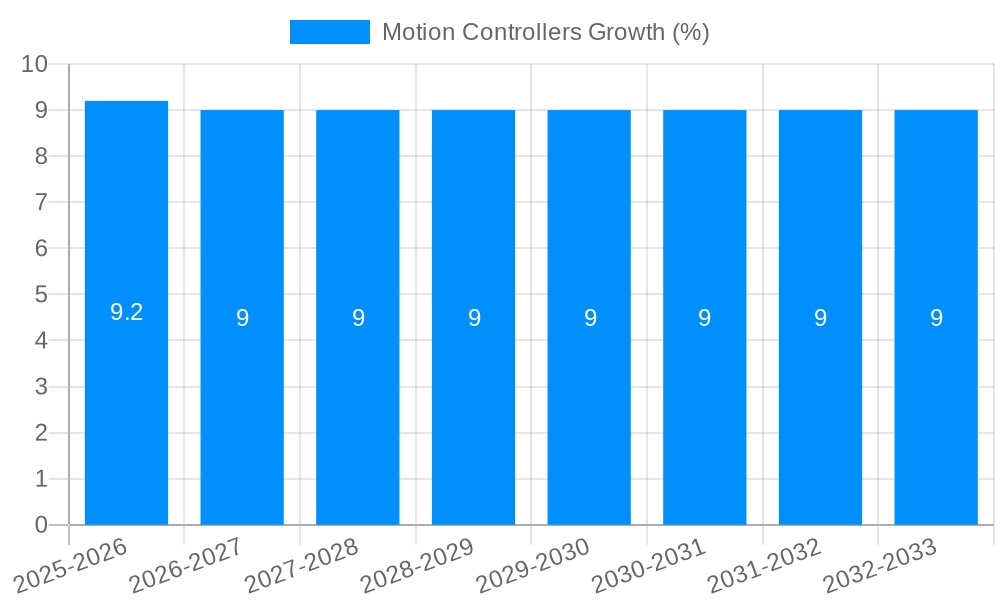

1. What is the projected Compound Annual Growth Rate (CAGR) of the Motion Controllers?

The projected CAGR is approximately 9.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Motion Controllers

Motion ControllersMotion Controllers by Type (PLC-based, Standalone, PC-based, PAC-based), by Application (Machine Tool, Packaging, Textile, HVAC, Food and Beverage, Automobile, 3C, Electronics and Semiconductor, Elevator, Metal and Mining), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

