1. What is the projected Compound Annual Growth Rate (CAGR) of the Smartphone LiDAR?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Smartphone LiDAR

Smartphone LiDARSmartphone LiDAR by Type (IOS, Android), by Application (High-End Smartphones, Mid-Range Smartphones), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

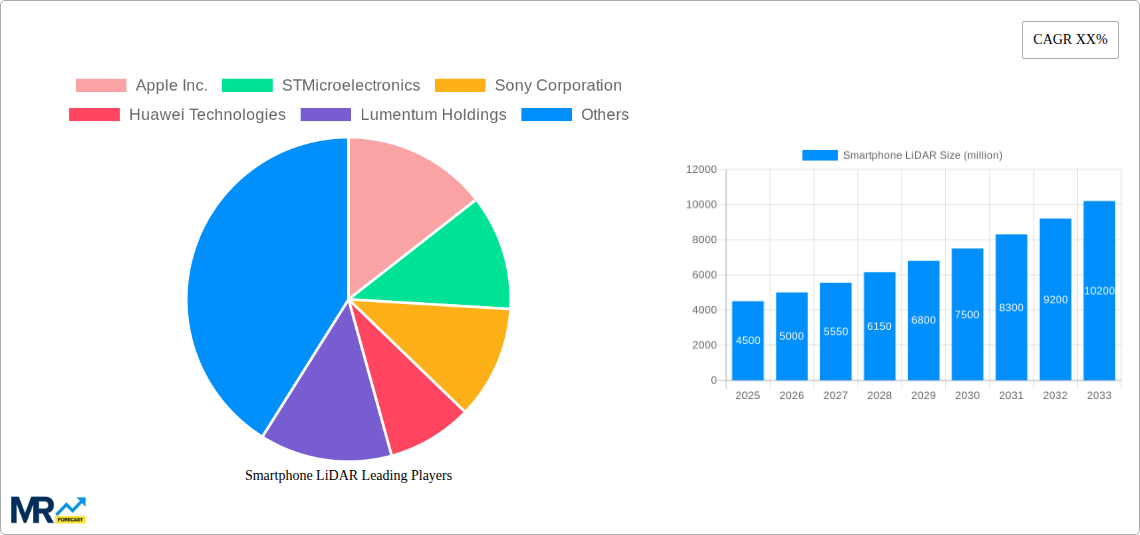

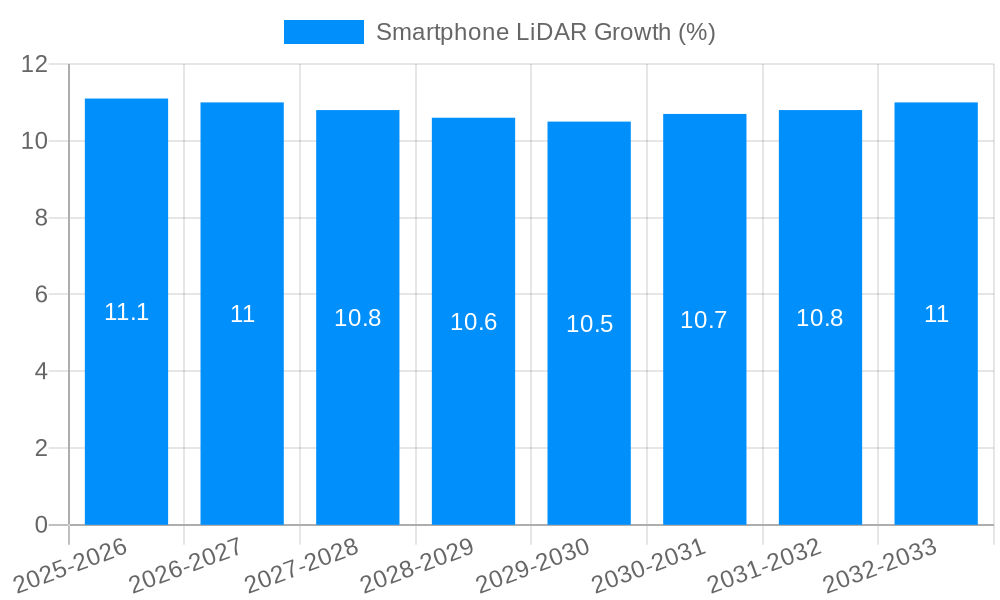

The global Smartphone LiDAR market is poised for significant expansion, projected to reach approximately USD 4.5 billion in 2025 and surge to an estimated USD 10.2 billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of around 11%. This impressive growth is primarily propelled by the increasing integration of LiDAR technology into high-end smartphones, enabling advanced augmented reality (AR) experiences, sophisticated 3D mapping, and enhanced photographic capabilities. The demand for immersive AR applications in gaming, interior design, and professional visualization is a key driver, as LiDAR empowers devices to accurately perceive and interact with the physical environment. Furthermore, the continuous innovation in sensor technology, leading to more compact, power-efficient, and cost-effective LiDAR modules, is making this advanced feature accessible to a wider range of consumer devices, including mid-range smartphones.

