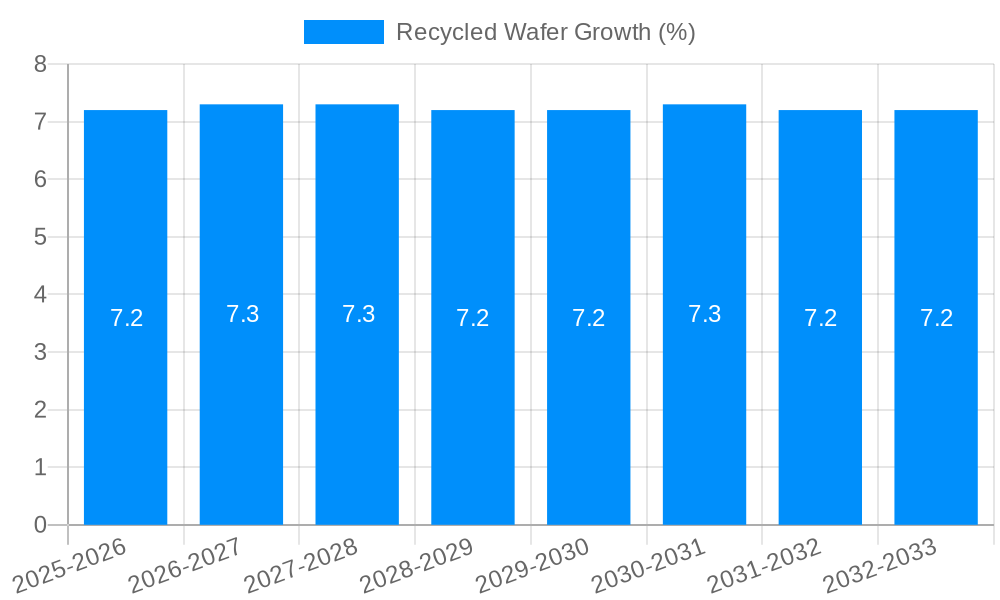

1. What is the projected Compound Annual Growth Rate (CAGR) of the Recycled Wafer?

The projected CAGR is approximately 7.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Recycled Wafer

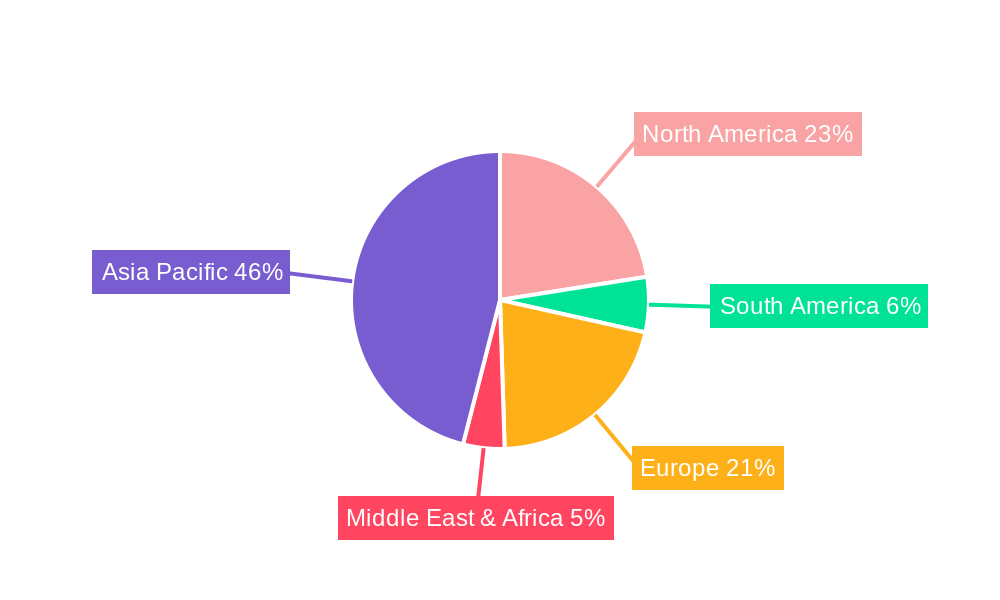

Recycled WaferRecycled Wafer by Type (Monitor Wafers, Dummy Wafers), by Application (IDM, Foundry, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

