1. What is the projected Compound Annual Growth Rate (CAGR) of the SiC High Temperature Annealing Furnace?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

SiC High Temperature Annealing Furnace

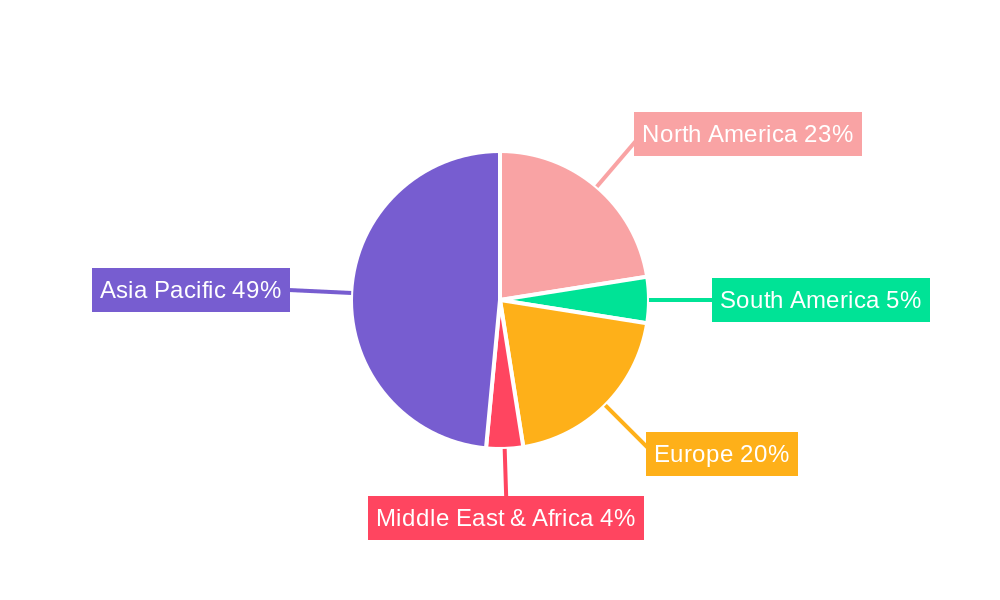

SiC High Temperature Annealing FurnaceSiC High Temperature Annealing Furnace by Type (Vertical Annealing Furnace, Horizontal Annealing Furnace, World SiC High Temperature Annealing Furnace Production ), by Application (4 Inch SiC Wafer, 6 Inch SiC Wafer, Others, World SiC High Temperature Annealing Furnace Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

