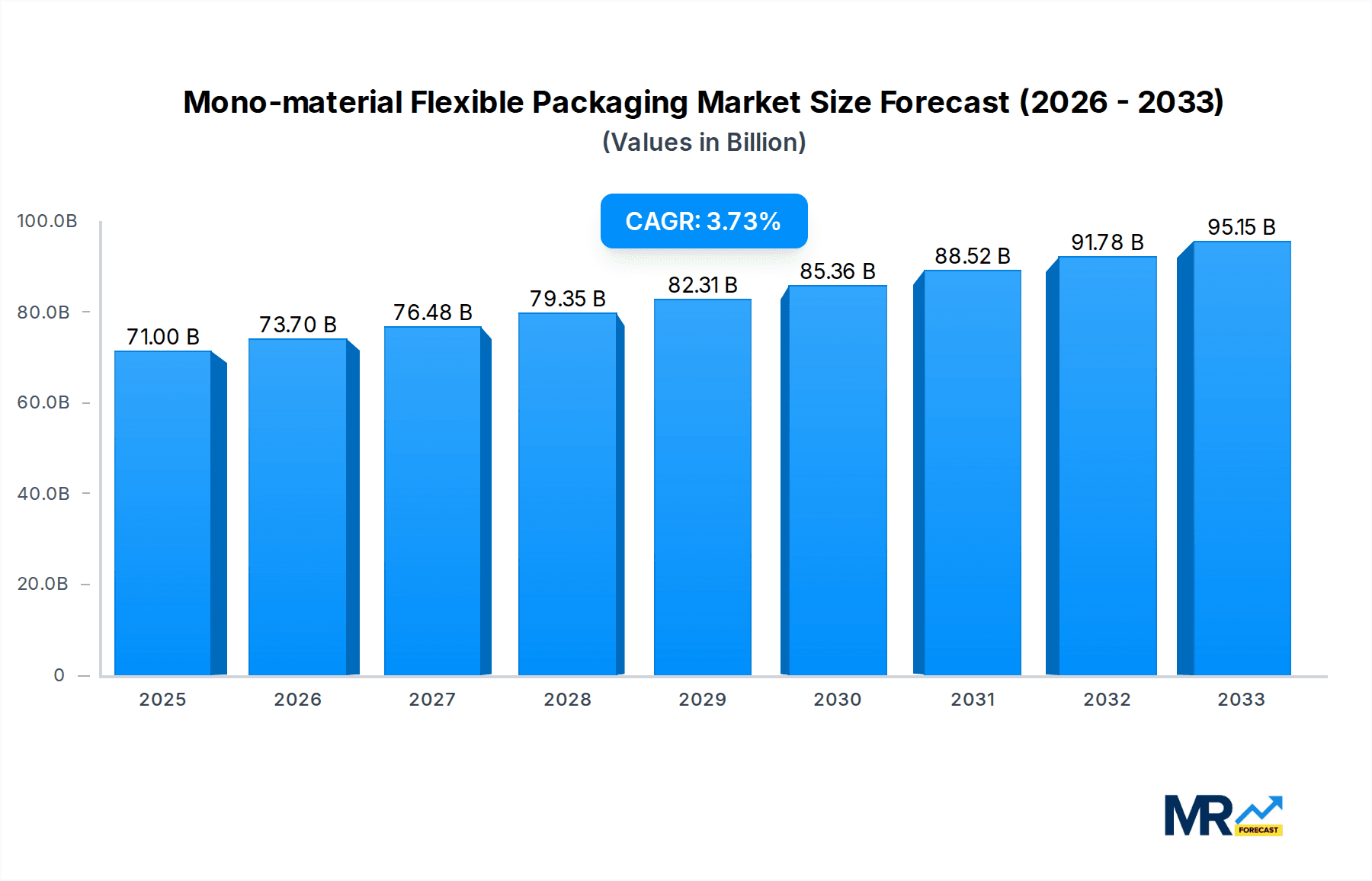

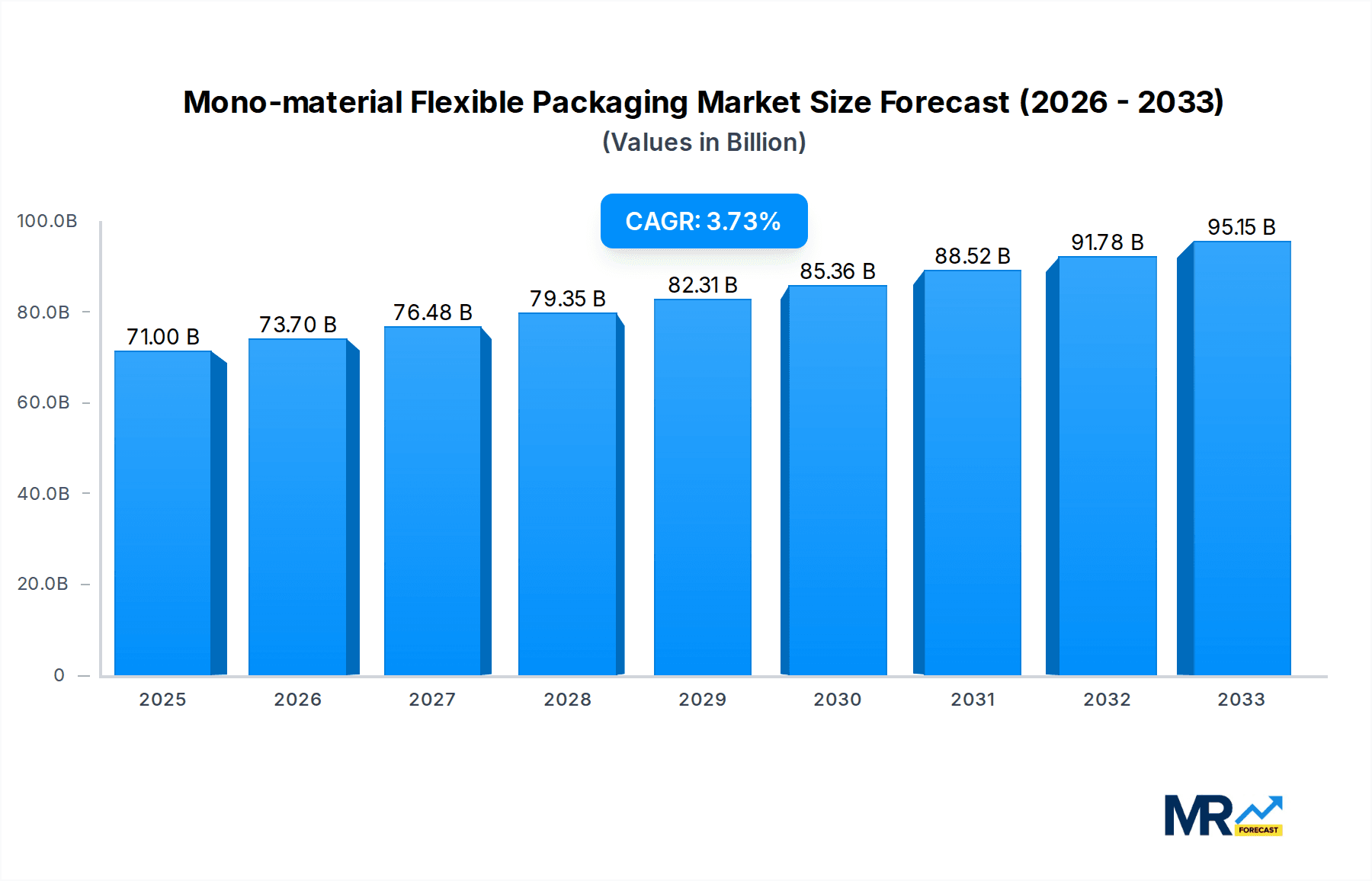

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mono-material Flexible Packaging?

The projected CAGR is approximately 3.8%.

Mono-material Flexible Packaging

Mono-material Flexible PackagingMono-material Flexible Packaging by Type (PE Packaging, PVC Packaging, PP Packaging, Others, World Mono-material Flexible Packaging Production ), by Application (Food and Beverage, Medicine, Consumer Goods, Others, World Mono-material Flexible Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

The global mono-material flexible packaging market is poised for robust expansion, projected to reach an estimated $71 billion by 2025. Driven by increasing consumer demand for sustainable packaging solutions and a growing emphasis on recyclability, this market is set to witness a Compound Annual Growth Rate (CAGR) of 3.8% over the forecast period of 2025-2033. Key drivers underpinning this growth include stringent government regulations promoting eco-friendly packaging, advancements in material science enabling the development of high-performance mono-material alternatives, and the expanding end-use industries such as food & beverage, pharmaceuticals, and consumer goods. The shift towards mono-material solutions is largely motivated by the desire to simplify recycling processes, reduce landfill waste, and mitigate the environmental impact associated with multi-layer, composite flexible packaging. Innovations in polymer science are facilitating the creation of mono-material films that offer comparable barrier properties, durability, and shelf-life preservation, thereby overcoming initial hesitations from manufacturers.