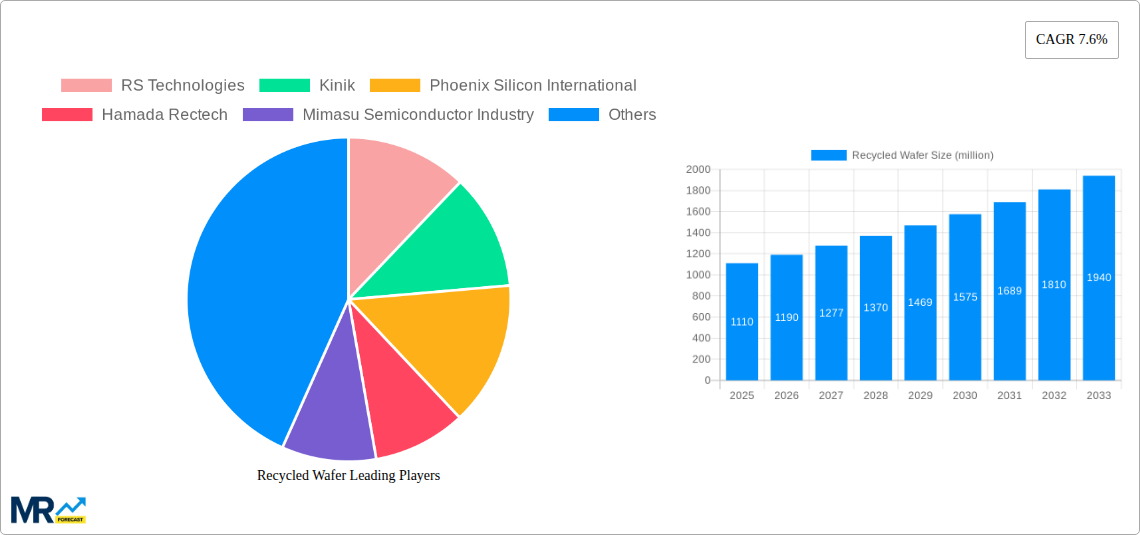

The global Recycled Wafer market is poised for substantial growth, projected to reach a significant valuation of $1110 million by 2025. This expansion is driven by a compelling compound annual growth rate (CAGR) of 7.6%, indicating a robust and sustained upward trajectory. The increasing demand for cost-effective wafer solutions, coupled with growing environmental consciousness within the semiconductor industry, are primary catalysts for this market's ascent. Manufacturers are actively seeking ways to reduce production costs while simultaneously minimizing their environmental footprint, making recycled wafers an increasingly attractive option. This trend is particularly pronounced in the face of rising raw material costs and supply chain volatilities for virgin silicon wafers. The market encompasses a range of types, including Monitor Wafers and Dummy Wafers, catering to diverse applications within Integrated Device Manufacturers (IDMs) and Foundries, among others.

Further strengthening the market's outlook are key trends such as advancements in wafer reclaiming technologies, leading to higher quality recycled wafers with performance comparable to new ones. The growing adoption of advanced semiconductor manufacturing processes also necessitates a consistent supply of wafers, where recycled options can play a crucial role in meeting this demand efficiently. While the market benefits from these drivers and trends, potential restraints such as stringent quality control requirements for certain high-end applications and initial skepticism regarding the reliability of recycled materials need to be addressed. However, as the technology matures and the benefits become more evident, these restraints are expected to diminish, paving the way for broader market penetration and continued strong growth throughout the forecast period of 2025-2033. The competitive landscape features a strong presence of key players, including RS Technologies, Kinik, and Ferrotec, indicating a dynamic and evolving market.

Here's a unique report description on Recycled Wafers, incorporating your specified values, companies, segments, and timeframes.

