1. What is the projected Compound Annual Growth Rate (CAGR) of the Wireless Charging IC?

The projected CAGR is approximately 25.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Wireless Charging IC

Wireless Charging ICWireless Charging IC by Application (Consumer Electronics, Automotive, Industrial, Medical, Aerospace and Military, Others), by Type (Transmitter ICs, Receiver ICs), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

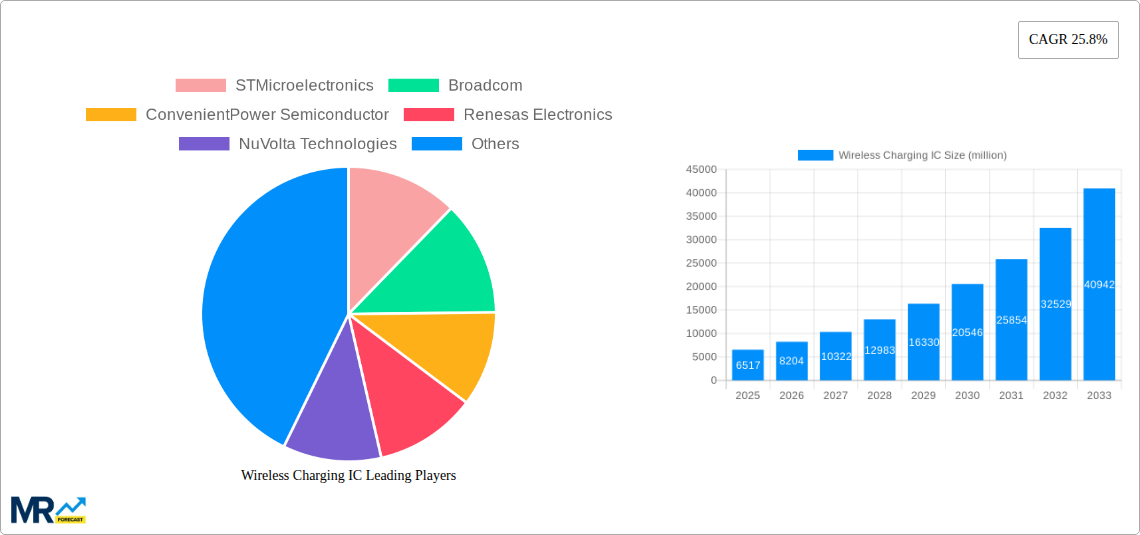

The global Wireless Charging IC market is poised for exceptional growth, projected to reach a market size of approximately $6,517 million by 2025, exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 25.8% through 2033. This surge is primarily driven by the burgeoning consumer electronics sector, where the convenience and seamless user experience offered by wireless charging technology are increasingly sought after. The automotive industry is also emerging as a significant growth engine, with the integration of wireless charging pads in vehicles becoming a standard feature, enhancing passenger convenience and safety. Furthermore, the adoption of wireless charging in industrial settings for robotics and IoT devices, alongside its growing application in medical devices for sterile environments and in aerospace and military for enhanced operational flexibility, underscores the technology's expanding utility. Transmitter ICs and Receiver ICs are the key components fueling this expansion, with ongoing advancements in power efficiency, charging speed, and interoperability further accelerating market penetration.