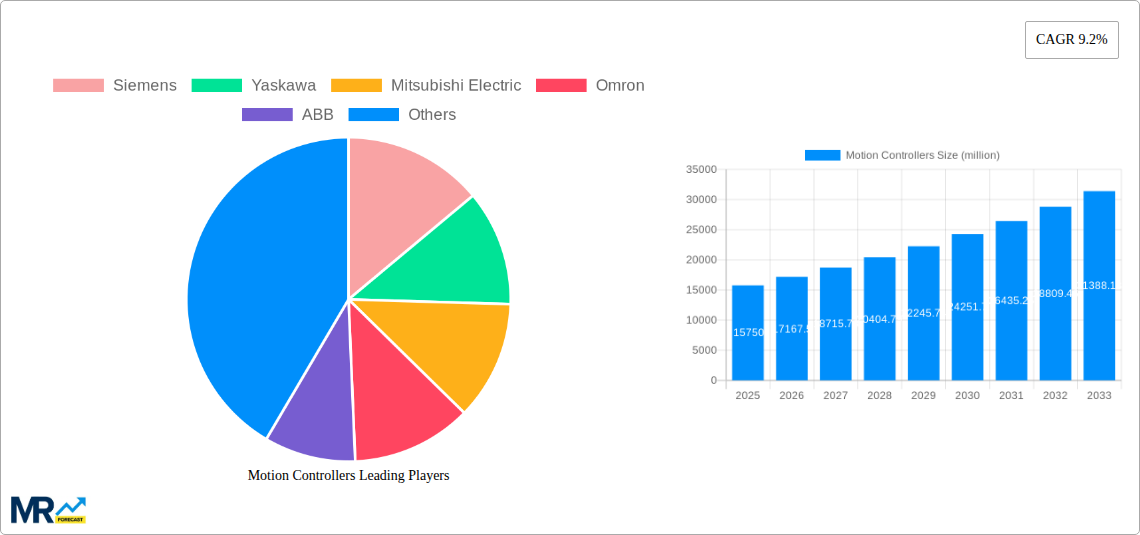

The global Motion Controllers market is poised for substantial expansion, with a current market size of approximately $15,750 million and a projected Compound Annual Growth Rate (CAGR) of 9.2% over the forecast period of 2025-2033. This robust growth is fueled by the increasing demand for automation across a multitude of industries, driven by the need for enhanced precision, efficiency, and productivity. Key applications like Machine Tool, Packaging, and Automobile are at the forefront of this adoption, leveraging advanced motion control solutions for sophisticated manufacturing processes. The proliferation of smart factories and Industry 4.0 initiatives further accelerates this trend, necessitating sophisticated motion control systems for seamless integration and optimized performance. Emerging economies, particularly in the Asia Pacific region, are anticipated to be significant growth engines due to rapid industrialization and substantial investments in automation technologies.

The market is characterized by a diverse range of motion controller types, including PLC-based, Standalone, PC-based, and PAC-based solutions, each catering to specific application needs and complexity levels. While advancements in technology and the growing adoption of robotics and collaborative robots present significant opportunities, certain factors could act as restraints. These may include the high initial investment costs for sophisticated systems and a potential shortage of skilled labor capable of implementing and managing these advanced technologies. Despite these challenges, the inherent benefits of motion controllers in improving operational efficiency, reducing waste, and enabling complex manufacturing tasks ensure a positive trajectory for the market. Leading players such as Siemens, Yaskawa, Mitsubishi Electric, and Omron are actively innovating, introducing advanced features and expanding their product portfolios to meet the evolving demands of this dynamic sector. The competitive landscape is marked by strategic collaborations, mergers, and acquisitions aimed at enhancing market reach and technological capabilities.

This report offers a definitive analysis of the global Motion Controllers market, spanning a comprehensive Study Period from 2019 to 2033, with a dedicated focus on the Base Year 2025 and an extensive Forecast Period from 2025 to 2033, building upon Historical Period data from 2019-2024. The market is expected to witness significant growth, driven by an increasing demand for automation across various industries. The report provides granular insights into market size projections, estimated to reach tens of millions of dollars by the end of the forecast period.

XXX The global Motion Controllers market is experiencing a profound transformation, characterized by the increasing integration of advanced technologies and a widening array of applications. A key trend is the burgeoning demand for intelligent and integrated motion control solutions, moving beyond basic single-axis control to sophisticated multi-axis coordination and synchronization. This shift is largely fueled by the growing adoption of Industry 4.0 principles, where connected devices and data analytics are paramount. Consequently, there's a palpable increase in the development and deployment of PC-based and PAC-based controllers, offering greater flexibility, processing power, and integration capabilities with higher-level enterprise systems. The rise of AI and machine learning within motion control is another significant development, enabling predictive maintenance, adaptive control algorithms, and enhanced operational efficiency. Furthermore, the market is witnessing a trend towards miniaturization and modularity, allowing for more compact and scalable automation solutions, particularly crucial for industries like 3C, Electronics and Semiconductor, and Packaging. The increasing emphasis on energy efficiency is also driving innovation, with manufacturers developing motion controllers that optimize power consumption without compromising performance. The digital twin concept is gaining traction, enabling virtual simulation and optimization of motion control systems before physical deployment, thus reducing commissioning time and costs. The proliferation of collaborative robots (cobots) is also a substantial driver, necessitating precise and safe motion control that can operate alongside human workers. This necessitates controllers with advanced safety features and intuitive programming interfaces. The report meticulously analyzes these trends, providing market size estimates, growth projections, and strategic recommendations based on data from 2019 to 2033, with a detailed focus on the Base Year 2025.

