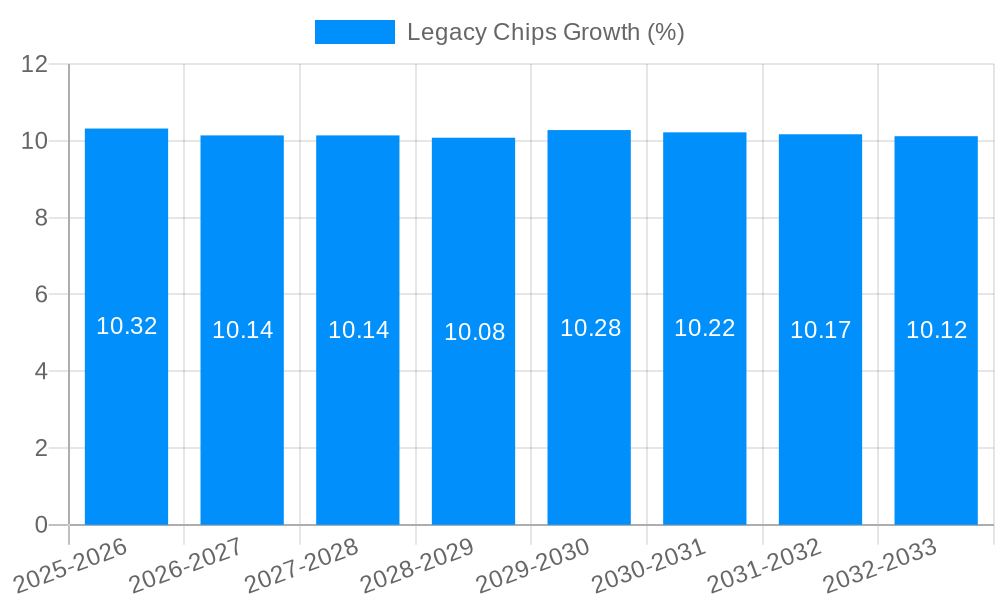

1. What is the projected Compound Annual Growth Rate (CAGR) of the Legacy Chips?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Legacy Chips

Legacy ChipsLegacy Chips by Type (/> 28nm, 40/45nm, 65nm, 90nm, 0.11/0.13micron, 0.15/0.18 micron, above 0.25 micron), by Application (/> Consumer & Mobile, Internet of Things (IoT), Automotive, Industrial, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

