influenced by technological advancements in waste treatment methods, making them more efficient and environmentally sound, thereby encouraging greater adoption.

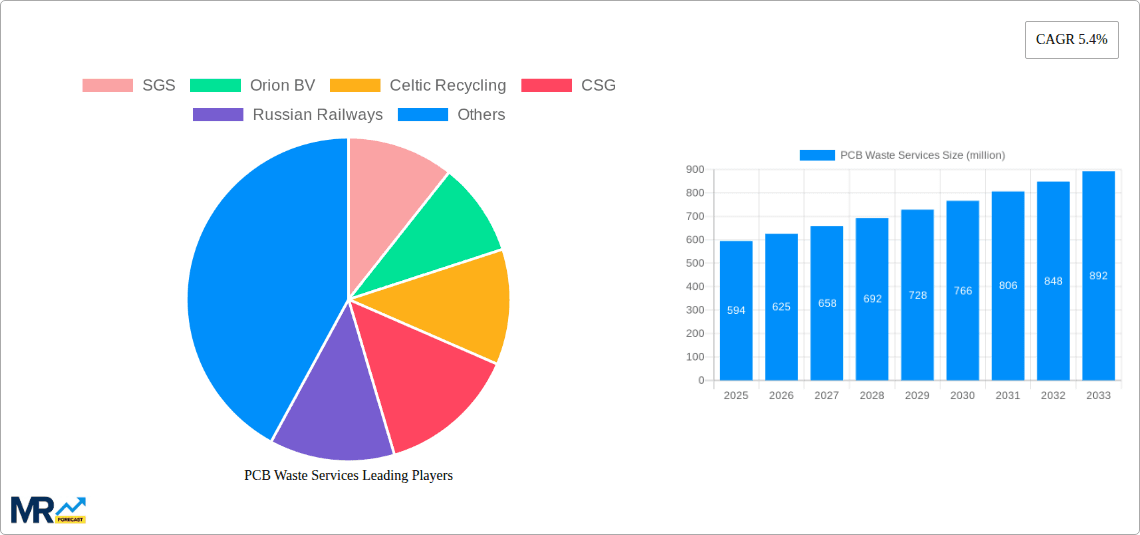

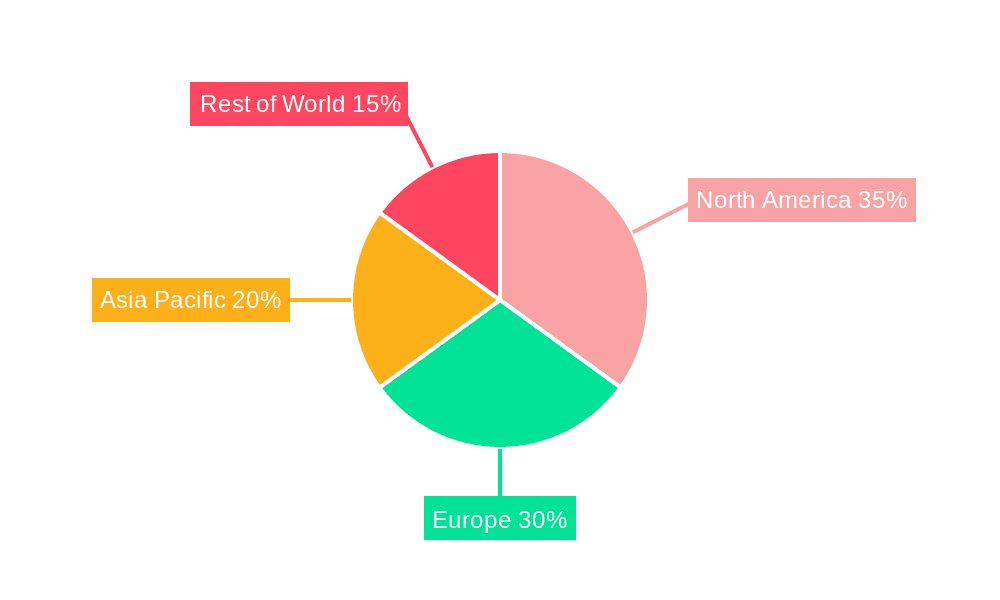

The PCB Waste Services market encompasses a diverse range of waste types, including abandoned devices containing PCBs, PCBs liquid waste, and wastewater contaminated with PCBs, as well as soil and manufactured items containing these persistent organic pollutants. The primary applications for managing this waste revolve around high-temperature combustion, chemical destruction, and secure landfilling. Leading companies such as Veolia, Clean Harbors, and Aevitas are at the forefront, offering comprehensive solutions to tackle the complex challenges of PCB waste management. Geographically, North America and Europe currently dominate the market due to their well-established regulatory frameworks and a higher concentration of legacy PCB-containing infrastructure. However, the Asia Pacific region, particularly China and India, is expected to witness significant growth driven by rapid industrialization and increasing environmental scrutiny. Addressing PCB waste is paramount for safeguarding public health and the environment from long-term contamination.

The global PCB waste services market is poised for significant expansion, driven by a confluence of stringent regulatory frameworks, growing environmental awareness, and the inherent persistence of polychlorinated biphenyls (PCBs). The study period from 2019 to 2033, with a base year of 2025, forecasts a robust Compound Annual Growth Rate (CAGR), reflecting the escalating need for specialized and compliant disposal and treatment solutions for PCB-contaminated materials. During the historical period (2019-2024), the market witnessed initial growth spurred by increasing awareness of PCB hazards and the implementation of early regulatory measures. The estimated year of 2025 marks a critical juncture where the market is expected to accelerate, fueled by more comprehensive global initiatives and advanced treatment technologies. By 2033, the market is projected to reach a substantial valuation, with the cumulative revenue from PCB waste management services in the millions of dollars. Key market insights reveal a growing preference for advanced destruction technologies over traditional landfilling, as concerns about long-term environmental impact and potential leakage persist. Furthermore, the increasing volume of waste generated from the decommissioning of older industrial facilities and the disposal of legacy equipment containing PCBs contributes significantly to market demand. The market is also seeing a rise in integrated waste management solutions, where companies offer end-to-end services