1. What is the projected Compound Annual Growth Rate (CAGR) of the Plastic Carrier Tapes?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Plastic Carrier Tapes

Plastic Carrier TapesPlastic Carrier Tapes by Type (Polycarbonate, Polystyrene, Others, World Plastic Carrier Tapes Production ), by Application (Power Discrete Devices, Integrated Circuit, Optoelectronics, Others, World Plastic Carrier Tapes Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

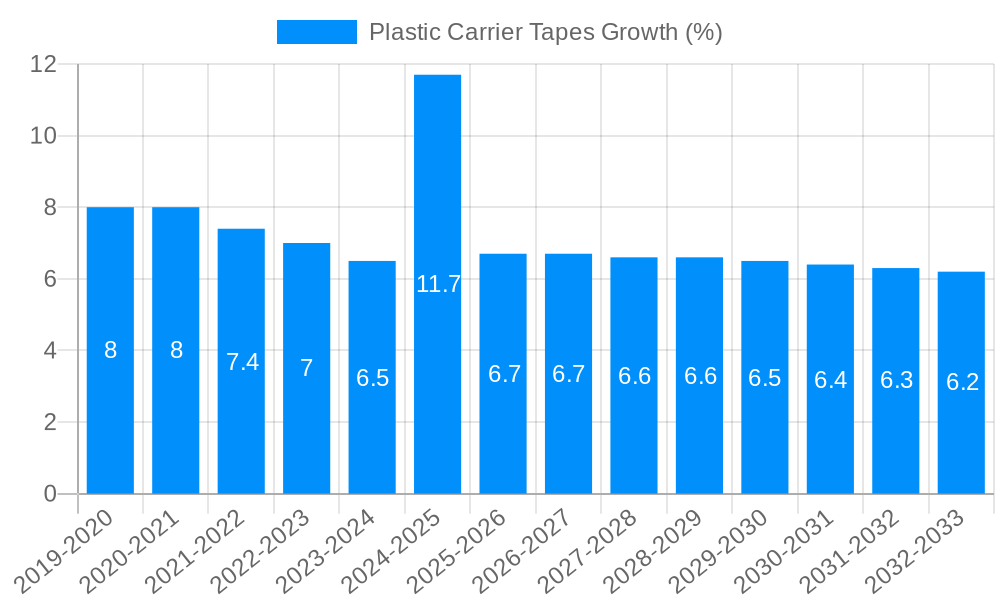

The global plastic carrier tapes market is poised for significant expansion, projected to reach an estimated \$1195 million by 2025. This robust growth is fueled by the escalating demand for advanced electronic components across a myriad of industries, including consumer electronics, automotive, telecommunications, and industrial automation. The burgeoning production of semiconductors and the increasing miniaturization of electronic devices necessitate high-precision packaging solutions, with plastic carrier tapes playing a pivotal role in protecting and transporting these delicate components during automated assembly processes. Key drivers include the continued innovation in integrated circuits, the rising adoption of power discrete devices in electric vehicles and renewable energy systems, and the rapid advancement in optoelectronic technologies powering next-generation displays and communication systems. The market is witnessing a pronounced shift towards more sustainable and high-performance materials, with polycarbonate and polystyrene tapes leading the pack due to their excellent durability, dimensional stability, and cost-effectiveness.

