1. What is the projected Compound Annual Growth Rate (CAGR) of the Cigarette Label?

The projected CAGR is approximately 7.49%.

Cigarette Label

Cigarette LabelCigarette Label by Type (Traditional Cigarette Label, E-cigarette Label, World Cigarette Label Production ), by Application (Tobacco Industry, Collection Industry, Others, World Cigarette Label Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

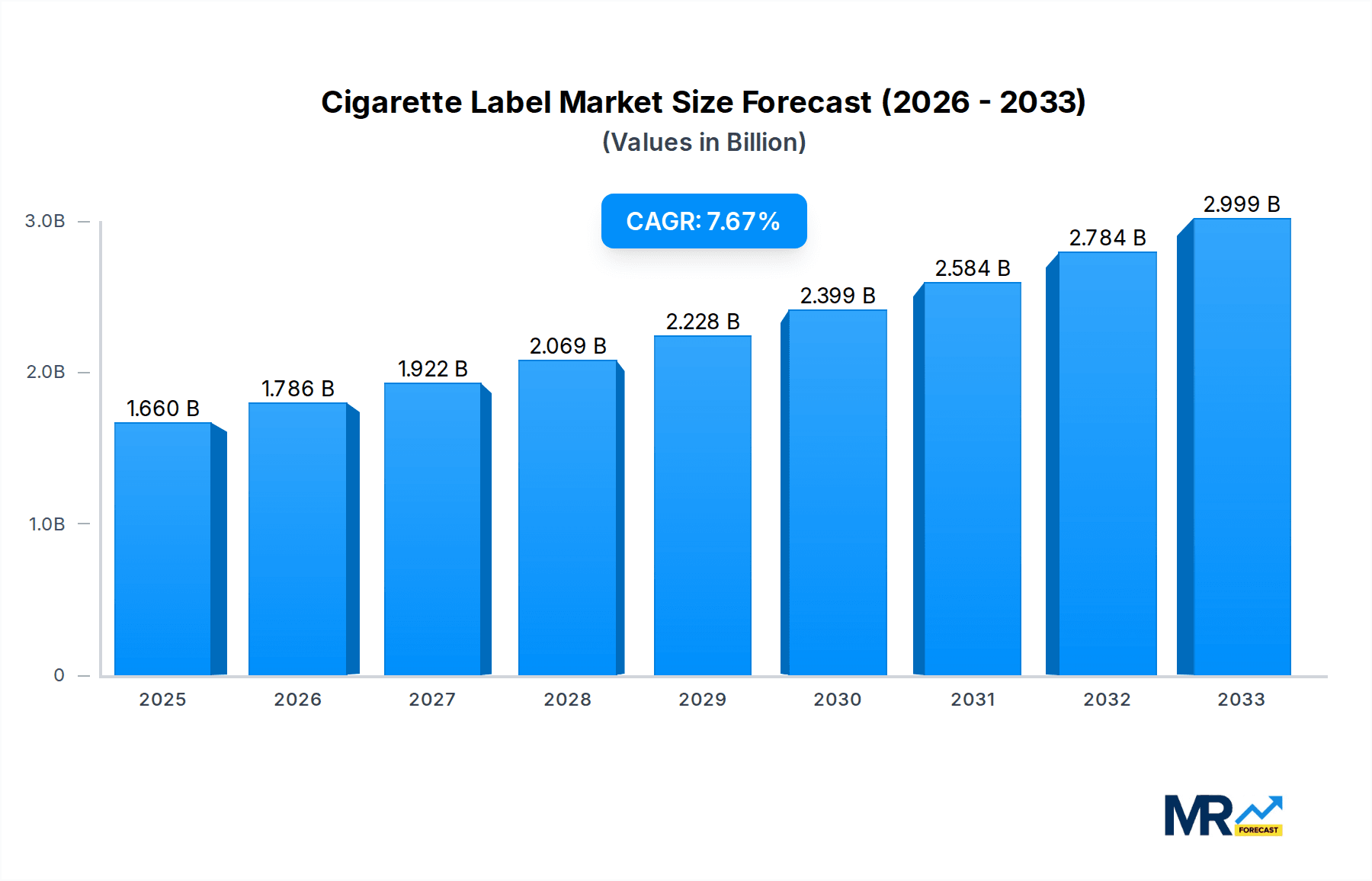

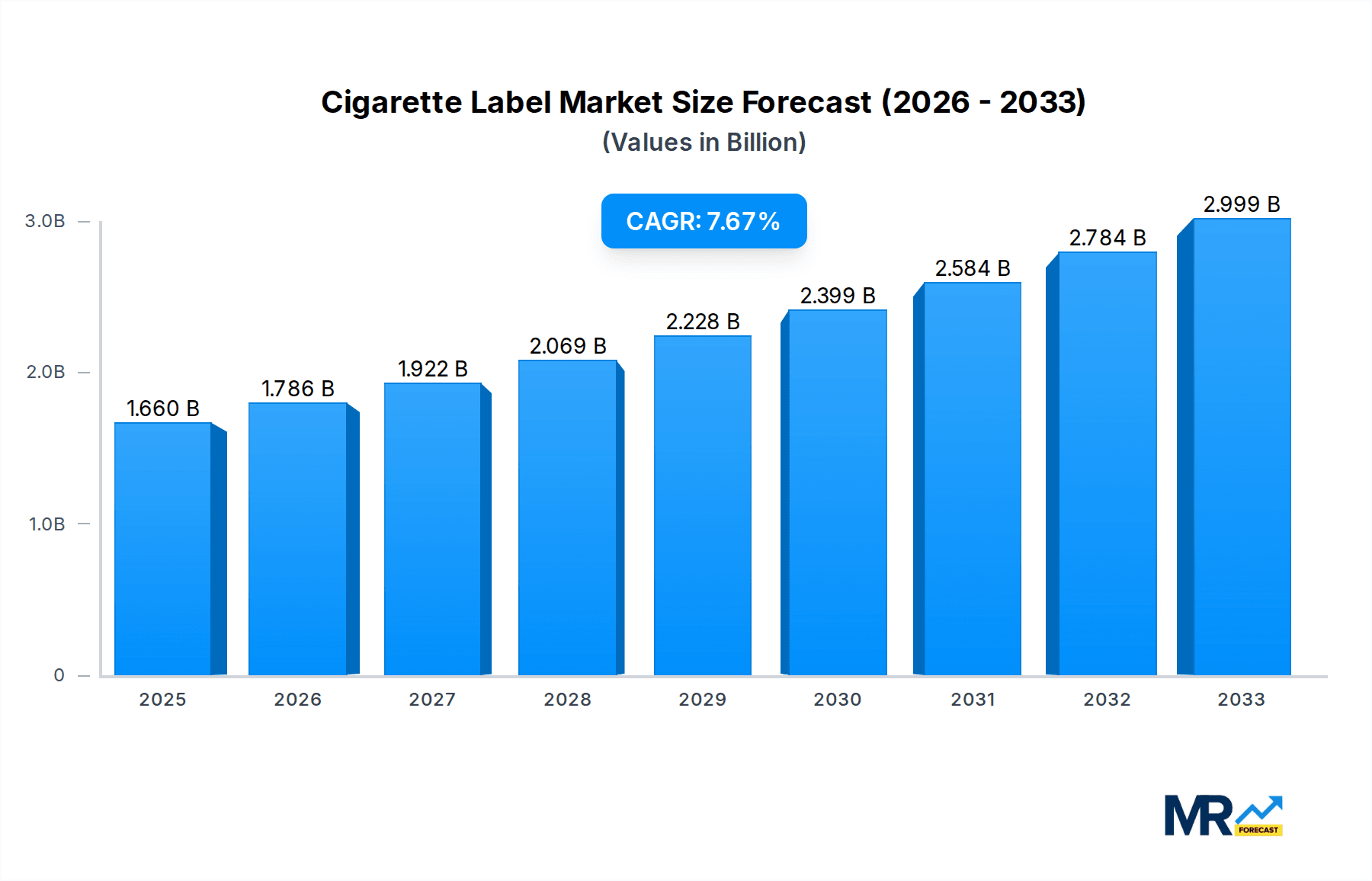

The global cigarette label market is poised for robust expansion, projected to reach a substantial market size of approximately \$1.66 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 7.49% from 2019 to 2033. This growth trajectory is significantly influenced by the dynamic shifts within the tobacco industry, including the increasing demand for sophisticated and visually appealing packaging solutions that differentiate brands and convey premium qualities. The burgeoning e-cigarette segment, in particular, is a key driver, necessitating innovative and high-quality labels that can withstand varied storage conditions and appeal to a younger demographic. Furthermore, the "World Cigarette Label Production" encompasses a broad scope, reflecting the widespread adoption of advanced printing technologies and materials to meet evolving regulatory requirements and consumer preferences for sustainability and tamper-evident features.