from collection and transportation to treatment and final disposal. The geographic landscape of PCB waste services is characterized by varying levels of regulatory enforcement and technological adoption, with developed economies leading in both aspects. The forecast period (2025-2033) is expected to witness a broader adoption of best practices and technologies in emerging economies, further bolstering the global market size. The increasing emphasis on a circular economy and resource recovery from hazardous waste streams will also play a pivotal role in shaping the future trajectory of the PCB waste services market. Innovations in chemical and thermal treatment methods are continuously being developed to enhance efficiency and reduce environmental footprints, making these services more attractive and cost-effective. The overall market sentiment is one of increasing urgency and investment in sustainable PCB waste management strategies to protect human health and the environment from the persistent dangers of these legacy pollutants.

The relentless expansion of the PCB waste services market is fundamentally propelled by a dual force of escalating regulatory pressure and a heightened global consciousness regarding environmental stewardship. Governments worldwide are progressively strengthening regulations concerning the management and disposal of PCB-containing materials. These regulations, often driven by international conventions like the Stockholm Convention on Persistent Organic Pollutants (POPs), mandate the safe and environmentally sound elimination of PCBs. This, in turn, creates a captive market for specialized services that can ensure compliance with these stringent legal frameworks. Companies are compelled to invest in professional PCB waste management to avoid hefty penalties and reputational damage. Simultaneously, there's a growing public and corporate awareness of the long-term environmental and health risks associated with PCBs. Their persistent nature, bioaccumulative properties, and potential carcinogenicity are well-documented, leading to increased demand for proactive and responsible waste disposal. This ethical imperative translates into a stronger market demand for services that offer a definitive and safe solution to the PCB legacy. The increasing decommissioning of older industrial plants and electrical infrastructure, which often house significant quantities of PCB-laden equipment, further amplifies the volume of waste requiring specialized management. As technology advances, the detection and quantification of PCB contamination are also becoming more sophisticated, leading to the identification of previously overlooked waste streams. This growing understanding of the scope of the PCB problem directly fuels the need for robust waste management solutions.

