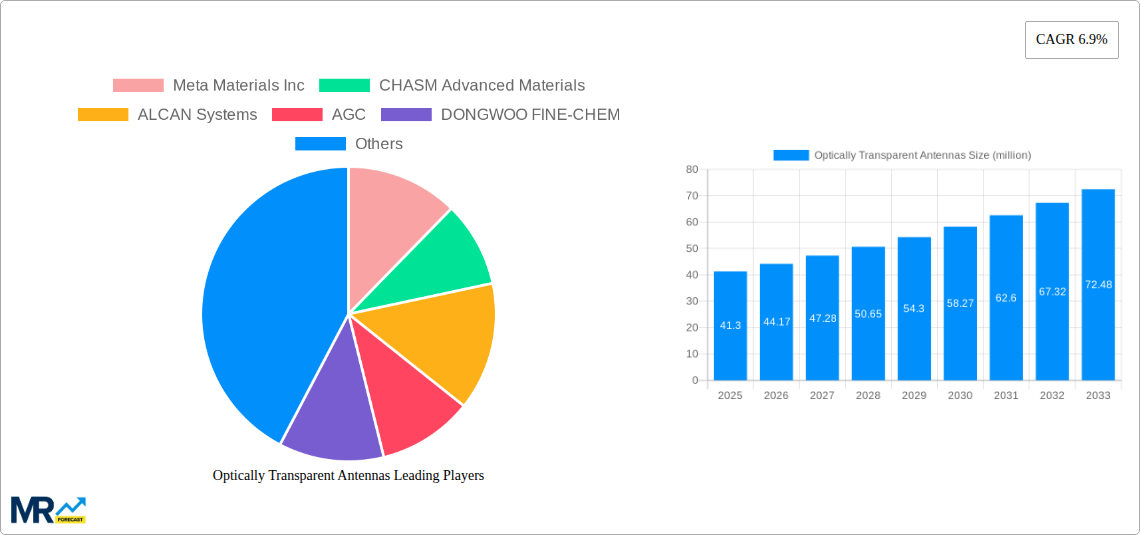

1. What is the projected Compound Annual Growth Rate (CAGR) of the Optically Transparent Antennas?

The projected CAGR is approximately 6.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Optically Transparent Antennas

Optically Transparent AntennasOptically Transparent Antennas by Type (90% Transparent, 98% Transparent, Others), by Application (Mobile Display Technologies, Automotive, Satellite, Smart Buildings, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The Optically Transparent Antennas market is poised for significant expansion, projected to reach a substantial market size of $41.3 million with a robust Compound Annual Growth Rate (CAGR) of 6.9% over the forecast period of 2025-2033. This impressive growth trajectory is fueled by burgeoning demand across several key applications, most notably in mobile display technologies and the automotive sector, where the integration of seamless and aesthetically pleasing connectivity solutions is becoming paramount. The increasing adoption of smart building technologies, alongside specialized applications in satellite communications, further bolsters market expansion. The market is characterized by a strong preference for highly transparent antenna types, with 90% and 98% transparent variants collectively dominating the landscape. This preference underscores the critical need for antennas that can be invisibly integrated into visual interfaces without compromising signal integrity, driving innovation in material science and manufacturing processes.

The market's dynamism is further shaped by several key drivers, including advancements in material science leading to more efficient and durable transparent conductive films, and the escalating demand for enhanced user experiences in connected devices. The miniaturization of electronic components and the rise of the Internet of Things (IoT) ecosystem are also significant catalysts. However, the market faces certain restraints, such as the relatively high cost of production for highly specialized transparent materials and the intricate manufacturing processes involved, which can impact widespread adoption, especially in price-sensitive segments. Despite these challenges, the future looks bright, with strategic investments in research and development by leading companies like Meta Materials Inc., CHASM Advanced Materials, and AGC, focusing on overcoming these hurdles and unlocking new application potentials. The Asia Pacific region, particularly China and Japan, is expected to emerge as a dominant force due to its strong manufacturing base and rapid technological adoption.

Here is a unique report description on Optically Transparent Antennas, incorporating your specified parameters:

This comprehensive report delves into the rapidly evolving market for optically transparent antennas, a transformative technology poised to redefine wireless communication integration. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025, this analysis provides an in-depth look at market dynamics, key trends, and future projections. The historical period of 2019-2024 has laid the groundwork, and the forecast period of 2025-2033 promises significant advancements and market expansion. The report meticulously examines various market segments, including antenna types (90% Transparent, 98% Transparent, and Others), diverse applications (Mobile Display Technologies, Automotive, Satellite, Smart Buildings, and Others), and crucial industry developments. With a projected market valuation in the millions of USD, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the burgeoning opportunities within the optically transparent antenna landscape.

