1. What is the projected Compound Annual Growth Rate (CAGR) of the Fiberglass Back Panel for Phone?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Fiberglass Back Panel for Phone

Fiberglass Back Panel for PhoneFiberglass Back Panel for Phone by Type (2D Fiberglass Panel, 2.5D Fiberglass Panel, 3D Fiberglass Panel, World Fiberglass Back Panel for Phone Production ), by Application (Phone Back Panel, Tablet Back Panel, Others, World Fiberglass Back Panel for Phone Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

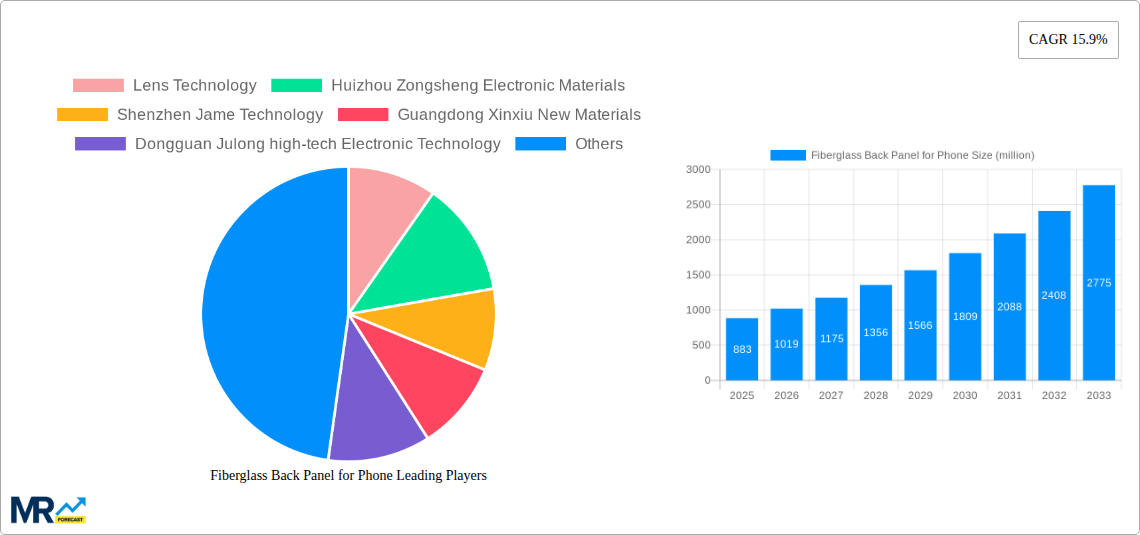

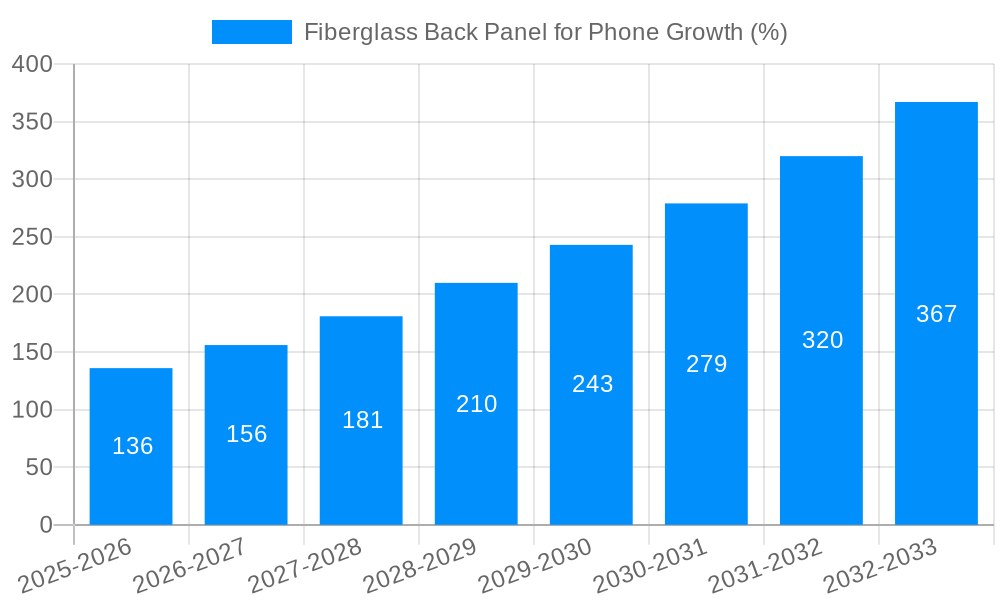

The global fiberglass back panel market for phones, currently valued at approximately $883 million in 2025, is poised for significant growth. Driven by increasing demand for lightweight, durable, and aesthetically pleasing smartphone designs, the market is expected to experience a robust Compound Annual Growth Rate (CAGR). While the exact CAGR is not provided, considering the industry trends towards innovative materials and the rising adoption of premium smartphones, a conservative estimate would place it between 8% and 12% through 2033. This growth is fueled by several factors: the rising popularity of 5G smartphones requiring advanced materials for efficient heat dissipation, the increasing preference for sleek and thin phone designs, and the expanding adoption of fiberglass panels in higher-end devices for their superior strength and scratch resistance compared to traditional plastic alternatives. The market segmentation reveals a strong preference for 2.5D and 3D fiberglass panels, indicating a shift towards more complex and sophisticated designs. Key players such as Lens Technology, Huizhou Zongsheng, and Shenzhen Jame Technology are driving innovation and expanding production capabilities to meet the growing demand. However, challenges exist, including the relatively higher cost of fiberglass panels compared to plastic and potential supply chain disruptions.

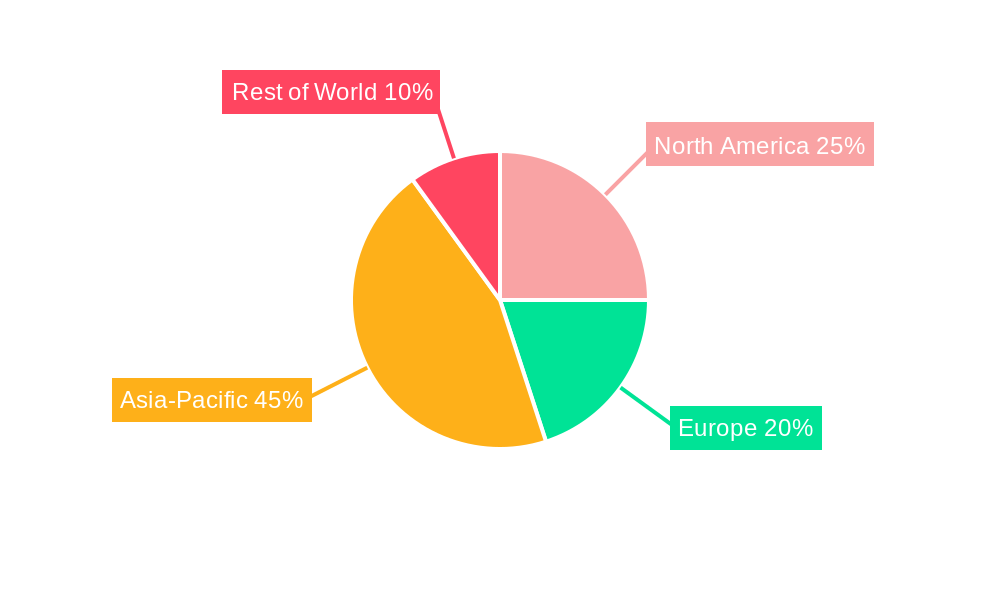

