1. What is the projected Compound Annual Growth Rate (CAGR) of the UAV-borne UV Imaging Camera?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

UAV-borne UV Imaging Camera

UAV-borne UV Imaging CameraUAV-borne UV Imaging Camera by Type (Field of view 18°×13.5°, Field of view 20°×11.2°, World UAV-borne UV Imaging Camera Production ), by Application (Power, Transportation, Petrochemical, Others, World UAV-borne UV Imaging Camera Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

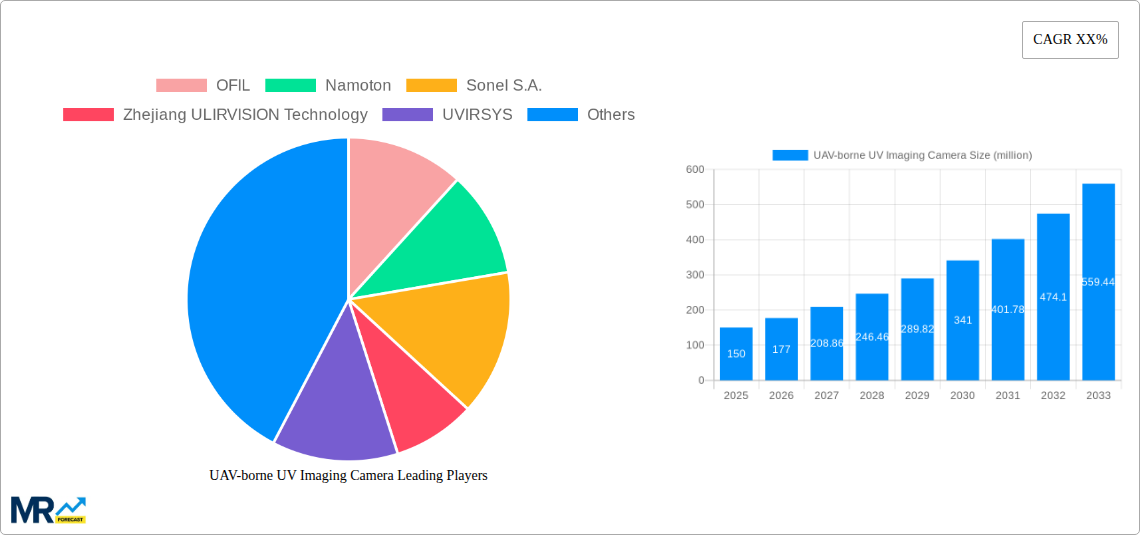

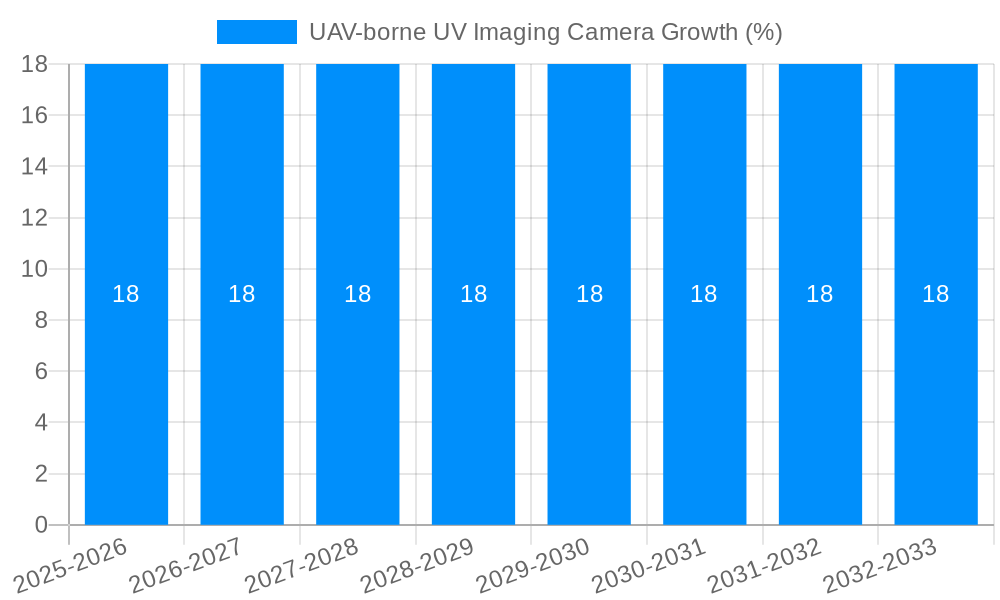

The global UAV-borne UV Imaging Camera market is poised for significant expansion, projected to reach an estimated market size of $150 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 18% expected through 2033. This growth trajectory is primarily fueled by the escalating demand for advanced inspection and monitoring solutions across critical industries. The burgeoning adoption of Unmanned Aerial Vehicles (UAVs) in sectors such as power grid inspection, infrastructure maintenance, and environmental surveillance has created a substantial market for specialized imaging technologies. UV imaging cameras offer unique advantages in detecting corona discharge, material degradation, and early signs of faults that are often invisible to the naked eye or standard visible-light cameras. This capability is paramount for predictive maintenance, enhancing operational efficiency, and ensuring the safety and longevity of vital assets. Furthermore, ongoing technological advancements in sensor resolution, miniaturization, and data processing are making UAV-borne UV imaging systems more accessible and powerful, driving further market penetration. The increasing investment in smart grid technologies and the growing need for efficient and safe infrastructure monitoring are key accelerators for this market.

