1. What is the projected Compound Annual Growth Rate (CAGR) of the Virtual Wafer Fab?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Virtual Wafer Fab

Virtual Wafer FabVirtual Wafer Fab by Type (/> Process, Equipment, Others), by Application (/> Etch, Deposition, Metrology, Wafer Operation, Integration), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

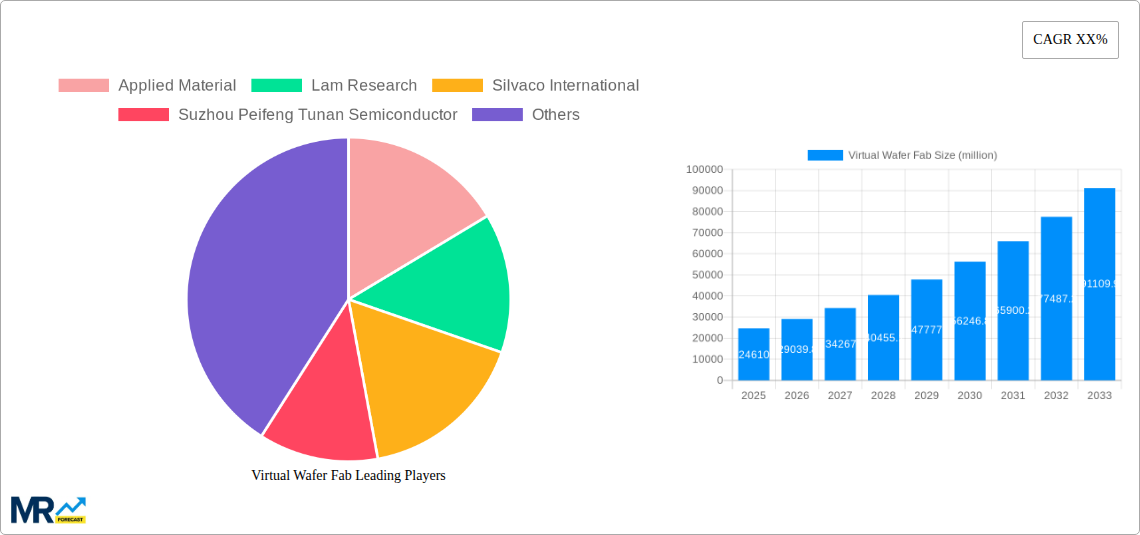

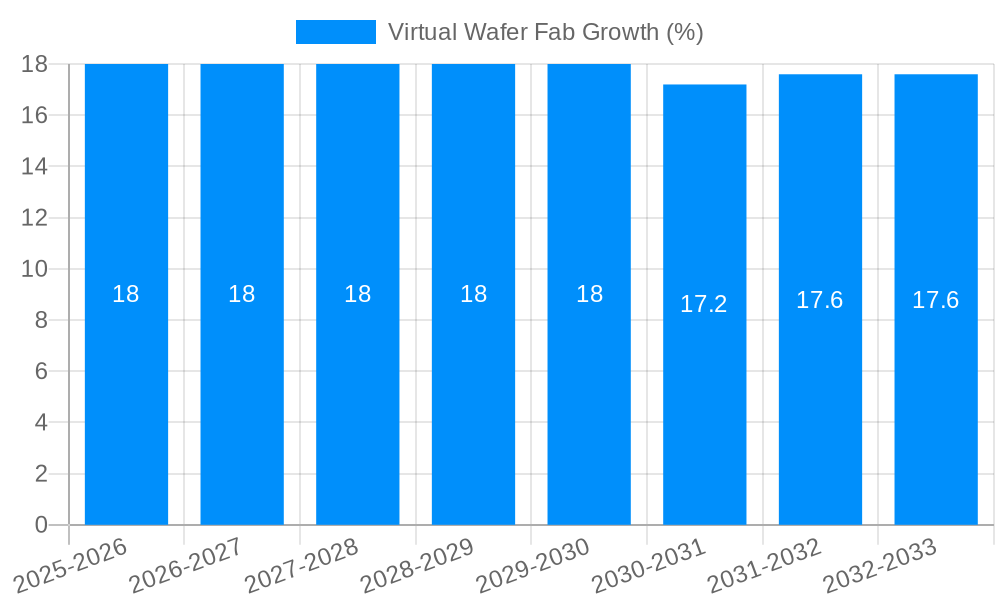

The Virtual Wafer Fab market is poised for significant expansion, projected to reach a substantial size of $24.61 billion by 2025. This growth is fueled by an estimated Compound Annual Growth Rate (CAGR) of approximately 18-22%, indicating a rapidly evolving landscape driven by the semiconductor industry's insatiable demand for advanced manufacturing solutions. Key drivers include the escalating complexity and cost of traditional wafer fabrication, the need for accelerated design cycles, and the increasing adoption of AI and machine learning in semiconductor development. Virtual wafer fabrication offers a compelling alternative, enabling simulation, optimization, and virtual testing of manufacturing processes without the need for expensive physical infrastructure. This allows for reduced time-to-market, lower development costs, and enhanced design flexibility, making it an indispensable tool for chip manufacturers and designers alike.