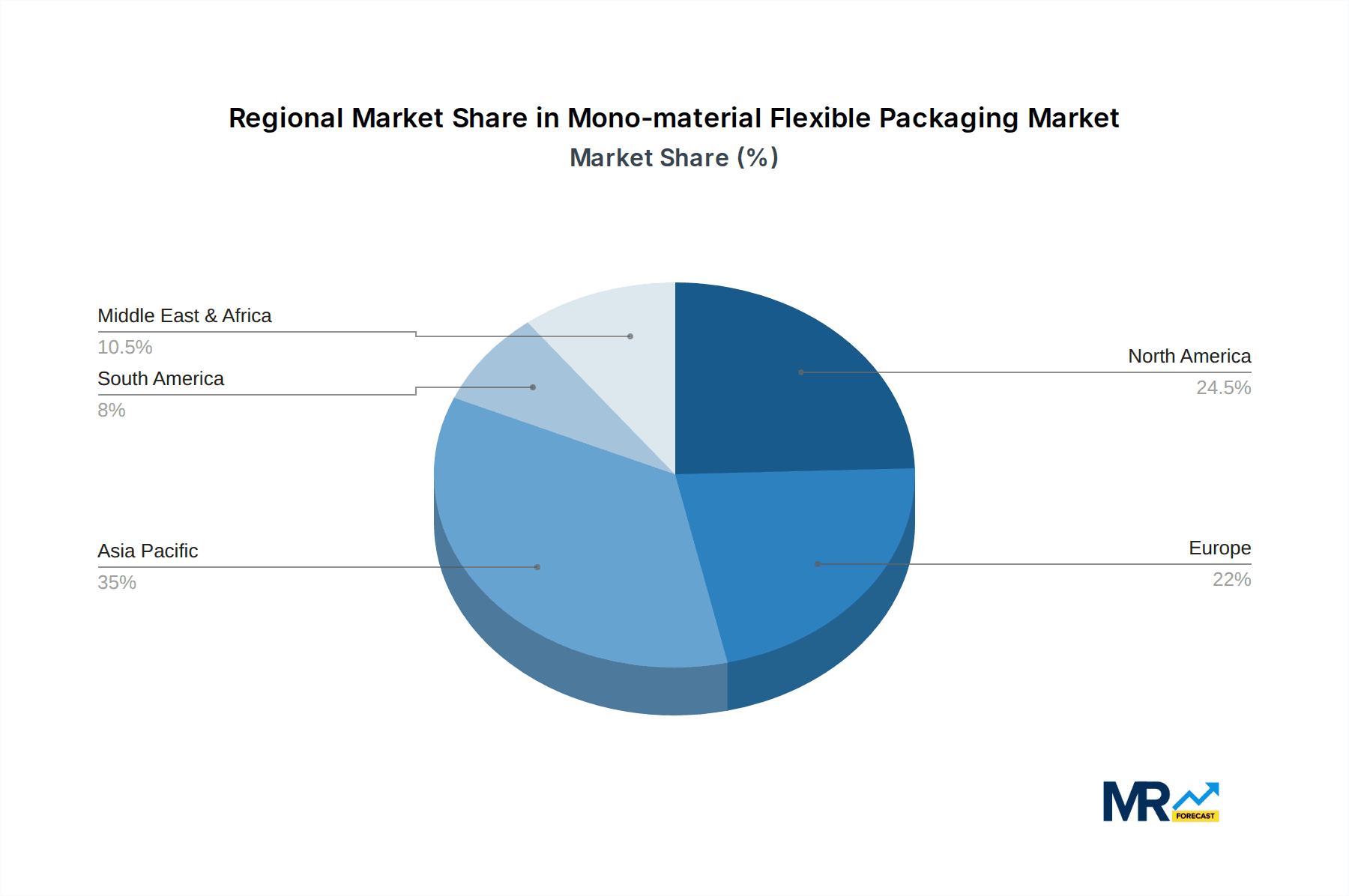

Further enhancing the market's trajectory are emerging trends such as the development of bio-based and compostable mono-material options, alongside the integration of smart packaging features for improved traceability and consumer engagement. While the market is experiencing significant growth, it is not without its restraints. The initial higher cost of some mono-material resins compared to traditional multi-layer options and the need for significant investment in new processing machinery for recyclers pose challenges. However, these are expected to be mitigated by economies of scale, technological advancements, and growing consumer preference for sustainable brands. The Asia Pacific region is anticipated to be a dominant force, propelled by rapid industrialization, a burgeoning middle class, and increasing awareness about environmental issues. North America and Europe are also expected to show substantial growth, fueled by supportive regulatory frameworks and a mature consumer base that values sustainability.

Here's a unique report description for Mono-material Flexible Packaging, incorporating the provided details and structure:

This comprehensive report delves into the dynamic landscape of the Mono-material Flexible Packaging market, offering an in-depth analysis of its evolution, current standing, and future trajectory. Spanning a detailed Study Period of 2019-2033, with a Base Year of 2025 serving as the Estimated Year and the core of our analysis for the Forecast Period of 2025-2033, this report provides a robust understanding built upon a thorough examination of the Historical Period (2019-2024). We quantify the market with projections in the billion unit, presenting a clear picture of its scale and growth potential.

The report investigates the intricate interplay of material innovations, regulatory shifts, and evolving consumer demands that are shaping the mono-material flexible packaging sector. From advancements in single-polymer solutions to the increasing adoption across diverse applications, this research provides actionable insights for stakeholders aiming to navigate this transformative market. We meticulously examine the types of mono-material packaging, their primary applications, and the cutting-edge industry developments that are defining the path forward.

XXX The global mono-material flexible packaging market is witnessing a profound transformation driven by an escalating demand for sustainable and recyclable solutions. Traditional multi-material flexible packaging, while offering excellent performance characteristics, has presented significant end-of-life disposal challenges due to the difficulty in separating constituent layers. This has propelled the adoption of mono-material alternatives, primarily based on polyethylene (PE), polypropylene (PP), and to a lesser extent, polyvinyl chloride (PVC) and other polymers. The market is projected to experience robust growth, with estimates indicating a significant expansion from its current standing in the billions of units. This growth is underpinned