The global recycled wafer market is experiencing a significant surge, moving beyond niche applications to become a cornerstone of sustainable semiconductor manufacturing. The market, valued at an estimated \$2,500 million in the base year 2025, is projected to witness robust expansion, reaching approximately \$7,000 million by the estimated year 2025 and further climbing to over \$15,000 million by 2033. This growth trajectory underscores a fundamental shift driven by economic imperatives and increasing environmental consciousness within the semiconductor industry. The study period spanning 2019-2033 encapsulates both the nascent stages and the accelerated adoption of recycled wafer technologies. During the historical period 2019-2024, the market witnessed steady but modest growth, primarily fueled by early adopters and specialized applications where cost savings were paramount. However, the forecast period 2025-2033 signals an inflection point. Key market insights reveal that the demand is being shaped by the dual pressures of soaring silicon wafer prices and stringent environmental regulations. As new wafer fabrication facilities (fabs) continue to be established, particularly in Asia, the need for cost-effective materials is intensifying. Recycled wafers, offering a significant percentage reduction in costs compared to virgin wafers, are thus becoming an increasingly attractive proposition. Furthermore, the concept of a circular economy is gaining traction. Companies are actively seeking ways to minimize waste and reduce their carbon footprint, and wafer recycling presents a tangible solution. The technological advancements in wafer reclamation and refurbishment are also playing a crucial role, ensuring that recycled wafers meet the stringent quality requirements demanded by modern semiconductor processes. The increasing prevalence of advanced packaging techniques, which can sometimes accommodate slightly lower-grade wafers or those that have undergone refurbishment, is also a contributing factor to the broadening application spectrum for recycled wafers. The market is moving towards greater standardization and acceptance, with leading semiconductor manufacturers exploring and integrating recycled wafers into their production lines for various critical stages, not just for less demanding applications.

The accelerated growth of the recycled wafer market is underpinned by a confluence of powerful driving forces, each contributing significantly to its expanding adoption. Foremost among these is the persistent volatility and upward trend in the prices of virgin silicon wafers. As the semiconductor industry continues its relentless expansion, driven by the insatiable demand for electronics across consumer, automotive, and industrial sectors, the supply of prime silicon wafers has become a critical bottleneck. This scarcity, coupled with the high cost of polysilicon and advanced manufacturing processes, has made virgin wafers a substantial expense for chip manufacturers. Recycled wafers, offering a substantial cost advantage – often ranging from 30% to 60% lower than new wafers – present a compelling economic solution. Beyond cost, the growing emphasis on sustainability and environmental responsibility within the global business landscape is a significant propellant. Governments worldwide are enacting stricter environmental regulations, pushing industries to reduce waste and adopt greener practices. The semiconductor industry, with its considerable resource consumption, is under particular scrutiny. Wafer recycling directly addresses this by diverting used wafers from landfills, reducing the demand for virgin silicon extraction, and minimizing the energy-intensive processes associated with producing new wafers. This aligns with corporate social responsibility goals and enhances brand image, attracting environmentally conscious investors and consumers. Moreover, technological advancements in wafer reclamation and refurbishment processes have significantly improved the quality and reliability of recycled wafers. Sophisticated cleaning, inspection, and polishing techniques now allow recycled wafers to meet the stringent specifications required for various semiconductor applications, broadening their acceptance beyond initial, less demanding uses. This technological maturation is crucial for overcoming past reservations about the performance of recycled materials.

Despite its promising trajectory, the recycled wafer market faces a discernible set of challenges and restraints that temper its growth. A primary hurdle remains the ingrained perception of quality and reliability associated with recycled materials. While technological advancements have bridged much of the gap, a lingering skepticism persists among some manufacturers regarding the performance consistency and defect levels of recycled wafers compared to brand-new ones. This can lead to stringent qualification processes and a reluctance to adopt them for mission-critical or highly sensitive fabrication steps. Furthermore, the logistical complexities of collecting, transporting, and processing used wafers from diverse locations can be substantial. Establishing efficient and cost-effective collection networks, particularly across different geographical regions, requires significant investment and coordination. The cleaning and refurbishment processes, while advanced, also demand specialized equipment and expertise, adding to the operational costs and potentially limiting the number of qualified service providers. Another restraint is the stringent purity and defect requirements of leading-edge semiconductor manufacturing. For advanced nodes and highly integrated circuits, even microscopic imperfections can render a wafer unusable. While recycled wafers are increasingly suitable for many applications, their suitability for the most cutting-edge processes remains a point of contention, requiring ongoing innovation to meet these exacting standards. Finally, the initial investment in establishing or outsourcing recycling capabilities can be a barrier for smaller foundries or IDMs, especially when facing the capital expenditure demands of wafer fabrication itself. This can lead to a concentration of recycling services among specialized third-party providers.

