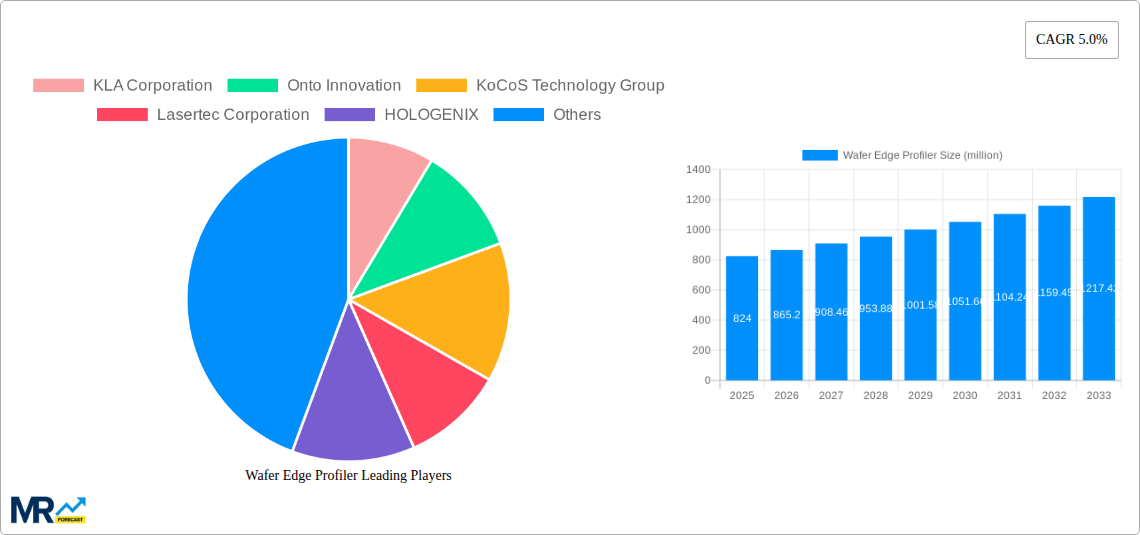

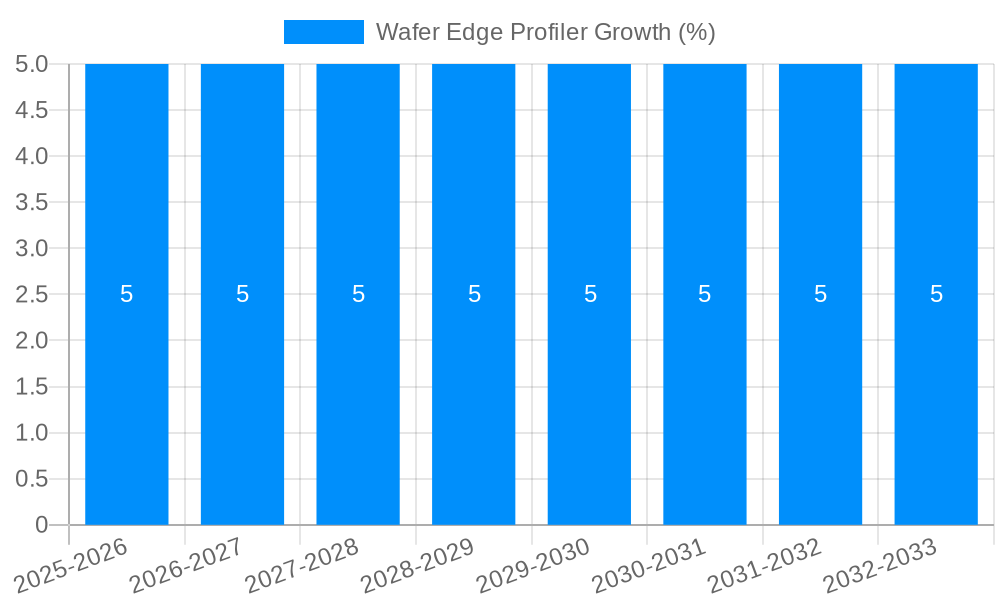

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wafer Edge Profiler?

