1. What is the projected Compound Annual Growth Rate (CAGR) of the Sustainable Food Packaging?

The projected CAGR is approximately 6.97%.

Sustainable Food Packaging

Sustainable Food PackagingSustainable Food Packaging by Application (Supermarket, Dining Room, Others, World Sustainable Food Packaging Production ), by Type (Liquid Packaging, Solid Packaging, World Sustainable Food Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

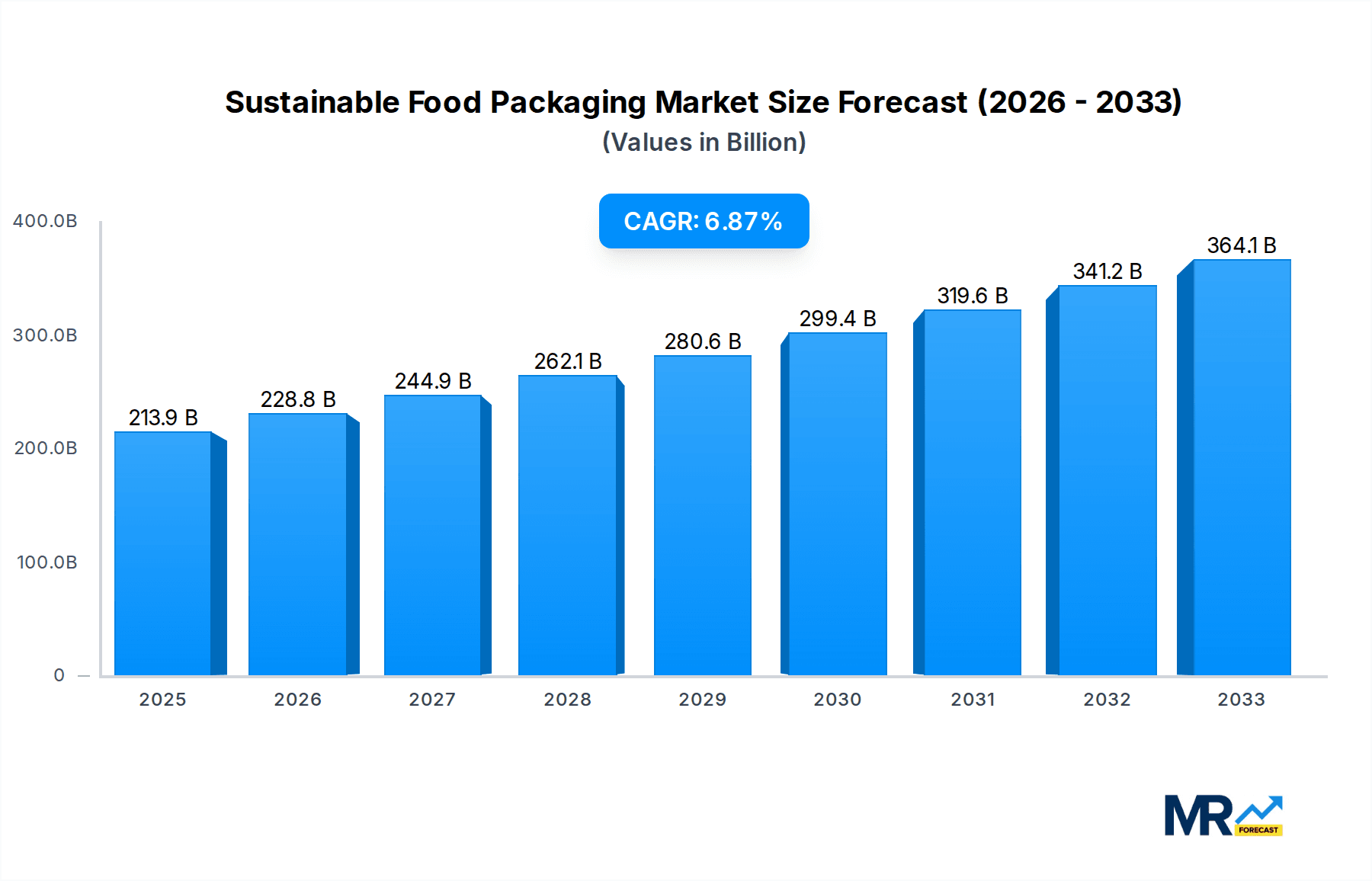

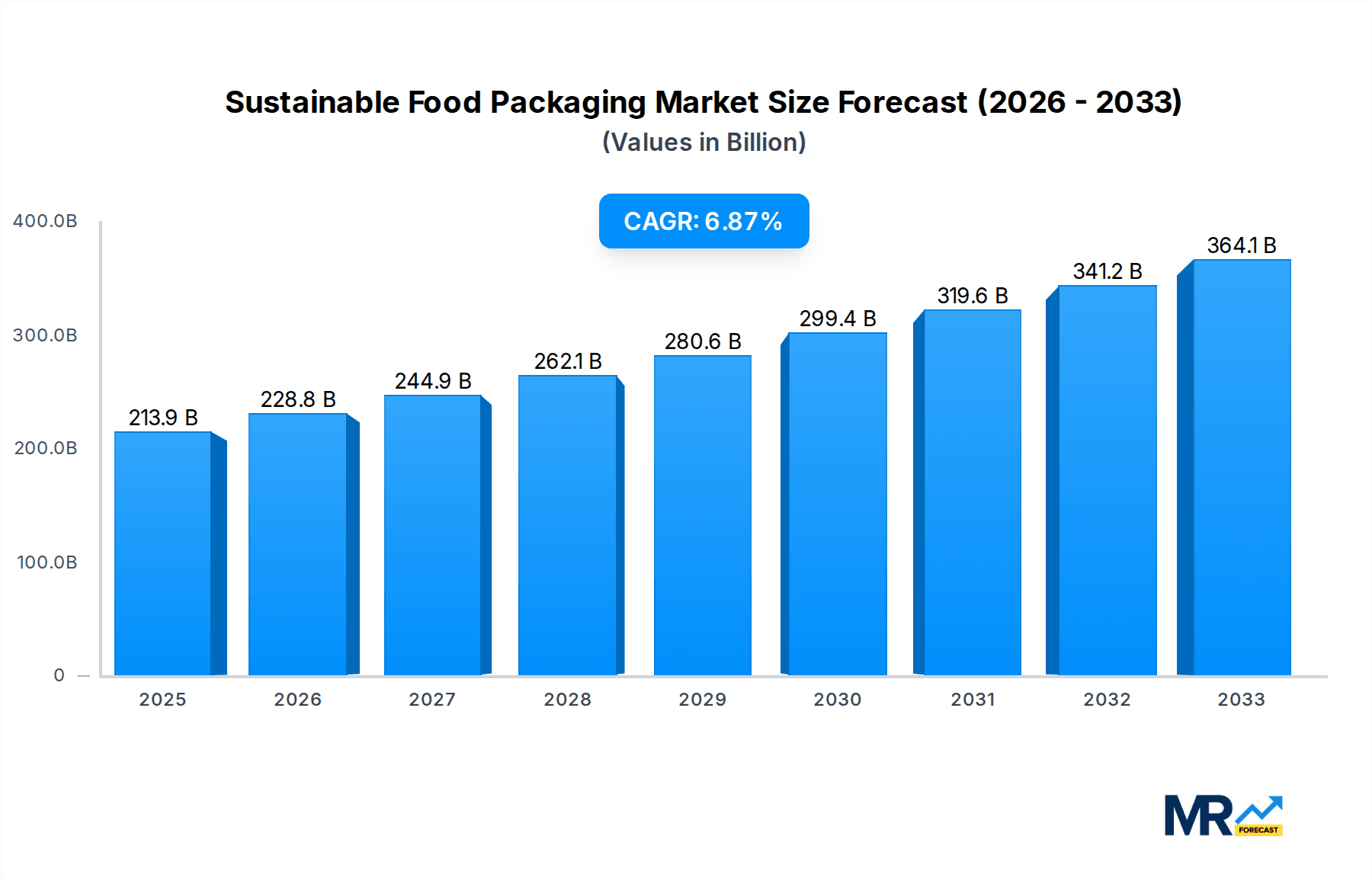

The global sustainable food packaging market is poised for significant expansion, with a current market size of approximately $213.93 billion. This robust growth is driven by an estimated Compound Annual Growth Rate (CAGR) of 6.97% from 2025 to 2033. This upward trajectory is largely propelled by increasing consumer awareness and demand for eco-friendly alternatives to traditional plastic packaging. Regulatory pressures and corporate sustainability initiatives are further accelerating the adoption of biodegradable, compostable, and recyclable materials across various food applications, including supermarkets and dining establishments. Key innovations in materials science and manufacturing processes are making these sustainable options more cost-effective and performance-driven, addressing previous limitations and unlocking new market opportunities. The shift towards a circular economy and a reduced environmental footprint are paramount in shaping the future of food packaging.