The motion controllers market is experiencing robust growth, propelled by a confluence of powerful drivers that are reshaping industrial automation landscapes. Foremost among these is the relentless pursuit of enhanced productivity and operational efficiency across all manufacturing sectors. As businesses strive to optimize production cycles, reduce waste, and meet increasingly demanding output targets, the need for precise, reliable, and intelligent motion control systems becomes paramount. This is particularly evident in industries like Automobile, 3C, Electronics and Semiconductor, and Packaging, where high-speed, synchronized movements are critical for complex assembly lines and intricate manufacturing processes. The global push towards advanced automation and the widespread adoption of Industry 4.0 initiatives are further accelerating this trend. Motion controllers, as the central nervous system of automated machinery, are indispensable for realizing the vision of smart factories, enabling seamless data flow, real-time monitoring, and decentralized control. Furthermore, the growing demand for sophisticated robotics, including industrial robots and collaborative robots (cobots), directly fuels the motion controller market. These robotic systems rely heavily on advanced motion control algorithms for accurate path planning, dynamic movement, and safe interaction with their environment and human operators. The continuous innovation in actuator technology, sensors, and communication protocols also contributes significantly, as newer, more capable motion controllers are developed to leverage these advancements. Finally, government initiatives promoting industrial modernization and digitalization in various regions are creating a favorable ecosystem for market expansion.

Despite the promising growth trajectory, the motion controllers market is not without its hurdles and limitations. A significant challenge lies in the increasing complexity of integration. As motion control systems become more sophisticated and interconnected with other automation components and enterprise-level software, ensuring seamless interoperability and data exchange can be a considerable undertaking. This complexity often requires specialized expertise and can lead to longer implementation times and higher upfront costs for end-users, particularly for small and medium-sized enterprises. The rapid pace of technological evolution also presents a challenge, as companies must constantly invest in R&D and software updates to remain competitive and to ensure their products remain compatible with emerging standards and functionalities. Cybersecurity concerns are also on the rise. With motion controllers becoming increasingly networked, protecting them from cyber threats, data breaches, and unauthorized access is critical, demanding robust security protocols and ongoing vigilance. The shortage of skilled personnel capable of designing, implementing, and maintaining advanced motion control systems can also act as a restraint, hindering the adoption of cutting-edge solutions in certain regions. Furthermore, the initial investment cost for high-performance motion controllers can be a significant barrier for some market segments, especially when compared to simpler, legacy automation solutions. The need for standardization across different manufacturers and communication protocols, while improving, still presents some fragmentation that can complicate system design and procurement.

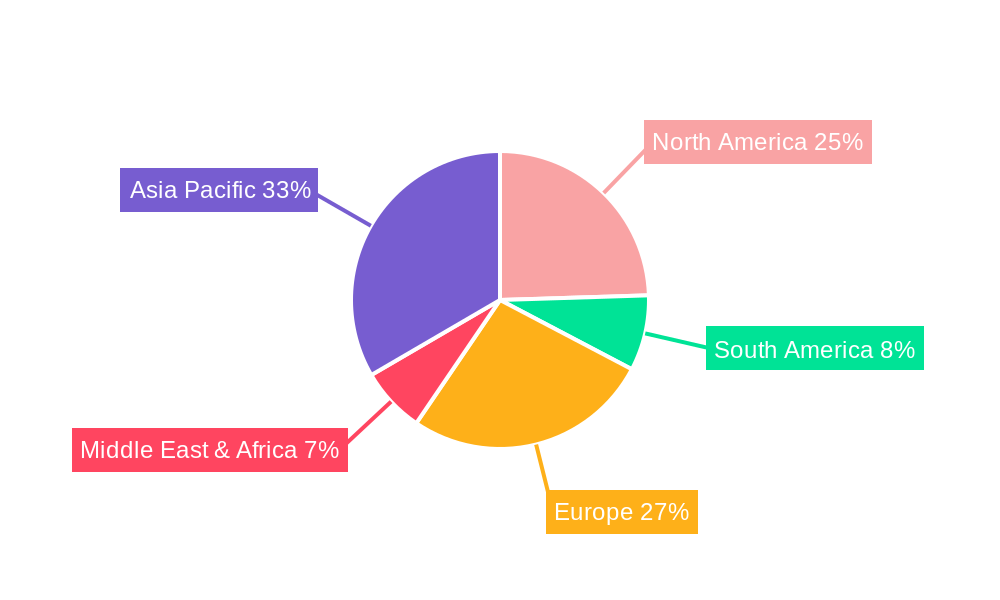

The global motion controllers market is poised for significant growth, with specific regions and segments demonstrating a clear propensity to dominate the landscape.