The geographic distribution of the market shows a significant concentration in the Asia Pacific region, primarily driven by China's dominance in smartphone manufacturing. However, increasing demand from North America and Europe, fueled by rising disposable incomes and premium smartphone adoption in these regions, presents significant growth opportunities. The forecast period (2025-2033) anticipates continued market expansion across all regions, with a particularly strong growth trajectory in developing economies experiencing rapid smartphone penetration. The ongoing technological advancements in fiberglass panel production, including improvements in surface finishing and integration with other materials, will further enhance the market's appeal and propel its growth throughout the forecast period. Competition among manufacturers is intense, necessitating continuous innovation and cost optimization to maintain market share and profitability.

The global fiberglass back panel market for phones is experiencing robust growth, driven by the increasing demand for lightweight, durable, and aesthetically pleasing smartphone designs. Over the study period (2019-2033), the market has witnessed a significant upswing, with production exceeding tens of millions of units annually. The shift towards premium-looking yet cost-effective materials is a key factor contributing to this trend. Fiberglass offers a compelling alternative to traditional materials like metal and glass, providing comparable durability at a lower manufacturing cost. This is especially crucial in the budget and mid-range smartphone segments, where manufacturers are constantly seeking ways to enhance product value without significantly increasing prices. The historical period (2019-2024) showcased steady growth, setting the stage for the impressive projected expansion during the forecast period (2025-2033). By the estimated year (2025), production is expected to reach a significant milestone, and this momentum is projected to continue, fueled by technological advancements in fiberglass composition and manufacturing processes. The market is characterized by innovation in surface finishes, allowing for a broader range of design options and enhanced aesthetic appeal. This continuous improvement in both functionality and aesthetics positions fiberglass as a strong contender in the smartphone back panel market, guaranteeing its continued growth in the coming years. The ability to integrate seamlessly with various phone designs and the increasing adoption of advanced manufacturing techniques promise an even brighter future for this segment.