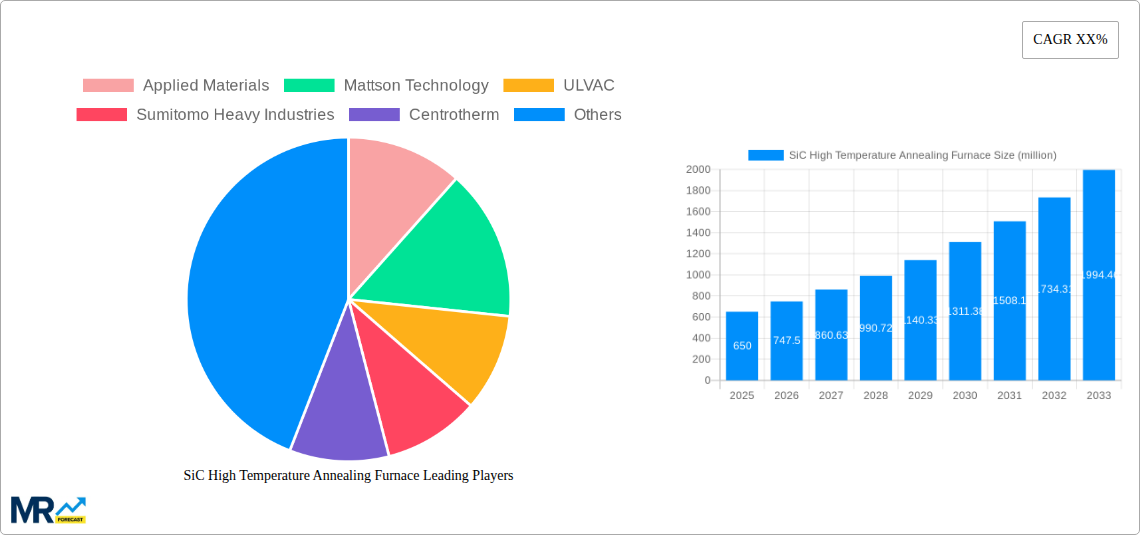

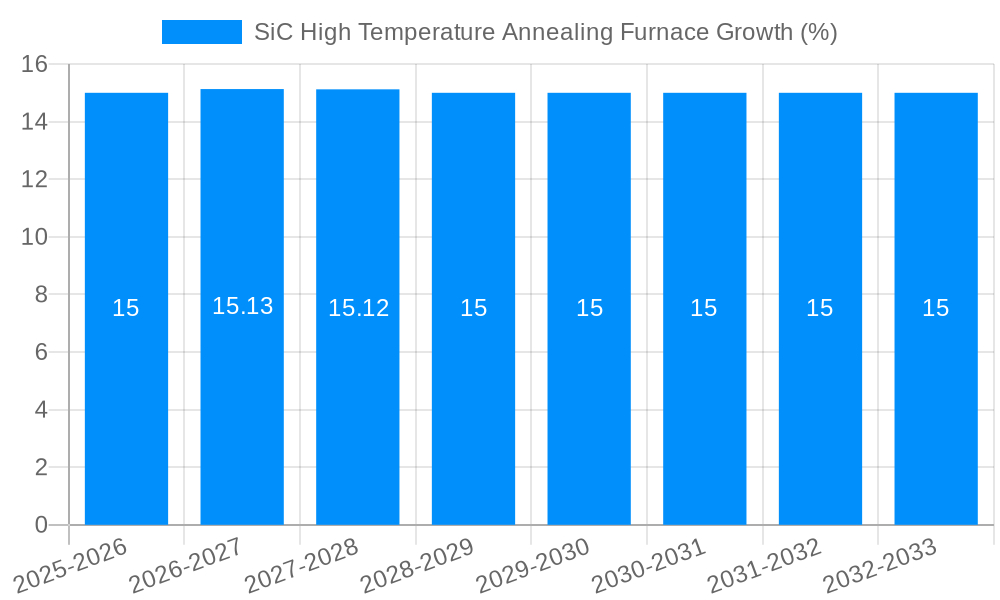

The global SiC (Silicon Carbide) high-temperature annealing furnace market is poised for significant expansion, projected to reach an estimated market size of $650 million by 2025. Driven by the burgeoning demand for high-performance semiconductors, particularly in electric vehicles (EVs), renewable energy systems, and advanced power electronics, the market is expected to witness a compound annual growth rate (CAGR) of approximately 15-20% over the forecast period of 2025-2033. This robust growth is fueled by the superior properties of SiC, such as its ability to withstand higher temperatures and voltages, which makes it an ideal material for next-generation power devices that offer enhanced efficiency and reduced energy loss. The increasing adoption of SiC in 5G infrastructure, data centers, and aerospace further solidifies its market trajectory. Key market drivers include technological advancements in SiC wafer processing, the continuous push for miniaturization and higher power density in electronic components, and favorable government initiatives supporting the semiconductor industry's growth and innovation.

