1. What is the projected Compound Annual Growth Rate (CAGR) of the Wafer Reclaiming Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Wafer Reclaiming Service

Wafer Reclaiming ServiceWafer Reclaiming Service by Type (/> 8 Inches Wafer, 12 Inches Wafer, Others), by Application (/> Monitor Wafers, Dummy Wafers), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

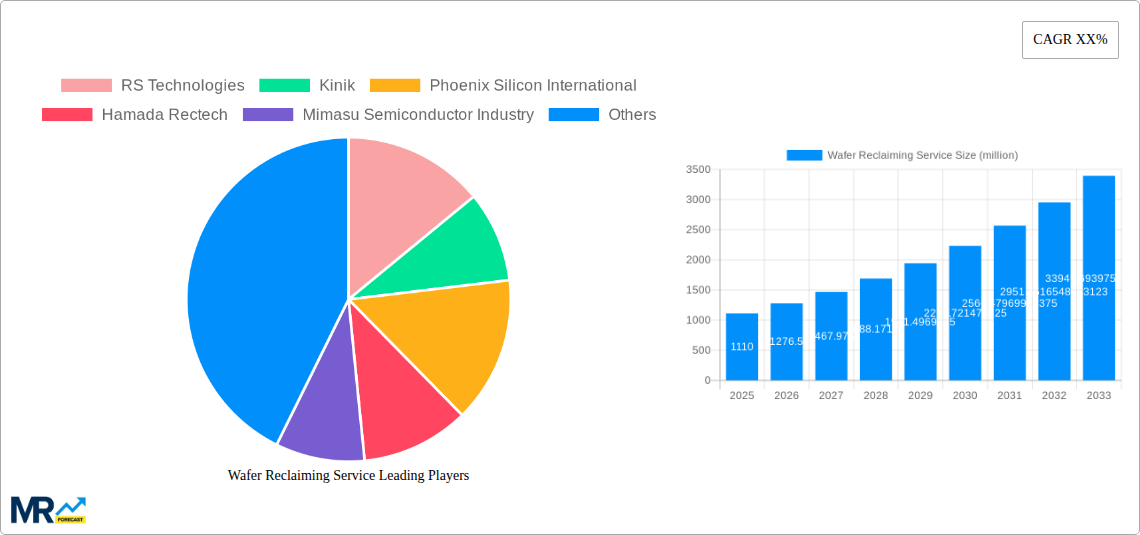

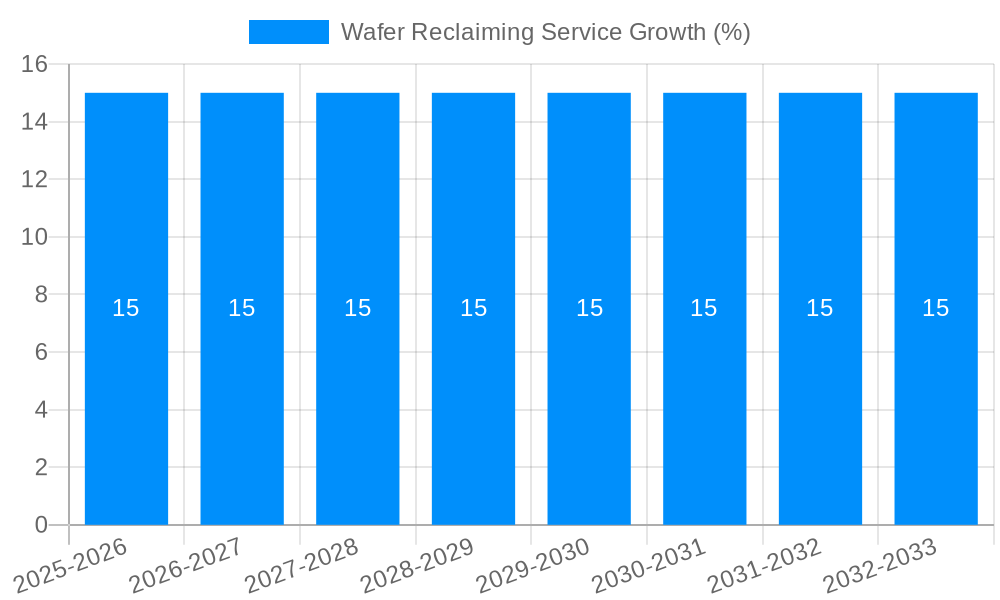

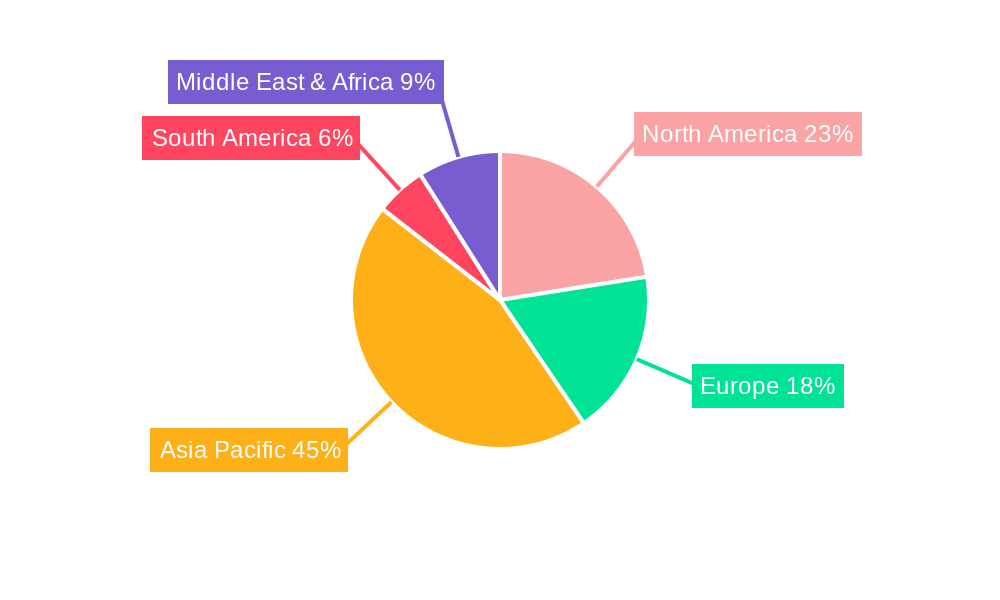

The global wafer reclaiming service market is poised for significant expansion, projected to reach an estimated $1110 million by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of approximately 15%, driven by the increasing demand for semiconductor devices across various industries. Key growth accelerators include the escalating production of advanced electronics, the widespread adoption of IoT devices, and the continuous innovation in automotive electronics and AI. The industry is also benefiting from a growing emphasis on sustainability and cost-efficiency in semiconductor manufacturing, as reclaimed wafers offer a more economical and environmentally friendly alternative to new ones. This trend is particularly pronounced in the Asia Pacific region, which is anticipated to dominate the market due to its substantial semiconductor manufacturing base.

The market is further segmented by wafer type, with 12-inch wafers expected to witness the highest demand, reflecting the industry's shift towards larger wafer sizes for enhanced efficiency. Monitor wafers and dummy wafers represent key application segments, catering to the stringent quality control and developmental needs of semiconductor manufacturers. Despite the positive outlook, the market faces certain restraints, including the technical challenges associated with achieving high-quality reclamation standards and the initial capital investment required for advanced reclaiming technologies. However, the growing number of established players and emerging companies, such as RS Technologies, Kinik, and Ferrotec, indicates a competitive landscape focused on innovation and service expansion. Strategic collaborations and technological advancements in wafer cleaning and refurbishment are expected to mitigate these challenges and further propel market growth through the forecast period of 2025-2033.

