1. What is the projected Compound Annual Growth Rate (CAGR) of the Micro AR-HUD PGU Module?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Micro AR-HUD PGU Module

Micro AR-HUD PGU ModuleMicro AR-HUD PGU Module by Type (TFT-LCD Solution, DLP Solution, LCOS Solution, LBS Solution), by Application (Sedan, SUV), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

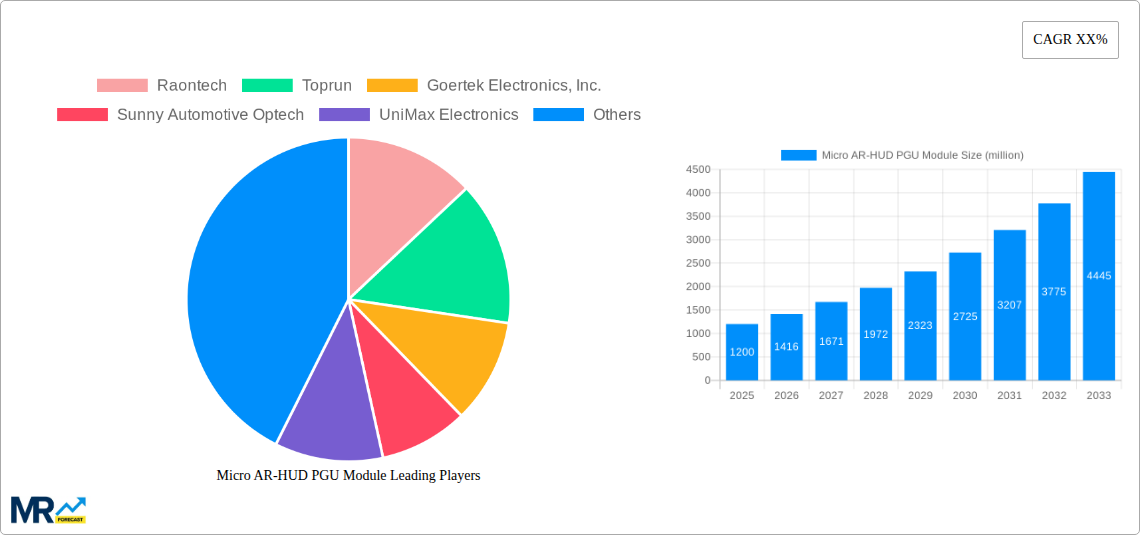

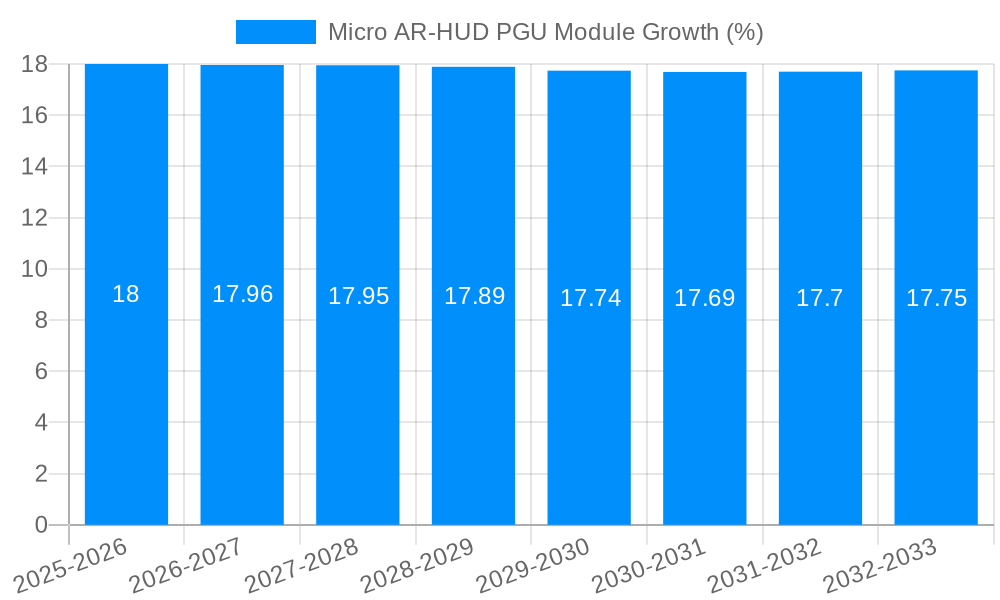

The global Micro AR-HUD PGU Module market is poised for significant expansion, with an estimated market size of approximately USD 1,200 million in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of around 18% through 2033. This robust growth is primarily propelled by the increasing demand for advanced driver-assistance systems (ADAS) and augmented reality (AR) functionalities in vehicles, enhancing both safety and the in-car experience. Key drivers include the escalating adoption of sophisticated display technologies like TFT-LCD and DLP solutions, which offer superior brightness, contrast, and resolution crucial for AR overlays. The automotive industry's relentless pursuit of innovation, coupled with rising consumer expectations for connected and intelligent vehicles, is further fueling this upward trajectory. The market is experiencing a transformative shift, with manufacturers actively integrating Micro AR-HUD PGU Modules into a wider range of vehicles, from sedans to SUVs, to offer immersive navigation, real-time information, and enhanced safety features.