The market landscape for SiC high-temperature annealing furnaces is characterized by a dynamic interplay of technological innovation and evolving application demands. Vertical annealing furnaces are gaining traction due to their superior uniformity and throughput for large-scale SiC wafer production, while horizontal furnaces continue to serve specialized applications. The market is segmented by wafer size, with 6-inch SiC wafers representing a dominant segment, followed by 4-inch and other emerging wafer sizes. Geographically, Asia Pacific, particularly China, is emerging as a powerhouse in both production and consumption, driven by its strong manufacturing base and increasing domestic demand for advanced semiconductors. North America and Europe are also significant markets, supported by robust R&D investments and a strong presence of leading semiconductor manufacturers. Restraints, such as the high cost of SiC wafer manufacturing and the complexity of the annealing process, are being addressed through ongoing research and development efforts aimed at improving yield and reducing production costs. Major players like Applied Materials, Mattson Technology, and ULVAC are at the forefront of innovation, continuously developing advanced furnace technologies to meet the evolving needs of the SiC semiconductor industry.

Here's a unique report description for a "SiC High Temperature Annealing Furnace" market analysis, incorporating your specified elements:

This comprehensive market research report delves deep into the dynamic landscape of Silicon Carbide (SiC) High Temperature Annealing Furnaces. Analyzing the market from the historical period of 2019-2024 and projecting future trends through 2033, with a base and estimated year of 2025, this report provides an invaluable outlook on production, applications, and technological advancements. We estimate the World SiC High Temperature Annealing Furnace Production to reach a significant valuation, potentially in the hundreds of millions of USD, with substantial growth anticipated throughout the forecast period. The report meticulously examines the market segmentation, offering in-depth insights into the dominance of specific furnace types and wafer applications. Furthermore, it identifies the key drivers, restraints, and emerging growth catalysts that will shape the industry's trajectory. Leading players and their strategic developments are also highlighted, offering a holistic view of the competitive environment.

The SiC High Temperature Annealing Furnace market is experiencing a period of rapid evolution, driven by the insatiable demand for advanced semiconductor materials. Current trends point towards an increasing adoption of higher throughput, more precise temperature control, and energy-efficient furnace designs. The transition from traditional silicon to SiC in power electronics, electric vehicles, and renewable energy infrastructure is fundamentally reshaping the semiconductor manufacturing ecosystem. This escalating demand necessitates specialized high-temperature annealing processes for SiC wafers, a critical step in achieving the desired electrical and material properties. As the industry matures, a notable shift is observed towards advanced furnace architectures that can handle larger wafer diameters, such as 6-inch SiC wafers, and accommodate increased production volumes. The global production capacity for these specialized furnaces is expected to see substantial expansion, likely reaching several hundred million USD in value by the base year of 2025, with robust growth projected throughout the forecast period to 2033. Innovations in process control, such as in-situ monitoring and closed-loop feedback systems, are becoming paramount to ensure batch-to-batch consistency and yield optimization, directly impacting the overall economic viability of SiC device manufacturing. The market is also witnessing a growing emphasis on furnaces designed for specific annealing steps, such as post-implantation annealing, which require precise temperature profiles and controlled atmospheres to mitigate crystal defects and enhance device performance. The overall outlook for SiC High Temperature Annealing Furnaces is exceptionally positive, fueled by ongoing technological advancements and the relentless drive for higher performance and efficiency in next-generation electronic components.

The SiC High Temperature Annealing Furnace market is being propelled by a confluence of powerful forces, chief among them being the exponential growth of the electric vehicle (EV) industry. SiC devices offer superior performance characteristics, including higher power density, faster switching speeds, and reduced energy loss compared to traditional silicon components, making them indispensable for EV powertrains and charging infrastructure. This demand is not only creating a massive market for SiC wafers but also driving the need for high-volume, high-quality annealing processes. Another significant driver is the increasing adoption of SiC in renewable energy applications, such as solar inverters and wind turbine converters, where efficiency and reliability are paramount. Governments worldwide are actively promoting decarbonization and the adoption of renewable energy sources, further stimulating the demand for SiC-based solutions. Furthermore, advancements in manufacturing technologies are making SiC more cost-competitive, expanding its applicability to a wider range of industries, including industrial automation, aerospace, and defense. The continuous innovation in SiC wafer production, including the development of larger wafer diameters and improved crystal quality, directly translates into a greater need for sophisticated annealing equipment capable of processing these advanced substrates efficiently and effectively. The projected World SiC High Temperature Annealing Furnace Production is set to reflect this sustained demand, with market valuations expected to climb into the hundreds of millions of USD by 2025.

