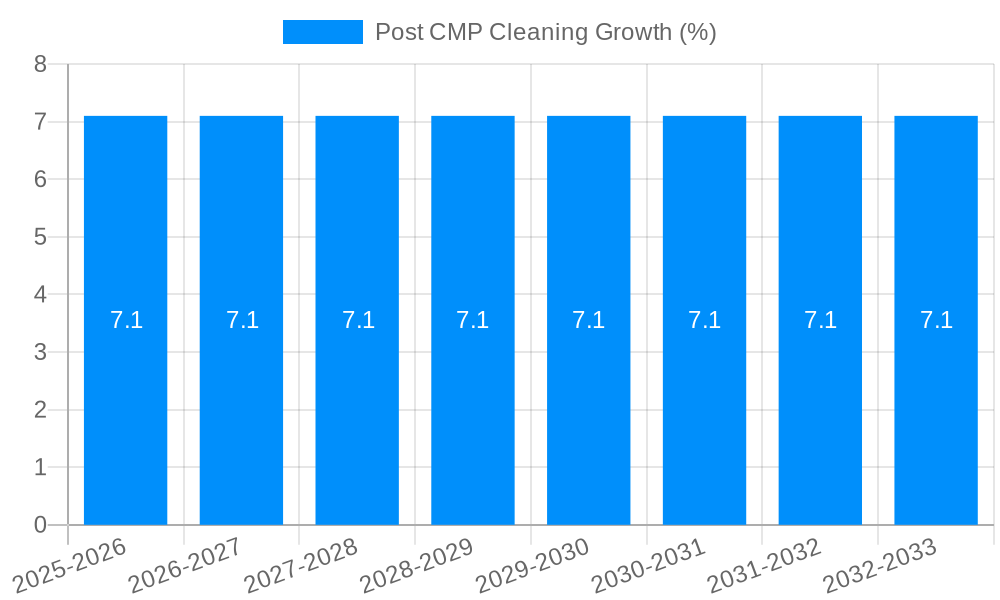

1. What is the projected Compound Annual Growth Rate (CAGR) of the Post CMP Cleaning?

The projected CAGR is approximately 7.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Post CMP Cleaning

Post CMP CleaningPost CMP Cleaning by Type (Acid Material, Alkaline Material), by Application (Metal Impurities and Particles, Organic Residue), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

