1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Piezoelectric Ceramics?

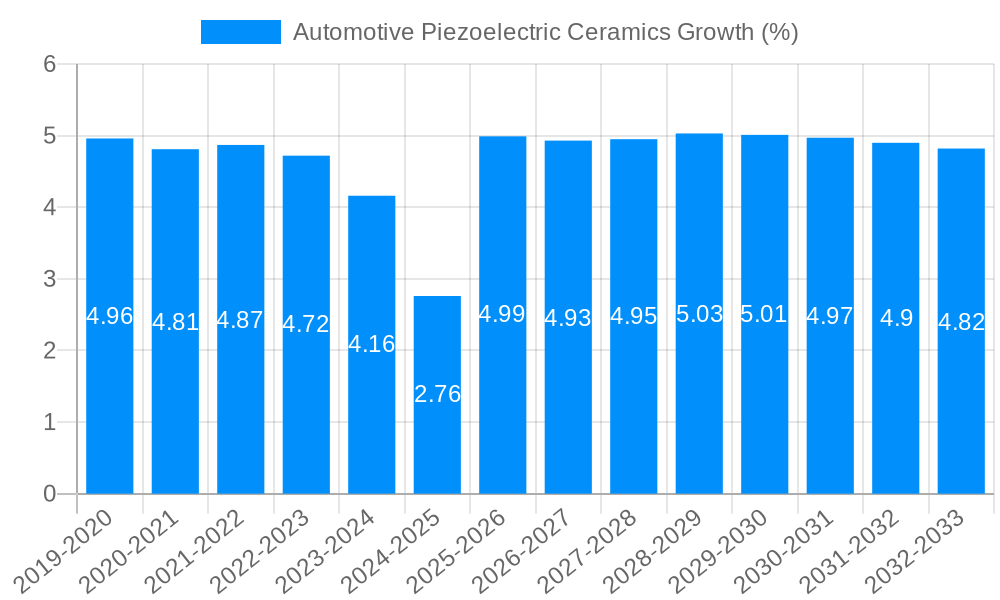

The projected CAGR is approximately 5.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive Piezoelectric Ceramics

Automotive Piezoelectric CeramicsAutomotive Piezoelectric Ceramics by Type (Lead Zirconate Titanate (PZT), Lead Magnesium Niobate (PMN), Others, World Automotive Piezoelectric Ceramics Production ), by Application (Commercial Vehicle, Passenger Car, World Automotive Piezoelectric Ceramics Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

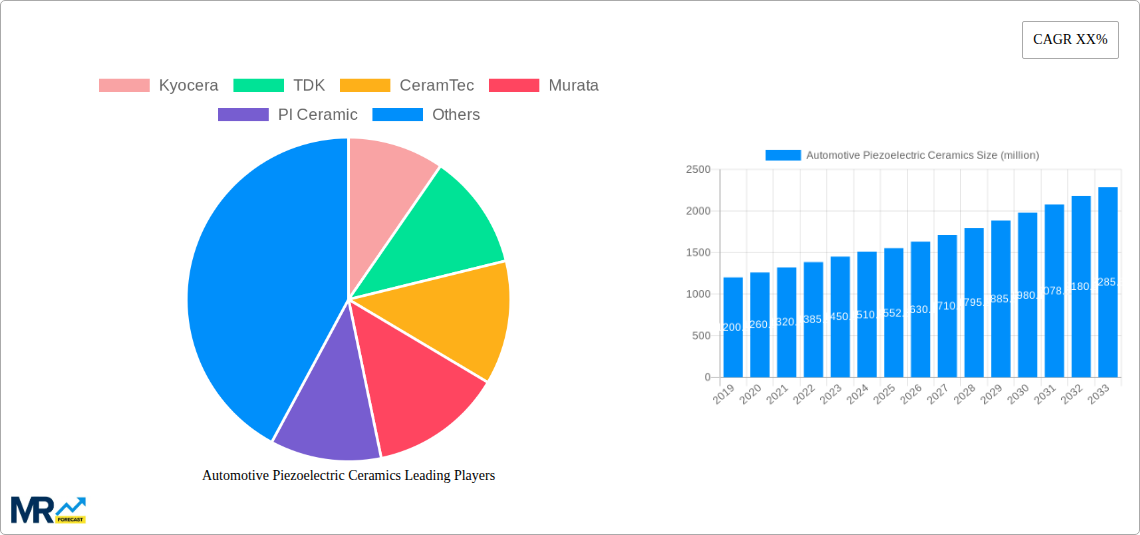

The global automotive piezoelectric ceramics market is poised for robust growth, projected to reach an estimated \$1552.5 million by 2025. Driven by a compound annual growth rate (CAGR) of 5.2% from 2019 to 2033, this expansion is fueled by the increasing adoption of advanced automotive technologies. Key applications benefiting from piezoelectric ceramics include advanced driver-assistance systems (ADAS) for enhanced safety and autonomous driving capabilities, such as proximity sensors and active noise cancellation. Furthermore, the growing demand for more fuel-efficient vehicles and electric vehicles (EVs) necessitates precise fuel injection systems and advanced battery management, areas where piezoelectric components play a crucial role. The surge in vehicle electrification, coupled with stringent automotive safety regulations, is a primary catalyst for this market's upward trajectory.