Despite the promising growth trajectory, the SiC High Temperature Annealing Furnace market faces several significant challenges and restraints that could temper its expansion. A primary concern revolves around the inherently complex and expensive nature of SiC wafer manufacturing and processing. The high temperatures and specialized environments required for SiC annealing necessitate robust and sophisticated furnace designs, leading to substantial capital investment for manufacturers. This cost barrier can slow down the widespread adoption of SiC technology, particularly for smaller players or in price-sensitive markets. Another challenge lies in the availability and consistency of high-quality SiC raw materials, which directly impacts wafer yield and the effectiveness of annealing processes. Supply chain disruptions or quality inconsistencies in these upstream materials can create bottlenecks and impact production schedules. Furthermore, the development and refinement of annealing processes themselves continue to be an area of active research. Achieving precise temperature uniformity across large SiC wafers and minimizing defect formation during high-temperature treatments require advanced control systems and meticulous process optimization. This ongoing need for technological advancement and process maturity can limit the immediate scalability of certain annealing solutions. Lastly, the competition from other advanced semiconductor materials and the evolving regulatory landscape concerning manufacturing processes and environmental impact also present potential restraints for the SiC High Temperature Annealing Furnace market.

The SiC High Temperature Annealing Furnace market is poised for significant growth, with certain regions and segments expected to play a dominant role.

Dominant Regions/Countries:

Dominant Segments:

The combined influence of these regions and segments will define the market's growth and competitive landscape, with substantial investments expected in manufacturing capacity and technological advancements.

The SiC High Temperature Annealing Furnace industry is experiencing powerful growth catalysts. Foremost among these is the accelerating adoption of electric vehicles (EVs), which require high-performance SiC components for enhanced efficiency and range. The expanding renewable energy sector, including solar power and wind energy, also relies heavily on SiC for power conversion. Government incentives and policies promoting electrification and clean energy are further fueling this demand. Additionally, continuous advancements in SiC material science and wafer manufacturing are improving performance and reducing costs, making SiC more accessible for a broader range of applications.

The SiC High Temperature Annealing Furnace market is characterized by a blend of established semiconductor equipment manufacturers and specialized furnace providers. Key players contributing to the World SiC High Temperature Annealing Furnace Production include:

The SiC High Temperature Annealing Furnace sector has witnessed several significant developments during the study period (2019-2033), shaping its current and future trajectory:

This report provides an exhaustive analysis of the SiC High Temperature Annealing Furnace market, offering insights into critical market dynamics. It meticulously examines the World SiC High Temperature Annealing Furnace Production, projecting its value to be in the hundreds of millions of USD by the base year of 2025, with substantial growth anticipated through 2033. The report delves into the market segmentation, evaluating the dominance of various furnace types and wafer applications, and provides regional market forecasts. It also identifies the key drivers, challenges, and growth catalysts propelling the industry forward. Detailed profiles of leading players and a timeline of significant developments further enhance the report's comprehensive nature, making it an indispensable resource for stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Applied Materials, Mattson Technology, ULVAC, Sumitomo Heavy Industries, Centrotherm, JTEKT Thermo Systems Corporation, Annealsys, Chengdu Laipu Science & Technology, NAURA, Toyoko Kagaku, Qingdao JCMEE, Shandong Leguan, Shanghai LarcomSE, Kokusai Electric, Wuhan Chengyuan Electronic Technology.

The market segments include Type, Application.

The market size is estimated to be USD 650 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "SiC High Temperature Annealing Furnace," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the SiC High Temperature Annealing Furnace, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.