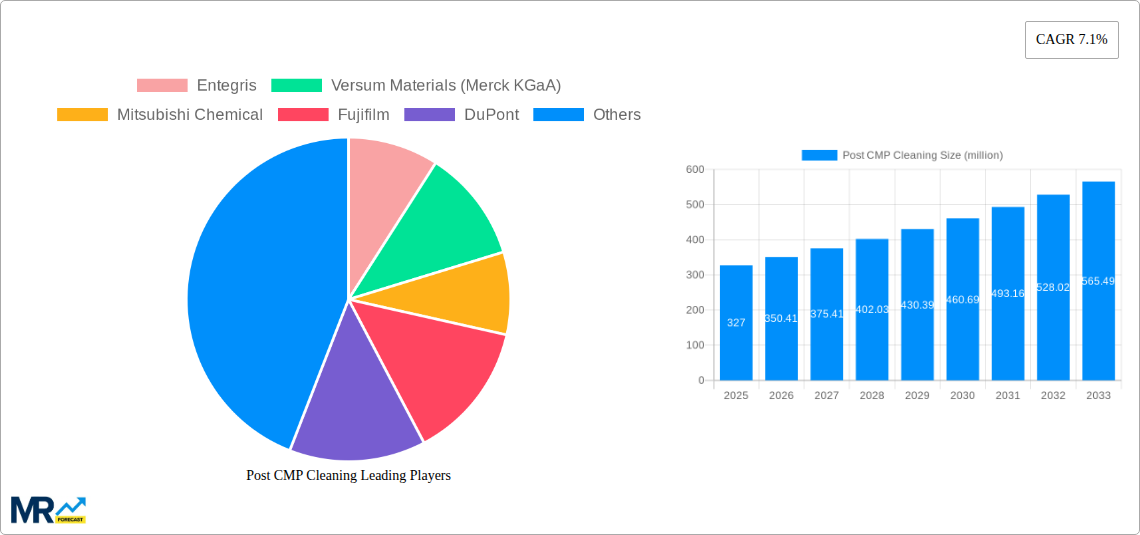

The global Post Chemical Mechanical Planarization (CMP) Cleaning market is poised for significant expansion, projected to reach an estimated USD 327 million in 2025. This growth is propelled by a robust Compound Annual Growth Rate (CAGR) of 7.1%, indicating a dynamic and evolving landscape within the semiconductor manufacturing industry. The increasing demand for advanced semiconductor devices, driven by burgeoning sectors like Artificial Intelligence (AI), 5G technology, and the Internet of Things (IoT), necessitates highly precise and efficient wafer cleaning processes. Post-CMP cleaning is a critical step in this fabrication process, ensuring the removal of abrasive slurry particles and organic residues that can compromise the performance and reliability of integrated circuits. This inherent requirement for defect-free wafer surfaces across all stages of production acts as a primary growth driver. Furthermore, continuous innovation in CMP slurries and polishing pads, leading to finer feature sizes and more complex chip architectures, directly fuels the need for sophisticated and highly effective post-CMP cleaning solutions.

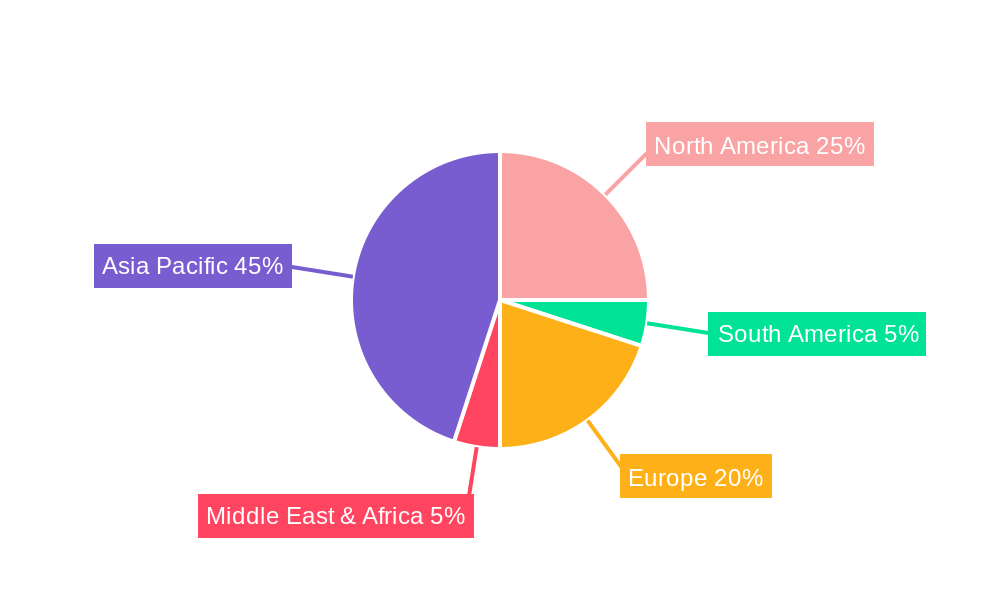

The market is segmented by material type, with Acid Materials and Alkaline Materials playing crucial roles, each tailored to specific residue removal challenges. Applications are broadly categorized into the removal of Metal Impurities and Particles and Organic Residue, reflecting the diverse contaminants encountered during wafer polishing. Key industry players such as Entegris, Versum Materials (Merck KGaA), Mitsubishi Chemical, and Fujifilm are at the forefront of developing advanced cleaning chemistries and equipment. These companies are investing heavily in research and development to address emerging challenges, including the cleaning of novel materials and nanoscale features. Regional analysis indicates a strong market presence in Asia Pacific, driven by the concentration of semiconductor fabrication facilities, followed by North America and Europe, which are also witnessing substantial growth due to ongoing technological advancements and investments in domestic chip manufacturing. Restrains such as increasing environmental regulations on chemical usage and the high cost of advanced cleaning chemistries may present some challenges, but the relentless pursuit of semiconductor performance will continue to drive market expansion.