by several key trends. Firstly, the increasing global awareness of plastic pollution and the subsequent pressure from consumers, governments, and regulatory bodies are forcing brands and converters to prioritize recyclability. Mono-material packaging, when designed for established recycling streams, offers a viable solution to these environmental concerns, thereby gaining significant traction. Secondly, material science advancements are continuously improving the performance attributes of mono-material films, such as barrier properties (oxygen, moisture, aroma), heat sealability, and mechanical strength, bringing them closer to, and in many cases equalling, the performance of traditional laminates. This is crucial for applications requiring extended shelf life and product protection, particularly in the Food and Beverage sector. Furthermore, the economic viability of mono-material packaging is becoming increasingly attractive. While initial investments in new equipment might be required, the long-term benefits of simplified supply chains, reduced material complexity, and potential cost savings through streamlined recycling processes are compelling. The shift towards mono-material solutions is not merely an environmental imperative but also a strategic business decision for many players in the packaging value chain. The market is also seeing a rise in the development of high-performance mono-material grades capable of meeting the stringent requirements of demanding applications, indicating a maturation of the technology and its increasing acceptance across the industry.

The relentless push towards a circular economy and enhanced environmental stewardship stands as the primary propellant for the mono-material flexible packaging market. Governments worldwide are enacting stricter regulations concerning plastic waste management, including mandates for recyclability and extended producer responsibility schemes, directly incentivizing the adoption of mono-material solutions. Consumers, increasingly eco-conscious, are actively seeking products with sustainable packaging, creating a pull factor for brands to align with these values. This consumer preference is translating into market share gains for companies offering clearly identifiable recyclable packaging. Furthermore, significant investments in research and development by material manufacturers and packaging converters are yielding innovative mono-material films with superior barrier properties and mechanical strength. These advancements are bridging the performance gap between mono-material and conventional multi-layer structures, making them suitable for a wider array of applications, from sensitive food products requiring extended shelf life to pharmaceutical packaging demanding stringent protection. The drive for operational efficiency and cost optimization also plays a crucial role. Simplified material sourcing, manufacturing processes, and end-of-life management for mono-material packaging can lead to substantial economic benefits for businesses in the long run, further accelerating their adoption.