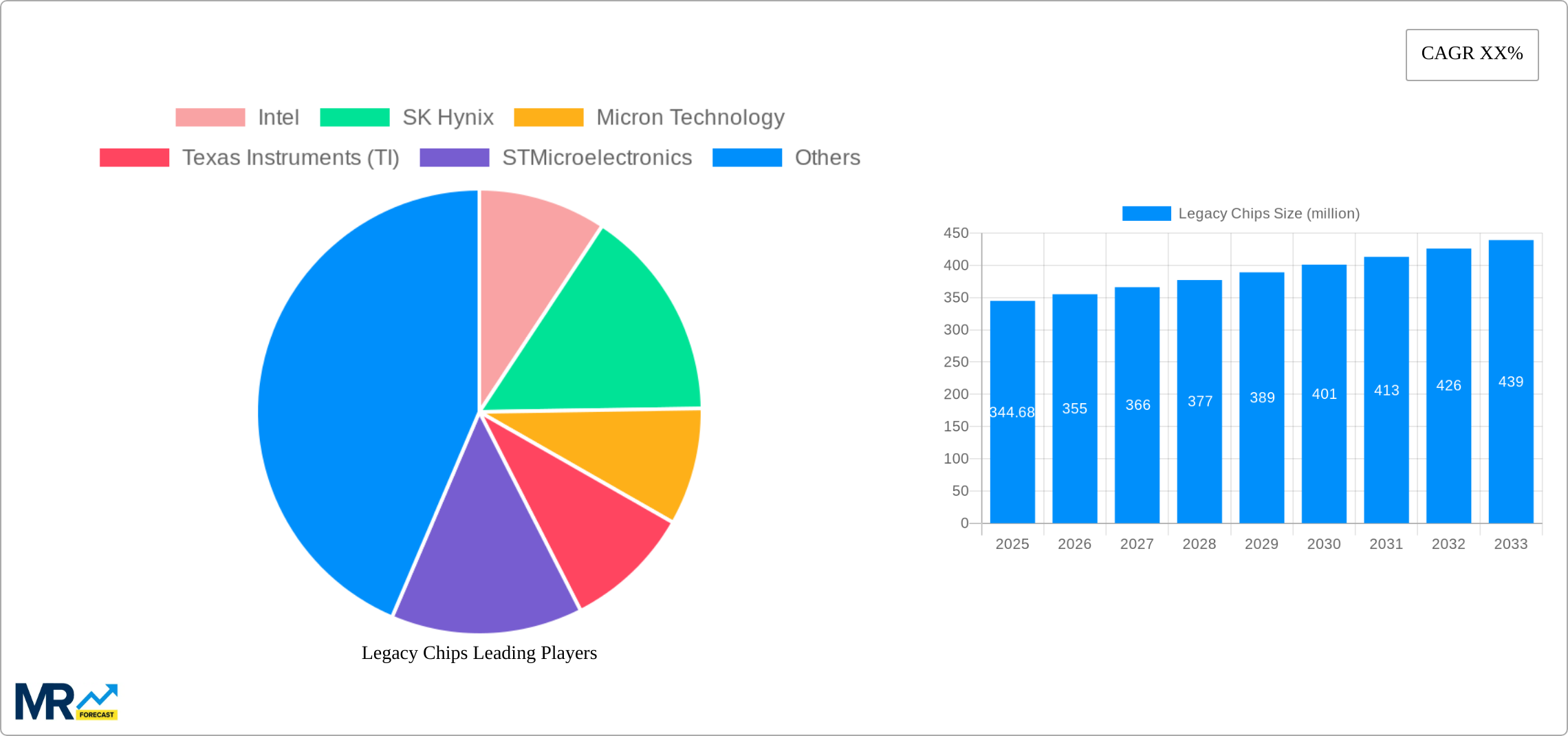

The legacy chip market, encompassing older node technologies like 90nm, 0.13µm, and above, represents a substantial and surprisingly resilient sector. While newer, more power-efficient nodes dominate high-performance computing and mobile applications, the demand for legacy chips remains robust due to several factors. Firstly, cost-effectiveness is a key driver. Legacy chips, utilizing mature manufacturing processes, are significantly cheaper to produce than their cutting-edge counterparts. This makes them attractive for cost-sensitive applications within automotive, industrial automation, and certain consumer electronics segments where performance requirements are less stringent. Secondly, supply chain stability plays a crucial role. Mature manufacturing processes are well-established, leading to more predictable supply chains and reduced risks associated with technological uncertainties inherent in newer node technologies. This reliability is highly valued in critical infrastructure and applications demanding long-term product lifecycle support. The market size of $344.68 million in 2025 indicates its considerable scale, even in the face of advancements in semiconductor technology. The market is segmented by technology node and application, with the automotive and industrial sectors being prominent consumers. Companies like Intel, Texas Instruments, and STMicroelectronics hold significant market share due to their extensive experience and established manufacturing capabilities in these legacy technologies.

