1. What is the projected Compound Annual Growth Rate (CAGR) of the Autonomous Driving Controller?

The projected CAGR is approximately 7.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Autonomous Driving Controller

Autonomous Driving ControllerAutonomous Driving Controller by Type (Centralization, Distributed), by Application (Special Vehicle, Commercial Vehicle, Passenger Vehicle), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

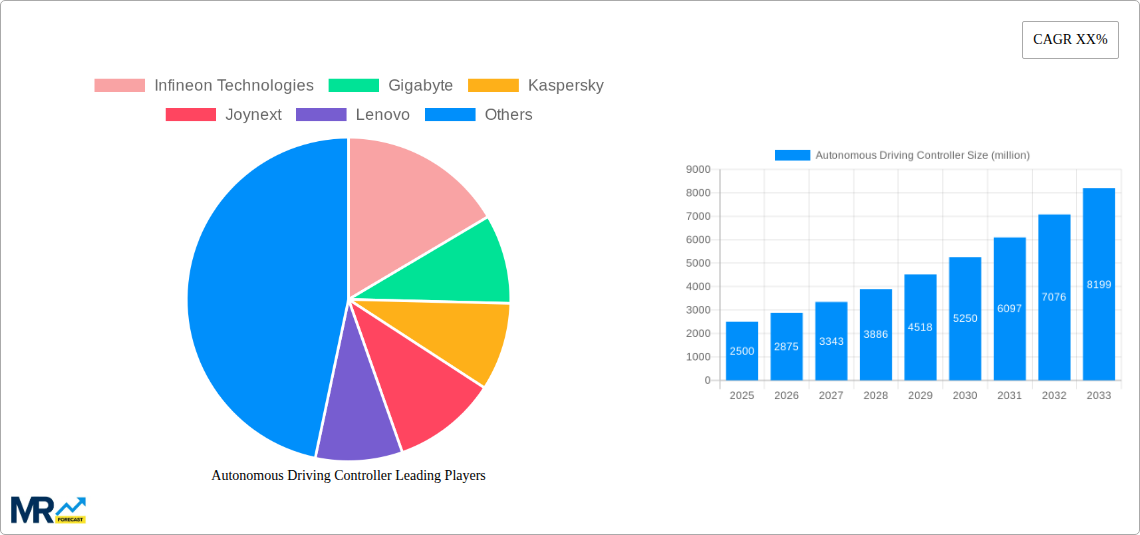

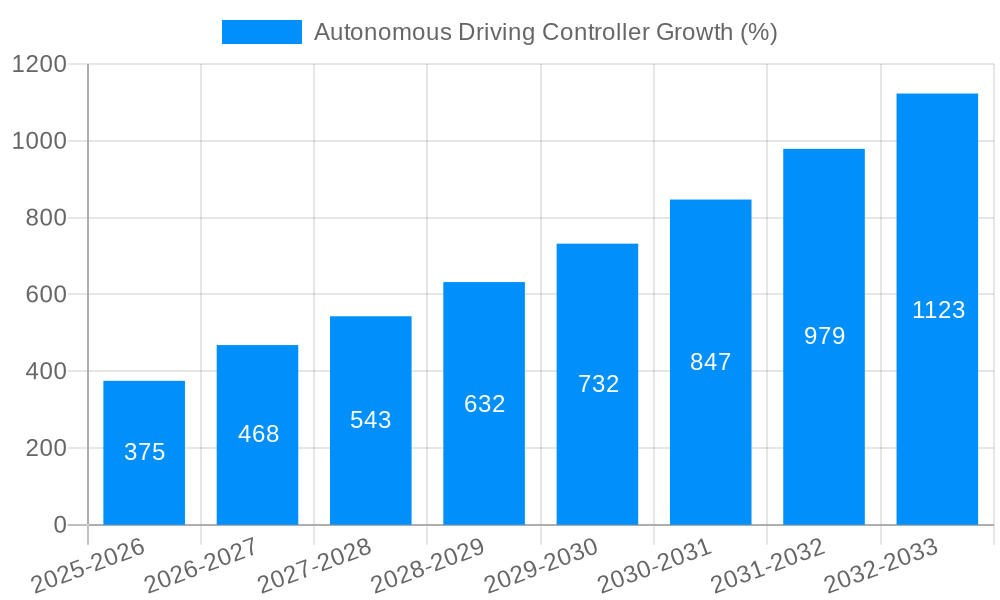