Despite the burgeoning growth, the mono-material flexible packaging market faces several inherent challenges and restraints that could temper its expansion. A significant hurdle remains the perception and reality of performance limitations in certain demanding applications. While advancements are being made, achieving the same level of barrier protection against oxygen, moisture, and light as achieved by complex multi-layer laminates can still be challenging for some mono-material solutions, particularly for highly sensitive products requiring extended shelf lives. This can necessitate compromises in product quality or shelf stability. Another critical restraint is the upfront investment required by converters and brand owners to retool their existing manufacturing lines. Many current packaging machines are designed for multi-material structures, and transitioning to mono-material production often necessitates significant capital expenditure on new equipment and process optimization. Furthermore, the global infrastructure for collecting, sorting, and recycling mono-material plastics is not uniformly developed. While PE and PP are widely recyclable, the effectiveness of these recycling streams varies significantly by region, and contamination can still pose a problem, impacting the quality and economic viability of the recycled material. Finally, consumer education and clear labeling are paramount. Without consistent understanding of what constitutes "recyclable" mono-material packaging and how to properly dispose of it, consumer confusion can hinder effective recycling and dilute the environmental benefits.

The Food and Beverage segment, coupled with the increasing dominance of PE Packaging and PP Packaging within this sector, is poised to be a significant driver and potential dominator of the global mono-material flexible packaging market. This is largely attributable to the sheer volume of flexible packaging consumed by the food and beverage industry, encompassing everything from snacks and confectionery to frozen foods, dairy products, and ready-to-eat meals. The inherent demand for extended shelf life, product protection, and visual appeal in this segment necessitates robust packaging solutions. Mono-material PE and PP films are increasingly offering the necessary barrier properties, heat sealability, and printability to meet these requirements effectively. For instance, high-barrier PE films are being developed to protect sensitive food items from oxidation and moisture, thereby extending their freshness and reducing food waste. Similarly, PP-based mono-material solutions are gaining traction for applications requiring good stiffness and transparency.

These segments are expected to witness substantial growth, particularly in regions with well-established recycling infrastructures and strong consumer demand for sustainable packaging. Countries in North America and Europe are leading the charge in terms of regulatory frameworks and consumer awareness, driving the adoption of mono-material solutions within the Food and Beverage sector, predominantly through PE and PP packaging. As other regions develop their waste management capabilities and consumer consciousness rises, these segments are expected to expand their market share globally.

Several potent growth catalysts are propelling the mono-material flexible packaging industry forward. The overarching driver is the accelerating global momentum towards a circular economy and stringent environmental regulations, which are creating a powerful imperative for sustainable packaging solutions. Consumer demand for eco-friendly products, coupled with increasing brand sustainability commitments, are further fueling the adoption of recyclable mono-material packaging. Innovations in polymer science are continuously enhancing the performance attributes of mono-material films, bridging the gap with conventional multi-layer structures and expanding their applicability across various sectors, particularly in Food and Beverage.

This report offers an unparalleled, comprehensive analysis of the mono-material flexible packaging market, providing stakeholders with the critical intelligence needed to navigate this evolving landscape. It dissects market dynamics, from the fundamental material innovations and evolving industry standards to the intricate interplay of consumer preferences and regulatory mandates. With granular data and insightful commentary, the report illuminates the growth trajectory of mono-material packaging across various applications and material types. It furnishes a robust understanding of the global market size, projected growth rates in billions of units, and detailed forecasts from 2025 to 2033, anchored by a thorough examination of the historical performance from 2019 to 2024.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.8% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.8%.

Key companies in the market include Amcor, Mondi Group, Sealed Air, Constantia Flexibles, Smurfit Kappa Group, Berry Global, Tetra Pak, Huhtamaki, Coveris, Novolex, DNP Group, AptarGroup, DS Smith, Mitsui Chemicals, Stora Enso, Polysack, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Mono-material Flexible Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Mono-material Flexible Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.