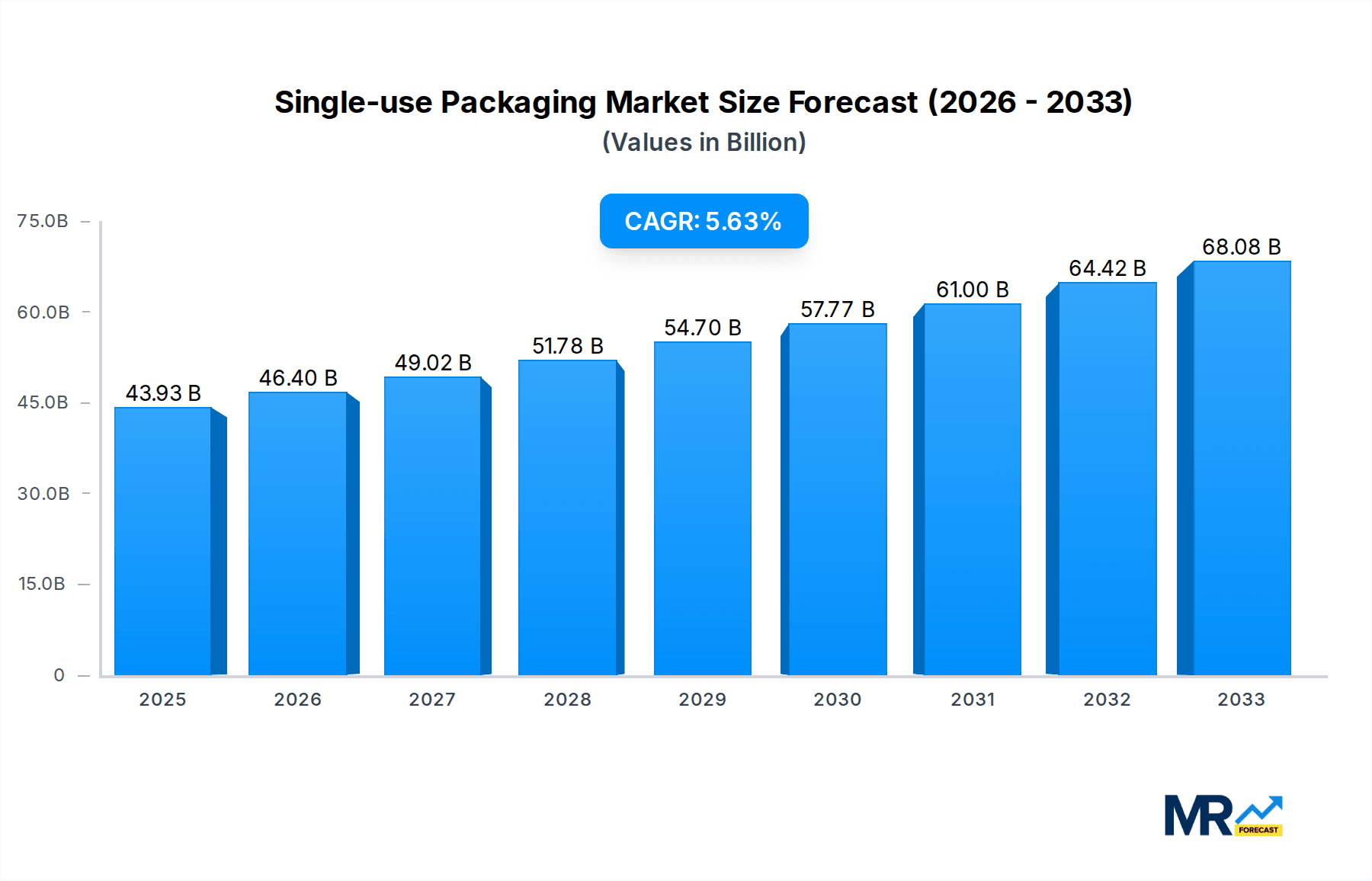

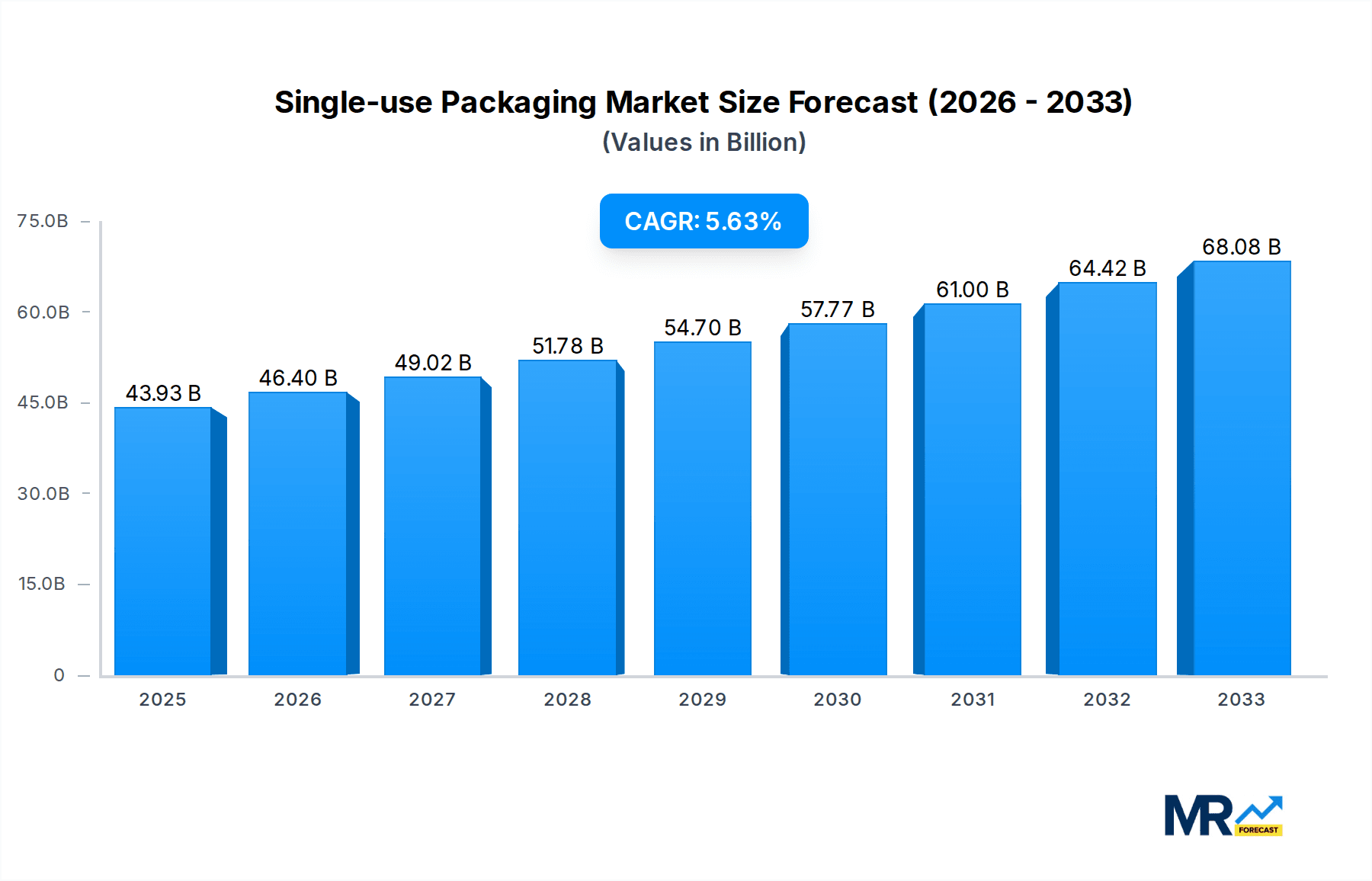

1. What is the projected Compound Annual Growth Rate (CAGR) of the Single-use Packaging?

The projected CAGR is approximately 5.46%.

