1. What is the projected Compound Annual Growth Rate (CAGR) of the Wafer Recycling Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Wafer Recycling Service

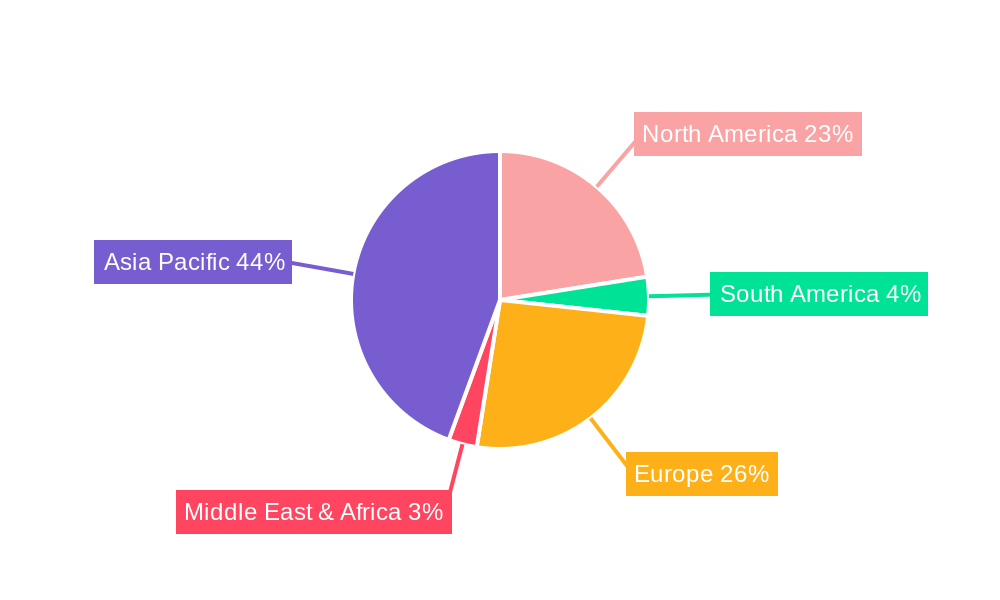

Wafer Recycling ServiceWafer Recycling Service by Type (/> Monitor Wafers, Dummy Wafers), by Application (/> IDM, Foundry, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