The global Post CMP (Chemical Mechanical Planarization) cleaning market is poised for substantial growth, with an estimated market size projected to reach $5,400 million in the base year of 2025. This upward trajectory is expected to continue through the forecast period of 2025-2033, driven by the ever-increasing demand for advanced semiconductor devices. The historical period of 2019-2024 laid a strong foundation, witnessing a compound annual growth rate (CAGR) that indicates a robust and sustained expansion. A key insight within the Post CMP cleaning trends is the evolving nature of semiconductor manufacturing itself. As lithography nodes shrink and chip complexities escalate, the need for ultra-pure cleaning processes becomes paramount. Even minute residual particles or metallic contaminants can drastically impact device performance and yield. This necessitates the development and adoption of more sophisticated cleaning chemistries and methodologies.

The market is characterized by a dual approach to cleaning chemistries: acid and alkaline materials. Both segments are crucial, with acid materials often employed for effective removal of metal impurities and certain inorganic residues, while alkaline materials excel in tackling organic residues and polishing byproducts. The application landscape further highlights the critical role of Post CMP cleaning. The removal of metal impurities and particles remains a dominant application, directly impacting the reliability of integrated circuits. Simultaneously, the effective clearance of organic residue, a byproduct of both the CMP process and previous fabrication steps, is gaining increasing importance as contamination control becomes more stringent. Industry developments are constantly pushing the boundaries, with a focus on greener chemistries, reduced water consumption, and enhanced selectivity to protect delicate device structures. Innovations in dispensing technologies, wafer handling, and in-situ monitoring are also key trends that will shape the future of this vital semiconductor manufacturing segment. The study period of 2019-2033 encompasses these dynamic shifts, providing a comprehensive outlook on market evolution.

Several potent forces are propelling the growth of the Post CMP cleaning market. Foremost among these is the relentless pursuit of miniaturization and enhanced performance in semiconductor devices. As transistors become smaller and more densely packed, the tolerance for even sub-nanometer level contamination dwindles. This necessitates advanced cleaning solutions that can effectively remove minuscule metal impurities and residual particles without damaging the delicate interconnects and active areas of the chip. Furthermore, the proliferation of high-performance computing, artificial intelligence, 5G technology, and the Internet of Things (IoT) is creating an unprecedented demand for sophisticated semiconductors. This surging demand directly translates into higher wafer production volumes, thereby escalating the requirement for Post CMP cleaning processes. The increasing complexity of advanced packaging techniques also contributes to this growth, as these processes often involve multiple CMP steps that require meticulous cleaning to ensure robust interconnectivity and prevent yield loss.

Despite its robust growth potential, the Post CMP cleaning market faces certain challenges and restraints that could temper its expansion. One significant hurdle is the ever-increasing cost of advanced cleaning materials and equipment. The development of ultra-pure chemistries and sophisticated dispensing systems demands substantial R&D investment, which is ultimately reflected in the product pricing. This can be a significant barrier for smaller manufacturers or those operating in cost-sensitive segments of the semiconductor industry. Another challenge lies in the stringent regulatory landscape surrounding chemical usage and waste disposal. As environmental concerns grow, manufacturers are under pressure to adopt greener cleaning solutions and implement more sustainable waste management practices, which can incur additional costs and require process modifications. Moreover, the rapid pace of technological advancement in semiconductor fabrication means that cleaning solutions need to be constantly adapted to new materials and architectures. Maintaining backward compatibility while innovating for future nodes presents a continuous R&D challenge.