Single-use Packaging

Single-use PackagingSingle-use Packaging by Type (Paper and Paper Board, Plastic, Glass, Metals, Wood), by Application (Food, Beverage, Personal Care, Pharmaceutical), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

The global single-use packaging market is experiencing robust growth, projected to reach approximately USD 43.93 billion in the base year 2025. This expansion is fueled by a Compound Annual Growth Rate (CAGR) of 5.46% expected to persist through the forecast period ending in 2033. Key drivers behind this upward trajectory include the ever-increasing demand for convenience, particularly in the food and beverage sectors, where single-use packaging ensures hygiene, portability, and extended shelf life. The personal care and pharmaceutical industries also contribute significantly, driven by consumer preference for single-dose products and stringent regulatory requirements for sterile packaging. Technological advancements in material science are leading to the development of more sustainable and efficient single-use packaging solutions, addressing environmental concerns while maintaining functional benefits. Innovations in barrier technologies, lightweight materials, and improved sealing mechanisms are enhancing product protection and reducing waste.

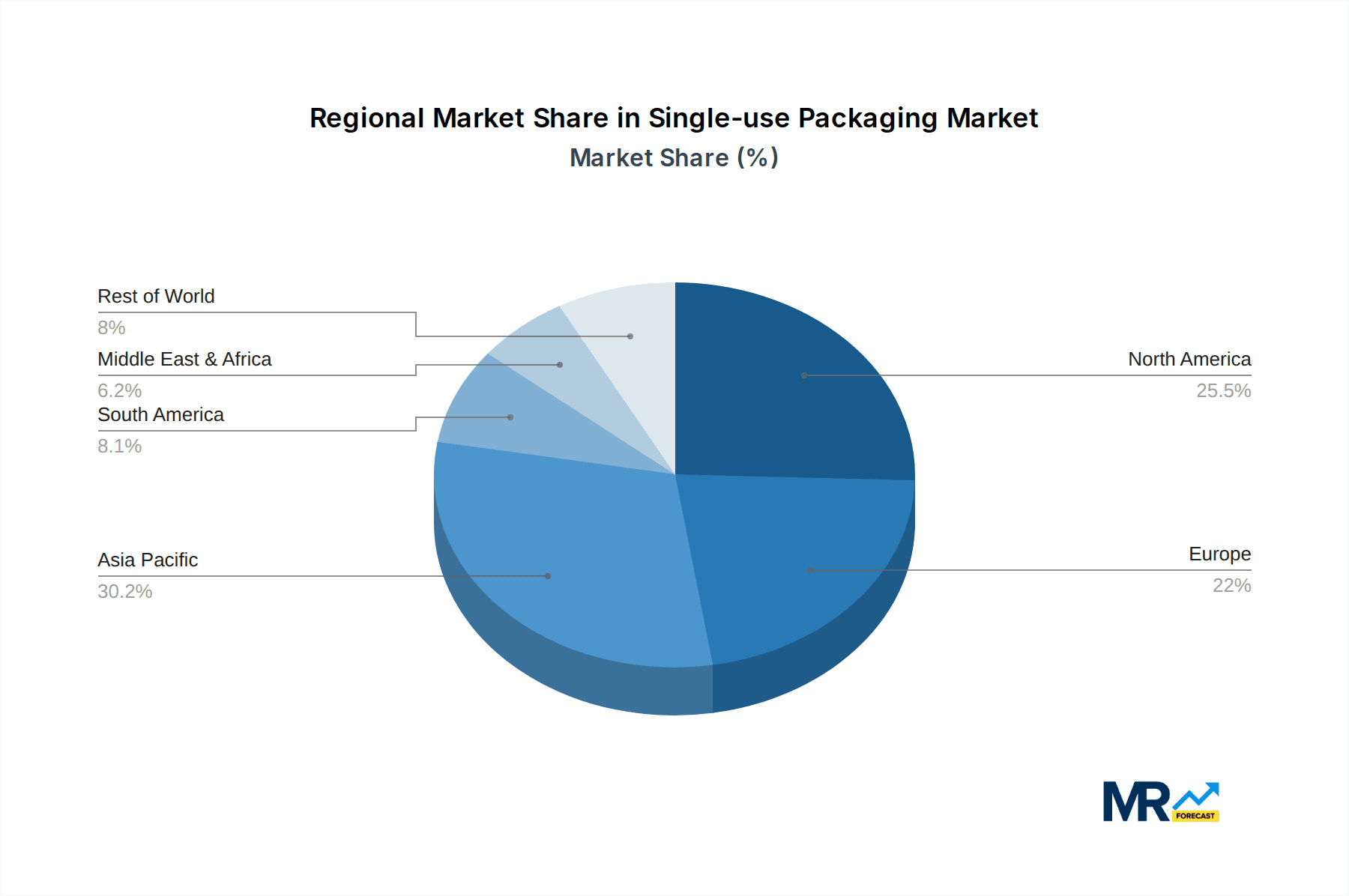

The market is segmented across various material types, with Paper and Paper Board, Plastic, Glass, Metals, and Wood representing the primary categories. Plastic, in particular, is a dominant segment due to its versatility, cost-effectiveness, and excellent barrier properties, although its environmental impact is a growing area of focus for innovation and regulatory scrutiny. Application segments such as Food, Beverage, Personal Care, and Pharmaceutical are all witnessing substantial demand. Geographically, the Asia Pacific region is anticipated to be a significant growth engine, driven by its large population, burgeoning middle class, and increasing disposable incomes, leading to higher consumption of packaged goods. North America and Europe remain mature markets with consistent demand, while emerging economies in South America and the Middle East & Africa present considerable untapped potential. Key players like Ardagh Group S.A., Amcor (Bemis Company Inc.), and Winpak Limited are actively investing in research and development to capitalize on these trends and expand their market presence.

This comprehensive report delves into the dynamic global single-use packaging market, offering a detailed analysis from the historical period of 2019-2024 through to a robust forecast period extending to 2033. Utilizing 2025 as both the base and estimated year, the study employs a meticulous methodology to project market trajectories, with a particular focus on the period between 2025 and 2033. The analysis encompasses a wide array of packaging types, including Paper and Paper Board, Plastic, Glass, Metals, and Wood, alongside key application segments such as Food, Beverage, Personal Care, and Pharmaceutical. The report meticulously quantifies market sizes in billions of units, providing a tangible understanding of the scale and scope of this critical industry.