Several factors are propelling the growth of the fiberglass back panel market for phones. Firstly, the cost-effectiveness of fiberglass compared to alternative materials like metal or glass offers a compelling advantage to manufacturers seeking to produce competitive devices at accessible price points. This is especially true in the burgeoning mid-range and budget smartphone markets, where cost-sensitive consumers are driving demand. Secondly, the increasing demand for lightweight and durable smartphones is fueling the adoption of fiberglass. Its inherent strength and low weight contribute to improved ergonomics and a more comfortable user experience. Thirdly, technological advancements in fiberglass production techniques have led to significant improvements in the material's aesthetic qualities, enabling manufacturers to achieve sophisticated finishes and designs, mimicking the appearance of more expensive materials. Furthermore, the environmentally friendly nature of fiberglass, compared to some other materials, is becoming an increasingly important consideration for both manufacturers and consumers. This aligns with the growing focus on sustainability and eco-conscious product choices within the electronics industry. Finally, the versatility of fiberglass allows for easy customization and integration with different phone designs and features, making it a highly adaptable material for smartphone manufacturers.

Despite the significant growth potential, several challenges and restraints could impede the market's expansion. One key challenge lies in the perception of fiberglass as a less premium material compared to glass or metal. While technological advancements are bridging this gap, overcoming consumer perceptions and associating fiberglass with high-quality design remains crucial. Furthermore, achieving the same level of scratch resistance and durability as glass can be a technical hurdle, requiring continuous improvements in manufacturing processes and material composition. Competition from other materials, such as bioplastics or recycled materials, also poses a challenge, especially as consumers and manufacturers place a higher emphasis on sustainability and environmental responsibility. Another restraint is the potential for variations in quality and consistency across different fiberglass suppliers. Maintaining consistent quality across the supply chain is essential for ensuring the reliability and performance of the end product. Finally, the evolving landscape of smartphone technology, including the integration of new features and design trends, might necessitate continuous adaptations in fiberglass manufacturing techniques to remain competitive.

Segment: The 2.5D Fiberglass Panel segment is poised to dominate the market due to its balance of cost-effectiveness, aesthetic appeal, and relatively simple manufacturing processes. It offers a good compromise between the affordability of 2D panels and the design flexibility of 3D panels.

Region: Asia, particularly China, is expected to remain the dominant region in terms of both production and consumption of fiberglass back panels for phones. This is largely due to the concentration of major smartphone manufacturers and related supply chains within the region. The country boasts a mature manufacturing infrastructure and readily available skilled labor, driving down production costs and making it a highly attractive manufacturing hub. However, other regions are experiencing growth, driven by increasing smartphone adoption rates and the growing demand for affordable yet durable devices. Significant growth is projected in other regions like India and South America, as the demand for mobile phones in emerging economies rises. The significant manufacturing capacity in China coupled with increasing consumption in other regions creates a dynamic interplay across the global market. The future dominance is expected to be maintained by Asia, driven by continued investment in technological advancement, favorable cost structures, and a robust demand for smartphones.

The fiberglass back panel industry is propelled by several factors: the rising demand for budget-friendly yet durable smartphones, the continual improvement in fiberglass production and design flexibility, and the increasing focus on eco-friendly materials in the electronics sector. These factors synergistically drive market growth, promising significant expansion in the years to come.

This report offers a comprehensive analysis of the fiberglass back panel market for phones, providing detailed insights into market trends, driving forces, challenges, and growth opportunities. It covers key players, significant developments, and future projections, enabling stakeholders to make informed business decisions. The report's data-driven approach, spanning historical, current, and future market dynamics, creates a robust and valuable resource for industry professionals, investors, and anyone interested in this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Lens Technology, Huizhou Zongsheng Electronic Materials, Shenzhen Jame Technology, Guangdong Xinxiu New Materials, Dongguan Julong high-tech Electronic Technology, Hochuen Smart Technology, Zhejiang Zhaoyi Technology, Shenzhen Goldenken New Material, Dongguan Shengyi Technology, Dongguan ZhengWei Precision Plastic, Berne Optical, TONGDA GROUP, Huizhou Weibrass Precision Technology, Dongguan Tarry Electronics, Dongguan Haonianjing New Material Technology, Shenzhen Yimingyue Technology, Dongguan Renshan Precision Technology, Dongguan Weiside New Material Technology, Dongguan Houbo Precision Plastic Technology, Guangdong Fastway New Materials.

The market segments include Type, Application.

The market size is estimated to be USD 883 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Fiberglass Back Panel for Phone," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Fiberglass Back Panel for Phone, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.