Despite the robust growth trajectory, the PCB waste services market faces considerable challenges and restraints that can temper its expansion. A primary hurdle is the high cost associated with the specialized treatment and disposal of PCB waste. Technologies like high-temperature incineration and advanced chemical destruction are inherently capital-intensive and require significant operational expenditure. This cost factor can be a significant deterrent, especially for smaller businesses or municipalities with limited budgets, potentially leading to a reliance on less environmentally sound, albeit cheaper, disposal methods where regulations are less enforced. Furthermore, the transportation of PCB-contaminated materials poses complex logistical and safety concerns. Strict regulations govern the packaging, labeling, and movement of hazardous waste, increasing transportation costs and requiring specialized carriers. The limited availability of certified treatment facilities in certain regions also creates bottlenecks and can lead to extended turnaround times and increased costs for waste generators. Public perception and local community resistance, often referred to as "Not In My Backyard" (NIMBY) syndrome, can also present significant obstacles to the siting and operation of new PCB treatment and disposal facilities, further exacerbating geographical limitations. The complex regulatory landscape itself, with variations in regulations across different countries and even within regions, can be a restraint, requiring service providers to navigate a patchwork of compliance requirements, adding to administrative burdens and operational complexities. The availability of skilled labor capable of safely handling and processing PCB waste is another concern, as specialized training is crucial for ensuring worker safety and environmental protection.

The PCB waste services market is experiencing significant dominance by specific regions and segments, largely dictated by the maturity of their regulatory frameworks, industrial legacy, and technological adoption.

Dominant Regions:

Dominant Segments:

The PCB waste services industry is experiencing significant growth catalysts that are shaping its future trajectory. A primary catalyst is the increasing global regulatory pressure to eliminate PCBs entirely, driven by international agreements and national environmental laws. This regulatory push forces industries and governments to invest in compliant disposal and destruction methods. Furthermore, advancements in treatment technologies, such as enhanced chemical destruction processes and more efficient high-temperature incineration with improved emission controls, are making PCB waste management more effective and environmentally sound, thereby increasing its attractiveness. The growing corporate social responsibility (CSR) initiatives and a heightened public awareness of the environmental and health hazards associated with PCBs are also compelling organizations to proactively manage their PCB waste. Finally, the ongoing decommissioning of older industrial infrastructure and electrical equipment, which are often rich in PCBs, creates a continuous and substantial supply of waste requiring specialized management.

This comprehensive report on PCB waste services delves into the intricate dynamics of a critical environmental sector. It provides an in-depth analysis of market trends, projecting significant growth from 2019 to 2033, with a base year of 2025. The report examines the driving forces behind this expansion, primarily focusing on the stringent regulatory landscape and escalating environmental consciousness. Conversely, it also addresses the inherent challenges and restraints, such as high costs and logistical complexities, that the industry navigates. Furthermore, the report identifies key regions and segments poised for market dominance, highlighting their unique contributions to the overall PCB waste management ecosystem. The report also illuminates crucial growth catalysts and provides an exhaustive list of leading industry players. It meticulously details significant developments within the sector, offering a forward-looking perspective. Ultimately, this report serves as an indispensable resource for stakeholders seeking a thorough understanding of the present and future of PCB waste services.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.4%.

Key companies in the market include SGS, Orion BV, Celtic Recycling, CSG, Russian Railways, Boliden, MITECO Kneževac, Recycla, Lorene, Reciclarg, Veolia, Republic Services, Clean Harbors, Daisyo Kogyo, Aevitas, Japan Environmental Storage & Safety Corporation (JESCO), O6 Environmental Services, Apex Envirotech.

The market segments include Type, Application.

The market size is estimated to be USD 594 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "PCB Waste Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the PCB Waste Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.