The global single-use packaging market is characterized by a complex interplay of evolving consumer demands, regulatory landscapes, and technological advancements. Throughout the historical period (2019-2024), the market experienced robust growth, largely driven by the convenience and hygiene offered by single-use formats across various industries. The COVID-19 pandemic significantly amplified this trend, particularly in the food and beverage and pharmaceutical sectors, where safety and sanitation became paramount. During this time, plastic packaging dominated in terms of volume, estimated to be in the tens of billions of units annually, owing to its versatility, durability, and cost-effectiveness. However, this dominance is increasingly being challenged by a growing awareness of environmental sustainability.

Looking ahead to the forecast period (2025-2033), several key trends are expected to shape the market. A significant shift towards sustainable single-use packaging solutions is anticipated, with an emphasis on recyclable, biodegradable, and compostable materials. Paper and paperboard packaging, for instance, is projected to witness substantial growth, moving from its historical position to potentially rival plastic in certain applications, with unit volumes in the billions. Innovations in material science are leading to the development of novel bio-plastics and advanced paper coatings that offer enhanced barrier properties and shelf-life extension, crucial for food and beverage preservation. The pharmaceutical sector will continue to rely on single-use packaging for its sterile and tamper-evident properties, with growth in specialized formats for drug delivery systems and diagnostics, also reaching billions of units. The report will provide granular data on the projected unit volumes for each material type and application segment, illustrating the nuanced evolution of the market. For instance, the food application segment alone is anticipated to consume hundreds of billions of units of single-use packaging by 2033, with a notable increase in sustainable options. Similarly, the beverage sector, a colossal consumer, is expected to see a transition towards lightweighted and recyclable plastic bottles and cartons, alongside a burgeoning market for paper-based beverage containers. The personal care segment, while smaller in absolute unit volumes compared to food and beverage, will see an increase in premium, single-use formats for skincare and beauty products, with a growing demand for aesthetically pleasing and eco-conscious packaging, likely in the tens of billions of units. The industrial sector, often overlooked, will continue to utilize robust single-use packaging for protection and transport, with a focus on efficiency and material reduction.