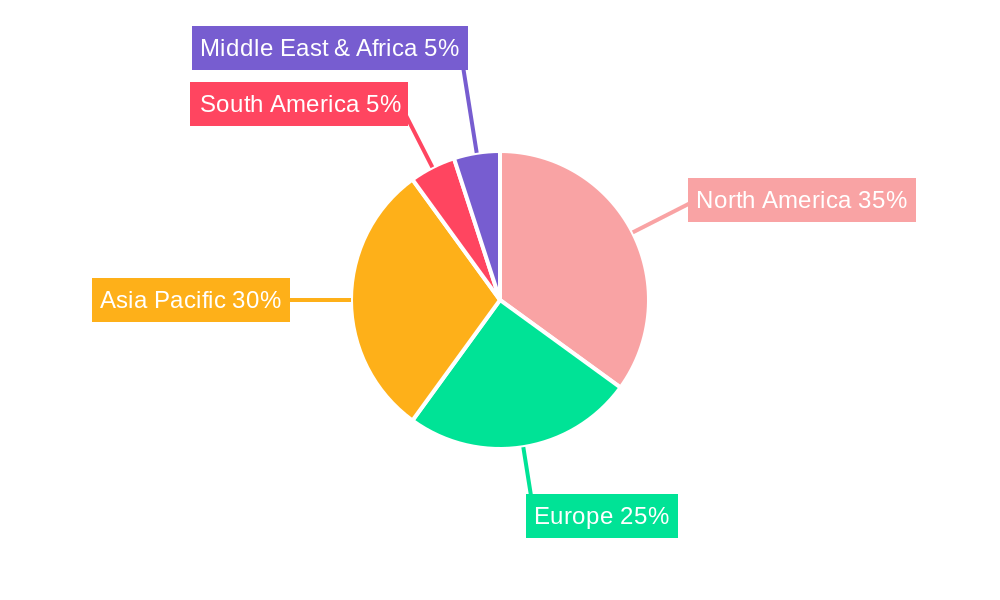

The market is characterized by a dynamic competitive landscape, with major players like Apple Inc., STMicroelectronics, Sony Corporation, and Huawei Technologies spearheading technological advancements and strategic partnerships. The proliferation of LiDAR in flagship devices by these companies is setting a benchmark for the industry, influencing consumer expectations and driving adoption rates. Geographically, North America, particularly the United States, is expected to lead the market due to its early adoption of cutting-edge smartphone features and a strong ecosystem for AR development. Asia Pacific, with its vast smartphone user base and growing disposable income in countries like China and India, presents a substantial growth opportunity. However, challenges such as the initial higher cost of LiDAR-equipped devices and the need for greater consumer awareness regarding its benefits may pose some restraints to rapid, widespread adoption across all market segments.