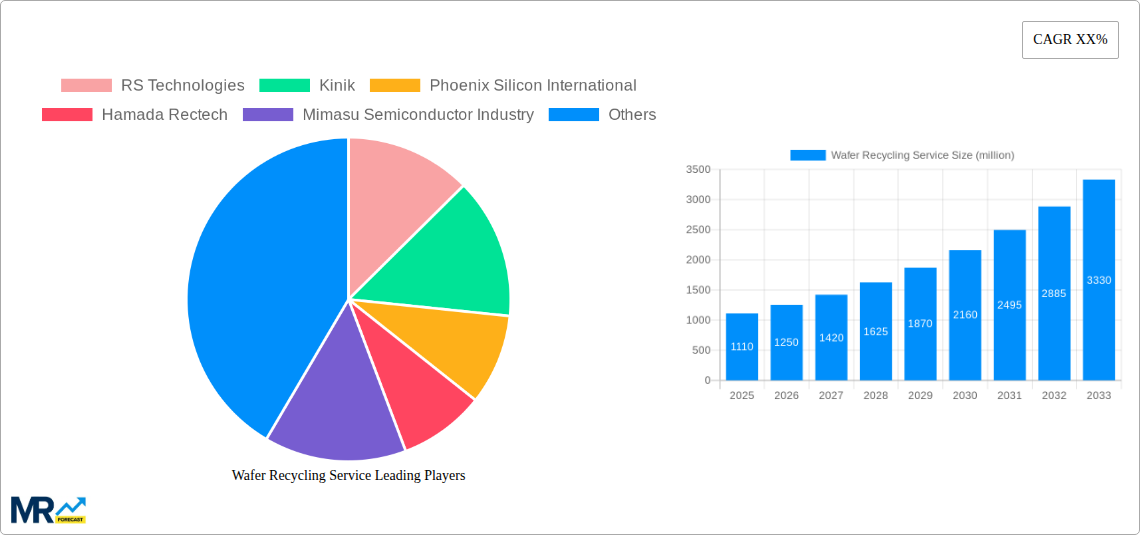

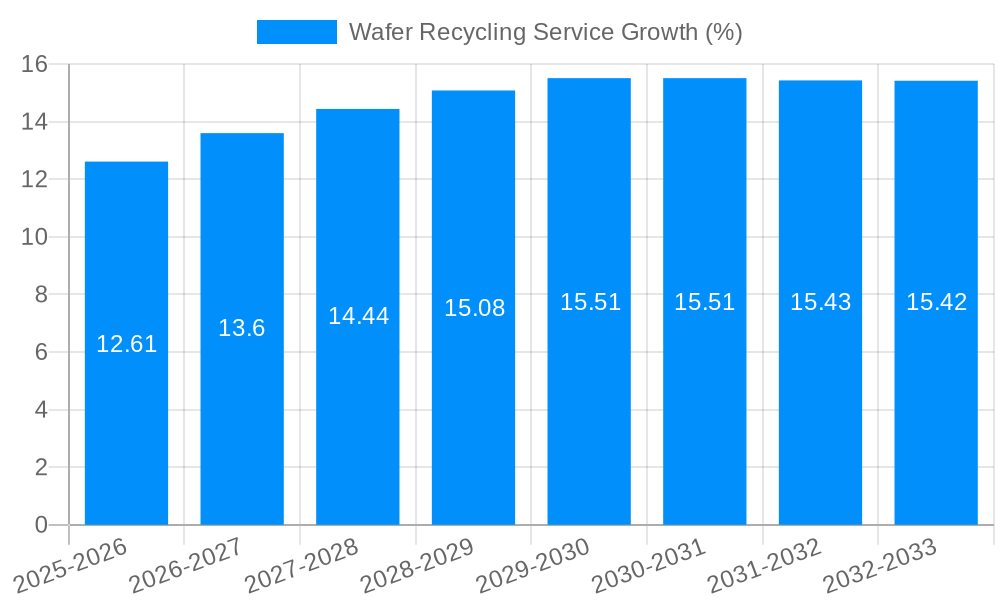

The global Wafer Recycling Service market is poised for substantial growth, projected to reach a market size of approximately USD 1,110 million in 2025. This expansion is driven by an increasing emphasis on sustainability within the semiconductor industry, coupled with the inherent cost-saving benefits of wafer reclamation. As the demand for advanced semiconductor devices continues to surge, so too does the generation of silicon wafers, making efficient recycling solutions not just an environmental imperative but also an economic necessity. The industry is witnessing a significant shift towards circular economy principles, with companies actively seeking to reduce waste and optimize resource utilization. This growing awareness and proactive approach are fueling investments in advanced recycling technologies and services, further propelling market expansion. Key segments such as monitor wafers and dummy wafers are experiencing heightened demand for recycling due to their critical role in quality control and process validation during semiconductor manufacturing.

The market's trajectory is further supported by a robust Compound Annual Growth Rate (CAGR), indicating sustained momentum throughout the forecast period. Major drivers include stringent environmental regulations, the rising cost of raw materials for wafer production, and the increasing complexity of semiconductor manufacturing processes, which often lead to higher wafer scrap rates. While the market enjoys strong growth, certain restraints such as the technical challenges associated with recycling highly contaminated or advanced process wafers, and the initial capital investment required for state-of-the-art recycling facilities, need to be addressed. However, the overwhelming trend towards a greener semiconductor ecosystem, alongside innovations in chemical and mechanical recycling processes, is expected to overcome these challenges. Companies like RS Technologies, Kinik, and Ferrotec are at the forefront of this evolution, offering specialized services that cater to the diverse needs of IDMs, foundries, and other players in the semiconductor supply chain, ensuring a more sustainable future for wafer production.