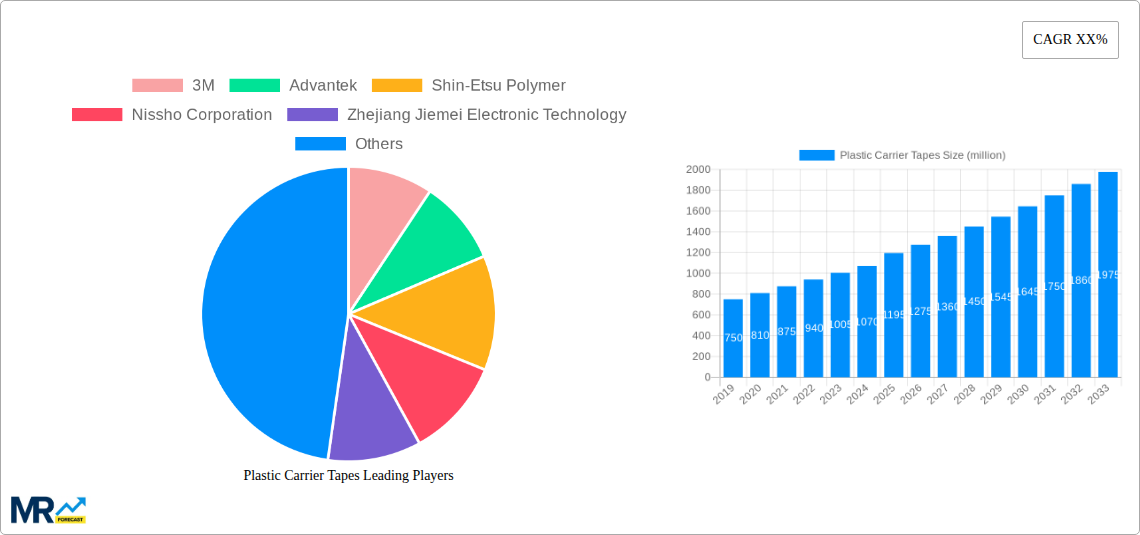

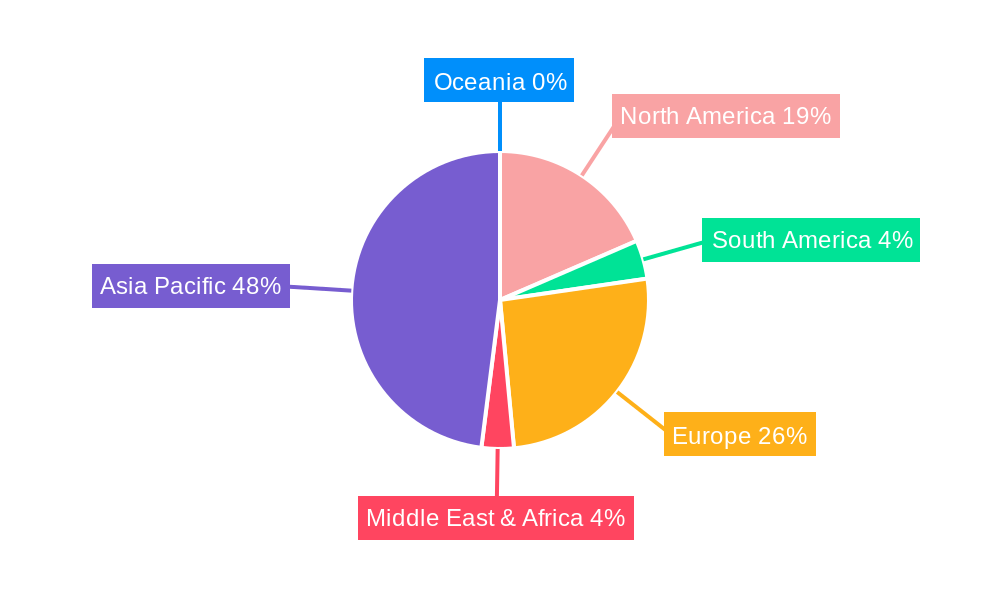

The competitive landscape is characterized by a dynamic interplay of established global players and emerging regional manufacturers, each vying for market share through product innovation, strategic partnerships, and capacity expansions. Companies like 3M, Advantek, and Shin-Etsu Polymer are at the forefront, leveraging their R&D capabilities to develop specialized tapes catering to specific application needs. While the market benefits from strong growth drivers, it also faces certain restraints. These include fluctuating raw material prices, particularly for polymers, which can impact manufacturing costs, and the increasing regulatory scrutiny regarding the environmental impact of plastics. However, the industry is actively exploring and implementing eco-friendly alternatives and advanced recycling initiatives to mitigate these concerns. Regionally, Asia Pacific is expected to dominate the market, driven by its significant manufacturing base for electronics and a growing domestic demand. North America and Europe also represent substantial markets, with a strong focus on high-end applications and technological advancements. The forecast period anticipates a healthy Compound Annual Growth Rate (CAGR) of approximately 7-9%, underscoring the sustained demand and evolving opportunities within the global plastic carrier tapes market.

This in-depth report provides a comprehensive analysis of the global Plastic Carrier Tapes market, projecting its trajectory from 2019 to 2033. Leveraging a robust Base Year of 2025 and an Estimated Year also of 2025, the study offers detailed insights for the Forecast Period of 2025-2033, built upon a thorough examination of the Historical Period from 2019-2024. The report delves into market dynamics, key growth drivers, prevailing challenges, regional dominance, and strategic developments, providing a crucial roadmap for stakeholders.