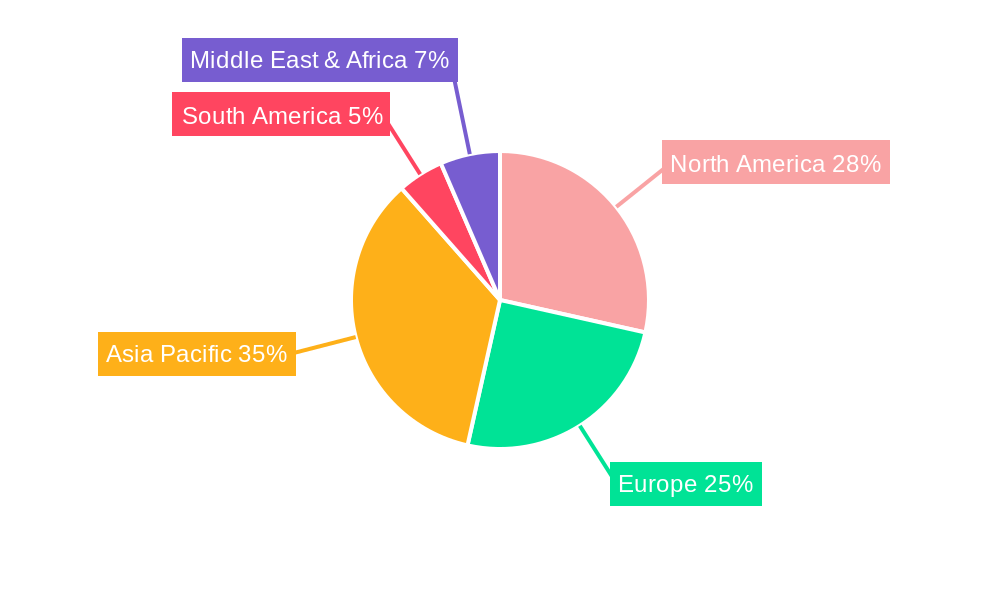

The market's robust growth is further bolstered by several key trends, including the development of longer-range wireless charging solutions, the increasing standardization of wireless charging protocols to ensure universal compatibility, and the miniaturization of IC components for integration into smaller devices. The push towards more efficient power management within these ICs, aiming to reduce energy loss during the charging process, is also a significant trend. While the market demonstrates immense potential, certain restraints, such as the higher cost compared to wired charging solutions and the limitations in charging speed for high-power devices, are being addressed through continuous innovation. The competitive landscape features a strong presence of established players like STMicroelectronics and Broadcom, alongside emerging innovators such as NuVolta Technologies and Shenzhen Injoinic Technology, all actively contributing to market dynamism through strategic partnerships and new product development. North America and Asia Pacific are expected to lead in market share due to high consumer adoption rates and strong manufacturing capabilities respectively.

The global wireless charging Integrated Circuit (IC) market is experiencing an explosive growth trajectory, driven by an insatiable consumer demand for convenience and the relentless innovation within the electronics industry. Our extensive analysis, spanning the historical period of 2019-2024 and projecting to 2033 with a base year of 2025, reveals a market poised for unprecedented expansion. The estimated market size for wireless charging ICs in 2025 is projected to reach approximately 750 million units, a substantial leap from historical figures, and is expected to surge well into the billions of units by the end of the forecast period. This surge is fueled by the increasing integration of wireless charging capabilities across a diverse range of consumer electronics, from smartphones and wearables to smart home devices and portable power banks. The technological evolution, particularly advancements in charging efficiency, speed, and the development of multi-device charging solutions, is creating a fertile ground for widespread adoption. Furthermore, the automotive sector is emerging as a significant growth driver, with in-car wireless charging pads becoming a standard feature in an increasing number of vehicle models. This trend, coupled with the expanding use cases in industrial and medical applications where sterile, cable-free environments are paramount, underscores the pervasive nature of this technology. The report delves into the nuanced shifts in market dynamics, analyzing the evolving landscape of both transmitter and receiver ICs, and highlighting the strategic maneuvers of key industry players as they race to capture market share. The market's expansion is not merely about unit sales; it signifies a fundamental shift in how we power our devices, moving towards a truly ubiquitous and seamless charging experience. The intricate interplay between technological innovation, consumer demand, and the strategic investments by leading semiconductor manufacturers will continue to define the contours of this dynamic market. The increasing average selling prices (ASPs) driven by higher integration and performance will further bolster revenue growth. The report forecasts a compound annual growth rate (CAGR) of over 20% for the wireless charging IC market throughout the study period.