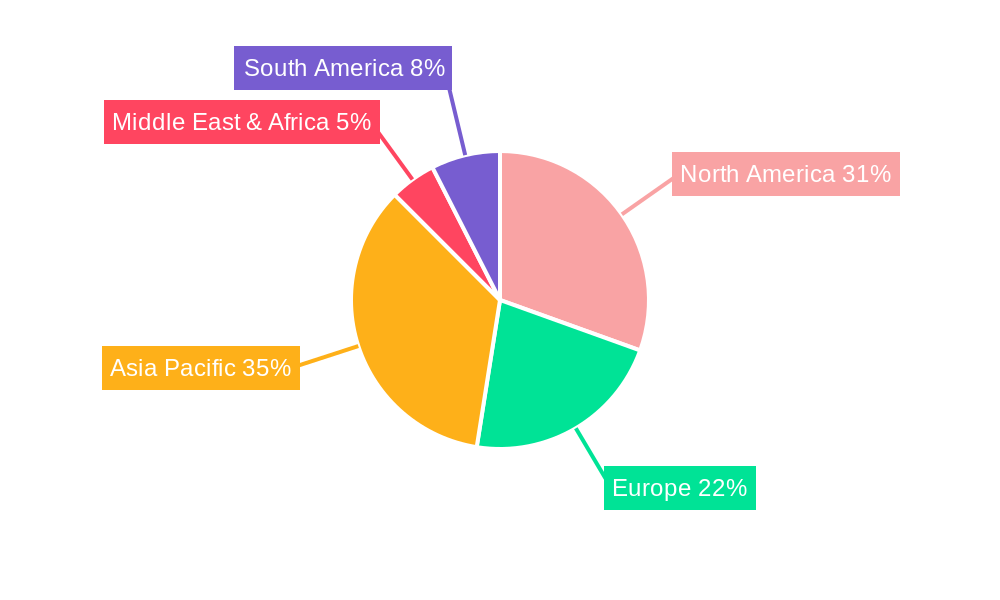

The market is segmented across various types and applications, with Process, Equipment, and Others forming the primary categories for technological solutions. On the application front, Etch, Deposition, Metrology, Wafer Operation, and Integration represent critical areas where virtual fabrication is making substantial inroads. Leading companies such as Applied Materials, Lam Research, Silvaco International, and Suzhou Peifeng Tunan Semiconductor are at the forefront, innovating and expanding their offerings to capture this burgeoning market. Geographically, North America, with its strong concentration of semiconductor design and manufacturing, is expected to lead market adoption, followed closely by Asia Pacific, particularly China, Japan, and South Korea, which are major hubs for semiconductor production. Europe also presents a significant opportunity, driven by its robust research and development ecosystem. Restraints, such as the initial investment in simulation software and the need for skilled personnel, are being progressively addressed through cloud-based solutions and enhanced user interfaces.

