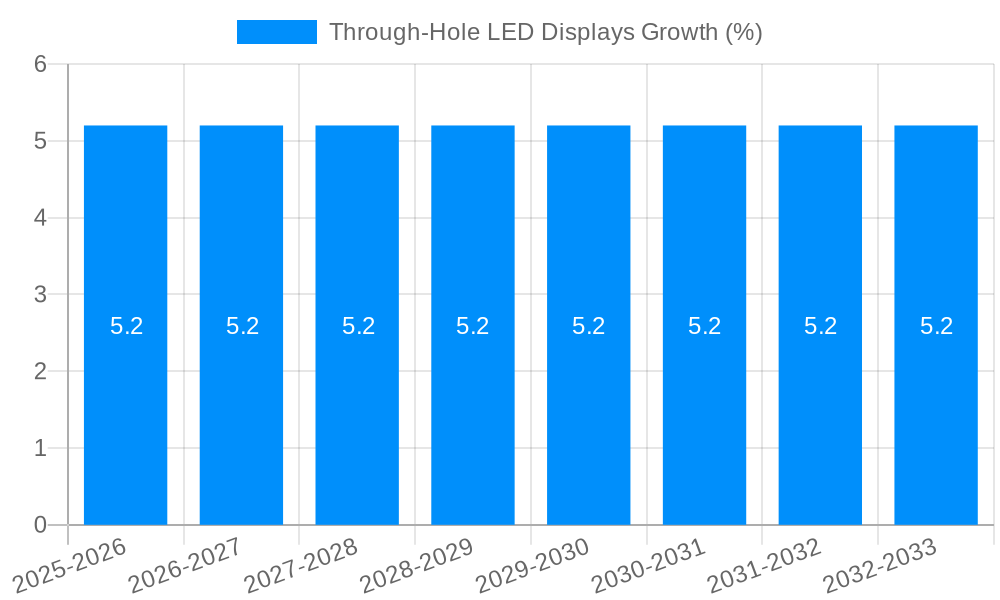

1. What is the projected Compound Annual Growth Rate (CAGR) of the Through-Hole LED Displays?

The projected CAGR is approximately 5.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Through-Hole LED Displays

Through-Hole LED DisplaysThrough-Hole LED Displays by Type (7-segment, Light Bar, Alphanumeric, Dot Matrix, Others), by Application (Commercial, Transportation, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

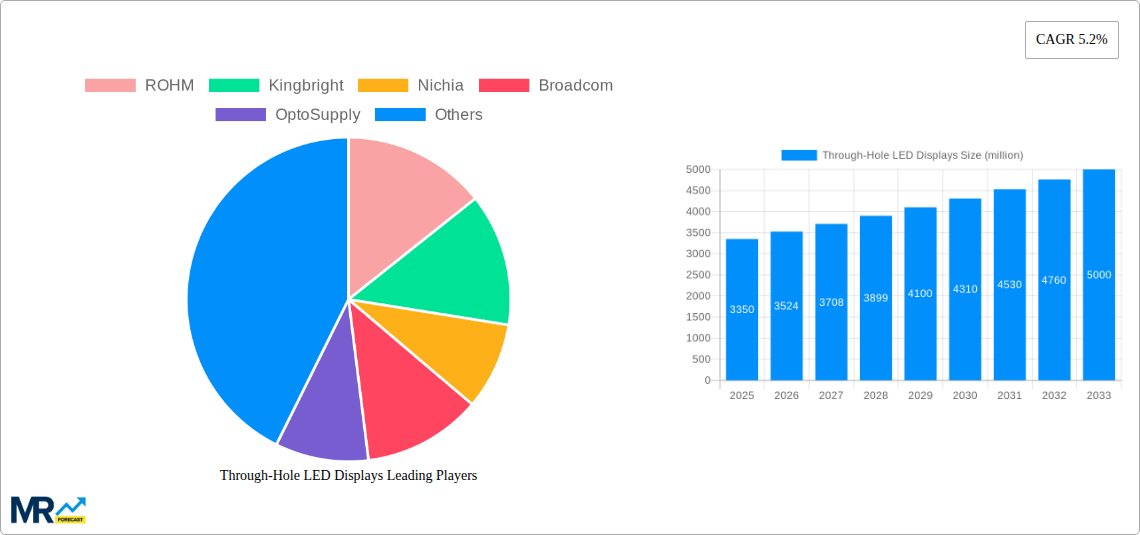

The global market for Through-Hole LED Displays, which was valued at approximately $1,800 million in 1991, has demonstrated consistent growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.2% during the study period of 2019-2033. This sustained expansion is primarily driven by the increasing demand for robust and reliable display solutions across various industrial and commercial applications. The resilience of through-hole technology, known for its durability and ease of assembly, continues to make it a preferred choice in sectors where environmental resilience and long operational life are paramount. Key segments like Commercial and Transportation are expected to be significant contributors to this growth, fueled by ongoing infrastructure development, the adoption of smart technologies in vehicles, and the need for clear, visible displays in public spaces. The market's expansion is also supported by ongoing technological advancements, enhancing the brightness, color accuracy, and energy efficiency of through-hole LED displays, further solidifying their position in the market.