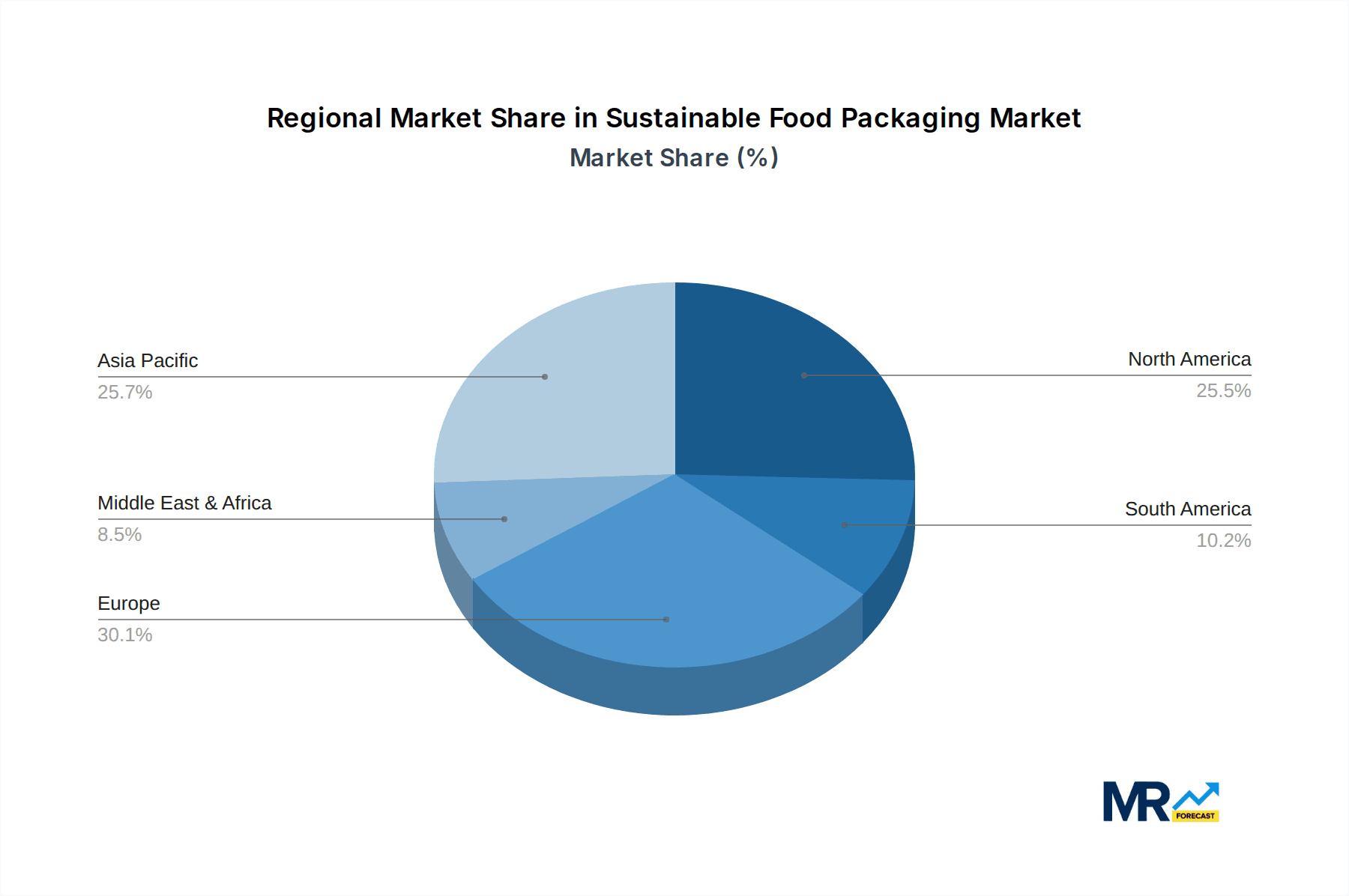

The market is segmented by application into supermarkets, dining rooms, and other categories, indicating a broad adoption across the food service and retail sectors. In terms of type, liquid packaging and solid packaging segments are both witnessing substantial growth as manufacturers develop specialized sustainable solutions for diverse food and beverage products. Leading companies like DuPont, Amcor, and Tetra Pak are at the forefront of this transformation, investing heavily in research and development to introduce innovative and sustainable packaging solutions. Geographically, Asia Pacific, particularly China and India, is emerging as a high-growth region due to rapid industrialization, increasing disposable incomes, and a growing emphasis on environmental regulations. North America and Europe continue to be significant markets, driven by strong consumer preferences for sustainability and stringent government mandates. Despite the optimistic outlook, challenges such as the initial cost of sustainable materials and the need for robust waste management infrastructure remain areas of focus for continued market development.

This comprehensive report delves into the dynamic and rapidly expanding global market for Sustainable Food Packaging, charting its trajectory from 2019 to 2033. With a base year of 2025, this study provides an in-depth analysis of current market conditions and projects future growth over the Forecast Period: 2025-2033, building upon insights from the Historical Period: 2019-2024. The market, already a multi-billion-dollar industry, is poised for significant expansion, driven by evolving consumer consciousness, stringent regulatory frameworks, and innovative technological advancements. We quantify this burgeoning sector, projecting its World Sustainable Food Packaging Production to reach substantial figures in the billion unit.

The report meticulously examines key market segments, including Application categories like Supermarket, Dining Room, and Others, alongside critical Type classifications such as Liquid Packaging and Solid Packaging. Understanding the interplay between these segments is crucial for stakeholders aiming to capitalize on future opportunities. Furthermore, the report scrutinizes the overall World Sustainable Food Packaging Production volume and its projected growth, offering a granular view of global output and consumption patterns. Through expert analysis and robust data, this report equips industry participants with the strategic intelligence needed to navigate the complexities and unlock the immense potential of the sustainable food packaging landscape.