The ascent of the wireless charging IC market is being propelled by a confluence of powerful forces, each contributing significantly to its robust expansion. Foremost among these is the ever-increasing consumer appetite for convenience and the desire for a clutter-free digital lifestyle. The elimination of tangled cables and the freedom to simply place a device on a charging surface has become a highly sought-after feature, especially in the rapidly evolving consumer electronics segment. This demand is further amplified by the continuous miniaturization and proliferation of electronic devices. As more gadgets become indispensable, the need for a universal and effortless charging solution becomes paramount, driving the adoption of wireless charging ICs. The significant investments in research and development by key industry players, aimed at improving charging speeds, efficiency, and compatibility across different standards (such as Qi), are directly contributing to overcoming previous adoption hurdles. This innovation cycle is making wireless charging a more practical and attractive alternative to traditional wired methods. Moreover, the growing adoption of wireless charging in the automotive industry, transforming car interiors into more user-friendly spaces, and its expanding utility in niche applications like industrial automation and medical devices, where hygienic and reliable power delivery is critical, are creating new and substantial avenues for growth. The report analyzes how these driving forces are collectively shaping the market landscape, influencing product development and strategic decision-making. The increasing demand for higher power output and faster charging speeds also necessitates more sophisticated IC designs, fostering a continuous innovation loop.

Despite the overwhelmingly positive outlook, the wireless charging IC market is not without its inherent challenges and restraints that warrant careful consideration. A primary concern remains the charging efficiency and speed compared to traditional wired charging. While advancements are being made, some consumers still perceive wireless charging as being slower and less efficient, especially for high-power devices. This perception, though diminishing, can still act as a barrier to widespread adoption in certain segments. Another significant factor is the fragmentation of standards. While the Qi standard has achieved widespread dominance, the existence of other proprietary or less prevalent standards can lead to compatibility issues and consumer confusion, potentially hindering market growth. The cost of implementation also remains a consideration. While the cost of wireless charging ICs has been steadily decreasing, the integration into devices can still add to the overall Bill of Materials (BOM), making it a less attractive option for budget-conscious manufacturers. Furthermore, heat generation during the wireless charging process can be a concern, impacting device performance and user experience, and necessitating careful thermal management strategies within the IC design and device integration. The report meticulously examines these challenges, assessing their potential impact on market expansion and identifying strategies that industry players are employing to mitigate these restraints. The ongoing efforts to standardize higher power transfer protocols and improve energy conversion rates are crucial in addressing efficiency concerns.

The global wireless charging IC market is characterized by dynamic regional dominance and segment leadership, with specific areas poised to significantly outpace others in the coming years.

Dominant Application Segment: Consumer Electronics is unequivocally the largest and most influential application segment within the wireless charging IC market. This dominance is driven by the ubiquitously of smartphones, tablets, smartwatches, wireless earbuds, and other portable gadgets, all of which are increasingly incorporating wireless charging capabilities. The sheer volume of these devices produced annually, coupled with a strong consumer preference for the convenience offered by wireless charging, makes this segment the primary engine of growth. The estimated unit sales of wireless charging ICs for consumer electronics in 2025 are projected to be in the hundreds of millions. The continuous innovation in smartphone design, with manufacturers striving for sleeker aesthetics and enhanced user experience, further bolsters the integration of wireless charging. Wearable technology, in particular, is experiencing a rapid uptake of wireless charging due to the small form factor and the desire for a seamless charging experience without the need for tiny, fiddly connectors. The market for wireless charging ICs in consumer electronics is expected to continue its robust expansion throughout the forecast period, driven by both replacement cycles and the introduction of new product categories.

Emerging Dominant Application Segment: The Automotive sector is rapidly emerging as a significant and high-growth application segment for wireless charging ICs. As vehicles become increasingly connected and consumers demand greater convenience and less clutter within their cars, integrated wireless charging solutions are becoming a standard feature. From premium sedans to mass-market vehicles, in-car wireless charging pads are being integrated into center consoles and storage compartments, offering drivers and passengers a hassle-free way to keep their devices powered. The estimated unit sales of wireless charging ICs for the automotive segment are expected to reach tens of millions in 2025 and will witness substantial year-on-year growth as more manufacturers prioritize this feature. The demand for higher power output and faster charging speeds is also more pronounced in the automotive sector, driving innovation in higher-performance wireless charging ICs. The report forecasts this segment to be a key driver of revenue growth for wireless charging IC manufacturers.

