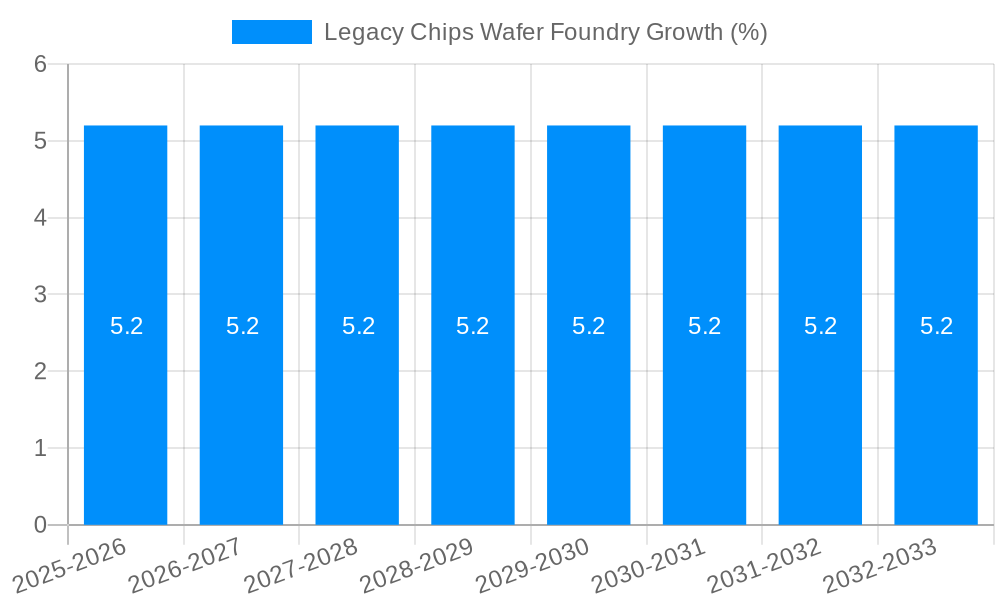

1. What is the projected Compound Annual Growth Rate (CAGR) of the Legacy Chips Wafer Foundry?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Legacy Chips Wafer Foundry

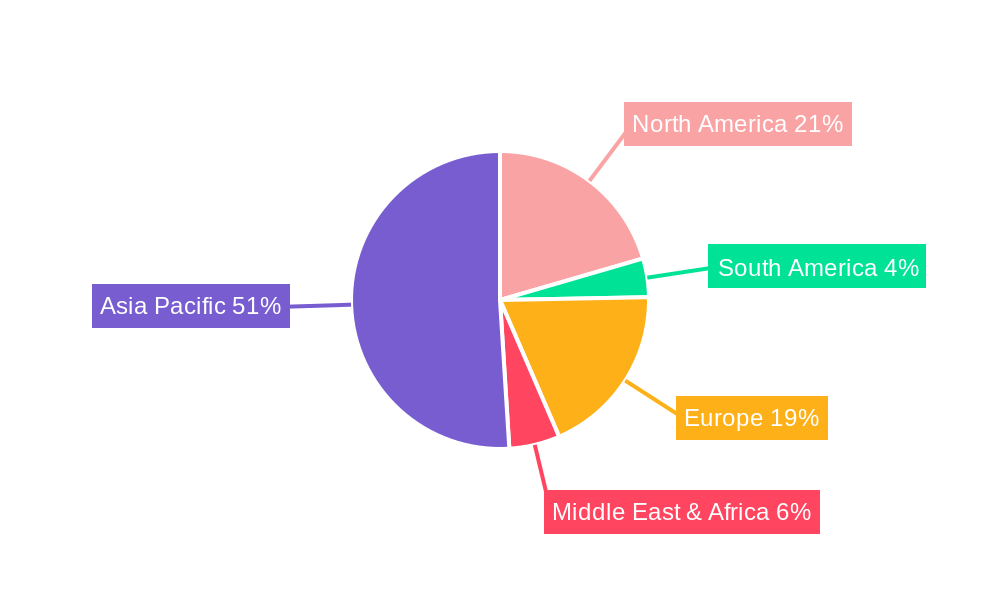

Legacy Chips Wafer FoundryLegacy Chips Wafer Foundry by Application (Consumer & Mobile, Internet of Things (IoT), Automotive, Industrial, Others, World Legacy Chips Wafer Foundry Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