The recycled wafer market is poised for significant regional and segment dominance, with Asia, particularly Taiwan and South Korea, emerging as critical hubs. These regions are home to a vast concentration of semiconductor manufacturing, including numerous Integrated Device Manufacturers (IDMs) and foundries, creating substantial demand for wafer materials. The presence of global leaders like TSMC in Taiwan and Samsung Electronics and SK Hynix in South Korea drives both the consumption and, increasingly, the innovation in wafer recycling. The sheer volume of wafer processing in these areas naturally generates a larger pool of used wafers, making the economics of recycling more attractive. Furthermore, these countries have been at the forefront of technological adoption and are actively pursuing sustainability initiatives, creating a fertile ground for the expansion of recycled wafer usage.

Within the segmentation of the recycled wafer market, Foundry applications are projected to exert significant dominance, followed closely by IDM.

Foundry:

IDM (Integrated Device Manufacturers):

Type Dominance:

The convergence of these dominant regions and segments creates a powerful market dynamic, where the economic benefits of recycled wafers are most acutely felt and where the infrastructure for their widespread adoption is most readily available. The increasing acceptance within these high-volume manufacturing environments will continue to drive innovation and economies of scale in the recycled wafer sector.

The recycled wafer industry is experiencing a surge fueled by several key growth catalysts. The escalating prices of virgin silicon wafers, driven by supply constraints and increasing demand, make recycled wafers a highly attractive cost-saving alternative for semiconductor manufacturers. Furthermore, the global push towards sustainability and circular economy principles is a significant driver, with companies seeking to reduce their environmental footprint and comply with stricter regulations. Technological advancements in wafer reclamation and refurbishment processes are continuously improving the quality and reliability of recycled wafers, expanding their applicability across a wider range of semiconductor manufacturing steps. The expansion of semiconductor manufacturing capacity, particularly in Asia, creates a larger volume of used wafers available for recycling and concurrently increases the demand for cost-effective materials.

This report offers a comprehensive analysis of the recycled wafer market, delving into its intricate dynamics from 2019 to 2033. It provides in-depth insights into market trends, projecting a substantial market value growth from an estimated \$2,500 million in 2025 to over \$15,000 million by 2033. The report meticulously dissects the driving forces behind this expansion, including the economic pressures of virgin wafer prices and the imperative for environmental sustainability. It also addresses the significant challenges and restraints, such as perceived quality concerns and logistical complexities, that the industry navigates. Crucially, the report identifies the dominant regions and segments, highlighting the pivotal role of Asia (Taiwan, South Korea) and the substantial contributions of the Foundry and IDM application segments, with a particular focus on Monitor and Dummy Wafers. Furthermore, it outlines key growth catalysts and presents a detailed list of leading industry players. The report also chronicles significant historical and ongoing developments within the sector. This all-encompassing coverage makes it an indispensable resource for stakeholders seeking to understand and capitalize on the evolving recycled wafer landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.6% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.6%.

Key companies in the market include RS Technologies, Kinik, Phoenix Silicon International, Hamada Rectech, Mimasu Semiconductor Industry, GST, Scientech, Pure Wafer, TOPCO Scientific Co. LTD, Ferrotec, Xtek semiconductor (Huangshi), Shinryo, KST World, Vatech Co., Ltd., OPTIM Wafer Services, Nippon Chemi-Con, KU WEI TECHNOLOGY, Hua Hsu Silicon Materials, Hwatsing Technology, Fine Silicon Manufacturing (shanghai), PNC Process Systems, Silicon Valley Microelectronics.

The market segments include Type, Application.

The market size is estimated to be USD 1110 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Recycled Wafer," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Recycled Wafer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.