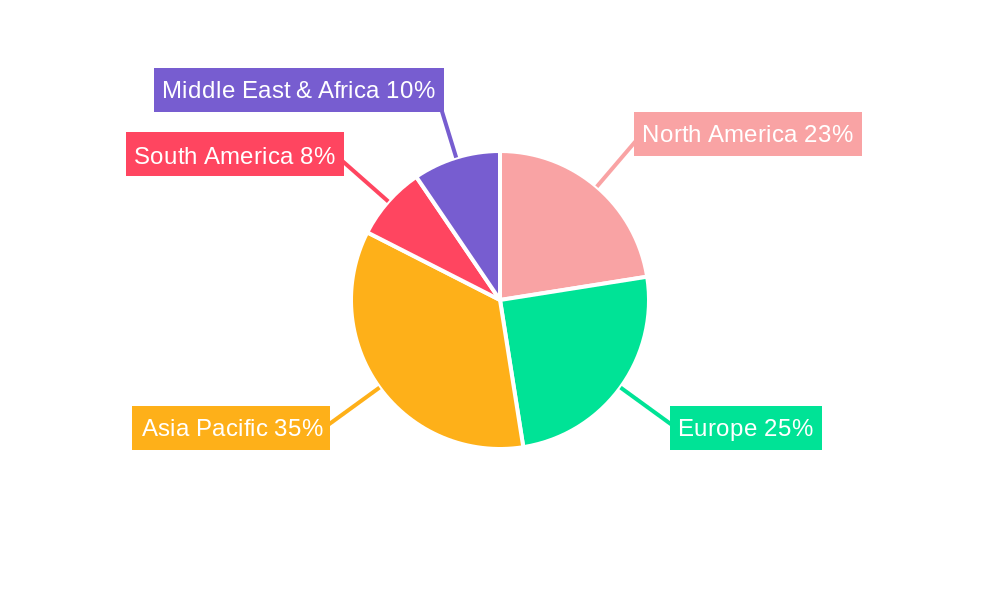

The market landscape is characterized by intense competition and ongoing technological advancements. Key players like Raontech, Goertek Electronics, Inc., and Sunny Automotive Optech are at the forefront, investing heavily in research and development to refine their PGU modules for improved performance and cost-effectiveness. While the market presents substantial opportunities, certain restraints such as the high initial cost of integration for some advanced solutions and the need for standardization across automotive platforms could temper immediate widespread adoption. However, the prevailing trend towards miniaturization and increased efficiency in PGU module technology, alongside the growing emphasis on in-car entertainment and personalized driving experiences, is expected to outweigh these challenges. The Asia Pacific region, particularly China, is anticipated to dominate the market due to its strong automotive manufacturing base and rapid technological adoption. Europe and North America also represent significant markets, driven by stringent safety regulations and a high consumer appetite for advanced automotive features.

