1. What is the projected Compound Annual Growth Rate (CAGR) of the Security Image Sensor?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Security Image Sensor

Security Image SensorSecurity Image Sensor by Type (CCD Image Sensor, CMOS Image Sensor, World Security Image Sensor Production ), by Application (Public Security Monitoring, Commercial Security, Residential Security, Traffic management, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

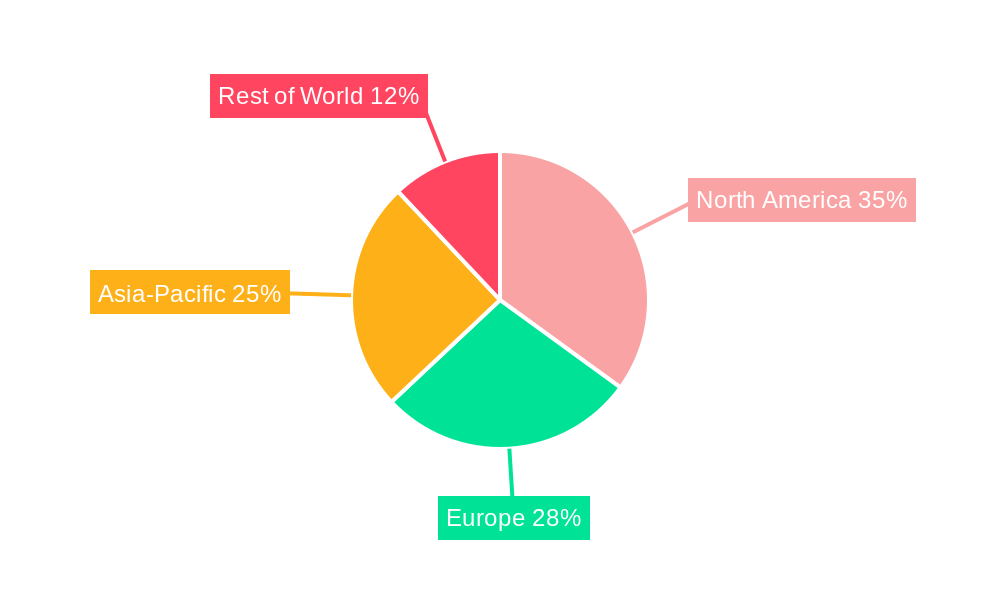

The global security image sensor market, currently valued at approximately $803 million in 2025, is poised for robust growth. Driven by increasing demand for advanced surveillance systems across public and private sectors, the market is experiencing a surge in adoption of high-resolution CMOS image sensors. Factors such as the rising need for enhanced security in commercial establishments, residential areas, and critical infrastructure are significant growth catalysts. Furthermore, the proliferation of smart cities initiatives, coupled with the increasing integration of artificial intelligence (AI) and machine learning (ML) in video analytics, fuels the demand for sophisticated image sensors with improved capabilities like low-light performance and wider dynamic range. The market segmentation reveals a strong preference for CMOS image sensors over CCD counterparts, primarily due to their superior cost-effectiveness, lower power consumption, and better integration capabilities. Geographic distribution shows strong growth in North America and Asia-Pacific regions, fueled by substantial investments in security infrastructure and technological advancements. This strong regional presence reflects the prioritization of security concerns and the increasing availability of advanced security solutions.

The market is expected to witness a significant expansion over the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) influenced by several factors. Technological advancements such as the development of higher-resolution, more sensitive sensors with enhanced functionalities like AI processing capabilities are expected to further propel market growth. However, factors like high initial investment costs for advanced surveillance systems and data privacy concerns might present challenges to market expansion. Nevertheless, the ongoing technological innovations and increasing government regulations emphasizing security infrastructure development are anticipated to mitigate these challenges, ensuring sustained market growth in the coming years. Competitive landscape analysis reveals the presence of established players alongside emerging companies, promoting innovation and healthy competition.

The global security image sensor market is experiencing robust growth, driven by the increasing demand for advanced surveillance systems across diverse sectors. Over the study period (2019-2033), the market witnessed a significant expansion, with the estimated year (2025) showing particularly strong performance. This surge is attributed to several factors, including the proliferation of smart cities initiatives, escalating concerns about public safety, and the rising adoption of intelligent video analytics. The shift towards higher resolution imaging, improved low-light performance, and the integration of artificial intelligence (AI) capabilities are further propelling market expansion. Specifically, the CMOS image sensor segment dominates the market due to its cost-effectiveness and superior performance compared to CCD technology. The increasing adoption of IP-based surveillance systems also fuels the demand for high-quality image sensors. We project continued strong growth in the forecast period (2025-2033), exceeding several million units annually, primarily driven by the expanding applications in public security monitoring, commercial security, and residential security sectors. The market is seeing the emergence of innovative technologies such as 3D imaging and thermal imaging, enhancing the capabilities of security systems and providing more comprehensive surveillance solutions. The historical period (2019-2024) showcased the foundational growth for this expansion, providing a solid base for the current and projected market momentum. The base year (2025) represents a pivotal point of market maturity, with established trends setting the stage for continued growth. Overall, the security image sensor market is poised for a period of significant expansion, fueled by technological advancements, increasing security concerns, and the growing adoption of advanced surveillance technologies.