Asia Pacific is projected to emerge as the leading region in the motion controllers market. This dominance is primarily attributed to the region's robust manufacturing base, particularly in countries like China, South Korea, and Japan. The rapid industrialization, coupled with substantial government investments in automation and smart manufacturing initiatives, fuels a relentless demand for advanced motion control solutions. The burgeoning 3C, Electronics and Semiconductor sector, a major consumer of sophisticated automation, is heavily concentrated in this region, driving the adoption of high-performance controllers for intricate assembly processes. The automotive industry's expansion and the increasing localization of production further bolster demand. China, in particular, stands out due to its vast manufacturing ecosystem and its strategic focus on technological self-sufficiency. The presence of numerous domestic motion controller manufacturers, such as Shenzhen Inovance Technology, Shanghai Moons' Electric, and Estun Automation, also contributes to the region's market strength and competitive dynamism. The sheer volume of production and the continuous drive for cost optimization in these industries ensure a sustained demand for a wide range of motion controller types.

Within the Application segment, Electronics and Semiconductor and Automobile are expected to be the key dominators.

This dual dominance of Asia Pacific and the Electronics and Semiconductor and Automobile application segments underscores the global shift towards advanced automation, precision manufacturing, and the ongoing technological revolution across key industries.

The motion controllers industry is experiencing a significant growth spurt fueled by several key catalysts. The escalating adoption of Industry 4.0 and smart manufacturing principles globally is a primary driver, demanding more intelligent and connected control systems. The burgeoning robotics sector, encompassing both industrial and collaborative robots, directly translates to increased demand for sophisticated motion controllers. Furthermore, the continuous innovation in actuator and sensor technologies allows for the development of more precise and efficient motion control solutions, expanding their applicability across new use cases. The growing emphasis on energy efficiency in industrial operations also encourages the adoption of advanced controllers that optimize power consumption.

This comprehensive report delves into the intricate dynamics of the global Motion Controllers market, offering a forward-looking perspective from 2019 to 2033, with a pivotal Base Year of 2025 and an in-depth Forecast Period spanning 2025-2033. The analysis encompasses a thorough examination of market size projections, estimated to reach tens of millions of dollars by the conclusion of the forecast period. It dissects the key trends shaping the industry, such as the integration of AI and machine learning, the growing demand for intelligent and connected solutions, and the impact of Industry 4.0 on automation strategies. The report also meticulously analyzes the driving forces behind market expansion, including the relentless pursuit of productivity, the growth of robotics, and advancements in related technologies. Conversely, it sheds light on the prevailing challenges and restraints, such as integration complexity, the rapid pace of technological change, and cybersecurity concerns, providing a balanced view of the market landscape. Crucially, the report identifies the dominant regions and segments poised for significant growth, offering strategic insights for stakeholders. Leading players are profiled, alongside a timeline of significant developments that have shaped and continue to shape the motion controllers sector. This report serves as an indispensable resource for understanding the current state and future trajectory of the motion controllers market, offering actionable intelligence for businesses operating within or looking to enter this dynamic industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.2% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 9.2%.

Key companies in the market include Siemens, Yaskawa, Mitsubishi Electric, Omron, ABB, Shenzhen Inovance Technology, LS Electric, Emerson, Schneider Electric, Bosch, Delta Electronics, Parker Hannifin, Kollmorgen (Regal Rexnord), Physik Instrumente (PI), Advanced Micro Controls Inc (AMCI), Newport (MKS Instruments), Panasonic, Galil Motion Control, Moog, Oriental Motor, Aerotech, Advantech, Autonics, ICP DAS, Estun Automation, Shanghai Moons' Electric, Googol Technology, Zhejiang Hechuan Technology, Shenzhen Zmotion Technology, Suzhou Veichi Electric, Leadshine Technology, Shanghai BOCHU Electronic Technology, Kinco Electric, Chengdu Leetro Automation, Shenzhen Vector, Shenzhen Gaochuan Automation Technology.

The market segments include Type, Application.

The market size is estimated to be USD 15750 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Motion Controllers," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Motion Controllers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.