The projected CAGR is approximately 5.0%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Wafer Edge Profiler

Wafer Edge ProfilerWafer Edge Profiler by Type (Contact, Contactless), by Application (6 Inches, 8 Inches, 12 Inches, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The Wafer Edge Profiler market is poised for substantial growth, projected to reach approximately $824 million by 2025. This expansion is fueled by the increasing demand for advanced semiconductor devices, particularly in the rapidly evolving electronics, automotive, and telecommunications sectors. The miniaturization of components and the relentless pursuit of higher performance necessitate stringent quality control throughout the wafer manufacturing process. Wafer edge profiling plays a critical role in identifying and mitigating defects along the wafer's perimeter, which can significantly impact yield and device reliability. The market is experiencing a robust Compound Annual Growth Rate (CAGR) of 5.0%, indicating a healthy and sustained upward trajectory. This growth is primarily driven by the escalating complexity of semiconductor fabrication, the introduction of new wafer materials, and the need for precise metrology solutions to ensure the integrity of wafer edges. Companies are investing heavily in advanced wafer edge inspection and measurement technologies to maintain a competitive edge and meet the demanding specifications of next-generation chips.

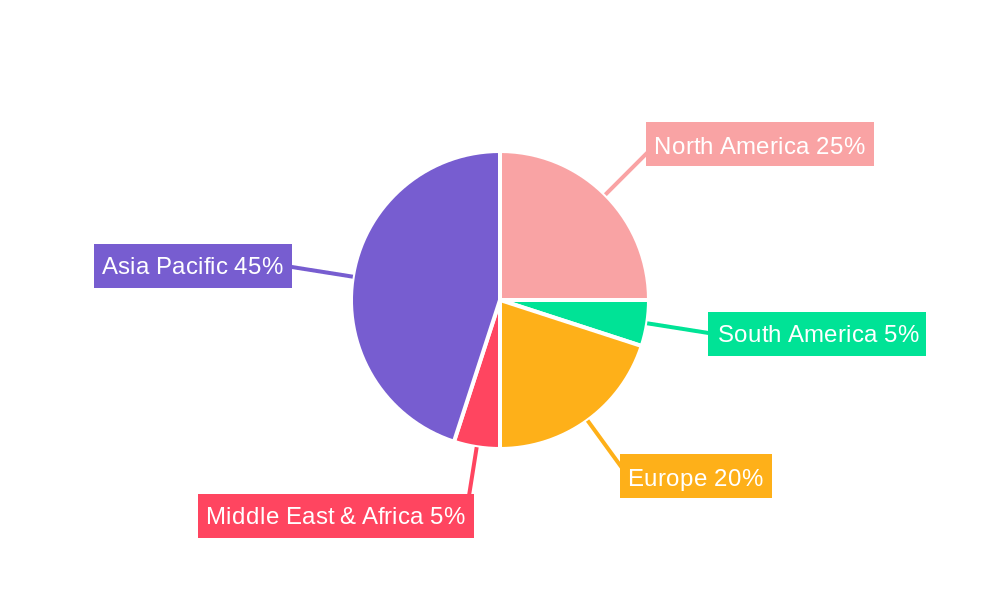

The market is segmented by type, with both contact and contactless profilers witnessing adoption. Contactless profilers are gaining traction due to their non-intrusive nature and higher precision, especially for delicate wafer materials. Applications span various wafer sizes, including 6 inches, 8 inches, 12 inches, and others, reflecting the diverse range of semiconductor products. Geographically, the Asia Pacific region, led by China and Japan, is expected to dominate the market due to its extensive semiconductor manufacturing base and significant investments in R&D. North America and Europe also represent substantial markets, driven by established players and the continuous innovation in chip design and manufacturing. The growth in these regions is further supported by government initiatives promoting domestic semiconductor production and technological advancements. Key players like KLA Corporation, Onto Innovation, and Lasertec Corporation are at the forefront, innovating and expanding their product portfolios to cater to the evolving needs of the semiconductor industry.