Here is a unique report description for the Wafer Reclaiming Service market, incorporating your specified details and structure:

The global wafer reclaiming service market is experiencing a significant surge, driven by an increasing awareness of resource sustainability and the escalating costs associated with semiconductor manufacturing. During the Historical Period (2019-2024), the market demonstrated steady growth, fueled by the expanding semiconductor industry and the inherent value in reusing silicon wafers. As we move into the Base Year (2025), the market is poised for even more accelerated expansion. The Study Period (2019-2033) encompasses a critical juncture where the economic and environmental imperatives of wafer reclamation are becoming increasingly pronounced. A key market insight is the shift from a niche service to a mainstream, indispensable component of the semiconductor supply chain. This transition is marked by substantial investments in advanced reclaiming technologies, aiming to achieve higher yield rates and cater to the stringent quality demands of modern chip fabrication. The increasing prevalence of 12 Inches Wafer reclamation is a significant trend, reflecting the industry's move towards larger wafer diameters for enhanced manufacturing efficiency. While 8 Inches Wafer reclamation continues to hold its ground, particularly in specific application segments, the future growth trajectory is heavily influenced by the adoption of larger formats. The market is also witnessing a growing demand for reclaimed wafers used as Monitor Wafers and Dummy Wafers, as manufacturers seek cost-effective solutions without compromising on process integrity. The overall market valuation is projected to reach several million dollars by the end of the Forecast Period (2025-2033), underscoring the economic viability and strategic importance of this sector. Innovations in chemical processes, surface treatments, and metrology are continuously enhancing the quality and reliability of reclaimed wafers, further solidifying their role in the semiconductor ecosystem. This upward trend is not merely opportunistic; it is a fundamental realignment of manufacturing practices towards a more circular economy within the high-tech industry.