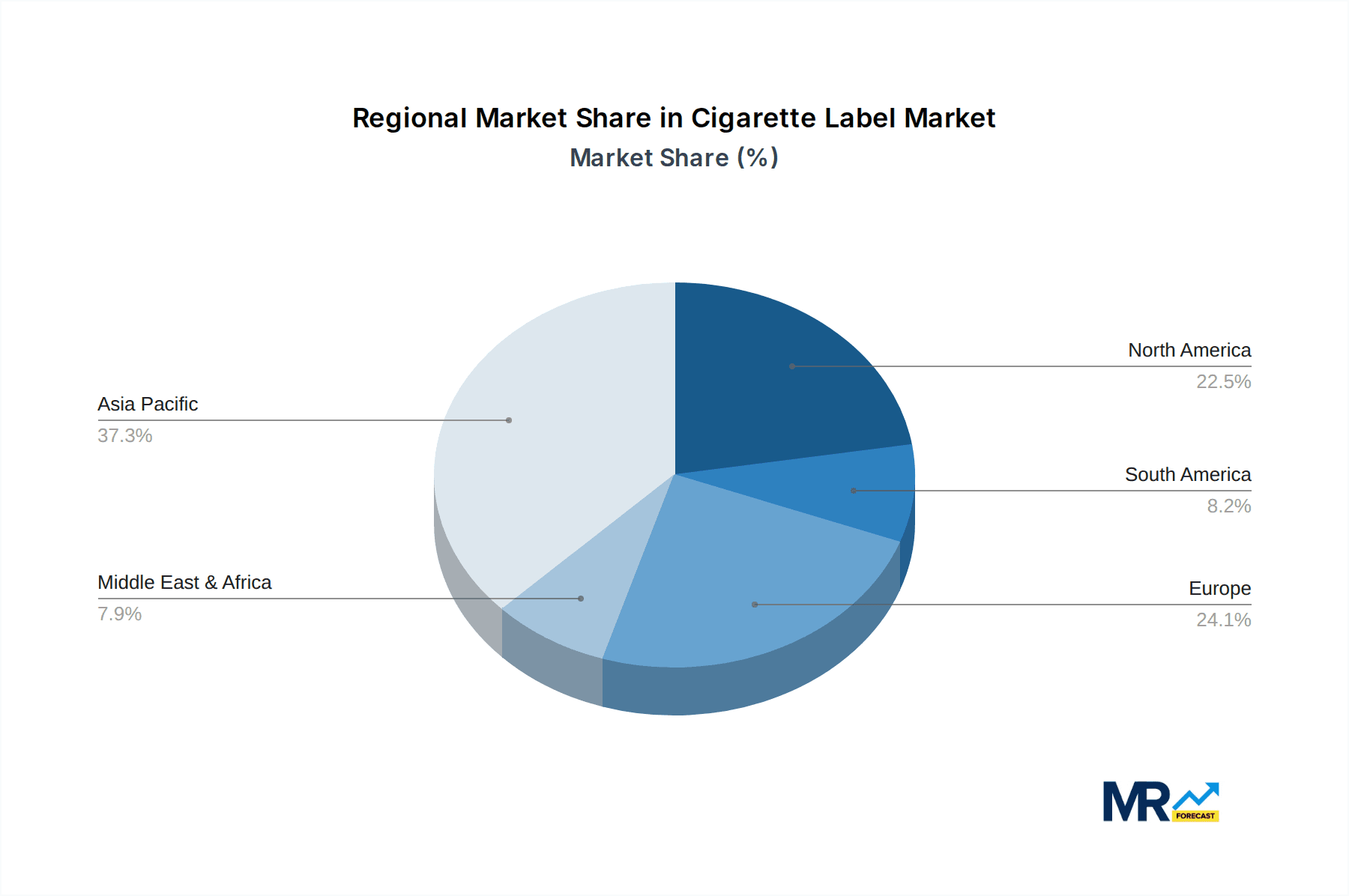

The market is characterized by intense competition among a diverse range of companies, from established players like Litu Holdings Limited and AMVIG HOLDINGS LIMITED to specialized material providers such as Anhui Genuine New Materials and YUTO Packaging Technology. These companies are actively investing in research and development to introduce advanced labeling solutions, including those with anti-counterfeiting measures and enhanced aesthetic qualities. While the traditional cigarette label segment continues to represent a significant portion of the market, the rapid adoption of e-cigarettes and the growing niche for collectible cigarette labels are opening up new avenues for innovation and revenue generation. Regional dynamics also play a crucial role, with Asia Pacific, led by China, emerging as a dominant market due to its large consumer base and significant manufacturing capabilities, followed closely by North America and Europe, which are characterized by a strong demand for premium and innovative packaging. Restraints, such as evolving regulations and increasing health consciousness, are being navigated through product innovation and a focus on higher-value segments.