The market is segmented by Type into Polycarbonate, Polystyrene, and Others, and by Application into Power Discrete Devices, Integrated Circuits, Optoelectronics, and Others. We have meticulously analyzed the World Plastic Carrier Tapes Production volumes, with projections indicating significant expansion. For instance, the production of plastic carrier tapes, currently valued in the hundreds of millions of units, is expected to witness a substantial CAGR, driven by the burgeoning electronics manufacturing sector. The report quantifies production volumes in millions of units, offering precise market sizing and forecasting.

The global Plastic Carrier Tapes market is currently navigating a dynamic phase, characterized by an escalating demand for miniaturized and high-performance electronic components. This trend is directly translating into a growing need for sophisticated packaging solutions that can accommodate these intricate semiconductor devices. The study period of 2019-2033 encapsulates a significant evolutionary arc for the industry. We are observing a notable shift towards advanced materials within the Type segment, with Polycarbonate tapes gaining prominence due to their superior strength, clarity, and heat resistance, essential for delicate and high-temperature manufacturing processes. While Polystyrene remains a cost-effective option for certain applications, the industry is increasingly prioritizing performance and reliability, favoring materials that offer enhanced dimensional stability and anti-static properties to protect sensitive electronics from electrostatic discharge.

The Application segment is equally illustrative of prevailing trends. The exponential growth in the Integrated Circuit market, fueled by the proliferation of smartphones, IoT devices, and advanced computing, is a primary volume driver. Similarly, the Optoelectronics segment, encompassing LEDs, sensors, and photonic components, is experiencing robust expansion, necessitating specialized carrier tapes designed for precise component placement and protection. The Power Discrete Devices segment, while more mature, continues to demand reliable and cost-efficient packaging. Emerging applications within the 'Others' category, such as advanced sensors and MEMS devices, are also beginning to contribute to market diversification.

Furthermore, the World Plastic Carrier Tapes Production is being shaped by increasing globalization of electronics manufacturing. Key manufacturing hubs in Asia are not only major consumers but also significant producers of carrier tapes, fostering intense competition and innovation. The emphasis on sustainability is also emerging as a subtle but important trend, with manufacturers exploring recyclable and bio-based materials, though the immediate focus remains on performance and cost-effectiveness. The overall market sentiment, as analyzed across the Base Year of 2025 and the Forecast Period of 2025-2033, points towards sustained growth, driven by technological advancements in electronics and the continuous quest for improved packaging solutions. The production volume, currently in the millions of units, is projected to experience consistent upward momentum.

The relentless advancement in the semiconductor industry stands as the paramount driving force behind the expansion of the Plastic Carrier Tapes market. The continuous miniaturization of electronic components, exemplified by the relentless pursuit of smaller and more powerful Integrated Circuits, necessitates increasingly precise and protective packaging solutions. Carrier tapes, with their ability to securely house and transport these delicate devices through automated assembly lines, are indispensable. The burgeoning demand for consumer electronics, including smartphones, wearables, and home appliances, directly translates into a higher volume of semiconductor production, thereby escalating the requirement for carrier tapes.

Moreover, the rapid growth of the Internet of Things (IoT) ecosystem is a significant catalyst. Billions of interconnected devices, from smart home gadgets to industrial sensors, rely on a constant stream of electronic components. Each of these devices requires secure and efficient packaging during its manufacturing process, with carrier tapes playing a critical role. Similarly, the expansion of the automotive sector, with its increasing integration of advanced electronics for infotainment, safety, and autonomous driving, is another substantial contributor. The shift towards electric vehicles (EVs) further amplifies this, as they incorporate a higher density of sophisticated power and control electronics. The global production of plastic carrier tapes, currently measured in the hundreds of millions of units, is experiencing a substantial uplift due to these converging technological and market trends. The Forecast Period of 2025-2033 is expected to witness an acceleration of these drivers, leading to sustained market expansion.

Despite the robust growth trajectory, the Plastic Carrier Tapes market is not without its hurdles. One of the primary challenges revolves around the increasingly stringent quality control and performance demands from end-users. As electronic components become more sophisticated and sensitive, the tolerance for defects in carrier tapes, such as contamination, dimensional inaccuracies, or inadequate anti-static properties, diminishes. Meeting these ever-rising standards requires significant investment in advanced manufacturing processes and quality assurance protocols, impacting production costs.