The single-use packaging market is propelled by a confluence of factors that underscore its essential role in modern commerce and daily life. Foremost among these is the unyielding demand for convenience, particularly within the food and beverage sectors. Consumers globally have come to expect readily consumable products that require minimal preparation and are easily portable, a demand that single-use packaging directly addresses. This convenience factor is deeply ingrained in lifestyles, from on-the-go meals and snacks to single-serving beverage options, contributing to billions of units consumed annually. Furthermore, hygiene and safety remain paramount drivers, especially in the wake of global health concerns. Single-use packaging provides an effective barrier against contamination, ensuring product integrity and consumer confidence. This is particularly critical in the pharmaceutical industry, where sterile packaging is non-negotiable, and in the food industry, where preventing spoilage and ensuring food safety are of utmost importance. The ability of single-use packaging to offer tamper-evident features also plays a significant role in building trust and security.

Technological advancements in material science and packaging machinery also contribute significantly to the market's momentum. Innovations have led to the development of lighter, stronger, and more functional single-use packaging materials, enhancing product protection and reducing material usage. For example, advancements in flexible packaging films have allowed for thinner yet more resilient pouches, contributing to a reduction in the overall material footprint while maintaining product quality. The increasing efficiency and speed of packaging lines mean that more products can be packaged quickly and cost-effectively, meeting the demands of high-volume consumer markets. Moreover, the cost-effectiveness of many single-use packaging solutions, especially for mass-produced goods, makes them an attractive option for manufacturers looking to optimize their production costs. While the environmental impact is a growing concern, the immediate economic benefits and functional advantages of single-use packaging continue to drive its widespread adoption, particularly in regions with rapidly developing economies and expanding consumer bases, ensuring billions of units continue to be produced and utilized.

Despite its widespread adoption and the numerous advantages it offers, the single-use packaging market faces significant challenges and restraints that are shaping its future trajectory. The most prominent and increasingly impactful restraint is the growing global concern over environmental sustainability and plastic waste. The sheer volume of single-use packaging, particularly plastic, that ends up in landfills and oceans has fueled public outcry and prompted stringent regulatory actions. Governments worldwide are implementing bans, taxes, and Extended Producer Responsibility (EPR) schemes on certain single-use plastic items, directly limiting their production and consumption. This regulatory pressure is a formidable challenge for manufacturers and brands that rely heavily on these materials. The reputational damage associated with environmentally unfriendly packaging is also a growing concern for companies, as consumers increasingly favor brands with demonstrable commitments to sustainability.

Furthermore, the push for a circular economy and the development of more sustainable alternatives, such as reusable packaging systems and advanced recycling technologies, pose a direct threat to the traditional single-use model. While these alternatives are still in various stages of development and adoption, their increasing viability presents a long-term restraint. The cost of implementing and scaling up sustainable alternatives can also be a barrier, both for producers and consumers, leading to a complex economic calculation. Moreover, the infrastructure for effective collection, sorting, and recycling of single-use packaging, especially in developing regions, is often inadequate, exacerbating the waste problem and hindering efforts to create a more closed-loop system. The chemical composition of certain single-use packaging materials can also make them difficult or impossible to recycle, further complicating waste management efforts. These multifaceted challenges necessitate a significant re-evaluation of packaging strategies by industry players, moving beyond just convenience and cost to encompass environmental responsibility, with a projected impact on the billions of units produced annually.

The global single-use packaging market is characterized by regional variations in demand, regulatory frameworks, and material preferences. However, Asia Pacific is poised to be a dominant force, driven by a burgeoning population, rapid urbanization, and a growing middle class with increasing disposable incomes. Countries like China, India, and Southeast Asian nations are witnessing an unprecedented surge in consumption across all key application segments, leading to a massive demand for single-use packaging. The sheer scale of these markets, with population figures in the billions, translates directly into billions of units of packaging being consumed annually.