This report provides an in-depth analysis of the global Micro Augmented Reality Head-Up Display (AR-HUD) Projection Guidance Unit (PGU) Module market. The study encompasses a comprehensive examination of market trends, driving forces, challenges, regional dynamics, leading players, and significant developments from the historical period of 2019-2024, with a base year of 2025 and a forecast period extending to 2033. The report leverages extensive primary and secondary research, incorporating insights from industry experts and financial data for companies.

The global Micro AR-HUD PGU Module market is experiencing a significant evolutionary phase, driven by an increasing demand for advanced driver-assistance systems (ADAS) and enhanced in-car user experiences. From 2019 to 2024, the market witnessed nascent adoption, primarily in premium vehicle segments. However, the base year of 2025 marks a pivotal point where cost reductions in component manufacturing and advancements in projection technology are democratizing AR-HUD capabilities. We project a compound annual growth rate (CAGR) of approximately 25% during the forecast period of 2025-2033, with the market valuation expected to surge from an estimated USD 750 million in 2025 to over USD 3,500 million by 2033. This growth is underpinned by several key trends. The miniaturization of PGU modules is paramount, enabling seamless integration into existing vehicle dashboards and windshields without compromising interior aesthetics. Furthermore, the shift towards higher resolution and wider field-of-view projections is enhancing the immersive and informative nature of AR overlays, moving beyond basic speed and navigation cues to include dynamic hazard warnings, lane guidance, and points of interest directly within the driver's line of sight. The report delves into the increasing adoption of diverse display technologies, with TFT-LCD solutions gaining traction due to their cost-effectiveness, while LCOS and DLP solutions offer superior image quality and brightness, catering to different market segments and performance demands. The integration of AI and sophisticated algorithms to interpret real-world scenarios and overlay relevant information is another critical trend, promising a more intuitive and safer driving experience. The penetration of AR-HUD technology into mid-range and even some compact vehicle segments is anticipated to be a major driver of volume growth throughout the study period.

The burgeoning Micro AR-HUD PGU Module market is fueled by a confluence of compelling driving forces, primarily centered on enhanced safety and the evolving expectations of vehicle occupants. Governments worldwide are increasingly mandating advanced safety features in vehicles, directly impacting the demand for AR-HUD systems as they offer a crucial platform for delivering critical driver alerts, such as forward collision warnings, blind-spot detection, and pedestrian detection, in an immediately perceivable manner. This heightened emphasis on road safety, coupled with a growing consumer awareness of these benefits, is a significant propellant. Moreover, the automotive industry's relentless pursuit of innovation and differentiation is pushing manufacturers to incorporate cutting-edge technologies that elevate the in-car experience. AR-HUDs, with their ability to project a wealth of information seamlessly into the driver's field of view, are at the forefront of this innovation wave, transforming the traditional dashboard into an interactive and intelligent interface. The proliferation of sophisticated navigation systems, coupled with the desire for a clutter-free and minimalist interior design, further reinforces the appeal of AR-HUDs. By eliminating the need for drivers to divert their gaze to separate screens or handheld devices, AR-HUDs contribute to reduced driver distraction and improved situational awareness, making them a highly sought-after feature in modern vehicles.

Despite the robust growth trajectory, the Micro AR-HUD PGU Module market is not without its challenges and restraints, which could temper the pace of widespread adoption. The initial cost of integrating AR-HUD systems remains a significant barrier for mass-market penetration. While prices are declining, the premium associated with these advanced modules can still make them a prohibitive feature for entry-level and mid-range vehicle segments. This cost factor is particularly pronounced when considering the inclusion of sophisticated optics, high-resolution displays, and powerful processing units required for advanced AR functionalities. Furthermore, the complexity of system integration presents another hurdle. Ensuring seamless and reliable operation of AR-HUD modules within a vehicle's existing electronic architecture, including compatibility with various sensor inputs and software platforms, requires significant engineering effort and development time. The calibration of AR overlays to maintain accuracy under diverse lighting conditions, road surfaces, and driving speeds also poses a technical challenge. Consumer education and awareness about the full capabilities and benefits of AR-HUD technology are also still developing. Many potential buyers may not fully comprehend the advanced safety and convenience features offered, leading to a hesitant adoption rate. Lastly, evolving regulatory landscapes surrounding driver distraction and the display of information in vehicles could introduce further complexities and potential constraints on the design and implementation of AR-HUD systems.