Here's a report description on Smartphone LiDAR, incorporating your specified elements:

The smartphone LiDAR market has witnessed a remarkable surge in adoption and innovation, driven by its transformative potential across a multitude of applications. During the Historical Period of 2019-2024, the market was largely characterized by nascent adoption, primarily within the high-end smartphone segment, with Apple Inc. leading the charge. However, the Study Period of 2019-2033, particularly the Base Year of 2025 and the subsequent Forecast Period of 2025-2033, is poised for exponential growth. We project the global smartphone LiDAR market to reach over 150 million units by the Estimated Year of 2025, a significant leap from its origins. This growth is fueled by an increasing understanding and integration of LiDAR's capabilities, moving beyond niche augmented reality (AR) and virtual reality (VR) experiences to encompass more practical applications like advanced photography, enhanced navigation, and sophisticated 3D scanning. The transition from high-end exclusivity to broader accessibility is a key trend, with manufacturers exploring cost-effective solutions for mid-range devices. STMicroelectronics and ams OSRAM are emerging as critical component suppliers, providing the necessary miniaturized and efficient LiDAR sensors that enable this democratization. Sony Corporation, with its expertise in image sensing technology, is also playing a pivotal role in developing next-generation LiDAR components. The Android ecosystem, initially lagging behind iOS in LiDAR adoption, is rapidly catching up, spurred by Huawei Technologies’ strategic investments and innovations. Lumentum Holdings remains a dominant force in the laser diode componentry crucial for LiDAR systems, ensuring a consistent supply chain for this burgeoning market. The market's trajectory indicates a future where LiDAR is an indispensable sensor suite in smartphones, akin to cameras and GPS, unlocking new frontiers in spatial computing and user interaction. The sheer volume of smartphones shipped annually, easily in the billions, suggests that even a modest percentage of adoption translates into hundreds of millions of units, making the 150 million unit projection by 2025 a conservative estimate considering the accelerated pace of technological integration. The next few years will see a significant ramp-up in production and a broader consumer awareness of LiDAR's benefits, solidifying its position as a cornerstone technology in the mobile device landscape.

The burgeoning adoption of LiDAR technology within smartphones is a direct consequence of several interconnected driving forces. Foremost among these is the burgeoning demand for more immersive and interactive augmented reality (AR) and virtual reality (VR) experiences. As smartphone capabilities advance, consumers increasingly expect seamless integration of digital content with their physical surroundings, a feat that LiDAR excels at by providing precise spatial understanding. Furthermore, advancements in computational photography have unlocked new possibilities, allowing LiDAR to significantly enhance image quality through improved depth mapping for portrait modes, low-light performance, and even enabling 3D object capture for creative and practical purposes. The continuous innovation from key players like Apple Inc. in their premium device offerings has served as a significant catalyst, demonstrating the tangible benefits of LiDAR and creating a benchmark for the industry. This early success has spurred competition and driven down component costs, making LiDAR more accessible for mid-range smartphones. The increasing availability of sophisticated LiDAR sensors from manufacturers such as STMicroelectronics and ams OSRAM, coupled with Sony Corporation's contributions to sensor technology, has made integration more feasible and cost-effective. The competitive landscape, with companies like Huawei Technologies pushing for widespread adoption in their diverse product lines, further accelerates this trend. Essentially, a convergence of consumer desire for advanced features, technological maturation, and competitive pressures is creating a powerful tailwind for smartphone LiDAR.