The market for optically transparent antennas is experiencing a paradigm shift, driven by an insatiable demand for integrated and aesthetically pleasing wireless solutions across a multitude of applications. Over the historical period of 2019-2024, early adoption was primarily seen in niche sectors where visual integration was paramount, such as augmented reality (AR) and virtual reality (VR) devices, and some high-end consumer electronics. The base year of 2025 marks a crucial inflection point, with the technology maturing and demonstrating its potential to move beyond specialized applications into mainstream markets. A significant trend observed is the increasing demand for higher transparency levels, moving from the initial 90% transparency offerings towards the more advanced 98% transparent solutions. This pursuit of near-invisibility is critical for applications like mobile display technologies, where antennas need to be seamlessly integrated into the device without compromising screen real estate or visual clarity.

Furthermore, the trend towards miniaturization and the development of flexible, adaptable antenna designs is gaining momentum. As devices become more complex and compact, the ability to embed antennas within existing transparent surfaces, such as smartphone screens, automotive windshields, and smart building facades, becomes increasingly important. The report highlights the growing interest in multi-band and reconfigurable transparent antennas, capable of supporting a wider range of wireless protocols and adapting to changing signal environments. This trend is directly influenced by the expansion of 5G and the anticipated rollout of 6G technologies, which necessitate more sophisticated antenna capabilities. The study also points to a significant rise in research and development efforts focused on enhancing the conductive properties of transparent materials, improving antenna efficiency, and reducing signal loss, all of which are crucial for widespread market acceptance. The market is also witnessing a gradual shift from research-oriented development to commercialization, with an increasing number of companies investing in manufacturing capabilities and product development. This transition is expected to accelerate market growth throughout the forecast period of 2025-2033, driven by both technological advancements and increasing consumer and industry acceptance of this innovative antenna solution. The overall trend indicates a move towards ubiquitous wireless integration, where antennas become an invisible yet essential component of our connected world.

Several potent forces are propelling the growth of the optically transparent antennas market, transforming it from a niche concept into a significant technological frontier. The relentless evolution of mobile display technologies is a primary driver. As smartphones, tablets, and wearable devices become more immersive and bezel-less, the need for antennas that do not interfere with the visual experience is paramount. Optically transparent antennas offer a seamless solution, allowing for the integration of wireless connectivity directly within the display itself. This eliminates the need for bulky external antennas and enhances the aesthetic appeal of consumer electronics. The widespread adoption of 5G and the anticipation of 6G are also significant catalysts. These next-generation wireless technologies demand higher bandwidth, lower latency, and more complex antenna arrays. Optically transparent antennas, particularly those designed for higher frequencies, are well-suited to meet these demanding requirements, enabling efficient signal transmission and reception without compromising design integrity.

The burgeoning automotive sector is another key contributor. Modern vehicles are essentially connected hubs, requiring robust wireless communication for infotainment systems, advanced driver-assistance systems (ADAS), and vehicle-to-everything (V2X) communication. Optically transparent antennas can be integrated into windshields, windows, and other glass surfaces, providing discreet and effective antenna solutions. The growing emphasis on smart buildings and the Internet of Things (IoT) further fuels demand. Transparent antennas can be embedded within smart windows and building facades, facilitating seamless connectivity for a wide array of sensors, smart devices, and communication systems, enhancing building management, security, and user experience without visual intrusion. Finally, advancements in material science and manufacturing techniques are making optically transparent antennas more cost-effective and performant, further broadening their applicability and driving market expansion.

Despite the immense potential, the optically transparent antennas market faces several significant challenges and restraints that could temper its growth trajectory. A primary hurdle lies in achieving a delicate balance between optical transparency and radio frequency (RF) performance. As materials become more transparent, their conductive properties can sometimes be compromised, leading to signal attenuation, reduced efficiency, and increased insertion loss. This necessitates ongoing research and development to create novel materials and antenna designs that can offer both high transparency (approaching 98% and beyond) and robust RF performance across various frequency bands, especially for demanding applications like 5G and future wireless technologies.

Another key challenge is the cost of manufacturing. The advanced materials and intricate fabrication processes required for producing high-quality optically transparent antennas can be significantly more expensive than traditional antenna solutions. This higher cost can be a deterrent for widespread adoption, particularly in cost-sensitive consumer electronics markets or large-scale deployments in smart buildings. The scalability of manufacturing is also a concern. Producing these specialized antennas in large volumes to meet the demands of mass-market applications requires significant investment in new production lines and optimized manufacturing techniques. Furthermore, the long-term durability and reliability of these transparent antenna materials under various environmental conditions, such as extreme temperatures, humidity, and UV exposure, need to be thoroughly validated to ensure their suitability for long-term deployment in demanding applications like automotive and satellite communications. Finally, the standardization of optically transparent antenna technologies is still in its nascent stages, which can create interoperability issues and slow down market adoption as manufacturers and end-users await clearer industry guidelines and performance benchmarks.