The global Micro AR-HUD PGU Module market is poised for substantial growth, with certain regions and specific technology segments set to lead this expansion. Asia Pacific, particularly China, is emerging as a dominant force, driven by its massive automotive manufacturing base, burgeoning domestic demand for advanced vehicle features, and significant government investments in automotive technology innovation. Chinese automakers are rapidly adopting AR-HUD technology to compete on a global scale, and the presence of key players like Goertek Electronics, Inc., Zhejiang Crystal-Optech, and Shenzhen Raythink further solidifies the region's dominance. The region's robust supply chain for display technologies and optical components also contributes to its leading position.

In terms of dominant segments, the TFT-LCD Solution for Micro AR-HUD PGU modules is expected to capture a significant market share, especially in the initial to mid-forecast period.

TFT-LCD Solution: This segment is favored due to its established manufacturing infrastructure, relatively lower cost of production, and continuous improvements in brightness, resolution, and color reproduction. Companies like Raontech and UniMax Electronics are actively developing and supplying advanced TFT-LCD based PGU modules. The increasing integration of TFT-LCD displays in mid-range vehicles, driven by cost-effectiveness without significant compromise on essential AR functionalities, makes this segment a prime driver of volume growth. The report forecasts TFT-LCD solutions to account for approximately 45% of the market revenue by 2033.

Sedan Application: Within the application segments, the Sedan category is anticipated to be a leading contributor to the Micro AR-HUD PGU Module market. Sedans, being a ubiquitous vehicle type globally, offer a vast addressable market. As AR-HUD technology becomes more affordable and its benefits more widely recognized, manufacturers are increasingly incorporating these systems into popular sedan models to enhance their appeal and competitiveness. This segment is expected to contribute over 40% of the total market revenue by the end of the forecast period.

SUV Application: The SUV segment also presents a substantial growth opportunity, driven by its increasing popularity and the segment's tendency to adopt premium and technologically advanced features. Consumers purchasing SUVs often seek enhanced safety and convenience features, making AR-HUDs a highly desirable addition. The report projects SUVs to represent a significant portion of the market, with an estimated 30% market share by 2033.

The Micro AR-HUD PGU Module industry is being propelled by several key growth catalysts. The increasing integration of Artificial Intelligence (AI) and machine learning within AR systems to enable predictive safety alerts and personalized driver experiences is a major catalyst. Furthermore, the growing demand for advanced driver-assistance systems (ADAS) that integrate seamlessly with AR-HUDs, providing intuitive visual cues for navigation, lane keeping, and hazard warnings, is significantly boosting market adoption. The continuous innovation in optical technologies, leading to smaller, more efficient, and brighter PGU modules, is also a crucial growth driver, making these systems more feasible for a wider range of vehicles.

This comprehensive report offers an exhaustive examination of the Micro AR-HUD PGU Module market, providing invaluable insights for stakeholders across the value chain. It details market segmentation by type (TFT-LCD, DLP, LCOS, LBS), application (Sedan, SUV, Industry), and region. The report analyzes market dynamics, including growth drivers, restraints, opportunities, and challenges, with a specific focus on the interplay between technological advancements and consumer demand. Furthermore, it presents detailed company profiles of leading players, historical market data (2019-2024), base year estimations (2025), and robust forecasts (2025-2033), empowering businesses with the data necessary for strategic decision-making and market positioning.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Raontech, Toprun, Goertek Electronics, Inc., Sunny Automotive Optech, UniMax Electronics, Zhejiang Crystal-Optech, Shenzhen Raythink.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Micro AR-HUD PGU Module," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Micro AR-HUD PGU Module, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.