This comprehensive report offers an in-depth analysis of the global Wafer Recycling Service market, projecting robust growth and highlighting key trends, driving forces, challenges, and dominant segments. The study covers the Historical Period (2019-2024), the Base Year (2025), and provides projections for the Forecast Period (2025-2033), with a special focus on the Estimated Year (2025). The analysis is informed by an extensive review of industry developments and the strategic contributions of leading players.

The Wafer Recycling Service market is poised for significant expansion, driven by an escalating global demand for semiconductors and an increasing awareness of environmental sustainability. As the semiconductor industry continues its trajectory of innovation and miniaturization, the consumption of silicon wafers, a critical component in chip manufacturing, has surged. This heightened production naturally leads to a greater volume of discarded or surplus wafers, including monitor wafers and dummy wafers, which are essential for process control and validation. The economic impetus behind wafer recycling is equally powerful. Reclaiming valuable silicon from these used wafers presents a compelling cost-saving opportunity for manufacturers, especially given the volatile prices of raw materials like polysilicon. By reprocessing these wafers, companies can reduce their reliance on virgin materials, thereby mitigating supply chain risks and lowering overall production expenses. This circular economy approach is gaining traction as companies seek to enhance their profitability while simultaneously minimizing their environmental footprint. The market is also witnessing a trend towards greater sophistication in recycling technologies. Advanced chemical and mechanical processes are being developed and refined to extract high-purity silicon from various types of wafers, ensuring that the recycled material meets the stringent quality standards required for semiconductor fabrication. Furthermore, regulatory bodies worldwide are increasingly implementing policies and incentives that encourage the adoption of sustainable manufacturing practices, including waste reduction and material reclamation. This regulatory push further accelerates the adoption of wafer recycling services. The industry is also observing a consolidation and specialization among service providers, with companies like RS Technologies, Kinik, and Phoenix Silicon International investing in advanced infrastructure and expertise to cater to the growing demand. The emphasis on achieving higher yields from recycled wafers and reducing processing times is a key focus area, aiming to make wafer recycling not just an environmentally responsible choice but also a highly efficient and economically viable one. The integration of wafer recycling into the broader semiconductor manufacturing lifecycle is becoming a strategic imperative for leading IDM and Foundry players.

The expansion of the wafer recycling service market is propelled by a confluence of compelling factors, primarily centered on economic advantages and burgeoning environmental consciousness. The semiconductor industry's insatiable appetite for silicon wafers, coupled with the inherent cost of virgin silicon, creates a strong economic incentive for recycling. Discarded or surplus wafers, often in the form of monitor and dummy wafers, contain significant amounts of high-purity silicon that can be reclaimed and repurposed. This reprocessing significantly reduces the need for newly mined polysilicon, thereby lowering raw material costs for semiconductor manufacturers. In a landscape often characterized by supply chain volatility and price fluctuations for essential materials, wafer recycling offers a tangible pathway to cost optimization and improved profitability. Beyond the financial benefits, a profound shift towards sustainability is a major catalyst. As global awareness of environmental issues intensifies, industries are under increasing pressure to adopt eco-friendly practices and minimize their ecological impact. The semiconductor sector, with its energy-intensive manufacturing processes and significant material consumption, is particularly scrutinized. Wafer recycling directly addresses this by diverting waste from landfills and reducing the carbon footprint associated with virgin material extraction and processing. This resonates with a growing segment of environmentally conscious consumers and investors who favor companies demonstrating a commitment to corporate social responsibility and sustainable operations. Consequently, companies are increasingly integrating wafer recycling into their corporate sustainability strategies.