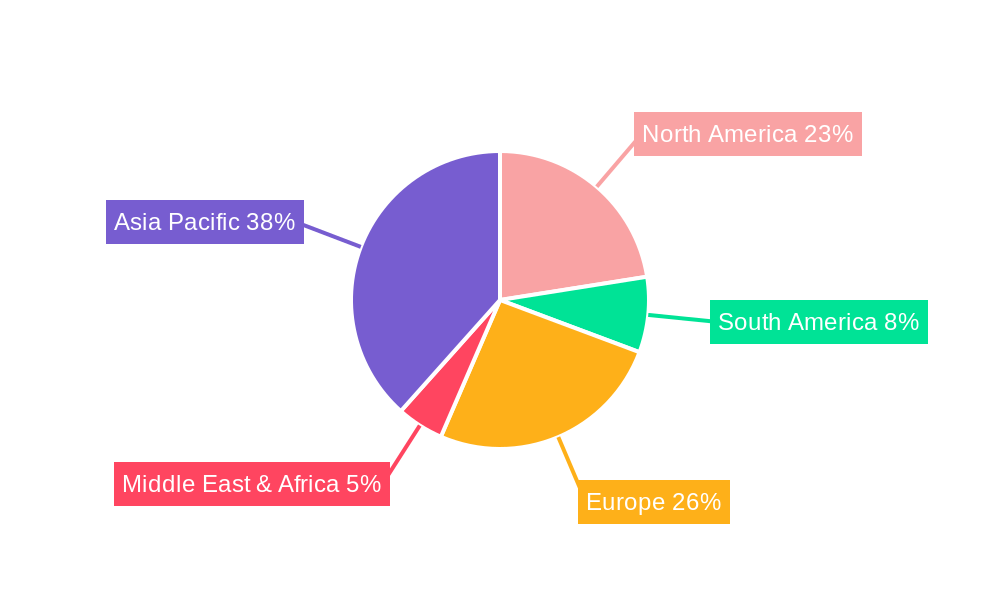

The market segmentation reveals a dynamic landscape. Lead Zirconate Titanate (PZT) currently dominates the market due to its cost-effectiveness and established performance characteristics. However, Lead Magnesium Niobate (PMN) is gaining traction, particularly in applications requiring higher temperature stability and broader operational ranges. The production of automotive piezoelectric ceramics is globally distributed, with Asia Pacific, particularly China, leading in manufacturing capacity. North America and Europe are significant consumers, driven by their advanced automotive industries and strong focus on technological innovation. Restraints such as the environmental concerns associated with lead-based materials and the development of alternative sensing technologies present challenges. However, ongoing research into lead-free piezoelectric materials and advancements in manufacturing processes are expected to mitigate these concerns and further propel market growth.

This comprehensive report delves into the dynamic global automotive piezoelectric ceramics market, providing an in-depth analysis of its trajectory from the historical period of 2019-2024 through to a robust forecast period extending to 2033. The base year for our estimations is 2025. We meticulously examine production volumes, projected to reach millions of units, across key application segments such as Commercial Vehicles and Passenger Cars, alongside crucial material types including Lead Zirconate Titanate (PZT), Lead Magnesium Niobate (PMN), and Other materials.

XXX highlights a pivotal shift in the automotive landscape, driven by the accelerating adoption of advanced sensing and actuation technologies, where piezoelectric ceramics play an indispensable role. The market is experiencing robust growth, fueled by the relentless pursuit of enhanced vehicle safety, improved fuel efficiency, and the burgeoning demand for sophisticated driver-assistance systems (ADAS) and increasingly autonomous driving capabilities. As vehicles become more electrified and intelligent, the need for precise and reliable sensors and actuators escalates, directly benefiting the piezoelectric ceramics sector. The miniaturization and integration of these components are also key trends, allowing for more compact and efficient electronic systems within vehicles. Furthermore, the growing awareness and implementation of stringent automotive safety regulations globally are creating sustained demand for piezoelectric-based solutions like airbag sensors and tire pressure monitoring systems (TPMS). The electrification of powertrains, while seemingly reducing the need for some traditional engine-related sensors, introduces new requirements for monitoring and control within electric vehicles (EVs) and hybrid electric vehicles (HEVs), including battery management systems and thermal control. The evolving consumer preference for connected car features and personalized in-cabin experiences also necessitates a greater array of sophisticated sensors, further bolstering the market for piezoelectric ceramics. The report anticipates a steady upward trend in production volumes, with projections indicating millions of units being manufactured annually to meet this escalating demand. The inherent robustness, high sensitivity, and relatively low cost of piezoelectric ceramics position them as the material of choice for a multitude of critical automotive functions, cementing their indispensable status in the future of mobility. The increasing integration of these ceramics into various vehicle sub-systems underscores a broader industry trend towards greater electrification, intelligence, and a more refined driving experience, all of which are underpinned by the unique capabilities of piezoelectric materials.