Within the Asia Pacific region, the Food and Beverage application segments are expected to be the primary drivers of single-use packaging demand. The convenience-oriented lifestyles prevalent in urban centers, coupled with the increasing availability of packaged food and beverages, fuel this growth. From ready-to-eat meals to single-serving drinks, the demand for hygienic, safe, and easily transportable packaging is immense. The Plastic type of packaging is anticipated to maintain a significant share in this region due to its cost-effectiveness, versatility, and established manufacturing infrastructure. While sustainability concerns are rising, the immediate need for affordable and functional packaging solutions often prioritizes plastic in emerging economies. However, there is a noticeable and growing trend towards exploring and adopting more sustainable plastic alternatives and paper-based options.

North America, particularly the United States, also represents a significant market for single-use packaging. Here, the Pharmaceutical and Personal Care segments exhibit strong growth, driven by advanced healthcare systems, a mature beauty and cosmetics industry, and a high consumer preference for convenience and hygiene. The pharmaceutical sector's reliance on sterile, tamper-evident single-use packaging for medications, diagnostics, and medical devices ensures a consistent demand, projected in the billions of units. In the personal care segment, premiumization and single-use formats for skincare, makeup, and toiletries contribute to substantial volume. While plastic remains dominant, North America is at the forefront of developing and implementing sustainable packaging solutions, with a strong regulatory push towards recyclability and material reduction. Therefore, while the total unit volume in North America might be less than Asia Pacific, its influence on innovation and the adoption of premium and sustainable single-use packaging, particularly in specialized segments like pharmaceuticals and high-end personal care, is considerable.

The Food segment, in terms of sheer volume, will continue to dominate globally, with an estimated consumption in the hundreds of billions of units by 2033. This is directly linked to global population growth and the evolving consumer habit of purchasing packaged food for convenience and safety. The Plastic packaging type, despite environmental pressures, is projected to maintain a leading position in terms of overall unit volume for the forecast period, owing to its widespread application across all segments and its cost-effectiveness. However, the Paper and Paper Board segment is expected to witness the highest growth rate, driven by sustainability initiatives and consumer preference for eco-friendly alternatives, particularly in food and beverage applications.

Several factors are acting as key growth catalysts for the single-use packaging industry. The continued growth of the global population, coupled with increasing urbanization, fuels a higher demand for convenience and packaged goods, particularly in emerging economies. This surge in consumerism directly translates to billions of units of single-use packaging. Furthermore, the ongoing focus on hygiene and safety across all sectors, especially post-pandemic, solidifies the indispensable role of single-use packaging in preventing contamination and ensuring product integrity, thus driving demand in the billions. Technological advancements in material science and manufacturing processes are also crucial, enabling the development of lighter, more durable, and more efficient single-use packaging solutions that can enhance product shelf-life and reduce material waste.

This report provides an in-depth analysis of the single-use packaging market, offering a strategic roadmap for stakeholders. It meticulously forecasts market growth, segment performance, and regional dynamics, providing billions of units in quantitative data. The study delves into the intricate interplay of driving forces and challenges, offering insights into the evolving landscape shaped by sustainability mandates and consumer preferences. Leading players are identified, alongside significant technological and material innovations, equipping businesses with actionable intelligence to navigate the complexities of the market. The comprehensive coverage ensures that stakeholders – from manufacturers and suppliers to investors and policymakers – possess the critical information needed to make informed decisions and capitalize on emerging opportunities within this vital, multi-billion-unit industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.46% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.46%.

Key companies in the market include Ardagh Group S.A., Bemis Company Inc.(AMCOR), Winpak Limited, Zipz Inc., Snapsil Corporation, Transcontinental Inc., Sealed Air Corporation, Coveris S.A, Ukrplastic, Flextrus AB, Ampac Holding, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Single-use Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Single-use Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.