The global Wafer Edge Profiler market, a critical component in the semiconductor manufacturing ecosystem, is poised for substantial growth, driven by the relentless pursuit of enhanced wafer quality and advanced device fabrication. This report delves into the market dynamics from 2019 to 2033, with a base year of 2025 and a forecast period extending from 2025 to 2033, building upon the historical period of 2019-2024. Key market insights reveal a burgeoning demand for sophisticated edge profiling technologies that can accurately detect and quantify minute imperfections, such as chipping, cracking, and contamination along the wafer's periphery. These defects, if left unchecked, can significantly impact yield, device reliability, and overall performance, especially as semiconductor geometries continue to shrink and device complexity escalates. The market is currently valued in the hundreds of millions, with projections indicating a Compound Annual Growth Rate (CAGR) of approximately 8-10% over the forecast period, potentially reaching figures exceeding 1 billion by the end of the study period. This expansion is underpinned by several interconnected trends. Firstly, the increasing adoption of advanced packaging techniques, which often involve intricate wafer thinning and dicing processes, necessitates highly precise edge inspection. Secondly, the demand for higher integrated circuit (IC) densities and functionalities in consumer electronics, automotive, and artificial intelligence (AI) applications directly translates to a need for flawless wafer substrates. Furthermore, the shift towards smaller wafer sizes, such as 6-inch and 8-inch wafers, in specialized applications, alongside the continued dominance of 12-inch wafers in high-volume manufacturing, presents diverse profiling challenges and opportunities. The market is witnessing a bifurcation, with both contact and contactless profilers carving out their respective niches, catering to different levels of sensitivity and application requirements. Contactless technologies, leveraging advanced optical and laser-based methods, are gaining traction due to their non-destructive nature and ability to achieve higher throughputs, while contact profilers remain relevant for specific metrology applications requiring tactile feedback. The underlying driver remains the industry's unwavering commitment to minimizing defects and maximizing yields, making wafer edge profiling an indispensable tool in the modern semiconductor foundry.

The wafer edge profiler market is propelled by a confluence of powerful technological and market forces, primarily stemming from the insatiable demand for more powerful and efficient semiconductor devices. The continuous drive towards miniaturization, as dictated by Moore's Law and its successors, means that even microscopic flaws on the wafer edge can have disproportionately catastrophic effects on the performance and yield of integrated circuits. This necessitates ever more sensitive and precise measurement capabilities. The increasing complexity of semiconductor architectures, including the integration of multiple functionalities onto single chips and the development of advanced 3D structures, further amplifies the criticality of wafer edge integrity. As fabrication processes become more intricate, with techniques like advanced lithography and etching, the propensity for edge-related defects can increase, making robust profiling essential for process control and optimization. Furthermore, the burgeoning demand for high-performance computing, AI accelerators, and advanced communication technologies, such as 5G and beyond, is fueling the need for larger quantities of higher-quality semiconductor wafers. This translates directly into increased investment in metrology and inspection equipment, including wafer edge profilers, to ensure that the production capacity can keep pace with market demand while maintaining stringent quality standards. The automotive sector's increasing reliance on sophisticated electronics for autonomous driving and advanced safety features, along with the expansion of the Internet of Things (IoT) ecosystem, are also significant contributors to this growth. These industries require highly reliable and durable semiconductor components, making wafer edge quality a non-negotiable aspect of their supply chain.