The Asia-Pacific (APAC) region is unequivocally poised to dominate the Post CMP cleaning market. This dominance is driven by several interconnected factors, primarily the concentration of leading semiconductor manufacturing hubs within this geographical area. Countries like Taiwan, South Korea, and China are home to the world's largest foundries and chip manufacturers, including TSMC, Samsung Electronics, and SMIC, respectively. These giants are at the forefront of adopting cutting-edge semiconductor fabrication technologies, which inherently require the most advanced Post CMP cleaning solutions. The sheer volume of wafer production in APAC significantly outpaces other regions, creating a colossal demand for all types of Post CMP cleaning materials and equipment. Furthermore, governments in these countries are actively investing in and supporting their domestic semiconductor industries, fostering an environment conducive to market growth.

Within APAC, Taiwan stands out as a critical player due to the overwhelming presence of TSMC, the world's largest contract chip manufacturer, which produces the most advanced logic chips. South Korea's leadership in memory chip manufacturing, driven by Samsung and SK Hynix, also contributes substantially to the demand for Post CMP cleaning. China's ambitious drive to achieve semiconductor self-sufficiency is leading to massive investments in new fabrication facilities, further fueling the market.

When considering the segments that will dominate, the Acid Material segment, particularly for the Metal Impurities and Particles application, is expected to hold a significant share. As semiconductor nodes shrink, the potential for metallic contamination from CMP slurries, polishing pads, and wafer handling equipment becomes a critical yield-limiting factor. Acidic chemistries are highly effective in complexating and removing various metal ions and particles that can cause short circuits or performance degradation in advanced integrated circuits. For instance, the removal of copper, tungsten, and aluminum residues is paramount in multi-layer interconnect fabrication, where acids play a crucial role. The increasing prevalence of 3D NAND flash memory, which involves intricate vertical structures, also amplifies the need for precise particle removal.

Similarly, the Alkaline Material segment will continue to be vital, especially for the removal of Organic Residue. CMP slurries, particularly oxide slurries, often leave behind organic films and residues that can impede subsequent deposition or etching steps. Alkaline solutions, with their specific pH levels and chelating agents, are highly effective in dissolving and lifting these organic contaminants without causing damage to the underlying substrate. The ongoing push for higher wafer throughput and improved cleaning efficiency in both logic and memory fabrication ensures a sustained demand for both acid and alkaline cleaning chemistries, with their respective dominance shifting slightly based on the specific material being polished and the nature of the contaminants. The broader industry trend towards increased wafer starts and the continuous advancement in chip architectures ensures robust and sustained demand across these key segments in the APAC region.

The Post CMP cleaning industry's growth is catalyzed by the relentless demand for advanced semiconductors driven by emerging technologies like AI, 5G, and IoT. The continuous innovation in semiconductor fabrication, leading to smaller nodes and more complex architectures, necessitates increasingly sophisticated and effective cleaning solutions. Furthermore, government initiatives worldwide supporting domestic semiconductor manufacturing are creating substantial market opportunities.

This comprehensive report offers an in-depth analysis of the global Post CMP cleaning market, covering the historical period from 2019 to 2024 and projecting market trends through 2033, with the base and estimated year set at 2025. It meticulously analyzes key market insights, driving forces, and challenges. The report provides a granular breakdown of market segmentation by type (Acid Material, Alkaline Material) and application (Metal Impurities and Particles, Organic Residue), highlighting the dominance of the Asia-Pacific region. It identifies critical growth catalysts and profiles leading industry players. Furthermore, the report details significant developments and offers strategic recommendations, providing stakeholders with a complete understanding of the market landscape and future opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.1% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.1%.

Key companies in the market include Entegris, Versum Materials (Merck KGaA), Mitsubishi Chemical, Fujifilm, DuPont, Kanto Chemical, BASF, Solexir, Anjimirco Shanghai.

The market segments include Type, Application.

The market size is estimated to be USD 327 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Post CMP Cleaning," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Post CMP Cleaning, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.