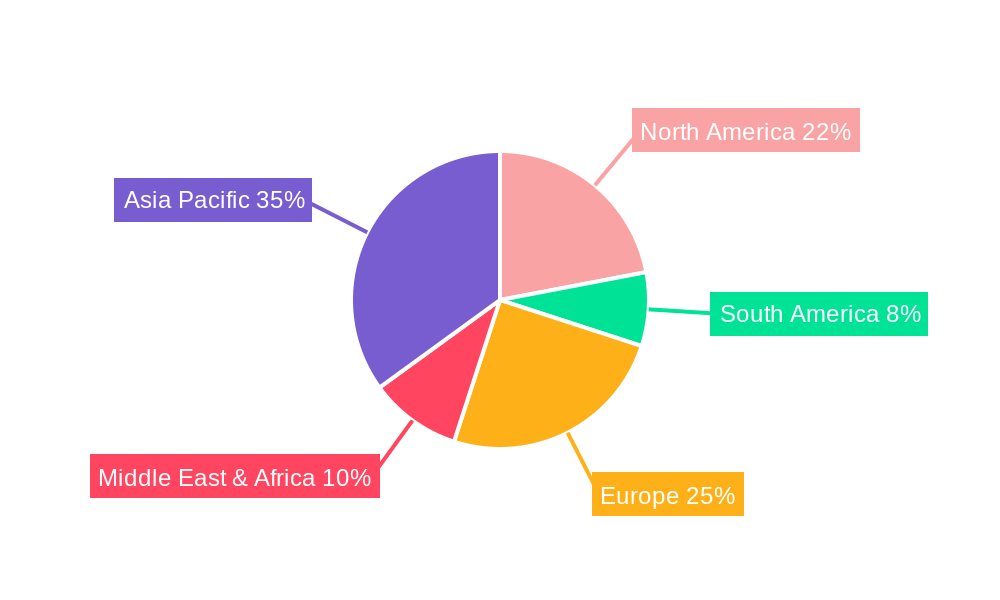

Despite the advent of surface-mount technology, through-hole LED displays maintain a strong foothold due to their inherent advantages in specific applications. The market faces certain restraints, including the higher manufacturing cost associated with through-hole assembly compared to surface-mount alternatives and a gradual shift towards newer technologies in consumer electronics. However, the development of more sophisticated through-hole display types, such as advanced Alphanumeric and Dot Matrix displays, coupled with their strategic use in specialized industrial equipment and critical infrastructure, are expected to mitigate these challenges. Emerging trends like the integration of through-hole displays into IoT devices and advanced automation systems in manufacturing are opening new avenues for growth. Regions like Asia Pacific, particularly China and India, are anticipated to lead market expansion due to their large manufacturing bases and increasing investments in industrial automation and smart city initiatives, further underscoring the continued relevance and potential of the through-hole LED display market.

The global Through-Hole LED Displays market is poised for significant expansion, projected to reach 2,350 million units by the end of the Forecast Period (2025-2033). This impressive growth trajectory is underpinned by a confluence of factors, including sustained demand from established applications and the emergence of novel use cases. The Study Period (2019-2033) encompasses a detailed analysis of market dynamics, with the Base Year (2025) serving as a critical benchmark for projections. During the Historical Period (2019-2024), the market witnessed steady advancements driven by the intrinsic advantages of through-hole LEDs, such as their robustness, ease of mounting, and superior brightness compared to earlier lighting technologies. As we move into the Estimated Year (2025) and beyond, the market is expected to accelerate, propelled by ongoing innovation in LED technology and an increasing appreciation for their energy efficiency and extended lifespan.

The market's evolution is characterized by a diversification of display types and applications. While traditional 7-segment displays continue to hold a strong position, particularly in instrumentation and basic indicators, the demand for more complex solutions like Dot Matrix and Alphanumeric displays is on the rise. These are finding increasing utility in applications requiring more sophisticated information display, such as industrial control panels and public information systems. Furthermore, Light Bar displays are carving out their niche in visual status indication and graphical representation, enhancing user interfaces across various devices. The Commercial segment, encompassing retail, hospitality, and advertising, remains a dominant force, leveraging through-hole LED displays for dynamic signage and informative panels. However, the Transportation sector is emerging as a key growth engine, with applications ranging from vehicle dashboards and external indicators to public transport signage, demanding high reliability and visibility. The Others application segment, which includes industrial automation, medical devices, and consumer electronics, is also contributing to the overall market expansion, showcasing the versatility of these components. The overarching trend is towards displays that offer enhanced clarity, durability, and energy efficiency, all while maintaining cost-effectiveness, a characteristic that through-hole LEDs are well-equipped to deliver. The strategic interplay between technological advancements in LED manufacturing and the evolving needs of diverse end-user industries will dictate the pace and direction of growth in the coming years.