The optically transparent antennas market is poised for significant growth, with several regions and segments demonstrating strong potential for market dominance. North America is expected to lead the charge, driven by its advanced technological infrastructure, significant investments in R&D, and a high concentration of key players in the semiconductor and telecommunications industries. The region's robust demand for cutting-edge mobile display technologies and rapid adoption of 5G services creates a fertile ground for optically transparent antennas. Furthermore, the growing automotive sector in North America, with its increasing integration of advanced connectivity features, will also contribute significantly to market expansion.

In terms of segmentation, the 98% Transparent antenna type is anticipated to be a dominant force. This higher level of transparency is crucial for applications where visual integration is paramount, such as the Mobile Display Technologies segment. As manufacturers of smartphones, tablets, and other portable devices strive for increasingly immersive and edge-to-edge displays, the demand for antennas that are virtually invisible will continue to surge. The ability to embed these high-transparency antennas directly into the display layers without compromising screen quality or user experience makes them indispensable for next-generation mobile devices. This segment is expected to experience substantial growth throughout the forecast period of 2025-2033, driven by consumer preference for sleeker, more integrated designs and the continuous innovation in display technology.

The Automotive segment also presents a substantial opportunity for market dominance, particularly for antennas integrated into vehicle glass. With the increasing sophistication of in-car connectivity, infotainment systems, and ADAS, the need for discreet and highly efficient antennas is paramount. Optically transparent antennas embedded in windshields and windows offer an ideal solution, maintaining the vehicle’s aesthetic appeal while ensuring reliable communication. The growing trend of connected and autonomous vehicles further amplifies this demand.

The Smart Buildings segment, while perhaps starting from a smaller base, holds immense long-term potential. As smart cities and IoT ecosystems expand, the ability to seamlessly integrate wireless connectivity into building envelopes, such as smart windows and facades, will become increasingly critical. Optically transparent antennas allow for the unobtrusive deployment of sensors and communication modules, contributing to energy efficiency, enhanced security, and improved occupant experience.

The Satellite segment, although more niche, will also see a rise in demand for optically transparent antennas, particularly in applications requiring lightweight and low-profile solutions where visibility might be a consideration, such as in specialized satellite terminals or communication payloads where integration with optical components is necessary.

The dominance across these segments and regions will be shaped by the continuous innovation in material science, manufacturing processes, and the increasing penetration of advanced wireless technologies. The interplay between these factors will define the market landscape for optically transparent antennas in the coming years, with the 98% transparent solutions leading the way in visually sensitive applications.

The optically transparent antennas industry is fueled by several powerful growth catalysts. The escalating demand for seamless device integration, particularly in mobile display technologies, is a primary driver, as consumers and manufacturers prioritize aesthetics and immersive user experiences. The rapid expansion of 5G and the looming advent of 6G technologies necessitate advanced antenna solutions that can be unobtrusively integrated into various form factors. Furthermore, the increasing connectivity demands in the automotive sector for infotainment and autonomous driving, coupled with the rise of smart buildings and IoT, are creating new avenues for optically transparent antenna deployment. Advancements in material science and manufacturing efficiencies are also reducing costs and improving performance, making these antennas more accessible and attractive for a wider range of applications.

This report offers a deep dive into the optically transparent antennas market, providing a holistic view of its trajectory. It meticulously analyzes the historical performance (2019-2024) and forecasts future growth (2025-2033) with a base year of 2025. The report examines key trends, driving forces such as the evolution of mobile display technologies and 5G expansion, and the challenges that need to be addressed, including RF performance and cost. It also identifies dominant regions and segments, with a particular focus on the potential of 98% transparent antennas in mobile display technologies and automotive applications. Furthermore, the report highlights critical growth catalysts and provides a comprehensive overview of leading industry players and their significant recent and projected developments. This detailed analysis ensures stakeholders are equipped with the knowledge to navigate and capitalize on this dynamic and innovative market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.9% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.9%.

Key companies in the market include Meta Materials Inc, CHASM Advanced Materials, ALCAN Systems, AGC, DONGWOO FINE-CHEM, Dengyo, VENTI Group, Taoglas, Nippon Electric Glass, Kreemo (and Sivers Semiconductors).

The market segments include Type, Application.

The market size is estimated to be USD 41.3 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Optically Transparent Antennas," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Optically Transparent Antennas, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.