Despite the promising growth trajectory, the widespread adoption of smartphone LiDAR technology is not without its hurdles. A primary challenge remains the cost of integration. While component costs are decreasing, the overall expense of incorporating LiDAR sensors and the associated processing power can still be prohibitive for many mid-range and budget smartphone models, limiting its universal appeal. Another significant restraint is the consumer understanding and perceived value of LiDAR. For many users, the benefits of LiDAR are still abstract, particularly outside of niche AR applications. Educating consumers about its practical advantages, such as enhanced photography or improved navigation in complex environments, is crucial for driving demand. Furthermore, miniaturization and power efficiency of LiDAR components, while improving, continue to be areas of active research and development. Integrating these sensors without compromising smartphone design, battery life, or thermal performance presents an ongoing engineering challenge. The fragmentation of the Android ecosystem in terms of LiDAR implementation and software support can also create a less unified and potentially more complex development environment compared to the more standardized iOS platform. Finally, the development of compelling, mass-market applications that truly leverage LiDAR's capabilities beyond AR is still evolving, requiring continuous innovation from app developers to showcase its full potential and justify its inclusion.

The dominance in the smartphone LiDAR market is poised to be a multifaceted landscape, with North America, particularly the United States, leading in High-End Smartphone applications within the iOS segment. This dominance is intrinsically linked to the pioneering efforts of Apple Inc., which has consistently integrated LiDAR technology into its flagship iPhone Pro models. The strong consumer propensity for premium devices, coupled with a well-established developer ecosystem for AR applications, creates a fertile ground for LiDAR adoption in this region. Apple's strategic roadmap, emphasizing spatial computing and AR integration, further solidifies North America's lead in the high-end iOS segment.

However, the broader market expansion and unit volume growth will be significantly influenced by the Android segment, particularly in Asia-Pacific countries like China. While historically lagging in LiDAR integration for flagship devices, Chinese manufacturers such as Huawei Technologies are rapidly closing the gap and are poised to drive volume through strategic deployment in both high-end and increasingly, mid-range Android smartphones. The sheer size of the smartphone market in China and other Asian countries, coupled with a growing consumer appetite for advanced features and a competitive pricing landscape, will make this region a crucial volume driver.

Considering the segments:

Type: iOS

Type: Android

Application: High-End Smartphones

Application: Mid-Range Smartphones

The interplay between these segments and regions will define the market's evolution. While North America will lead in sophisticated applications within the iOS ecosystem, the sheer scale of the Android market, particularly in Asia, will dictate the ultimate global unit volume for smartphone LiDAR.

The growth of the smartphone LiDAR industry is being significantly catalyzed by the accelerating pace of technological miniaturization and cost reduction in LiDAR sensor components, spearheaded by companies like STMicroelectronics and ams OSRAM. The increasing demand for more engaging AR/VR experiences and advancements in mobile photography, where LiDAR enhances depth sensing and low-light performance, are also major drivers. Furthermore, strategic integrations by major smartphone manufacturers, particularly Apple Inc. and increasingly Huawei Technologies, are normalizing LiDAR's presence and creating a robust developer ecosystem. The expanding application landscape beyond AR, into areas like 3D scanning and spatial mapping, further fuels adoption.

This comprehensive report delves into the intricate dynamics of the smartphone LiDAR market, projecting a significant expansion from the Historical Period of 2019-2024 to the expansive Study Period of 2019-2033. With the Base Year of 2025 estimated to see unit sales exceed 150 million units, the Forecast Period of 2025-2033 is anticipated to witness sustained and substantial growth. The report meticulously analyzes key market insights, including the driving forces behind adoption, such as the demand for enhanced AR/VR experiences and computational photography. It also critically examines the challenges and restraints, including cost, consumer awareness, and technological limitations. The report provides an in-depth regional and segment-specific analysis, highlighting the dominance of North America in the iOS high-end segment and the projected volume leadership of the Android segment in Asia-Pacific. Leading players like Apple Inc., STMicroelectronics, Sony Corporation, Huawei Technologies, Lumentum Holdings, and ams OSRAM are profiled, along with their strategic contributions. Furthermore, significant technological developments and their anticipated impact are detailed, offering a holistic view of this rapidly evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Apple Inc., STMicroelectronics, Sony Corporation, Huawei Technologies, Lumentum Holdings, ams OSRAM.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Smartphone LiDAR," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Smartphone LiDAR, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.