The automotive piezoelectric ceramics market is experiencing a significant uplift driven by several interconnected forces. The primary catalyst is the pervasive integration of advanced safety features. As regulatory bodies worldwide mandate enhanced safety standards and consumer expectations rise, the deployment of systems like airbag inflation sensors, ABS, and TPMS, which heavily rely on piezoelectric technology for their accurate operation, is rapidly increasing. This trend is further amplified by the global push towards vehicle electrification. Electric vehicles (EVs) and hybrid electric vehicles (HEVs) present a new frontier for piezoelectric applications, particularly in battery management systems for thermal monitoring and in the precise control of electric powertrains and charging infrastructure. The burgeoning development and implementation of autonomous driving technologies represent another powerful propellant. Piezoelectric sensors are crucial for sophisticated environmental perception, enabling autonomous systems to accurately detect obstacles, measure distances, and ensure safe navigation. Moreover, the ongoing quest for improved fuel efficiency and reduced emissions across both internal combustion engine (ICE) vehicles and electrified powertrains necessitates the use of highly efficient and responsive sensors for engine control, exhaust gas monitoring, and other critical functions, where piezoelectric ceramics excel. The continued innovation in material science and manufacturing processes is also a significant driving force, leading to the development of more cost-effective, durable, and performance-optimized piezoelectric components that are better suited to the harsh automotive environment.

Despite the robust growth trajectory, the automotive piezoelectric ceramics market faces several hurdles that could potentially temper its expansion. A primary challenge lies in the inherent material limitations and environmental concerns associated with certain piezoelectric materials, particularly Lead Zirconate Titanate (PZT). The presence of lead in PZT raises regulatory scrutiny and environmental concerns, prompting research and development into lead-free alternatives. This transition, while necessary, can be a complex and costly process, requiring extensive validation and qualification for automotive applications. Another significant restraint is the stringent and lengthy qualification process for new components within the automotive industry. Any new material or component must undergo rigorous testing to meet the exceptionally high standards for reliability, durability, and safety demanded by automakers, which can significantly prolong the time-to-market for innovative piezoelectric solutions. Furthermore, the cyclical nature of the automotive industry and its susceptibility to global economic downturns and supply chain disruptions can impact demand for piezoelectric ceramics. Geopolitical events, trade disputes, and unforeseen crises can lead to volatility in production and demand, affecting market stability. Intense price competition among manufacturers, especially in the more commoditized segments, can also put pressure on profit margins and limit investment in research and development. Finally, the increasing complexity of vehicle electronics and the need for seamless integration with other sensor technologies can pose integration challenges, requiring close collaboration between piezoelectric component suppliers and automotive system integrators.

The global automotive piezoelectric ceramics market is characterized by a dynamic interplay between regions and specific product segments, with Asia-Pacific emerging as the dominant force, largely driven by its unparalleled manufacturing capabilities and the sheer volume of vehicle production within the region.

Dominant Region/Country:

Dominant Segment (by Type):

Dominant Segment (by Application):

Several key factors are acting as powerful catalysts for the growth of the automotive piezoelectric ceramics industry. The relentless drive towards enhanced vehicle safety and the increasing stringency of global safety regulations are paramount, fueling demand for piezoelectric-based sensors in airbags, ABS, and TPMS. The accelerating pace of vehicle electrification is opening new avenues for piezoelectric applications in battery management, thermal control, and electric powertrain systems. Furthermore, the widespread adoption of Advanced Driver-Assistance Systems (ADAS) and the ongoing development towards autonomous driving heavily rely on the precision and reliability of piezoelectric sensors for environmental perception and actuation.

This report offers an all-encompassing analysis of the global automotive piezoelectric ceramics market. It meticulously details production volumes, market segmentation by material type (PZT, PMN, Others) and application (Commercial Vehicle, Passenger Car), and provides a granular forecast from 2019 to 2033, with a detailed focus on the base year of 2025. The report investigates the driving forces behind market growth, including technological advancements and evolving vehicle requirements, while also critically assessing the challenges and restraints such as material limitations and regulatory hurdles. Furthermore, it identifies key regions and segments poised for dominance and outlines the significant growth catalysts and future industry developments, offering a strategic roadmap for stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.2%.

Key companies in the market include Kyocera, TDK, CeramTec, Murata, PI Ceramic, Jiangjia, CTS Corporation, Kaili Tech, Jiakang Electronics, KEPO Electronics, Sparkler Ceramics, JCCERAM.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Automotive Piezoelectric Ceramics," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Piezoelectric Ceramics, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.