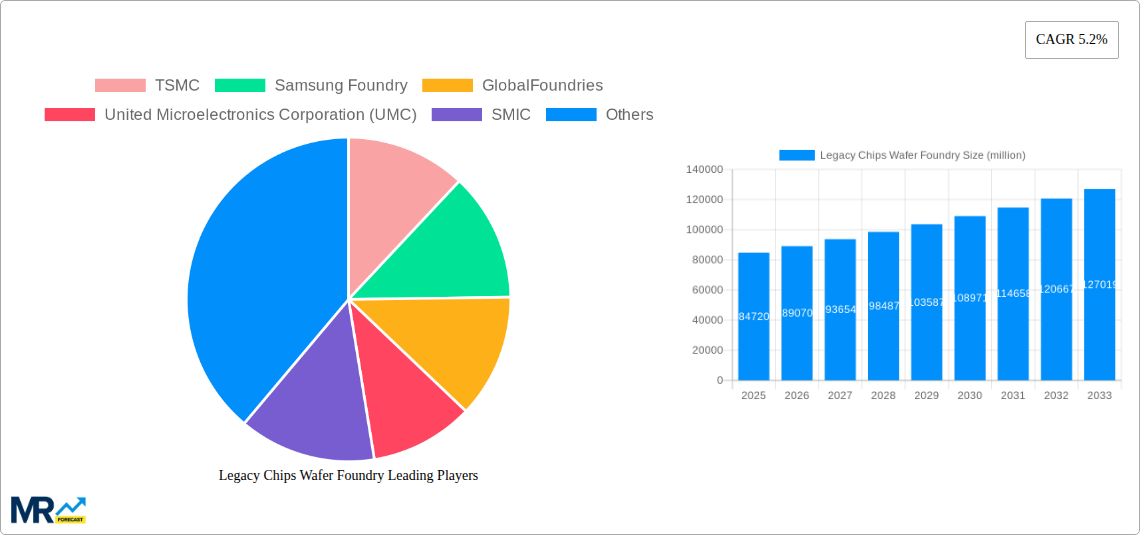

The Legacy Chips Wafer Foundry market, valued at $84,720 million in 2025, is experiencing steady growth driven by the persistent demand for mature node chips across various applications. Consumer electronics and the Internet of Things (IoT) are significant contributors, fueled by the increasing adoption of smart devices and connected technologies. The automotive industry's reliance on legacy chips for safety and control systems also contributes to market expansion. While advancements in cutting-edge semiconductor technology are attracting significant investment, the need for cost-effective solutions and the vast installed base of legacy chip-dependent systems ensure continued relevance for mature nodes. This demand sustains a robust market for legacy chip wafer foundries, prompting ongoing investment in capacity and process optimization within this segment. Geographic distribution reflects established manufacturing hubs in Asia, especially in China, Taiwan, and South Korea, along with significant presence in North America and Europe. However, the market faces constraints such as fluctuating commodity prices and potential geopolitical disruptions, which impact production costs and supply chains. The competitive landscape is characterized by a mix of large established players like TSMC and Samsung Foundry alongside several smaller, specialized foundries, each aiming to cater to specific niches within the mature node market.