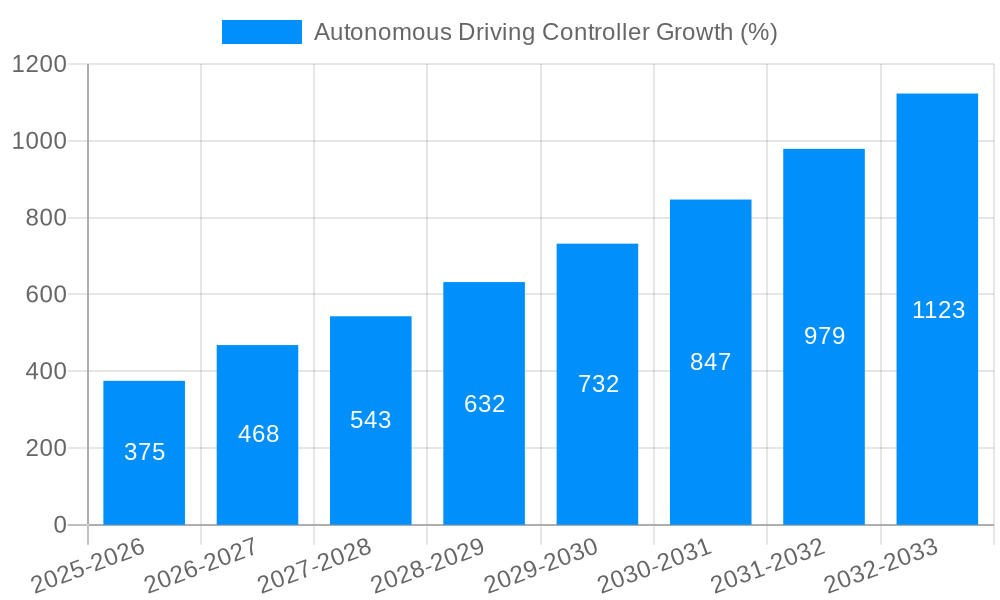

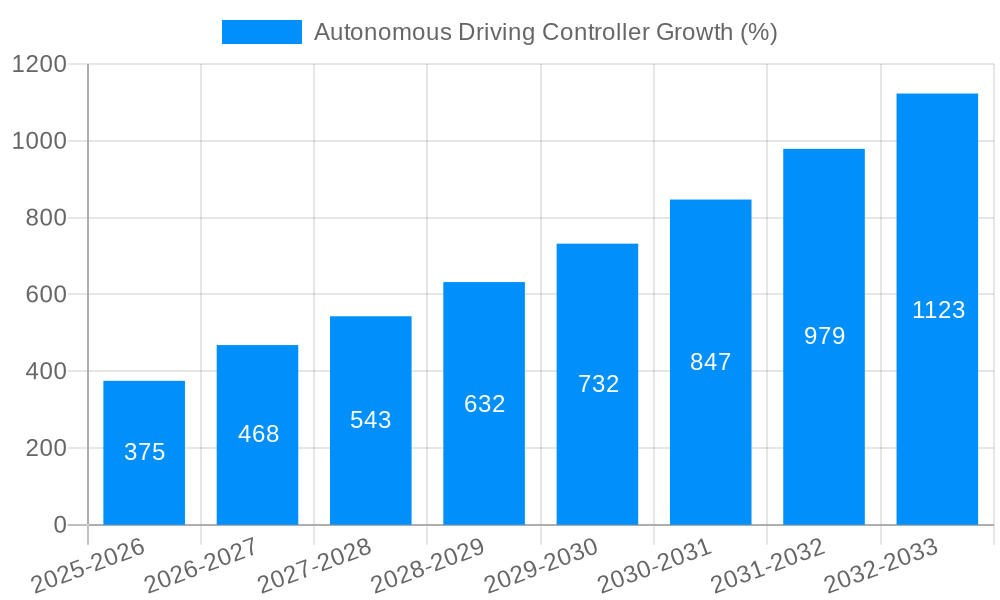

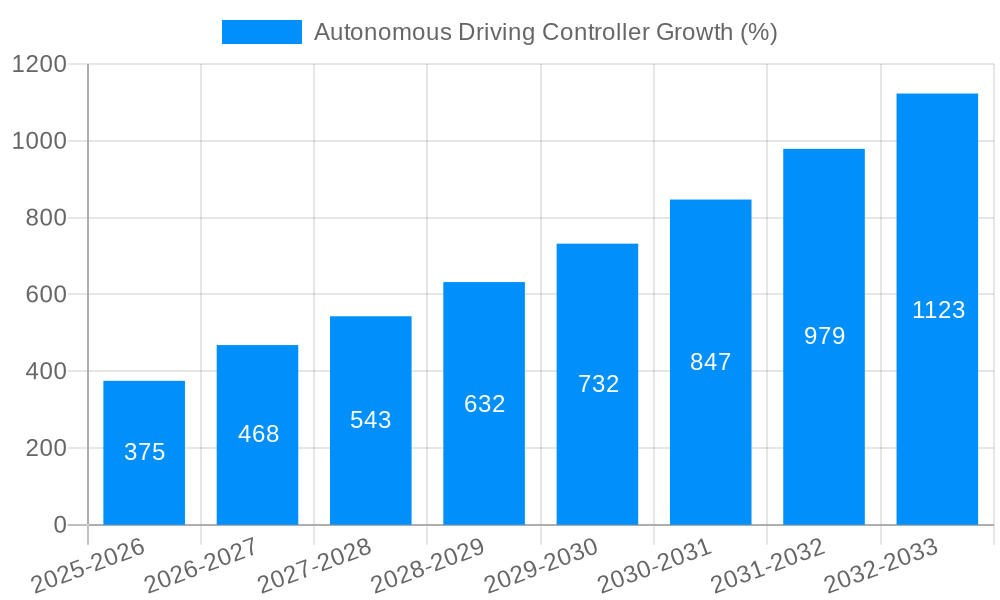

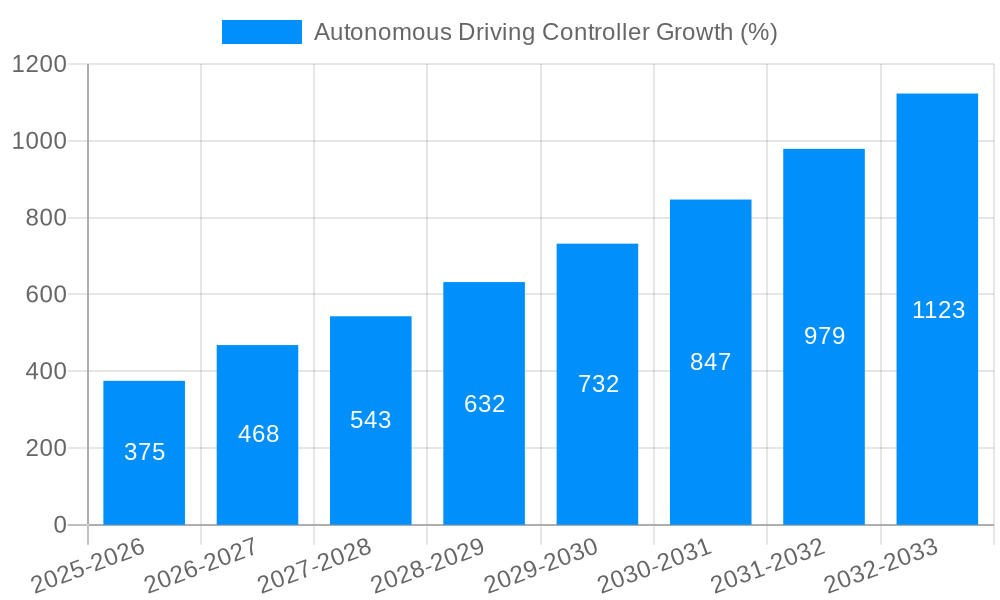

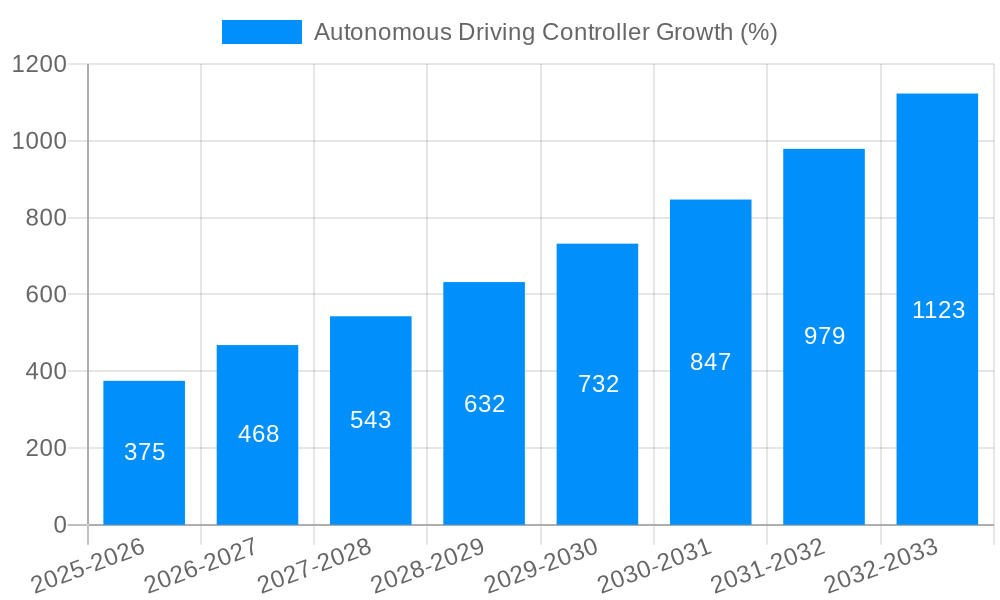

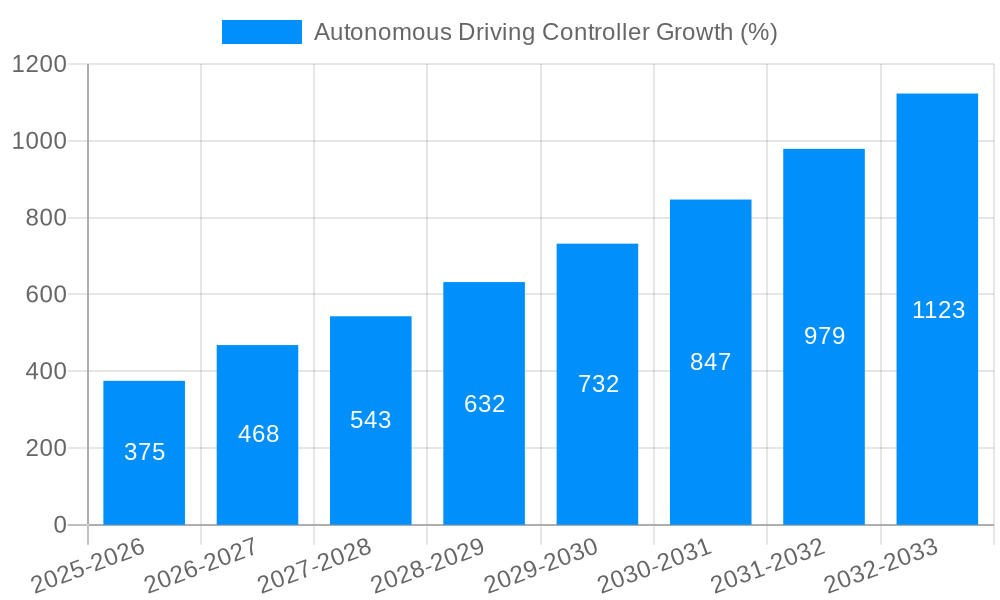

The Autonomous Driving Controller market is experiencing robust growth, projected to reach approximately $1,907 million by 2025, fueled by an impressive Compound Annual Growth Rate (CAGR) of 7.3% anticipated to persist through 2033. This significant expansion is primarily driven by the escalating demand for