Despite the promising growth trajectory, the wafer recycling service market is not without its hurdles. A primary challenge revolves around maintaining the ultra-high purity standards required for semiconductor manufacturing. Silicon wafers used in the fabrication of advanced microchips demand exceptionally low levels of contamination. Achieving this level of purity from recycled wafers necessitates sophisticated and often costly processing technologies. The presence of trace impurities from previous manufacturing steps, handling, or packaging can render the recycled silicon unsuitable for certain high-end applications, limiting its market applicability and potentially impacting the yield of the recycling process. Another significant restraint is the initial investment required for establishing and scaling up efficient wafer recycling infrastructure. Companies like Hamada Rectech and Mimasu Semiconductor Industry must invest heavily in specialized equipment, advanced chemical treatments, and rigorous quality control systems to ensure the integrity of the recycled silicon. This capital expenditure can be a barrier, particularly for smaller players or those entering the market. Furthermore, the logistics of collecting, transporting, and processing used wafers from various manufacturing sites can be complex and add to the overall cost of the service. Ensuring a consistent and reliable supply of suitable waste wafers also presents a challenge, as the volume and type of discards can fluctuate based on production cycles and technological advancements within semiconductor fabrication. The market also faces a degree of inertia, with some manufacturers still accustomed to traditional disposal methods or hesitant to fully embrace recycled materials due to perceived risks to device performance, though this perception is gradually changing.

The Wafer Recycling Service market is projected to witness significant dominance by specific regions and segments, driven by a combination of established semiconductor manufacturing hubs, supportive regulatory environments, and the inherent characteristics of certain wafer types and industry players.

Dominant Regions/Countries:

Dominant Segments:

The interplay between these dominant regions and segments, coupled with ongoing industry developments and the strategic efforts of leading companies such as Hwatsing Technology, Fine Silicon Manufacturing (shanghai), and PNC Process Systems, will shape the future landscape of the wafer recycling service market.

The wafer recycling service industry is experiencing several key growth catalysts. The escalating cost of virgin polysilicon, a fundamental raw material in semiconductor manufacturing, makes recycled silicon a more economically attractive alternative. Coupled with this is the growing global emphasis on environmental sustainability and circular economy principles, pushing industries to adopt greener practices. Advancements in recycling technologies are improving the purity and quality of reclaimed silicon, making it suitable for a wider range of applications. Furthermore, the increasing production volume of semiconductors, especially for emerging technologies like AI and 5G, leads to a larger supply of discarded wafers, creating more opportunities for recycling.

This report provides a 360-degree view of the wafer recycling service market, delving into its intricate dynamics and future potential. It meticulously analyzes market trends, from the growing demand for sustainable practices to the economic imperatives driving material reclamation. The report identifies and elaborates on the key forces propelling market expansion, such as cost reduction and environmental regulations. It also critically examines the challenges and restraints that the industry faces, including technological hurdles and initial investment requirements. Furthermore, the report highlights the dominant regions and segments, offering valuable insights into where market growth is most concentrated and which types of wafers and applications are expected to drive demand. A detailed exploration of growth catalysts and a comprehensive list of leading players underscore the competitive landscape. The report's extensive coverage, spanning from historical data to future projections, equips stakeholders with the knowledge necessary to navigate this evolving and crucial sector of the semiconductor industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include RS Technologies, Kinik, Phoenix Silicon International, Hamada Rectech, Mimasu Semiconductor Industry, GST, Scientech, Pure Wafer, TOPCO Scientific Co. LTD, Ferrotec, Xtek semiconductor (Huangshi), Shinryo, KST World, Vatech Co., Ltd., OPTIM Wafer Services, Nippon Chemi-Con, KU WEI TECHNOLOGY, Hua Hsu Silicon Materials, Hwatsing Technology, Fine Silicon Manufacturing (shanghai), PNC Process Systems, Silicon Valley Microelectronics.

The market segments include Type, Application.

The market size is estimated to be USD 1110 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Wafer Recycling Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Wafer Recycling Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.