Another significant restraint is the volatility in raw material prices. The production of plastic carrier tapes relies heavily on petrochemical-derived polymers like Polycarbonate and Polystyrene. Fluctuations in crude oil prices and the broader petrochemical market can directly affect the cost of these essential raw materials, thereby impacting the profitability margins of carrier tape manufacturers. This price volatility can also lead to increased operational expenses for businesses and potentially influence pricing strategies for end-users, creating market uncertainty. Furthermore, the evolving regulatory landscape concerning environmental impact and sustainability presents a long-term challenge. While the industry is gradually exploring more eco-friendly alternatives, the widespread adoption of such materials can be slow due to performance limitations, cost considerations, and the need for extensive qualification processes. The sheer volume of production, in the millions of units, amplifies the importance of these factors. The Study Period of 2019-2033 encompasses the growing awareness and implementation of such regulations.

The global Plastic Carrier Tapes market is poised for significant regional and segmental dominance, with Asia-Pacific emerging as the undisputed leader, driven by its unparalleled position as the world's manufacturing hub for electronics. Within this vast region, China stands out as the primary driver, accounting for a substantial portion of both production and consumption of plastic carrier tapes. This dominance is a direct consequence of the concentration of semiconductor assembly, testing, and packaging facilities within its borders. The country's robust domestic electronics industry, coupled with its role as a global manufacturing outsourcing destination, fuels an insatiable demand for carrier tapes to package a wide array of electronic components, from high-volume Integrated Circuits to specialized Optoelectronics. The sheer scale of production here, reaching into the hundreds of millions of units, underscores China's critical role.

Beyond China, other East Asian economies like South Korea, Taiwan, and Japan also play pivotal roles, specializing in advanced semiconductor manufacturing and innovation. These countries contribute significantly to the demand for high-precision and performance-driven carrier tapes, particularly for advanced Integrated Circuits and Optoelectronics. The United States and Europe represent significant markets for specialized applications and high-value components, with a focus on advanced Power Discrete Devices and niche Optoelectronics, but their overall production volume pales in comparison to Asia-Pacific.

From a segmental perspective, the Integrated Circuit (IC) application segment is projected to dominate the market in terms of volume and value throughout the Forecast Period of 2025-2033. The relentless growth in demand for ICs across virtually every electronic device, from smartphones and laptops to automotive systems and industrial equipment, makes this segment the primary volume driver. The continuous innovation in IC design and manufacturing, leading to smaller, more complex, and higher-density chips, necessitates specialized and high-quality carrier tapes. The Type segment of Polycarbonate is expected to witness significant growth and increasingly dominate the market share within the premium and high-performance applications due to its superior physical and thermal properties, crucial for protecting advanced ICs during manufacturing and transit. While Polystyrene will continue to hold a significant share in cost-sensitive segments, the trend towards higher performance is undeniably tilting the scales towards Polycarbonate. The World Plastic Carrier Tapes Production figures strongly reflect this IC-centric demand.

The Plastic Carrier Tapes industry is experiencing several potent growth catalysts. The accelerating adoption of 5G technology globally is driving demand for advanced semiconductor components, requiring specialized packaging solutions. The burgeoning automotive sector, particularly the shift towards electric and autonomous vehicles, is a significant driver, as these vehicles incorporate a higher density of electronic control units and power modules. Furthermore, the continued expansion of the Internet of Things (IoT) ecosystem, with billions of connected devices, necessitates a constant supply of packaged electronic components, thereby boosting carrier tape consumption. The Estimated Year of 2025 shows these catalysts already in full effect, shaping the Forecast Period of 2025-2033.

This comprehensive report offers an unparalleled deep dive into the global Plastic Carrier Tapes market, providing exhaustive coverage of trends, drivers, and future projections spanning the Study Period of 2019-2033. It meticulously analyzes market segmentation by Type (Polycarbonate, Polystyrene, Others) and Application (Power Discrete Devices, Integrated Circuit, Optoelectronics, Others), alongside detailed insights into World Plastic Carrier Tapes Production volumes, which are consistently quantified in millions of units. The report equips stakeholders with actionable intelligence to navigate the complexities of this vital industry, from identifying growth opportunities to mitigating potential challenges and understanding the competitive landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include 3M, Advantek, Shin-Etsu Polymer, Nissho Corporation, Zhejiang Jiemei Electronic Technology, NIPPO CO.,LTD, YAC GARTER, U-PAK, C-Pak, ePAK International, ROTHE, Sumitomo Bakelite, Tek Pak, Jiangyin Winpack, SEKISUI SEIKEI, Asahi Kasei, Kanazu Giken, Taiwan Carrier Tape Enterprise Co., Ltd, LaserTek, JSK Co.,Ltd, Miyata System, Hwa Shu Enterpris, Xiamen Hatro Electronics.

The market segments include Type, Application.

The market size is estimated to be USD 1195 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Plastic Carrier Tapes," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Plastic Carrier Tapes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.