advanced driver-assistance systems (ADAS) and the ongoing development and adoption of fully autonomous vehicles across various sectors. Key growth factors include advancements in artificial intelligence (AI) and machine learning for enhanced perception and decision-making, the increasing connectivity of vehicles, and the supportive regulatory frameworks emerging globally that are paving the way for widespread deployment. The market is segmented into Centralization and Distributed types, with applications spanning Special Vehicles, Commercial Vehicles, and Passenger Vehicles, indicating a broad adoption spectrum.

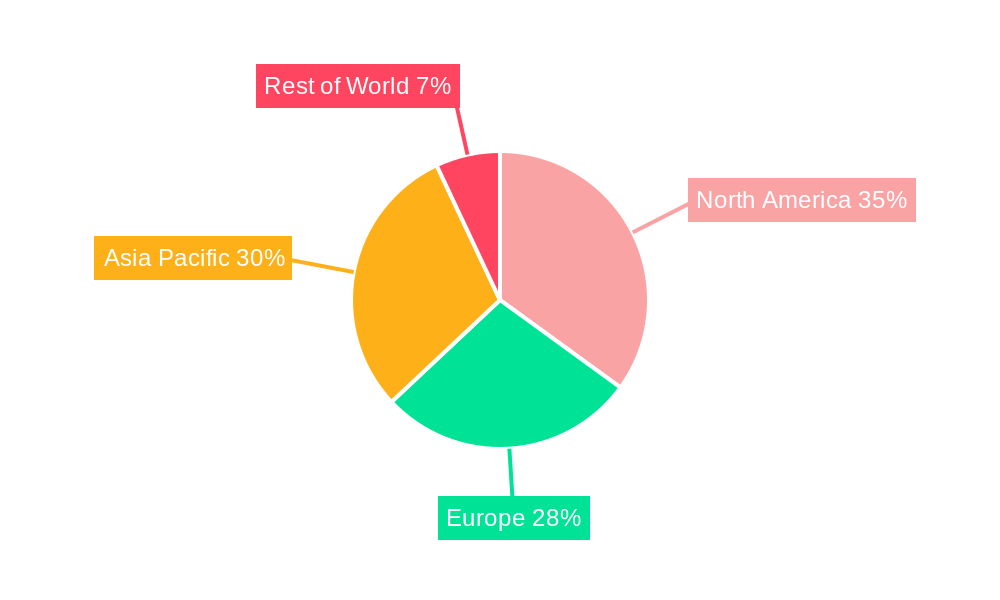

Emerging trends like the integration of sophisticated sensor fusion technologies, the development of software-defined vehicles, and the growing focus on in-vehicle cybersecurity are further propelling market momentum. However, the market faces certain restraints, including the high cost of development and implementation, stringent safety regulations that necessitate extensive testing and validation, and concerns regarding data privacy and ethical considerations of autonomous driving. Despite these challenges, the concerted efforts of leading companies like Infineon Technologies, Gigabyte, Kaspersky, and Lenovo, along with regional investments in smart city infrastructure and connected vehicle technologies, are expected to overcome these hurdles. Asia Pacific, particularly China and Japan, is poised to be a dominant region, followed closely by North America and Europe, due to significant investments in R&D and a strong consumer appetite for automotive innovation.