This comprehensive report delves into the dynamic World Cigarette Label Production market, offering a granular analysis of its trajectory from the Historical Period of 2019-2024, through the Base Year and Estimated Year of 2025, and projecting forward to the Forecast Period of 2025-2033. With a focus on market insights and industry developments, this study aims to provide stakeholders with actionable intelligence on a sector valued in the billions. The report examines key segments including Traditional Cigarette Label and E-cigarette Label, and their applications within the Tobacco Industry, Collection Industry, and Others.

The global cigarette label market, a segment intrinsically linked to the multi-billion dollar tobacco industry, is undergoing a significant metamorphosis driven by evolving consumer preferences, regulatory landscapes, and technological advancements. During the Study Period of 2019-2033, the market has witnessed a considerable shift, particularly with the ascendance of e-cigarettes and the increasing demand for more sophisticated and sustainable labeling solutions. Traditional cigarette labels, once primarily focused on brand identity and basic product information, are now incorporating enhanced anti-counterfeiting features and premium finishes to differentiate themselves in a highly competitive and regulated environment. The value of the World Cigarette Label Production is expected to see nuanced movements, influenced by both the declining volume of traditional cigarette sales in developed economies and the burgeoning e-cigarette market, which demands distinct and often more visually engaging labels. Furthermore, the growing emphasis on corporate social responsibility and environmental consciousness is propelling the adoption of eco-friendly materials and printing technologies for cigarette labels. This includes a move towards recycled paper, biodegradable inks, and reduced material usage, reflecting a broader industry trend towards sustainability. The integration of smart labeling technologies, such as QR codes for product traceability and consumer engagement, is also gaining traction, offering manufacturers new avenues to connect with consumers and ensure product authenticity. As the market matures, a greater emphasis on customization and niche labeling for premium and artisanal tobacco products is also anticipated, further diversifying the demand landscape. The interplay between these trends, from regulatory pressures on traditional tobacco to the innovative marketing strategies for e-cigarettes, creates a complex yet compelling market dynamic that this report meticulously unravels. The Tobacco Industry remains the bedrock of demand, but the evolving nature of nicotine consumption necessitates a forward-looking perspective on label innovation.

The cigarette label market's trajectory is primarily propelled by a confluence of robust demand from the Tobacco Industry, particularly in emerging economies, and the rapid expansion of the e-cigarette sector. The sheer volume of traditional cigarette production globally, despite declining trends in some mature markets, continues to sustain a significant market for conventional labels. Simultaneously, the e-cigarette segment, characterized by its rapid innovation and aggressive marketing, presents a burgeoning opportunity for unique and visually appealing E-cigarette Label designs. This growth is further fueled by advancements in printing technology that enable higher quality graphics, special effects, and the incorporation of anti-counterfeiting measures, thereby enhancing brand security and consumer trust. Regulatory pressures, while posing challenges, also drive innovation as companies seek compliant yet visually appealing labeling solutions. The Collection Industry, though a smaller segment, also contributes to demand for specialized and aesthetically superior labels. The increasing disposable income in developing nations further supports the demand for tobacco products and, consequently, their associated labeling.

Despite the growth drivers, the cigarette label market faces significant headwinds. The most prominent restraint stems from increasingly stringent global regulations aimed at curbing tobacco consumption. These regulations often mandate plain packaging, graphic health warnings, and the prohibition of branding elements, which directly impact the design and aesthetic appeal of cigarette labels, particularly for Traditional Cigarette Label types. The declining volume of traditional cigarette sales in many developed countries, due to health awareness campaigns and policy interventions, presents a substantial challenge to market expansion. Furthermore, the volatile pricing of raw materials, such as paper and inks, coupled with the rising costs of advanced printing technologies, can squeeze profit margins for manufacturers. The negative public perception surrounding tobacco products also creates an indirect restraint, potentially impacting investment and innovation within the sector. The ongoing shift towards e-cigarettes, while an opportunity, also requires significant investment in new technologies and design capabilities for E-cigarette Label production, posing a hurdle for companies heavily invested in traditional methods. The environmental impact of packaging materials and the growing consumer preference for sustainable options also necessitate a transition that can be costly and complex to implement.