XXX The sustainable food packaging market is witnessing a profound transformation, driven by an unprecedented surge in consumer demand for eco-conscious products and increasingly stringent environmental regulations globally. The imperative to reduce plastic waste and its detrimental impact on ecosystems has become a paramount concern for governments, corporations, and individuals alike. This report forecasts the World Sustainable Food Packaging Production to witness a significant CAGR, driven by the adoption of innovative materials and advanced manufacturing processes. The market is characterized by a strong shift towards biodegradable and compostable packaging solutions, moving away from traditional single-use plastics. Plant-based materials like PLA, PHA, and starch-based polymers are gaining considerable traction across various applications, from flexible films for snacks to rigid containers for ready-to-eat meals. Recycled content is also playing a pivotal role, with an increasing emphasis on post-consumer recycled (PCR) plastics and paperboard, contributing to a circular economy model. The Supermarket application segment is a primary driver, with retailers actively seeking sustainable alternatives to meet consumer expectations and corporate sustainability goals. This translates into a substantial portion of the World Sustainable Food Packaging Production, particularly for Solid Packaging solutions that are easily recyclable or compostable. The demand for innovative designs that minimize material usage while maintaining product integrity is also on the rise. This includes lightweighting initiatives, multi-functional packaging, and smart packaging technologies that extend shelf life and reduce food spoilage, thereby contributing to overall sustainability. The adoption of reusable packaging models, especially in the Dining Room sector and for food delivery services, is also emerging as a significant trend, although it presents its own set of logistical and hygiene challenges. The Liquid Packaging segment, historically dominated by materials like Tetra Pak, is also evolving, with companies exploring bio-based carton solutions and improved recyclability of composite materials. The overarching trend points towards a future where packaging is not merely a protective shell but an integral part of a product's sustainable lifecycle, influencing consumer purchasing decisions and brand loyalty. As the Estimated Year: 2025 solidifies, these trends are not just predictions but established market realities shaping the future of food packaging.