Despite the robust growth trajectory, the wafer edge profiler market faces several significant challenges and restraints that could temper its full potential. One of the primary hurdles is the escalating cost of advanced metrology equipment. The sophisticated technologies required for ultra-high precision edge profiling often come with a hefty price tag, making them a substantial investment, particularly for smaller foundries or those operating in cost-sensitive market segments. This high capital expenditure can lead to a slower adoption rate in certain regions or for specific applications. Another challenge lies in the increasing complexity of wafer materials and structures. As semiconductor manufacturers explore novel materials and advanced 3D stacking techniques, the development of profiling technologies capable of accurately characterizing these new substrates becomes more demanding. Ensuring the universality and adaptability of existing profilers to these evolving materials presents an ongoing R&D challenge. Furthermore, the availability of skilled personnel to operate and maintain these highly specialized instruments can be a bottleneck. The intricate nature of the technology requires a deep understanding of both metrology principles and semiconductor manufacturing processes, and a shortage of such expertise can hinder efficient deployment and utilization. Data management and analysis also pose a significant challenge. The vast amounts of data generated by wafer edge profilers require sophisticated software solutions and analytical capabilities for effective interpretation and actionable insights. Inadequate data handling can lead to missed defect identification or inefficient process adjustments. Finally, the inherent limitations of certain profiling techniques, such as the potential for mechanical damage with contact profilers or the susceptibility of optical methods to surface contamination, necessitate careful selection and implementation strategies, adding another layer of complexity to market adoption.

The global Wafer Edge Profiler market exhibits distinct regional and segment dynamics that are poised to shape its future dominance. Within the segmentation by Application, the 12 Inches wafer segment is expected to continue its reign as the dominant force. This is directly attributable to the prevailing industry trend of migrating high-volume manufacturing for advanced logic and memory devices to 300mm (12-inch) wafers. The inherent economies of scale and higher throughput offered by larger wafers make them the cornerstone of modern semiconductor fabrication. Consequently, the demand for high-precision wafer edge profiling solutions tailored to the unique challenges of 12-inch wafer processing remains exceptionally strong. These advanced profilers are crucial for ensuring the defect-free production of billions of transistors on each wafer, directly impacting the yield and cost-effectiveness of leading-edge chip manufacturing. The continuous push for higher transistor densities and performance in consumer electronics, data centers, and high-performance computing applications further solidifies the importance of 12-inch wafer production and, by extension, the demand for sophisticated edge profiling.

In terms of regional dominance, Asia-Pacific is projected to lead the market in both value and volume. Several factors contribute to this:

While other regions like North America and Europe are significant players, particularly in specialized IC design and niche manufacturing, the sheer scale of wafer production and the aggressive expansion plans in Asia-Pacific make it the undisputed leader in the wafer edge profiler market.

The wafer edge profiler industry is experiencing significant growth catalysts. The relentless pursuit of higher yields and reduced defect rates in advanced semiconductor manufacturing is paramount. As device geometries shrink and complexity increases, the impact of edge defects becomes more pronounced, driving demand for precise and reliable profiling solutions. The expanding applications of semiconductors in emerging fields like AI, 5G, autonomous vehicles, and IoT are creating a surge in demand for higher quantities of high-quality wafers. Furthermore, the ongoing consolidation and expansion of wafer fabrication facilities globally, particularly in Asia-Pacific, directly translate to increased investment in essential metrology equipment, including wafer edge profilers.

This comprehensive report on the Wafer Edge Profiler market offers an in-depth analysis of critical market trends, driving forces, challenges, and growth opportunities. It provides detailed insights into regional market dynamics, with a particular focus on the dominating Asia-Pacific region, and examines the significance of key segments such as 12-inch wafer processing. The report includes an exhaustive list of leading industry players and highlights significant technological developments and strategic initiatives undertaken by these companies throughout the study period (2019-2033). This detailed coverage ensures stakeholders have the necessary information to understand the current market landscape, anticipate future trajectories, and make informed strategic decisions within the dynamic wafer edge profiler industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.0% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.0%.

Key companies in the market include KLA Corporation, Onto Innovation, KoCoS Technology Group, Lasertec Corporation, HOLOGENIX, Optima Co., Ltd., Delta Electronics, Hitachi High-Tech, ERS, Xinmao Semiconductor Technology, Jiangsu Jinggong Semiconductor Equipment, Suzhou Secote Precision Electronic, Beijing Khltech Semiconductor Technology.

The market segments include Type, Application.

The market size is estimated to be USD 824 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Wafer Edge Profiler," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Wafer Edge Profiler, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.