The World Cigarette Label Production market exhibits a pronounced regional and segmental dominance, with Asia Pacific and the Tobacco Industry segment standing out as key influencers.

Asia Pacific: A Production Powerhouse and Consumption Hub The Asia Pacific region is poised to dominate the cigarette label market due to its substantial contribution to global cigarette production and consumption. Countries like China, India, and Southeast Asian nations represent massive consumer bases for tobacco products, both traditional and emerging. The presence of a robust manufacturing infrastructure, coupled with lower production costs, also positions Asia Pacific as a significant hub for World Cigarette Label Production. The sheer volume of cigarettes manufactured and sold within this region directly translates into a colossal demand for cigarette labels. Furthermore, the growing middle class in these economies contributes to increased disposable incomes, thereby supporting the consumption of tobacco products and, by extension, the need for their packaging and labeling. While regulatory landscapes are evolving, the sheer scale of the market ensures its continued dominance.

Tobacco Industry Segment: The Undisputed Leader The Tobacco Industry segment, encompassing both traditional cigarettes and newer nicotine delivery systems, is unequivocally the dominant application for cigarette labels. The inherent nature of tobacco products necessitates elaborate and informative labeling for brand identification, product details, health warnings, and regulatory compliance. The market for Traditional Cigarette Label remains substantial, driven by established brands and consistent demand in many parts of the world. Concurrently, the explosive growth of the e-cigarette market has created a new and rapidly expanding sub-segment within the Tobacco Industry, demanding innovative and visually distinct E-cigarette Label solutions. Manufacturers of e-cigarettes are investing heavily in packaging and labeling to differentiate their products, capture consumer attention, and convey brand messaging. This dual demand from traditional and emerging tobacco product categories solidifies the Tobacco Industry segment's leading position.

E-cigarette Label: The Growth Frontier While the Tobacco Industry as a whole is dominant, the E-cigarette Label segment is emerging as the primary growth engine. The rapid evolution of e-cigarette designs, flavors, and functionalities demands a more dynamic and often premium labeling approach. Unlike traditional cigarette labels, which are increasingly constrained by plain packaging regulations, e-cigarette labels are free to leverage vibrant colors, intricate graphics, and sophisticated finishes to attract a younger, tech-savvy demographic. The market for e-cigarettes is characterized by frequent product launches and brand innovation, necessitating a continuous demand for novel and eye-catching labels. This segment offers significant opportunities for label manufacturers to implement advanced printing techniques, holographic elements, and tactile finishes to enhance the perceived value and appeal of e-cigarette products. The increasing penetration of e-cigarettes in both developed and developing markets indicates a sustained and accelerated growth trajectory for this specific label type within the broader World Cigarette Label Production.

Several factors are acting as potent growth catalysts for the cigarette label industry. The burgeoning e-cigarette market, with its emphasis on sophisticated branding and visual appeal, is a primary driver. Advancements in printing technology, enabling enhanced graphics, anti-counterfeiting features, and unique finishes, are also spurring demand. Furthermore, the growing disposable incomes in emerging economies are supporting increased tobacco consumption, thereby boosting label requirements. The introduction of smart labeling solutions, such as QR codes for traceability and consumer engagement, presents new avenues for growth and innovation within the sector.

This report provides an all-encompassing view of the World Cigarette Label Production market. It meticulously analyzes market size and forecasts, segmenting by Type (Traditional Cigarette Label, E-cigarette Label) and Application (Tobacco Industry, Collection Industry, Others). The study spans the Study Period of 2019-2033, with detailed insights into the Historical Period (2019-2024), Base Year (2025), and Forecast Period (2025-2033). The report offers a deep dive into market dynamics, including key trends, driving forces, challenges, and growth catalysts. It also features a comprehensive profiling of leading players and significant developments, making it an indispensable resource for stakeholders seeking to understand and navigate this complex and evolving industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.49% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.49%.

Key companies in the market include Litu Holdings Limited, Jinjia Group, DFP, Anhui Genuine New Materials, Guangdong New Grand Long Packing, GuiZhou YongJi Printing, AMVIG HOLDINGS LIMITED, Jinshi Technology, Shaanxi Jinye Science Technology and Education Group, Energy New Material, Shunho New Materials Technology, YUTO Packaging Technology, Minong Screen Printing, Huabao Flavours and Fragrances, Masterwork Group, Prince New Materials.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Cigarette Label," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cigarette Label, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.