The relentless march of the Through-Hole LED Displays market is being propelled by several powerful drivers that underscore its enduring relevance and burgeoning potential. Foremost among these is the inherent reliability and durability associated with through-hole mounting technology. Unlike surface-mount devices, through-hole components are physically anchored within the PCB, offering superior mechanical strength and resistance to vibration and shock. This robustness makes them exceptionally well-suited for demanding environments prevalent in industrial automation, automotive, and heavy machinery applications, where component integrity is paramount. Furthermore, the distinct thermal management capabilities of through-hole LEDs contribute significantly to their longevity and consistent performance. Their larger lead frames facilitate better heat dissipation away from the LED junction, mitigating the risk of overheating and premature failure. This translates into extended operational lifespans and reduced maintenance costs for end-users. The cost-effectiveness of through-hole LED displays, especially for high-volume applications, also continues to be a significant advantage. The manufacturing processes are well-established, and economies of scale contribute to competitive pricing, making them an attractive choice for budget-conscious projects. Moreover, the ease of soldering and inspection associated with through-hole components simplifies the manufacturing process for electronic devices, contributing to faster assembly times and lower labor costs. This combination of physical resilience, superior thermal management, and economic viability creates a strong foundation for sustained market growth, ensuring that through-hole LED displays remain a preferred option for a wide array of critical applications.

Despite its robust growth prospects, the Through-Hole LED Displays market is not without its hurdles. A primary challenge stems from the increasing dominance of surface-mount technology (SMT) in modern electronic manufacturing. SMT components offer significant advantages in terms of miniaturization, automated assembly efficiency, and higher component density on PCBs. As electronic devices continue to shrink and demand for sleek, compact designs grows, SMT LEDs are often the preferred choice, limiting the adoption of through-hole alternatives in certain consumer electronics and mobile applications. This trend necessitates a strategic focus by through-hole LED manufacturers on segments where their inherent advantages are most pronounced. Another significant restraint arises from the evolving performance demands of certain high-end applications. While through-hole LEDs offer good brightness, the quest for ever-increasing luminosity, higher color rendering indices, and faster refresh rates in sophisticated display technologies like advanced digital signage and high-resolution video walls often favors more advanced SMT LED architectures and integrated display modules. The development and integration of these more advanced solutions can sometimes outpace the innovation cycles for traditional through-hole components. Furthermore, the repairability of through-hole components, while generally straightforward, can be more time-consuming and labor-intensive compared to the quick replacement of SMT components in high-speed production lines. This can be a deterrent in high-volume manufacturing environments where minimizing downtime is critical. Finally, the perception that through-hole technology is less cutting-edge, even when its performance is superior for specific applications, can also act as a soft restraint, requiring concerted marketing and educational efforts to highlight the continued value proposition of these reliable components.

The Through-Hole LED Displays market is poised for dynamic regional and segmental growth, with certain areas and applications exhibiting particularly strong potential.

Dominant Segments:

Type: 7-Segment Displays: This foundational segment is expected to maintain a dominant position throughout the Forecast Period (2025-2033). The inherent simplicity, cost-effectiveness, and reliability of 7-segment displays make them indispensable for a vast array of applications.

Application: Commercial: The Commercial segment is a substantial revenue generator and is anticipated to remain a leading force in the market.

Key Regions:

Asia-Pacific: This region is projected to be the largest and fastest-growing market for Through-Hole LED Displays.

North America: This region represents a mature yet significant market, driven by technological innovation and a strong industrial base.

Europe: Europe is another vital market, characterized by stringent quality standards and a focus on industrial and automotive applications.

The interplay between the enduring utility of 7-segment displays and the vast consumption in the commercial sector, coupled with the manufacturing and market growth in Asia-Pacific, is expected to cement these as the primary drivers of market dominance. The ability of through-hole LED displays to offer cost-effective, reliable, and visible solutions across these segments and regions will continue to underpin their market success.

The growth of the Through-Hole LED Displays industry is being significantly catalyzed by several key factors. The increasing demand for energy-efficient and long-lasting display solutions across various applications, from industrial equipment to consumer appliances, provides a strong foundation. Furthermore, the robust nature and ease of integration of through-hole LEDs make them ideal for harsh environments, thereby driving adoption in industrial automation, automotive, and transportation sectors where reliability is paramount. The ongoing technological advancements in LED manufacturing, leading to improved brightness, color accuracy, and reduced costs, also contribute to their wider applicability. Finally, the sustained demand from developing economies for basic yet functional display indicators in a wide range of products acts as a crucial growth enabler.

This report offers a holistic examination of the Through-Hole LED Displays market, providing in-depth analysis from 2019 to 2033. It meticulously dissects market trends, driving forces, and challenges, offering strategic insights for stakeholders. The report includes detailed segmentation by type, application, and region, with a particular focus on the dominant 7-segment displays and Commercial applications, highlighting the Asia-Pacific region’s pivotal role. Key players are identified, alongside significant historical and projected industry developments. The report aims to equip businesses with the comprehensive data and foresight needed to navigate this evolving market and capitalize on emerging opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.2% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.2%.

Key companies in the market include ROHM, Kingbright, Nichia, Broadcom, OptoSupply, SMART Global Holdings, P-tec, Lumex, Wurth Elektronik, Opto Devices.

The market segments include Type, Application.

The market size is estimated to be USD 1991 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Through-Hole LED Displays," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Through-Hole LED Displays, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.