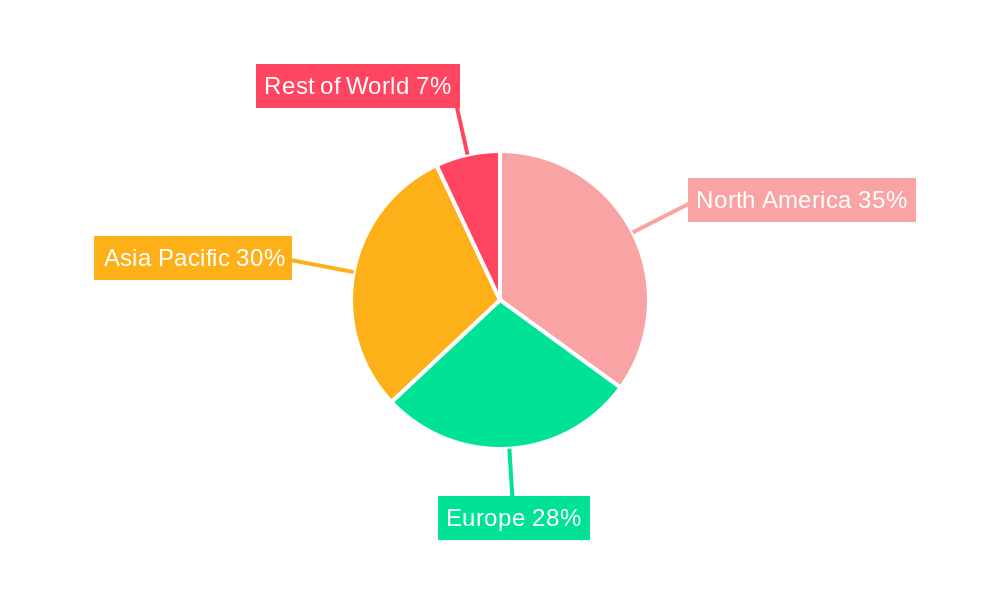

The future of the legacy chip market is likely to see continued growth, albeit at a moderate pace. Factors influencing this growth include the ongoing need for cost-effective solutions in various applications, the inherent reliability of mature manufacturing processes, and the extended lifecycles of equipment using these chips. However, potential restraints include the ongoing transition towards more efficient technologies and the possibility of future supply chain disruptions. Nonetheless, the substantial existing installed base of equipment relying on legacy chips ensures a sustained market for the foreseeable future. The market is expected to experience steady growth driven by sustained demand from established applications and potential new opportunities in niche markets. Geographical distribution of the market is likely to mirror the existing global manufacturing and consumer bases, with North America, Europe, and Asia-Pacific being key regions. Careful analysis of individual regional market dynamics will be crucial for future market projections.

The legacy chip market, encompassing older node technologies (above 25nm) and various applications, presents a complex landscape characterized by steady, albeit slower, growth compared to cutting-edge nodes. While the market share of newer, higher-performing chips is increasing, the demand for legacy chips remains robust, driven by several factors explored later in this report. The historical period (2019-2024) witnessed a moderate expansion, primarily fueled by the enduring need for cost-effective solutions in mature applications. The estimated market value in 2025 is projected to reach several billion dollars, representing a considerable segment of the overall semiconductor market. This report analyzes market trends from 2019 to 2033, highlighting key insights into the dynamics of this substantial sector. The forecast period (2025-2033) anticipates continued growth, albeit at a more measured pace than previously experienced, influenced by technological advancements, economic conditions, and evolving application requirements. The continued relevance of these chips underlines their irreplaceable role in numerous applications where performance requirements are less stringent, or cost-effectiveness takes precedence. This report delves deeper into these specifics, providing a detailed analysis of the factors driving both growth and challenges within the industry. The considerable number of players involved, ranging from established industry giants to specialized niche manufacturers, underscores the competitive and multifaceted nature of this market segment.

Several factors contribute to the sustained demand for legacy chips. Firstly, the cost-effectiveness of older node technologies remains a significant advantage in price-sensitive applications. Manufacturing costs for legacy chips are generally lower compared to their more advanced counterparts, making them attractive for mass-market products and applications where high performance isn’t paramount. Secondly, the extensive installed base of devices utilizing these older chips creates a constant need for replacements and upgrades. Existing infrastructure often relies on components built with legacy technologies, thereby ensuring a steady market for replacement parts and sustaining demand. Thirdly, certain applications inherently require legacy chipsets due to legacy systems. For instance, some industrial control systems and older automotive systems are not easily adaptable to newer technologies, thereby continuing to rely on components from mature nodes. Finally, the availability of established supply chains and manufacturing expertise for legacy technologies contributes to their continued viability. The extensive experience and infrastructure supporting these older nodes guarantee reliable production and supply, ensuring a steady stream of components even as the industry advances.

Despite sustained demand, the legacy chip market faces challenges. The continuous advancement of semiconductor technology leads to a gradual decline in the relative importance of older nodes. Newer chips boast higher performance, lower power consumption, and improved functionalities, prompting many manufacturers to explore new technologies wherever feasible. This shift can potentially lead to reduced demand for legacy chips in the long run, although the aforementioned cost and application factors work to mitigate this. Furthermore, the increasing complexity of modern electronic systems can sometimes necessitate the use of a mix of legacy and advanced chips, making the market more fragmented and demanding of diverse production capabilities. This can present logistical and supply chain challenges for manufacturers. Finally, geopolitical factors and potential disruptions to global supply chains represent significant risks that could impact production and pricing in this segment. Fluctuations in the availability of raw materials and the complexities of international trade affect manufacturing, which affects availability and price.