The relentless growth of the sustainable food packaging market is propelled by a confluence of powerful forces. Foremost among these is the escalating global awareness regarding the environmental crisis, particularly the pervasive issue of plastic pollution. Consumers, armed with information and driven by a desire for responsible consumption, are actively seeking out products with eco-friendly packaging. This sentiment is translating directly into market demand, compelling manufacturers to innovate and adopt more sustainable materials. Governments worldwide are responding by implementing stricter regulations, including bans on single-use plastics, mandates for recycled content, and extended producer responsibility (EPR) schemes. These policies act as significant catalysts, forcing industries to invest in sustainable alternatives and discouraging the use of conventional, environmentally harmful packaging. Furthermore, corporate sustainability initiatives and the growing emphasis on Environmental, Social, and Governance (ESG) criteria are pushing companies to integrate sustainable packaging into their core business strategies. Beyond environmental concerns, technological advancements are playing a crucial role. Innovations in material science are leading to the development of novel biodegradable, compostable, and recyclable packaging solutions that offer comparable or superior performance to traditional plastics. These advancements are making sustainable packaging more economically viable and functionally effective, thereby accelerating their adoption across various applications. The economic benefits, such as reduced waste disposal costs and enhanced brand reputation, also contribute to this driving force, making sustainability a strategic advantage rather than just a compliance issue.

Despite its robust growth trajectory, the sustainable food packaging market is not without its impediments. A primary challenge lies in the cost-effectiveness of many sustainable alternatives compared to conventional fossil-fuel-based plastics. While economies of scale are improving, the initial investment in new materials and manufacturing processes can be prohibitive for some businesses, particularly small and medium-sized enterprises. Consumer perception and education also present a hurdle. While awareness is growing, a lack of understanding regarding the proper disposal of compostable or biodegradable packaging can lead to contamination of recycling streams and ultimately undermine the intended environmental benefits. Infrastructure limitations for collection, sorting, and processing of specialized sustainable packaging materials, especially in developing regions, also pose a significant constraint. The complexity of global supply chains and the need for standardization in materials and end-of-life solutions further complicate widespread adoption. Furthermore, achieving the same level of performance characteristics—such as barrier properties, shelf life, and durability—as traditional packaging can be challenging with certain sustainable materials, requiring ongoing research and development. The regulatory landscape, while a driver, can also be a restraint if policies are fragmented or unclear across different regions, creating compliance challenges for global businesses. Finally, the scalability of production for certain novel sustainable materials can lag behind the rapidly increasing demand, leading to supply chain bottlenecks.

The global sustainable food packaging market is projected to witness significant dominance from North America and Europe, driven by a combination of strong consumer demand, proactive regulatory frameworks, and a mature industrial base. Within these regions, the Supermarket application segment is anticipated to be a primary driver for World Sustainable Food Packaging Production. Retailers in these areas are at the forefront of adopting sustainable practices, spurred by consumer pressure and corporate ESG mandates. This translates into a substantial demand for eco-friendly packaging for a wide array of food products, from fresh produce to processed goods and ready-to-eat meals.

Key Dominating Regions/Countries:

North America (specifically the United States and Canada): This region benefits from a highly conscious consumer base, significant investment in research and development for sustainable materials, and a growing number of stringent environmental regulations. The presence of major food manufacturers and packaging companies like Amcor, Graphic Packaging, and Sealed Air further bolsters its leadership. The Supermarket segment in North America is particularly robust, with retailers actively seeking to reduce their environmental footprint through the adoption of recyclable, compostable, and reusable packaging solutions. The demand for sustainable Solid Packaging, including paper-based trays, pouches, and boxes, is immense.