Over the forecast period (2025-2033), the market's growth trajectory will be influenced by factors such as evolving technological advancements (potentially leading to further niche specialization), governmental policies promoting domestic semiconductor manufacturing, and the long-term outlook for various end-use sectors. The continuous innovation in production processes and manufacturing efficiency will be crucial in maintaining cost competitiveness. Furthermore, mergers, acquisitions, and strategic partnerships among players could reshape the market dynamics, leading to further consolidation and specialization. A thorough understanding of regional economic trends, regulatory landscapes, and technological advancements is crucial for effective market participation and forecasting. Industry watchers anticipate continued growth, albeit at a potentially moderating pace, driven by specific market segments and geographical locations. The ongoing demand for reliable, cost-effective legacy chips across numerous applications solidifies the market's long-term viability.

The global legacy chips wafer foundry market, encompassing the production of mature nodes (typically 200nm and above), is experiencing a complex interplay of factors. While the overall semiconductor market focuses heavily on advanced node technologies, the demand for legacy chips remains robust, driven by a diverse range of applications. The market exhibits steady, if not spectacular, growth, largely fueled by the continued need for cost-effective solutions in established industries. This report analyzes the market's evolution from 2019 to 2033, projecting a Compound Annual Growth Rate (CAGR) of approximately X% during the forecast period (2025-2033), reaching a market value of approximately XXX million units by 2033. This growth is not uniform across all segments. While certain legacy nodes are experiencing decline due to technological advancements and the shift towards more power-efficient designs, others are experiencing resurgence, particularly those serving niche applications where cost and established supply chains outweigh the need for cutting-edge performance. This presents both opportunities and challenges for established foundries. The competitive landscape is characterized by a mix of large, internationally recognized players and smaller, specialized foundries catering to regional or specific customer needs. The report details the market share of key players, highlighting their strategic initiatives in navigating this dynamic environment, including mergers and acquisitions, capacity expansions, and technological advancements aimed at optimizing legacy node production for greater efficiency and profitability. Furthermore, geopolitical factors and supply chain resilience are increasingly shaping the market's trajectory, with a growing emphasis on regional diversification and secure sourcing of materials. The report thoroughly examines these trends, providing a comprehensive overview of the market's dynamics and future prospects.

Several key factors are propelling the growth of the legacy chips wafer foundry market. Firstly, the automotive industry's increasing reliance on electronic control units (ECUs) and advanced driver-assistance systems (ADAS) creates substantial demand for mature node chips. These applications often prioritize cost-effectiveness and established supply chains over cutting-edge technology. Secondly, the industrial sector continues to utilize legacy chips in a wide array of applications, including industrial automation, process control, and embedded systems. The long lifecycles of these systems and the need for reliable, readily available components sustain demand. Thirdly, the ever-growing Internet of Things (IoT) market, despite the emergence of newer, more energy-efficient chips, still utilizes a significant number of legacy chips in various low-power applications. The sheer volume of IoT devices necessitates cost-effective solutions, favoring mature node technologies. Fourthly, the considerable installed base of legacy devices necessitates ongoing production to support repairs, replacements, and upgrades. Maintaining supply chains for these established components is crucial for numerous industries. Finally, the resilience and reliability of mature node technologies, often preferred in safety-critical applications, further contribute to sustained market demand. These factors, combined with strategic investments by foundries in optimizing legacy node manufacturing, ensure the market's continued relevance in the semiconductor landscape.

Despite the consistent demand for legacy chips, the legacy chips wafer foundry market faces several challenges. Firstly, the continuous advance of technology and the associated cost reductions in newer nodes create significant competitive pressure. Foundries must strategically manage their production capacity, ensuring profitability in a market where advanced nodes often command higher margins. Secondly, fluctuating raw material prices and geopolitical instability impact production costs and supply chain stability. This necessitates careful planning and diversification strategies to mitigate these risks. Thirdly, maintaining skilled workforce for legacy node manufacturing can prove challenging as talent often gravitates towards more advanced technologies. Attracting and retaining experienced engineers and technicians is crucial for maintaining production quality and efficiency. Furthermore, managing inventory effectively is key, as the demand for certain legacy chips might fluctuate significantly, leading to potential overstocking or shortages. Finally, the industry faces the ongoing challenge of balancing environmental concerns with efficient production, necessitating continuous improvement in sustainability practices. These obstacles require careful navigation and strategic adaptation to ensure the long-term viability of the legacy chips wafer foundry sector.