The legacy chip market is geographically diverse, with significant presence across various regions. However, several key regions and segments are poised for continued dominance:

Asia (Specifically, China, Taiwan, South Korea, and Japan): These nations are home to a substantial number of semiconductor manufacturers with extensive experience in legacy technologies, encompassing both production and consumption. This region benefits from established manufacturing infrastructure and a strong supply chain for mature nodes. The large consumer base in Asia further supports the demand for cost-effective legacy chips.

North America (United States): While not as heavily involved in the manufacturing of legacy chips as Asia, North America remains a dominant consumer, primarily in industries such as automotive and industrial automation. This region features numerous design houses and technology firms incorporating legacy chips into their products.

Europe: Europe is a growing player, with increasing focus on automotive and industrial applications, representing a significant consumer base for legacy chips.

Dominant Segments:

Above 0.25-micron node technologies: These older nodes continue to serve as the backbone for various price-sensitive applications, such as consumer electronics, simple IoT devices, and basic automotive systems. The demand for these technologies remains high due to cost effectiveness and the vast installed base.

Automotive applications: The automotive industry represents a significant driver of demand for legacy chips. While newer vehicles incorporate advanced technologies, many legacy systems and components still use mature nodes. This creates a steady need for cost-effective yet reliable parts.

Industrial applications: The Industrial Internet of Things (IIoT) and industrial automation heavily utilize legacy chips for their reliability and cost-effectiveness. Numerous industrial control systems, sensors, and actuators rely on chips from mature nodes.

Consumer and Mobile: The widespread use of older nodes in everyday consumer devices and some basic mobile components remains a significant contributor to the overall market. The sheer volume of such devices sustains the need for these chip types.

The overall demand for these technologies is expected to sustain steady growth, ensuring a significant and long-lasting market segment for legacy chips despite the advance of higher-performance nodes.

The legacy chip industry benefits from several growth catalysts. The continued expansion of IoT applications across various sectors fuels demand for cost-effective solutions. Furthermore, the automotive industry’s relentless growth, coupled with the increasing need for robust and reliable components in vehicles, ensures substantial demand for legacy chips in this sector. Finally, the prevalence of legacy equipment in industrial automation and other industries guarantees a steady need for replacement parts and upgrades, ensuring the continued relevance of legacy chip technology for the foreseeable future.

This report offers a comprehensive overview of the legacy chip market, providing detailed insights into market trends, driving forces, challenges, key players, and significant developments. It serves as a valuable resource for industry stakeholders, investors, and researchers seeking a deep understanding of this vital segment of the semiconductor industry. The detailed analysis, covering the historical period, estimated year, and future forecast, allows for informed decision-making and strategic planning within the rapidly evolving landscape of the semiconductor market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Intel, SK Hynix, Micron Technology, Texas Instruments (TI), STMicroelectronics, Kioxia, Sony Semiconductor Solutions Corporation (SSS), Infineon, NXP, Analog Devices, Inc. (ADI), Renesas Electronics, Microchip Technology, Onsemi, Samsung, NVIDIA, Qualcomm, Broadcom, Advanced Micro Devices, Inc. (AMD), MediaTek, Marvell Technology Group, Novatek Microelectronics Corp., Tsinghua Unigroup, Realtek Semiconductor Corporation, OmniVision Technology, Inc, Monolithic Power Systems, Inc. (MPS), Cirrus Logic, Inc., Socionext Inc., LX Semicon, HiSilicon Technologies, Synaptics, Allegro MicroSystems, Himax Technologies, Semtech, Global Unichip Corporation (GUC), Hygon Information Technology, GigaDevice, Silicon Motion, Ingenic Semiconductor, Raydium, Goodix Limited, Sitronix, Nordic Semiconductor, Silergy, Shanghai Fudan Microelectronics Group, Alchip Technologies, FocalTech, MegaChips Corporation, Elite Semiconductor Microelectronics Technology, SGMICRO, Chipone Technology (Beijing), Loongson Technology.

The market segments include Type, Application.

The market size is estimated to be USD 344680 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Legacy Chips," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Legacy Chips, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.