Europe (particularly Germany, the UK, and France): Europe has long been a leader in environmental policy, with the European Union implementing ambitious targets for waste reduction and circular economy principles. This has fostered a strong market for sustainable packaging. Countries like Germany have a well-established infrastructure for waste management and recycling, which supports the adoption of compostable and biodegradable solutions. The Dining Room and food service sectors in Europe are also increasingly embracing sustainable packaging, driven by a growing concern for single-use plastic reduction. This includes a rise in reusable containers and biodegradable cutlery and wrappers. The focus on extended producer responsibility (EPR) schemes across Europe encourages innovation and investment in sustainable packaging technologies. Companies like Tetra Pak and Mondi Limited have a significant presence and are key players in this region's sustainable packaging evolution.

Key Dominating Segments:

Application: Supermarket: This segment is expected to account for a considerable portion of the World Sustainable Food Packaging Production. The sheer volume of packaged food sold in supermarkets globally, coupled with increasing retailer commitments to sustainability, makes this a critical segment. Demand spans a wide range of packaging types, from flexible films and pouches for snacks and dry goods to rigid containers for dairy products, meats, and ready-to-eat meals. The shift towards plant-based, recycled, and easily recyclable materials is most pronounced here.

Type: Solid Packaging: While Liquid Packaging holds significant market share, Solid Packaging is anticipated to witness more dynamic growth in the sustainable domain. This is due to the greater diversity of materials and formats available for solid food items. Paperboard, molded pulp, bioplastics, and recycled plastics are all widely used and continuously improving for solid food applications. This includes everything from cereal boxes and pizza cartons to fruit punnets and takeaway containers. The ease of recycling or composting many solid packaging formats, particularly paper-based ones, contributes to its dominant growth.

The combined influence of these regions and segments, coupled with the growing global focus on reducing environmental impact, will shape the future of World Sustainable Food Packaging Production over the Study Period: 2019-2033.

Several factors are acting as potent growth catalysts for the sustainable food packaging industry. The unwavering demand from environmentally conscious consumers, who actively seek out eco-friendly products, is a primary driver. This consumer preference is compelling brands to prioritize sustainability in their packaging choices. Furthermore, increasingly stringent government regulations and policies, such as bans on single-use plastics and mandates for recycled content, are creating a favorable market environment and incentivizing innovation. Technological advancements in material science are continuously yielding new, high-performance biodegradable, compostable, and recyclable materials, making sustainable options more viable and cost-effective. Corporate sustainability goals and the rising importance of ESG metrics are also pushing companies to invest heavily in sustainable packaging solutions, enhancing brand reputation and meeting investor expectations.

This report offers a holistic and exhaustive analysis of the sustainable food packaging market, providing stakeholders with the critical insights necessary for strategic decision-making. It covers every facet of the industry, from the micro-level details of material innovations and production techniques to the macro-level dynamics of global market trends and regulatory impacts. The report meticulously dissects the World Sustainable Food Packaging Production volumes and forecasts, segmenting them by key applications such as Supermarket and Dining Room, and by critical product types including Liquid Packaging and Solid Packaging. Utilizing data from the Study Period: 2019-2033, with a focus on the Base Year: 2025 and the Forecast Period: 2025-2033, it provides a data-driven roadmap for future growth. Furthermore, it profiles leading companies like DuPont, Amcor, and Tetra Pak, examining their strategies and contributions. The report also delves into the driving forces, challenges, growth catalysts, and significant developments shaping the industry, offering a 360-degree perspective. This comprehensive coverage ensures that businesses, investors, and policymakers are equipped with the knowledge to navigate this rapidly evolving, multi-billion-dollar sector and capitalize on its immense potential.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.97% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.97%.

Key companies in the market include DuPont, PakFactory, Sealed Air, Tetra Pak, Amcor, Graphic Packaging, BioPak, Noissue, Good Start Packaging, BIOFASE, Mondi Limited, .

The market segments include Application, Type.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Sustainable Food Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Sustainable Food Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.