This comprehensive report delves into the intricate landscape of the Autonomous Driving Controller (ADC) market, providing a detailed analysis of its evolution and future trajectory. The study encompasses a Study Period from 2019 to 2033, with a Base Year of 2025, allowing for robust insights into past performance, current standing, and projected growth. The Estimated Year also aligns with 2025, ensuring a focused view on the immediate future. The Forecast Period extends from 2025 to 2033, offering critical predictions for market expansion. The Historical Period from 2019 to 2024 lays the groundwork by examining past market dynamics and influencing factors.

The global Autonomous Driving Controller market is projected to witness substantial growth, driven by the relentless pursuit of enhanced vehicle safety, efficiency, and passenger convenience. As the automotive industry transitions towards higher levels of automation, the demand for sophisticated and reliable ADCs is set to skyrocket. This report forecasts a market size reaching over $20 million by 2025, with projections indicating an impressive compound annual growth rate (CAGR) of over 15% during the forecast period, potentially exceeding $50 million by 2033. The increasing integration of AI, sensor fusion technologies, and advanced computational power within vehicles underscores the critical role of ADCs in enabling complex driving maneuvers and decision-making. Furthermore, supportive government regulations and significant investments in autonomous vehicle research and development are further accelerating market penetration. The evolving consumer preference for connected and intelligent mobility solutions also acts as a strong tailwind for this burgeoning sector. The report will meticulously dissect these trends, providing actionable intelligence for stakeholders across the value chain.

The Autonomous Driving Controller (ADC) market is characterized by a dynamic interplay of technological advancements, evolving regulatory frameworks, and shifting consumer expectations. A key trend observed throughout the Study Period (2019-2033) is the accelerating shift from Distributed architectures towards more Centralized systems. While distributed controllers offered modularity and redundancy, the increasing complexity of autonomous driving functions necessitates a consolidated computational platform for efficient data processing, decision-making, and inter-component communication. This centralization allows for a more holistic approach to vehicle autonomy, enabling smoother transitions between different driving modes and facilitating over-the-air (OTA) updates for enhanced functionality and security. The Base Year of 2025 marks a pivotal point where centralized architectures are increasingly gaining traction, promising improved scalability and cost-effectiveness in the long run.

Several other significant trends are shaping the ADC landscape. The integration of advanced AI and machine learning algorithms within controllers is becoming paramount, enabling vehicles to learn from their environment, adapt to unforeseen situations, and make more intelligent driving decisions. Sensor fusion, the process of combining data from multiple sensors like LiDAR, radar, cameras, and ultrasonic sensors, is another critical area of development, leading to more robust and accurate perception of the surrounding environment. Furthermore, the emphasis on cybersecurity is growing exponentially, as ADCs are prime targets for malicious attacks. Robust security protocols and encryption are becoming standard features, ensuring the integrity and safety of autonomous systems. The report also highlights the increasing adoption of domain controllers, which consolidate the control of various vehicle sub-systems, leading to greater integration and efficiency. The demand for ADCs designed for specific vehicle types, such as Special Vehicle, Commercial Vehicle, and Passenger Vehicle applications, is also diversifying the market, with tailored solutions emerging to meet the unique operational requirements of each segment. For instance, commercial vehicles might prioritize durability and long-haul efficiency, while passenger vehicles focus on comfort and advanced infotainment integration. The Forecast Period (2025-2033) is expected to witness a rapid maturation of these trends, with widespread adoption of centralized, AI-powered, and highly secure ADCs across all vehicle segments. The ability of these controllers to handle complex scenarios, communicate seamlessly with infrastructure (V2I), and other vehicles (V2V) will be critical differentiators in the coming years.

