1. What is the projected Compound Annual Growth Rate (CAGR) of the Wireless Load Monitoring System?

The projected CAGR is approximately 5.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Wireless Load Monitoring System

Wireless Load Monitoring SystemWireless Load Monitoring System by Type (Static monitoring system, Dynamic monitoring system), by Application (Industrial, Architecture, Transportation, Energy, Aerospace, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

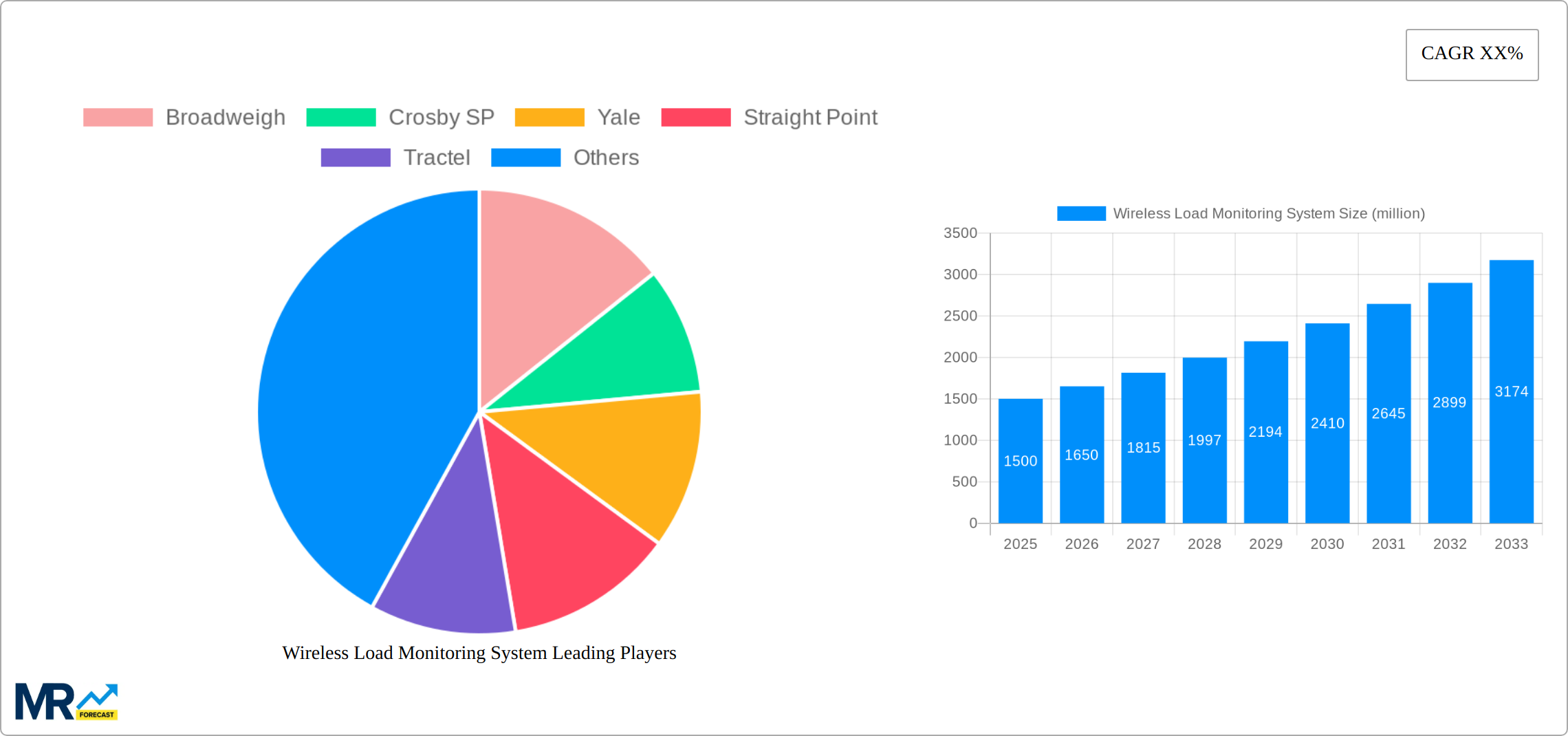

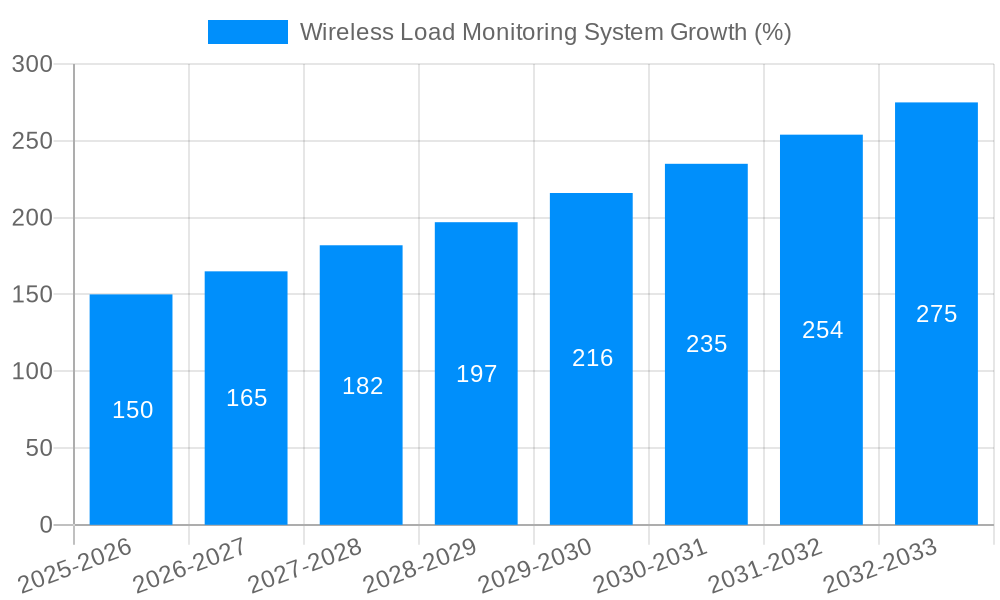

The global Wireless Load Monitoring System market is experiencing robust growth, projected to reach a significant size of approximately $3.9 billion by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 5.3% through 2033. This upward trajectory is fueled by the increasing demand for enhanced safety, efficiency, and real-time data acquisition across a multitude of industries. The inherent benefits of wireless systems – including reduced installation complexity, greater flexibility, and improved operational oversight – are major drivers. Industries such as industrial manufacturing, construction (architecture), transportation, energy, and aerospace are increasingly adopting these systems to prevent overloads, optimize lifting operations, and ensure the structural integrity of critical infrastructure. The market is characterized by a shift towards more sophisticated "dynamic monitoring systems" that offer advanced analytical capabilities and predictive maintenance features, moving beyond basic static load indication.

Technological advancements in sensor technology, data transmission protocols (like IoT and cloud connectivity), and miniaturization are further propelling market expansion. These innovations enable more accurate and reliable data, facilitating better decision-making and remote management. However, the market does face certain restraints, including the initial cost of advanced systems and concerns regarding data security and cybersecurity in sensitive applications. Despite these challenges, the overarching benefits of improved safety compliance, reduced downtime, and operational cost savings are outweighing these concerns, driving widespread adoption. Key players are focusing on developing integrated solutions that offer comprehensive monitoring and reporting capabilities, catering to the evolving needs of a diverse customer base.

This report delves into the dynamic world of Wireless Load Monitoring Systems, exploring their current market landscape, future trajectory, and the intricate interplay of forces shaping their evolution. With an anticipated market valuation reaching over 3 billion USD by 2033, this sector is poised for substantial growth, driven by an escalating demand for enhanced safety, efficiency, and data-driven decision-making across a multitude of industries.