Here is a unique report description on Virtual Wafer Fab, incorporating your specified elements:

This report provides an in-depth analysis of the Virtual Wafer Fab (VWF) market, examining its trajectory from the historical period of 2019-2024 through to the projected forecast period of 2025-2033, with a detailed focus on the Base Year of 2025. The VWF market, a critical enabler of advanced semiconductor manufacturing, is experiencing a paradigm shift, moving towards highly integrated and simulated environments that mirror the complexity and functionality of physical wafer fabrication facilities. This evolution is driven by an increasing demand for faster design iterations, reduced time-to-market, and significant cost efficiencies in the semiconductor industry. The market's expansion is also fueled by the growing complexity of chip designs, the need for advanced process simulation, and the burgeoning semiconductor ecosystem, which necessitates robust tools for process development, yield optimization, and new technology integration. As the industry grapples with escalating manufacturing costs and the imperative to innovate rapidly, VWF solutions are becoming indispensable for achieving competitive advantages and enabling the development of next-generation electronic devices. The projected market growth indicates a significant investment in these sophisticated simulation and emulation platforms, reflecting their pivotal role in the future of semiconductor production. The report offers detailed segmentation across types (Process, Equipment, Others), applications (Etch, Deposition, Metrology, Wafer Operation, Integration), and explores the strategic landscape of key players, industry developments, and regional dominance.

XXX reports a dynamic and accelerating trend within the Virtual Wafer Fab (VWF) market, projecting significant growth driven by the relentless pursuit of innovation and efficiency in the semiconductor industry. The VWF market, valued at approximately 550 million units in 2025, is anticipated to witness a robust Compound Annual Growth Rate (CAGR) of over 15% throughout the forecast period (2025-2033). This expansion is primarily attributed to the escalating costs and complexities associated with physical wafer fabrication, which often run into billions of units for a single fab. VWF offers a compelling alternative by providing highly accurate digital twins of fabrication processes and equipment, enabling extensive simulation, optimization, and virtual experimentation without the prohibitive expense and lead times of physical prototyping. Key market insights reveal a pronounced shift towards cloud-based VWF solutions, democratizing access to advanced simulation tools for a wider range of semiconductor companies, including smaller design houses and research institutions. Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms within VWF platforms is becoming a significant trend, enabling predictive maintenance, anomaly detection, and accelerated process recipe optimization, thereby further enhancing operational efficiency and yield prediction. The increasing sophistication of chip architectures, particularly in areas like AI accelerators, advanced logic, and memory, necessitates highly detailed and accurate simulation capabilities, which VWF provides. The market is also observing a growing demand for specialized VWF solutions tailored to specific manufacturing processes, such as advanced lithography and 3D NAND, as manufacturers strive to push the boundaries of device performance and density. The projected market valuation for VWF by the end of the forecast period in 2033 is expected to surpass 2.5 billion units, underscoring its critical and expanding role in the global semiconductor manufacturing ecosystem. This growth is not merely about cost reduction; it is fundamentally about enabling faster, more reliable, and more innovative semiconductor development cycles.

The Virtual Wafer Fab (VWF) market is experiencing a substantial upswing, propelled by a confluence of powerful driving forces that are fundamentally reshaping the semiconductor manufacturing landscape. Foremost among these is the astronomical cost of building and operating physical wafer fabrication plants, with new advanced fabs requiring investments often exceeding 10 to 20 billion units. VWF offers a significant cost advantage by allowing extensive process simulation, design exploration, and yield optimization in a virtual environment, thereby reducing the need for costly and time-consuming physical runs. The accelerating pace of technological advancement in the semiconductor industry, characterized by shrinking device geometries, increasing chip complexity, and the introduction of novel materials and architectures, demands more sophisticated design and process development tools. VWF's ability to accurately model these intricate processes and predict outcomes before committing to physical fabrication is crucial for staying competitive. The imperative to shorten product development cycles and accelerate time-to-market is another major catalyst. By enabling rapid iteration of process designs and virtual validation, VWF significantly reduces the time spent on experimental fabrication and troubleshooting, allowing companies to bring new products to market faster. Furthermore, the growing emphasis on sustainability and resource efficiency within the industry is driving adoption of VWF. Simulating processes virtually reduces material waste, energy consumption, and the environmental impact associated with numerous physical test runs. The increasing accessibility of cloud-based VWF platforms is also democratizing these advanced capabilities, making them available to a broader range of companies and fostering innovation across the entire semiconductor ecosystem.