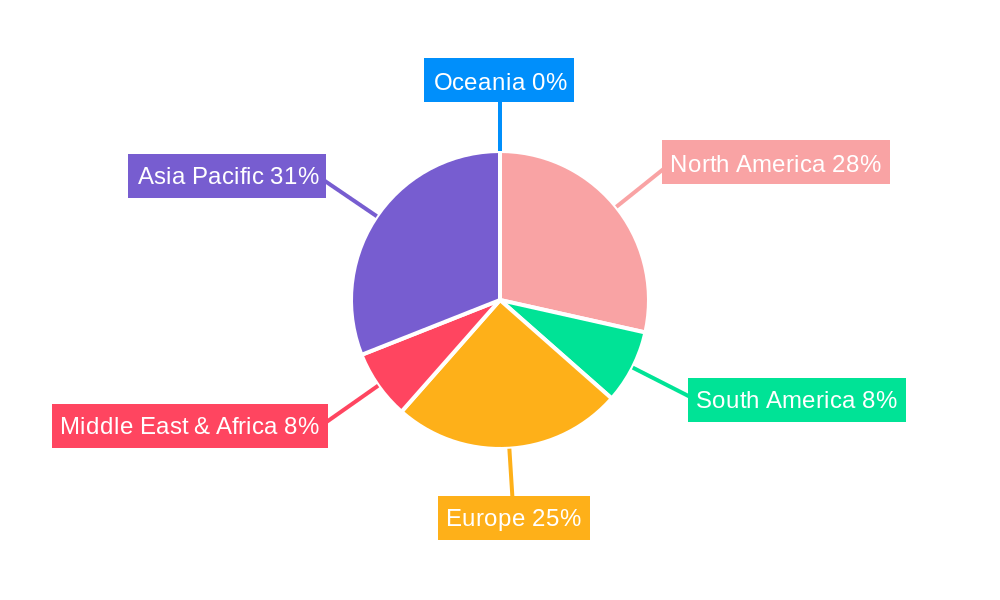

The market is segmented by field of view, with 18°×13.5° and 20°×11.2° representing the primary configurations catering to diverse application needs. Application-wise, the power sector leads the demand, followed by transportation, petrochemical, and other emerging industries like agriculture and environmental monitoring. Geographically, Asia Pacific is expected to emerge as a dominant region due to rapid industrialization, increasing infrastructure development, and a growing adoption of drone technology in China and India. North America and Europe also present significant opportunities, driven by stringent regulatory standards for infrastructure safety and increasing adoption of advanced inspection technologies. However, challenges such as the high initial cost of sophisticated UV imaging systems and the need for specialized training for operators could pose moderate restraints. Despite these, the undeniable benefits of early fault detection, reduced downtime, and enhanced safety are expected to outweigh these limitations, propelling the market forward. Companies like OFIL, Namoton, and Zhejiang ULIRVISION Technology are at the forefront, innovating and expanding their product portfolios to meet the evolving demands of this dynamic market.

This report delves into the dynamic landscape of the UAV-borne UV Imaging Camera market, offering an in-depth analysis of its growth trajectory, technological advancements, and key market drivers. The study encompasses a comprehensive period from 2019 to 2033, with a base year of 2025, and detailed forecasts for the period 2025-2033, building upon the historical data from 2019-2024. The report quantifies the World UAV-borne UV Imaging Camera Production and its future outlook, projecting significant market expansion in the coming years, potentially reaching hundreds of millions in terms of unit production. This growth is fueled by escalating demand across critical sectors and continuous innovation in imaging technology.

The UAV-borne UV Imaging Camera market is experiencing a significant upswing, driven by a confluence of technological innovation and increasing adoption across various industries. XXX The market is characterized by a strong trend towards higher resolution imaging, miniaturization of sensor technology, and enhanced data processing capabilities. This allows for more precise detection of UV emissions, crucial for identifying anomalies in critical infrastructure. For instance, the development of advanced UV sensors with wider spectral ranges and improved sensitivity is enabling the detection of fainter UV discharges, which can be early indicators of insulation degradation in power lines or corona discharge in high-voltage equipment. The integration of AI and machine learning algorithms into these systems is also a prominent trend, facilitating automated analysis of captured images, identification of potential faults, and predictive maintenance insights. This shift from manual inspection to automated, intelligent analysis significantly reduces operational costs and improves the efficiency of infrastructure monitoring. The proliferation of drones equipped with sophisticated UV imaging payloads is revolutionizing inspection methodologies in sectors such as power transmission and distribution, where the early detection of electrical faults can prevent catastrophic failures and widespread outages. Similarly, the petrochemical industry is leveraging this technology for leak detection in pipelines and storage facilities, enhancing safety and environmental protection. The report forecasts robust growth in the production of UAV-borne UV Imaging Cameras, with unit sales projected to reach hundreds of millions in the coming years. This expansion will be further bolstered by the increasing availability of specialized UAV platforms designed for payload integration and extended flight times, allowing for comprehensive inspections of vast geographical areas. Furthermore, the development of more robust and weather-resistant UV imaging cameras is expanding their applicability in challenging environmental conditions, making them an indispensable tool for a wide array of industrial inspections and monitoring tasks. The increasing global focus on asset integrity management and preventive maintenance is a key underlying factor driving this market's upward trajectory. The ability of UAV-borne UV cameras to provide non-intrusive, remote inspection with unparalleled detail is positioning them as a cornerstone technology for modern industrial operations, ensuring the reliability and longevity of critical infrastructure.