The global Wireless Load Monitoring System market is experiencing a significant upswing, projected to surpass 3 billion USD in value by 2033. This robust growth is underpinned by a confluence of technological advancements, increasing regulatory emphasis on workplace safety, and the inherent advantages of wireless solutions over traditional wired systems. During the Study Period of 2019-2033, the market has witnessed a steady expansion, with the Base Year of 2025 serving as a pivotal point for current estimations. The Forecast Period of 2025-2033 is expected to be characterized by accelerated adoption, fueled by innovation and a broadening application base. Key market insights reveal a growing preference for dynamic monitoring systems due to their ability to provide real-time data during operations, thereby enabling proactive adjustments and preventing potential failures. The increasing complexity of industrial operations and the need for precise weight management in diverse applications, from construction cranes to subsea operations, are pushing the boundaries of what these systems can achieve. Furthermore, the integration of IoT capabilities and advanced analytics is transforming load monitoring from a passive data collection tool into an active component of operational intelligence. The historical period from 2019-2024 laid the groundwork, demonstrating a consistent upward trend as industries began to recognize the tangible benefits of these systems in terms of cost savings, risk mitigation, and operational optimization. The Estimated Year of 2025 marks a point where the market is poised for even greater acceleration, as the technology matures and becomes more accessible. The penetration of wireless load monitoring is expected to deepen across sectors like Energy, Transportation, and Industrial applications, where the stakes for safety and efficiency are exceptionally high. The development of more compact, robust, and power-efficient sensors, coupled with enhanced wireless communication protocols, is further democratizing access to these critical monitoring solutions. The increasing demand for data logging and remote access capabilities also plays a crucial role, allowing stakeholders to monitor loads from anywhere in the world, enhancing oversight and facilitating rapid response to any anomalies. The sheer volume of critical infrastructure and ongoing projects globally, particularly in emerging economies, presents a vast untapped market for wireless load monitoring solutions. The report will meticulously dissect these trends, providing granular insights into regional adoption patterns and the specific technological drivers fueling this market expansion.

The remarkable growth of the Wireless Load Monitoring System market is propelled by a powerful synergy of factors, primarily revolving around the indispensable need for enhanced safety, improved operational efficiency, and the relentless pursuit of data-driven decision-making across industries. In an era where regulatory compliance and minimizing risk are paramount, wireless load monitoring systems offer a proactive approach to preventing catastrophic failures and ensuring the well-being of personnel. These systems provide real-time insights into load capacities, preventing overloads and potential structural damage, thereby significantly reducing the likelihood of accidents. Furthermore, the inherent advantages of wireless technology – ease of installation, flexibility, and elimination of cumbersome cabling – contribute to substantial cost savings in terms of labor and maintenance. This has become particularly attractive in complex or remote environments where traditional wired systems are impractical or prohibitively expensive to deploy. The increasing sophistication of industrial processes and the growing emphasis on optimizing every facet of operations necessitate precise and continuous monitoring. Wireless load monitoring systems deliver this vital data, enabling operators to fine-tune their processes, identify bottlenecks, and enhance overall productivity. The integration of these systems with broader Industrial IoT (IIoT) ecosystems is further amplifying their impact, allowing for seamless data flow and sophisticated analytics that inform predictive maintenance, resource allocation, and strategic planning. The global push towards greater automation and smart manufacturing also inherently favors wireless solutions due to their adaptability and ease of integration with automated workflows.

Despite its promising growth trajectory, the Wireless Load Monitoring System market is not without its hurdles. One of the primary challenges revolves around data security and integrity. The wireless transmission of sensitive load data raises concerns about potential interception, manipulation, or unauthorized access, especially in critical infrastructure applications. Robust encryption protocols and secure network architecture are essential to mitigate these risks, but their implementation can add complexity and cost. Another significant restraint is the initial investment cost. While long-term savings are evident, the upfront expenditure for sophisticated wireless load monitoring systems, including sensors, receivers, and software, can be a barrier for smaller businesses or those with limited capital budgets. Interference and range limitations can also pose challenges, particularly in industrial environments with high levels of electromagnetic interference or in vast operational areas where signal strength might be compromised. Ensuring reliable and consistent data transmission requires careful planning and potentially the use of signal repeaters or alternative communication technologies. Interoperability issues between different manufacturers' systems can also hinder widespread adoption, as end-users may face difficulties in integrating diverse components into a unified monitoring network. Furthermore, the lack of standardized protocols in some segments of the market can create fragmentation and limit the scalability of solutions. Finally, user adoption and training remain crucial. Educating the workforce on the proper use and interpretation of data from these advanced systems is vital to fully realize their benefits and overcome any initial resistance to technological change.