Key Dominant Region/Country: Asia-Pacific, particularly China, is set to dominate the wireless charging IC market in terms of both production and consumption. China is the world's largest manufacturing hub for consumer electronics, including smartphones, wearables, and other portable devices that heavily utilize wireless charging technology. Major global electronics manufacturers have a strong presence in China, driving significant demand for wireless charging ICs. Furthermore, the rapid adoption of new technologies and the growing disposable income of consumers in the region contribute to the high penetration rate of wireless charging enabled devices. The country's robust semiconductor industry, with a strong focus on IC design and manufacturing, also positions it as a key player in the supply chain. The estimated unit sales from this region are expected to account for over 60% of the global market by 2025. The growth of the automotive sector in China also contributes to this regional dominance. South Korea and Japan are also significant contributors to the Asia-Pacific market, with leading electronics companies in these countries driving innovation and adoption.

Type Segment Dominance: Both Transmitter ICs and Receiver ICs are critical components of the wireless charging ecosystem, and their market share will be closely aligned with the overall adoption of wireless charging technology. However, Receiver ICs are expected to exhibit slightly higher unit volumes in the short to medium term, as a single transmitter (e.g., a charging pad) can serve multiple receiver-equipped devices. The proliferation of wireless charging capabilities in a wide array of consumer electronics directly translates to a higher demand for receiver ICs. As the market matures and dedicated charging solutions become more common, the demand for transmitter ICs will also surge in parallel. The report will provide detailed unit projections for both types of ICs. The increasing integration of receiver ICs into the power management solutions of devices further solidifies their dominant position in terms of unit volume.

The wireless charging IC industry is propelled by several key growth catalysts that are accelerating its expansion. The increasing consumer demand for convenience and a cable-free lifestyle is the most significant driver, encouraging manufacturers to integrate wireless charging into a wider array of devices. Technological advancements leading to faster charging speeds, improved efficiency, and enhanced interoperability across standards are continuously making wireless charging more attractive. The expanding adoption of wireless charging in the automotive sector, transforming vehicle interiors, is opening up substantial new market opportunities. Furthermore, the growing focus on enabling wireless power transfer for a broader range of applications, including industrial automation, medical devices, and even smart furniture, is creating novel use cases and driving demand for specialized IC solutions.

This comprehensive report offers an in-depth analysis of the global wireless charging IC market, providing invaluable insights for stakeholders across the industry. It meticulously dissects market trends, analyzes the driving forces and restraining factors, and identifies key regions and segments poised for dominance. The report offers detailed projections for market size and unit sales, with a robust study period encompassing 2019-2033, a base year of 2025, and a forecast period of 2025-2033. Furthermore, it highlights the strategic initiatives and significant developments of leading players, alongside emerging growth catalysts. The report’s extensive coverage aims to equip businesses with the strategic intelligence needed to navigate this rapidly evolving landscape, capitalize on emerging opportunities, and make informed investment decisions within the dynamic wireless charging IC ecosystem. The detailed examination of both transmitter and receiver ICs, along with their respective application segments, ensures a holistic understanding of the market dynamics.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 25.8% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 25.8%.

Key companies in the market include STMicroelectronics, Broadcom, ConvenientPower Semiconductor, Renesas Electronics, NuVolta Technologies, Maxic Technology, Shenzhen Injoinic Technology, Southchip Semiconductor, Celfras Semiconductor, NXP, Infineon, Generalplus Technology, Shenzhen Beirand Technology, Shenzhen Jingxin Microelectronics, Xiamen Newyea Science and Technology, Suncore Semiconductor, Wise Power Innovation, COPO Microelectronics.

The market segments include Application, Type.

The market size is estimated to be USD 6517 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Wireless Charging IC," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Wireless Charging IC, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.