The rapid ascent of the Autonomous Driving Controller (ADC) market is being fueled by a confluence of powerful driving forces, fundamentally reshaping the automotive industry. Foremost among these is the unwavering commitment to enhancing vehicle safety. Autonomous driving technology, powered by sophisticated ADCs, promises to significantly reduce human error, the leading cause of road accidents, thereby saving lives and minimizing injuries. This societal imperative is a primary catalyst for investment and innovation in the ADC sector. Secondly, the pursuit of improved fuel efficiency and reduced emissions is another significant driver. Optimized driving patterns, such as smoother acceleration and deceleration facilitated by ADCs, can lead to substantial reductions in fuel consumption and greenhouse gas emissions, aligning with global sustainability goals.

Furthermore, the burgeoning demand for enhanced convenience and productivity in vehicles plays a crucial role. As commutes become longer and traffic congestion intensifies, consumers are increasingly looking for ways to reclaim their time. Autonomous driving, enabled by advanced ADCs, offers the potential to transform travel time into productive or leisure time, fostering a new era of in-car experiences. The growth of the ride-sharing and logistics industries also contributes significantly. Autonomous fleets have the potential to drastically reduce operational costs and increase efficiency for these sectors, making autonomous driving controllers an indispensable component of future mobility solutions. The continuous advancements in underlying technologies such as AI, machine learning, high-performance computing, and sensor technology are also acting as potent accelerators, making increasingly complex autonomous functions feasible and driving down the cost of implementation. The Historical Period (2019-2024) has seen steady progress in these areas, laying the groundwork for the accelerated growth anticipated in the Forecast Period (2025-2033).

Despite the immense potential and accelerating growth, the Autonomous Driving Controller (ADC) market faces several significant challenges and restraints that could temper its pace. The most prominent hurdle remains the regulatory and legal framework. The absence of standardized global regulations for autonomous vehicle deployment creates uncertainty for manufacturers and can slow down widespread adoption. Ensuring public trust and acceptance is another critical factor. High-profile accidents involving autonomous vehicles, even if statistically rare, can erode public confidence and lead to increased scrutiny, necessitating robust safety validation and transparent communication. The sheer complexity and cost of development and integration of ADCs are also substantial. Developing sophisticated algorithms, ensuring seamless sensor integration, and meeting stringent safety standards require significant R&D investment and specialized expertise, leading to high initial costs for manufacturers and potentially for consumers.

Cybersecurity threats represent a persistent and growing concern. As vehicles become more connected and reliant on complex software, they become more vulnerable to hacking and data breaches. Ensuring the robust security of ADCs and the entire autonomous driving system is paramount to preventing malicious interference and safeguarding the integrity of the driving process. Infrastructure readiness is another challenge. While autonomous vehicles are advancing, the supporting infrastructure, such as smart road markings, vehicle-to-infrastructure (V2I) communication systems, and high-definition mapping, is still in its nascent stages in many regions. The scalability and reliability of sensor technology under all weather and lighting conditions also require continuous improvement. Finally, ethical considerations surrounding decision-making in unavoidable accident scenarios present complex dilemmas that need to be addressed through societal consensus and clear programming guidelines. These restraints, if not adequately addressed, could impede the full realization of the ADC market's potential during the Study Period (2019-2033).

The Autonomous Driving Controller (ADC) market is poised for significant growth, with certain regions and segments expected to take the lead in adoption and innovation. While global market expansion is anticipated, North America and Europe are anticipated to emerge as dominant forces in the ADC market. These regions benefit from a combination of factors including advanced technological infrastructure, supportive regulatory environments, significant investments in research and development, and a strong consumer appetite for innovation. The presence of leading automotive manufacturers and technology companies in these areas further solidifies their position. For instance, countries like the United States and Germany are actively promoting autonomous vehicle testing and deployment, creating a fertile ground for ADC market expansion.