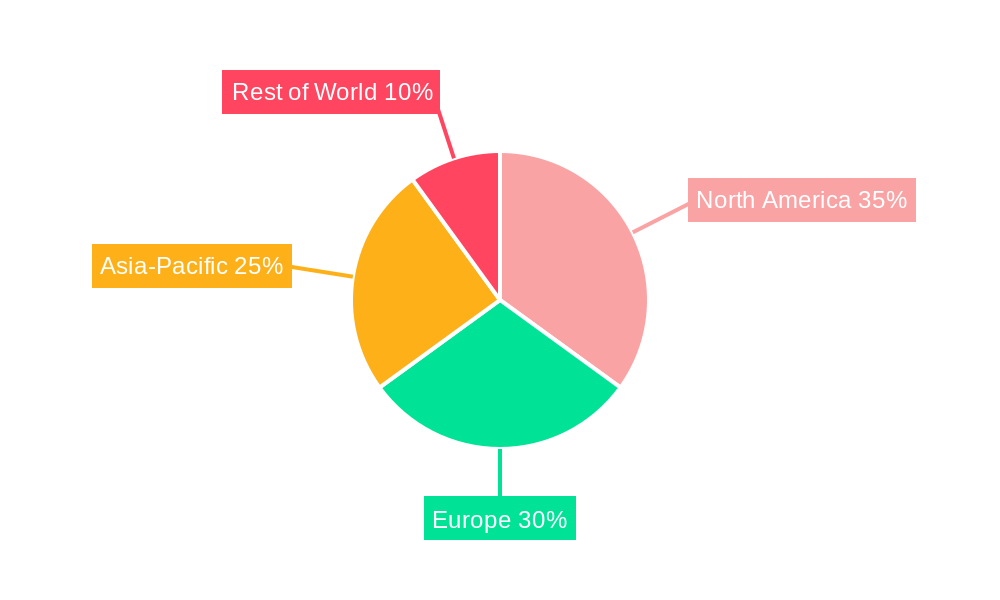

The Wireless Load Monitoring System market is characterized by strong regional adoption patterns and a clear dominance of certain segments, driven by industry needs, technological infrastructure, and regulatory frameworks.

Dominant Regions/Countries:

Dominant Segment: Application - Industrial

The Industrial segment is a primary driver and will continue to dominate the Wireless Load Monitoring System market. This dominance stems from the ubiquitous need for precise load management and safety assurance in a vast array of industrial processes:

The Static Monitoring System sub-segment within the Industrial application often sees substantial adoption due to its suitability for long-term monitoring of loads on structures, bridges, and fixed installations where continuous, passive data collection is required. However, the increasing demand for real-time operational control and immediate feedback is driving the growth of Dynamic Monitoring Systems, especially in material handling and active lifting scenarios within the industrial sector. The synergy between these two types of monitoring, often deployed together within a comprehensive industrial setup, further solidifies the Industrial segment's leading position.

The Wireless Load Monitoring System industry is experiencing robust growth catalyzed by several key factors. The escalating global emphasis on workplace safety and stringent regulatory compliance is a primary driver, pushing industries to adopt advanced solutions that prevent overloads and minimize accident risks. Furthermore, the inherent efficiency gains offered by wireless systems, including simplified installation and reduced maintenance, translate into significant cost savings for businesses. The increasing integration of IoT and cloud-based platforms enables real-time data access, advanced analytics, and predictive maintenance, transforming load monitoring into a strategic operational tool. The growing complexity of industrial operations and the demand for greater precision in material handling and lifting applications also fuel the adoption of these sophisticated systems.

This comprehensive report delves into the intricacies of the Wireless Load Monitoring System market, offering a detailed analysis from 2019 to 2033. It provides in-depth insights into market segmentation, encompassing Static and Dynamic Monitoring Systems and their respective applications across Industrial, Architecture, Transportation, Energy, Aerospace, and Others. The report meticulously analyzes market trends, driving forces, and challenges, painting a clear picture of the competitive landscape. It also identifies key regions and countries poised for significant growth and highlights the dominant application segments. The study further explores significant industry developments and leading players, providing a holistic view of this vital sector. The report's findings are crucial for stakeholders seeking to understand the market's current state and future potential.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.3%.

Key companies in the market include Broadweigh, Crosby SP, Yale, Straight Point, Tractel, Eilon, LCM, Straightpoint, INSIGHT, Groundforce, CHAINMASTER, Transmission Dynamics, Power Jacks.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Wireless Load Monitoring System," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Wireless Load Monitoring System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.