Despite its significant promise and accelerating adoption, the Virtual Wafer Fab (VWF) market faces several notable challenges and restraints that could temper its growth trajectory. A primary hurdle is the accuracy and fidelity of VWF models. While VWF solutions have made considerable advancements, achieving the same level of precision as physical experimentation remains a complex task, especially for cutting-edge processes or novel materials. Discrepancies between simulated and real-world results can lead to costly errors and erode trust in the technology. The initial investment and integration complexity for some VWF platforms can also be a restraint, particularly for smaller companies with limited IT infrastructure and budget. Implementing and customizing sophisticated VWF software and ensuring seamless integration with existing design and manufacturing workflows can be a resource-intensive undertaking. Lack of standardization and interoperability across different VWF tools and vendors can create fragmentation in the market and make it difficult for users to leverage data and models across diverse platforms. This can lead to vendor lock-in and hinder collaborative development efforts. The need for skilled personnel to effectively operate and interpret VWF simulations is another significant challenge. Developing and validating complex process models requires specialized expertise in semiconductor physics, simulation techniques, and data analysis, a talent pool that is currently in high demand. Finally, resistance to change and inertia within established manufacturing processes can also pose a restraint. Some companies may be hesitant to move away from traditional, proven methods and embrace new virtual approaches, particularly if they perceive a high risk or uncertainty associated with VWF adoption.

The Virtual Wafer Fab (VWF) market is poised for substantial dominance by key regions and specific segments, reflecting the global distribution of semiconductor manufacturing and R&D.

Key Dominating Regions/Countries:

North America: The United States, with its strong presence in advanced semiconductor research, design, and leading-edge manufacturing, is a major driver of the VWF market.

East Asia (South Korea, Taiwan, Japan, China): This region is the undisputed powerhouse of global semiconductor manufacturing, making it a critical market for VWF solutions.

Dominating Segments:

Type: Process

Application: Wafer Operation and Integration

Wafer Operation: This encompasses the holistic simulation and optimization of the entire wafer manufacturing flow, from initial wafer processing to final inspection. VWF solutions here focus on:

Integration: This segment focuses on the complex task of integrating various process modules and equipment models into a cohesive and functional virtual fab.

The synergy between these regions and segments, particularly the focus on process simulation and integrated wafer operations, is expected to drive the VWF market to new heights, with projected investments in these areas by leading semiconductor players likely to reach billions of units by 2033.

Several key catalysts are fueling the rapid expansion of the Virtual Wafer Fab (VWF) industry. The relentless drive for miniaturization and increased performance in semiconductors necessitates highly complex process development, where the cost of physical experimentation can exceed 10 million units per iteration. VWF provides a cost-effective and accelerated pathway for this. The growing adoption of advanced AI and machine learning techniques within VWF platforms allows for predictive modeling and optimization, further enhancing accuracy and efficiency. Furthermore, the increasing demand for customized chip solutions and the rise of fabless semiconductor companies with limited in-house manufacturing capabilities are creating a significant market for accessible VWF services. The global push towards semiconductor self-sufficiency in various nations is also leading to substantial investments in new fabs, which in turn drives the need for advanced simulation tools like VWF to accelerate development and ensure manufacturing readiness.

This report offers unparalleled comprehensive coverage of the Virtual Wafer Fab (VWF) market, delving deep into its strategic, technological, and economic dimensions. We provide granular insights into market segmentation by type and application, analyzing the specific contributions of Process, Equipment, Others, Etch, Deposition, Metrology, Wafer Operation, and Integration segments, with a focus on their projected market share, valued in the millions of units. The report dissects the growth catalysts, such as the escalating cost of physical fabs (often exceeding 10 billion units), and the increasing demand for faster R&D cycles. Furthermore, it meticulously examines the challenges and restraints, including the critical need for model fidelity and skilled personnel. Our analysis includes detailed profiles of leading players and significant industry developments, offering a forward-looking perspective on market trends and opportunities through 2033. The report is designed to be an indispensable resource for stakeholders seeking to understand and capitalize on the transformative potential of Virtual Wafer Fab technology.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Applied Material, Lam Research, Silvaco International, Suzhou Peifeng Tunan Semiconductor.

The market segments include Type, Application.

The market size is estimated to be USD 24610 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Virtual Wafer Fab," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Virtual Wafer Fab, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.