Several key factors are driving the substantial growth of the security image sensor market. The increasing urbanization and the subsequent need for enhanced public safety measures are major contributors. Smart city initiatives across the globe are heavily reliant on sophisticated surveillance infrastructure, creating a massive demand for high-quality image sensors. Furthermore, the rising incidence of crime and terrorism has fueled the demand for advanced security systems capable of providing real-time monitoring and threat detection. Technological advancements, such as the development of higher-resolution, more sensitive CMOS sensors, are making surveillance systems more effective and affordable. The integration of AI and machine learning algorithms into these systems allows for automated threat detection, facial recognition, and license plate reading, further boosting market demand. The declining cost of image sensors, coupled with the increasing availability of high-speed data networks, makes the deployment of large-scale surveillance systems economically viable. Finally, government regulations and initiatives mandating the use of advanced security systems in various sectors also play a crucial role in propelling market growth. The convergence of these factors ensures the continued expansion of the security image sensor market in the coming years.

Despite the considerable growth potential, the security image sensor market faces certain challenges and restraints. One significant concern is the potential for misuse of surveillance technologies, raising ethical and privacy issues. Stringent data privacy regulations are emerging globally, which can restrict the implementation and usage of certain surveillance technologies, impacting market growth. The high initial investment required for deploying advanced surveillance systems can pose a barrier, particularly for smaller businesses and residential users. Technological advancements also bring challenges, including the need for robust cybersecurity measures to protect sensitive data transmitted through surveillance systems. Furthermore, the market is subject to fluctuations in raw material prices, affecting the production costs of image sensors. Maintaining the quality and reliability of image sensors is crucial, as malfunctions can have serious consequences in security applications. Competition among manufacturers is intense, putting pressure on profit margins. Finally, the need for continuous research and development to meet evolving customer demands represents an ongoing challenge for market players.

The CMOS Image Sensor segment is projected to dominate the market, surpassing several million units in annual production by 2033. This is due to its inherent advantages: superior performance at lower cost compared to CCD technology. CMOS sensors offer faster data processing, lower power consumption, and the ability to integrate more advanced features directly onto the chip. This makes them particularly well-suited for applications requiring real-time processing and high-bandwidth data transmission, such as advanced video analytics. While CCD sensors maintain a niche in specific applications requiring exceptionally high image quality, the cost-effectiveness and versatility of CMOS sensors are driving their market dominance.

In terms of geographic regions, North America and Europe are expected to lead the market during the forecast period, driven by high levels of technological adoption, stringent security regulations, and substantial investments in advanced surveillance infrastructure. These regions have well-established security systems infrastructure and a high level of awareness regarding security threats, fueling demand for sophisticated image sensors. Asia-Pacific, particularly China, is also experiencing rapid growth due to rapid urbanization and government initiatives promoting smart city development. However, the market in these regions is expected to witness significant growth but will likely lag behind North America and Europe in terms of overall market size during the forecast period. The growth in these regions will be primarily driven by increases in public security monitoring and commercial security applications, along with increasing adoption of residential security systems. The robust growth in these sectors underscores the global significance of security image sensors across various regions.

Several factors are accelerating growth within the security image sensor industry. The integration of AI and machine learning capabilities into security systems enhances the analytical capacity of surveillance footage, automating tasks like facial recognition and object detection. The increasing demand for high-resolution imaging, particularly in applications requiring detailed analysis of captured footage, also fuels market expansion. Government initiatives and funding for public safety and smart city projects provide significant impetus to market growth. Furthermore, the decreasing cost of sensors makes them accessible to a broader range of applications and consumers, boosting market penetration. The convergence of these factors contributes significantly to the industry's continued expansion.

This report provides a comprehensive analysis of the security image sensor market, covering key trends, drivers, challenges, and growth opportunities. The report details market segmentation by type (CCD and CMOS), application (public security, commercial security, residential security, traffic management, and others), and geography, providing a granular view of the market landscape. The competitive landscape is also thoroughly analyzed, highlighting the key players, their market strategies, and recent developments. The report utilizes a robust methodology, incorporating both primary and secondary research to ensure the accuracy and reliability of the data and forecasts. It offers actionable insights for stakeholders to capitalize on the market's growth potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Hamamatsu Photonics, Teledyne DALSA, Xenics, New Imaging Technologies, SYNERGY OPTOSYSTEMS, FLIR Systems, Gpixel Changchun Microelectronics, SmartSens Technology, Hefei Aike Optoelectronics Technology, Microview, Bonphot.

The market segments include Type, Application.

The market size is estimated to be USD 803 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Security Image Sensor," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Security Image Sensor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.