The escalating adoption of UAV-borne UV Imaging Cameras is propelled by several potent forces, primarily stemming from the critical need for enhanced infrastructure monitoring and maintenance across diverse industries. The aging infrastructure in power grids, transportation networks, and petrochemical facilities worldwide necessitates proactive inspection strategies to prevent failures and ensure public safety. UV imaging offers a unique capability to detect early signs of electrical arcing, corona discharge, and material degradation that are invisible to the naked eye, thereby enabling timely intervention and mitigating costly repairs or catastrophic events. Furthermore, the increasing emphasis on operational efficiency and cost reduction within these sectors is driving the demand for advanced inspection solutions. UAVs equipped with UV cameras can cover large areas rapidly and safely, reducing the need for manual, on-site inspections that are often time-consuming, labor-intensive, and pose significant safety risks to personnel. The continuous advancements in drone technology, including longer flight times, improved payload capacity, and greater autonomy, directly contribute to the expanded operational capabilities and cost-effectiveness of UV imaging solutions. This synergistic relationship between drone technology and UV imaging is creating a fertile ground for market growth.

Despite the promising growth, the UAV-borne UV Imaging Camera market faces certain challenges and restraints that could impede its full potential. One significant hurdle is the high initial cost of sophisticated UAV and UV imaging systems. While the long-term benefits often outweigh the initial investment, the upfront expenditure can be a deterrent for smaller organizations or those with limited capital budgets. Secondly, regulatory complexities surrounding drone operations, including airspace restrictions, licensing requirements, and data privacy concerns, can vary significantly by region and necessitate extensive compliance efforts. These regulations can limit deployment flexibility and increase operational lead times. Furthermore, the need for specialized training and skilled personnel to operate UAVs and interpret UV imagery is another restraint. Improper operation or misinterpretation of data can lead to ineffective inspections or false positives, undermining the technology's value. Environmental factors such as extreme weather conditions (heavy rain, fog, or high winds) can also impact UAV flight operations and the quality of UV imaging data, necessitating careful planning and potentially delaying inspections. Finally, the ongoing development and integration of new technologies mean that existing systems can become obsolete relatively quickly, requiring continuous investment in upgrades and new equipment to stay competitive.

The global UAV-borne UV Imaging Camera market is poised for significant growth, with certain regions and segments expected to lead this expansion.

Dominant Region/Country: North America (particularly the United States)

North America, spearheaded by the United States, is anticipated to be a dominant region in the UAV-borne UV Imaging Camera market. This is primarily attributed to:

Dominant Segment: Power Application

Within the application segments, the Power industry is projected to be the most dominant consumer of UAV-borne UV Imaging Cameras. This dominance is driven by:

Key Segment Example: Field of View 18°×13.5°

Among the technological specifications, the Field of View 18°×13.5° segment is likely to witness significant traction and potentially dominate in certain applications due to its balanced characteristics.

The UAV-borne UV Imaging Camera industry is experiencing robust growth catalyzed by several factors. The increasing demand for predictive maintenance and proactive asset management across critical sectors like power and petrochemicals is a primary driver. The inherent safety benefits of remote inspection using UAVs, mitigating risks associated with manual inspections of high-voltage or hazardous environments, further fuel adoption. Continuous technological advancements, leading to more compact, sensitive, and cost-effective UV sensors and improved drone capabilities, are making these systems more accessible and powerful. Additionally, the growing recognition of the environmental benefits, such as early leak detection in the petrochemical industry, contributes to market expansion.

This report provides a comprehensive overview of the UAV-borne UV Imaging Camera market, encompassing production volumes, application segmentation, and detailed regional analysis. It meticulously forecasts market trends and growth opportunities from 2019 to 2033, with a strong focus on the period 2025-2033, using 2025 as the base year. The report quantifies the World UAV-borne UV Imaging Camera Production and its projected expansion, highlighting the critical role of this technology in modern infrastructure inspection and maintenance. It delves into the driving forces, challenges, and key growth catalysts shaping the industry, offering actionable insights for stakeholders seeking to navigate this evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include OFIL, Namoton, Sonel S.A., Zhejiang ULIRVISION Technology, UVIRSYS, Beijing Sancta Sci-Tech.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "UAV-borne UV Imaging Camera," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the UAV-borne UV Imaging Camera, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.