The legacy chips wafer foundry market exhibits geographical diversity in production and consumption. East Asia, particularly Taiwan, South Korea, and China, hold a significant share of global production due to the presence of major foundries. However, regional demand is also a crucial factor. North America and Europe, while producing less, represent substantial consumption markets for legacy chips, primarily for automotive, industrial, and medical applications.

Asia (Taiwan, South Korea, China): Dominates production due to the concentration of large-scale foundries. This region benefits from established infrastructure, skilled labor, and significant government investment in the semiconductor industry. The market is further driven by the massive consumer electronics market in the region and rapidly expanding automotive and industrial sectors.

North America: A key consumer market, characterized by strong demand in the automotive, industrial, and aerospace sectors. While production is less concentrated, several specialized foundries and integrated device manufacturers contribute to the region's market. Growing focus on domestic semiconductor production is expected to further boost this region's importance.

Europe: Another important consumer market, experiencing growth driven by the automotive and industrial sectors. The European Union's initiatives to strengthen its domestic semiconductor industry are driving investment and expansion in the region.

Consumer & Mobile: This segment consistently remains a significant consumer of legacy chips, particularly in applications such as feature phones, wearables, and older generation mobile devices. The immense installed base of these devices ensures a steady demand for replacement parts and maintenance.

Automotive: This segment presents remarkable growth potential. The increasing complexity and electronics content in modern vehicles drive demand for legacy chips in various applications, including engine control units, body control modules, and infotainment systems.

Industrial: This segment consistently requires robust and reliable components, favoring the established technology and mature supply chains of legacy nodes. The longevity of industrial equipment often necessitates extended availability of replacement parts, ensuring consistent demand.

The market share of each region and segment is expected to evolve over the forecast period, with continued competition and strategic investments shaping the industry's landscape.

The legacy chip wafer foundry industry's growth is significantly catalyzed by several factors. Firstly, the increasing demand from established industries such as automotive and industrial sectors, driven by their extensive use of legacy chips in applications requiring proven reliability and cost-effectiveness. Secondly, the expansion of the IoT market, despite the adoption of advanced nodes in some high-performance applications, still relies heavily on legacy chips for numerous low-power devices. Lastly, continued government initiatives and investments in strengthening domestic semiconductor capabilities across various regions further contribute to the industry's expansion. These factors collectively ensure the continued relevance and growth of legacy chip wafer foundry capabilities in the foreseeable future.

This report provides a comprehensive analysis of the legacy chips wafer foundry market, offering valuable insights into market trends, driving forces, challenges, key players, and future growth prospects. It offers a detailed segmentation of the market by application, region, and node technology, providing a nuanced understanding of the diverse dynamics within this sector. The extensive data analysis and forecasts provide a robust framework for informed decision-making for stakeholders across the semiconductor value chain.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include TSMC, Samsung Foundry, GlobalFoundries, United Microelectronics Corporation (UMC), SMIC, Tower Semiconductor, PSMC, VIS (Vanguard International Semiconductor), Hua Hong Semiconductor, HLMC, X-FAB, DB HiTek, Nexchip, Intel Foundry Services (IFS), United Nova Technology, WIN Semiconductors Corp., Wuhan Xinxin Semiconductor Manufacturing, GTA Semiconductor Co., Ltd., CanSemi, Polar Semiconductor, LLC, Silterra, SkyWater Technology, LA Semiconductor, Silex Microsystems, Teledyne MEMS, Asia Pacific Microsystems, Inc., Atomica Corp., Philips Engineering Solutions, AWSC, GCS (Global Communication Semiconductors), Wavetek, Seiko Epson Corporation, SK keyfoundry Inc., SK hynix system ic Wuxi solutions.

The market segments include Application.

The market size is estimated to be USD 84720 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Legacy Chips Wafer Foundry," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Legacy Chips Wafer Foundry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.