Within these dominant regions, the Passenger Vehicle segment is projected to be a primary driver of ADC market growth. The increasing integration of Advanced Driver-Assistance Systems (ADAS) in passenger cars, which are precursors to full autonomy, is already creating substantial demand for sophisticated controllers. As higher levels of automation become more accessible and affordable, passenger vehicles will be at the forefront of adopting fully autonomous driving capabilities. This segment benefits from economies of scale, allowing for broader deployment and subsequent cost reductions for ADCs. The ability of passenger vehicles to cater to a wider consumer base and the inherent demand for enhanced comfort, safety, and convenience in personal transportation further solidify its dominance.

Furthermore, the Centralization type of ADC architecture is expected to significantly outperform Distributed architectures in terms of market share and growth trajectory. This shift towards centralization is driven by the need for more powerful, integrated, and efficient computational platforms to manage the complex tasks involved in autonomous driving. Centralized controllers offer several advantages, including reduced wiring complexity, lower power consumption, and the ability to process vast amounts of data from multiple sensors and systems simultaneously. This consolidation is crucial for achieving the computational power required for advanced AI algorithms and real-time decision-making, essential for SAE Level 4 and Level 5 autonomy. The Base Year of 2025 represents a turning point where centralized architectures are becoming the preferred choice for new vehicle platforms, and this trend is expected to accelerate throughout the Forecast Period (2025-2033). The convergence of hardware and software capabilities within a single, powerful computing unit allows for more streamlined development, easier updates, and ultimately, a more robust and cost-effective solution for autonomous driving. The ability to integrate multiple functions, such as infotainment, ADAS, and core driving control, onto a single platform also contributes to the appeal of centralized ADCs in the passenger vehicle segment. This synergy between the passenger vehicle application and the centralized controller architecture will be a defining characteristic of the ADC market's dominance in the coming years. The report will provide detailed market share projections for these key regions and segments, offering valuable insights into the most lucrative areas of the ADC market.

The Autonomous Driving Controller (ADC) industry is experiencing a surge in growth, propelled by several key catalysts. Robust government support, including favorable regulations and incentives for autonomous vehicle development and deployment, is a significant driver. The continuous advancements in AI, machine learning, and sensor technology are enabling more sophisticated and reliable ADCs, pushing the boundaries of autonomous driving capabilities. Furthermore, substantial investments from both established automotive giants and emerging tech companies are fueling innovation and accelerating product development. The growing consumer demand for enhanced safety, convenience, and personalized mobility experiences also acts as a strong pull factor.

This report offers unparalleled coverage of the Autonomous Driving Controller (ADC) market, providing a holistic view of its present state and future potential. It delves deep into the technological nuances, market dynamics, and strategic imperatives that define this rapidly evolving sector. The analysis is underpinned by extensive data collection and rigorous market research, ensuring accuracy and reliability. Stakeholders will gain invaluable insights into market trends, growth drivers, and potential challenges.

The report provides a granular breakdown of the market by controller type (Centralization vs. Distributed) and application (Special Vehicle, Commercial Vehicle, Passenger Vehicle), offering specific forecasts and strategic recommendations for each segment. Furthermore, it meticulously analyzes the competitive landscape, identifying key players and their strategic initiatives, alongside emerging threats and opportunities. The comprehensive scope ensures that businesses can make informed decisions regarding investment, product development, and market entry strategies within the dynamic ADC ecosystem.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.3%.

Key companies in the market include Infineon Technologies, Gigabyte, Kaspersky, Joynext, Lenovo, Advantech, Oneway Robotics, Zhixing Automobile Technology (Suzhou), Youkong Zhixing, Beijing Jingwei Hengrun Technology, Tianzun Technology, Zhongke Waytous, Shenzhen Acrosser Technology.

The market segments include Type, Application.

The market size is estimated to be USD 1907 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Autonomous Driving Controller," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Autonomous Driving Controller, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.