The wafer reclaiming service market is experiencing a robust expansion fueled by a confluence of powerful driving forces. Foremost among these is the escalating cost of virgin silicon wafers, a direct consequence of sophisticated manufacturing processes and the increasing complexity of semiconductor devices. As the semiconductor industry continues its relentless pursuit of miniaturization and performance enhancement, the raw materials, particularly high-purity silicon, become ever more precious. Reclaiming used wafers offers a compelling economic alternative, significantly reducing capital expenditure for foundries and integrated device manufacturers (IDMs). This cost-effectiveness is amplified when considering the substantial volumes of wafers utilized in the production of advanced chips. Furthermore, growing global environmental consciousness and stringent regulatory pressures are playing a pivotal role. The semiconductor industry, known for its significant resource consumption and waste generation, is under increasing scrutiny to adopt more sustainable practices. Wafer reclamation directly addresses this challenge by diverting substantial amounts of silicon from landfills and reducing the need for virgin silicon extraction and processing, thereby lowering the overall environmental footprint. This alignment with sustainability goals makes wafer reclaiming services an attractive proposition for companies aiming to enhance their Environmental, Social, and Governance (ESG) profiles. The growing adoption of larger wafer diameters, such as 12 Inches Wafer, also contributes to market growth as the absolute cost of virgin wafers in these formats becomes even more substantial, making reclamation more economically attractive.

Despite its burgeoning growth, the wafer reclaiming service market faces several significant challenges and restraints that temper its full potential. A primary concern revolves around maintaining the pristine quality and defect-free nature of reclaimed wafers. The intricate multi-layer structures and nanoscale features of modern semiconductor devices demand exceptionally high standards for substrates. Any residual contamination or surface damage from previous fabrication steps can lead to yield losses in subsequent processes, making manufacturers hesitant to adopt reclaimed wafers for critical applications. Ensuring consistent quality across different reclaimers and for diverse wafer types remains a hurdle. Another significant restraint is the perception of reclaimed wafers as being inferior to virgin wafers. This perception, though often challenged by advancements in reclaiming technologies, can create a barrier to entry, especially for applications requiring the highest levels of reliability and performance. The logistical complexities of collecting, transporting, and processing used wafers from various manufacturing sites can also add to operational costs and introduce potential delays. Furthermore, the rapid pace of technological advancement in semiconductor fabrication means that newer, more advanced wafer specifications might emerge, potentially rendering existing reclaiming techniques obsolete or less effective for the latest generations of chips. The specialized nature of reclaiming equipment and expertise also necessitates significant upfront investment, which can be a barrier for smaller players or those entering the market. Finally, the inherent cyclicality of the semiconductor industry, with its periods of boom and bust, can impact the demand for reclaiming services as fab utilization rates fluctuate.

The wafer reclaiming service market is characterized by regional dominance and specific segment leadership, driven by the concentration of semiconductor manufacturing and the economic imperatives of wafer reuse.

Dominant Region/Country:

Dominant Segment:

Several key factors are acting as significant growth catalysts for the wafer reclaiming service industry. The relentless drive for cost reduction in semiconductor manufacturing is paramount, as reclaimed wafers offer a substantial economic benefit over virgin wafers. Coupled with this is the increasing global emphasis on sustainability and circular economy principles, pushing industries towards resource conservation and waste reduction. The continuous technological advancements in reclaiming processes, improving yield and quality, are making reclaimed wafers more acceptable for a wider range of applications. Furthermore, the strategic investments by leading semiconductor players in optimizing their supply chains, including wafer reclamation, are further accelerating market growth.

This report offers a comprehensive analysis of the global wafer reclaiming service market, delving deep into its multifaceted dynamics. It provides an in-depth look at market trends, driving forces, and the challenges that shape the industry's trajectory. The report meticulously forecasts market growth from 2019 to 2033, with a detailed breakdown for the Base Year (2025) and the Forecast Period (2025-2033), building upon insights from the Historical Period (2019-2024). It identifies key regions and segments, such as 12 Inches Wafer and the applications of Monitor Wafers and Dummy Wafers, poised for significant dominance. Furthermore, the report highlights the leading players, their competitive strategies, and significant developments that are revolutionizing the sector. The comprehensive coverage ensures stakeholders gain a clear understanding of market opportunities, risks, and the strategic landscape for navigating this evolving industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include RS Technologies, Kinik, Phoenix Silicon International, Hamada Rectech, Mimasu Semiconductor Industry, GST, Scientech, Pure Wafer, TOPCO Scientific Co. LTD, Ferrotec, Xtek semiconductor (Huangshi), Shinryo, KST World, Vatech Co., Ltd., OPTIM Wafer Services, Nippon Chemi-Con, KU WEI TECHNOLOGY, Hua Hsu Silicon Materials, Hwatsing Technology, Fine Silicon Manufacturing (shanghai), PNC Process Systems, Silicon Valley Microelectronics.

The market segments include Type, Application.

The market size is estimated to be USD 1110 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Wafer Reclaiming Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Wafer Reclaiming Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.