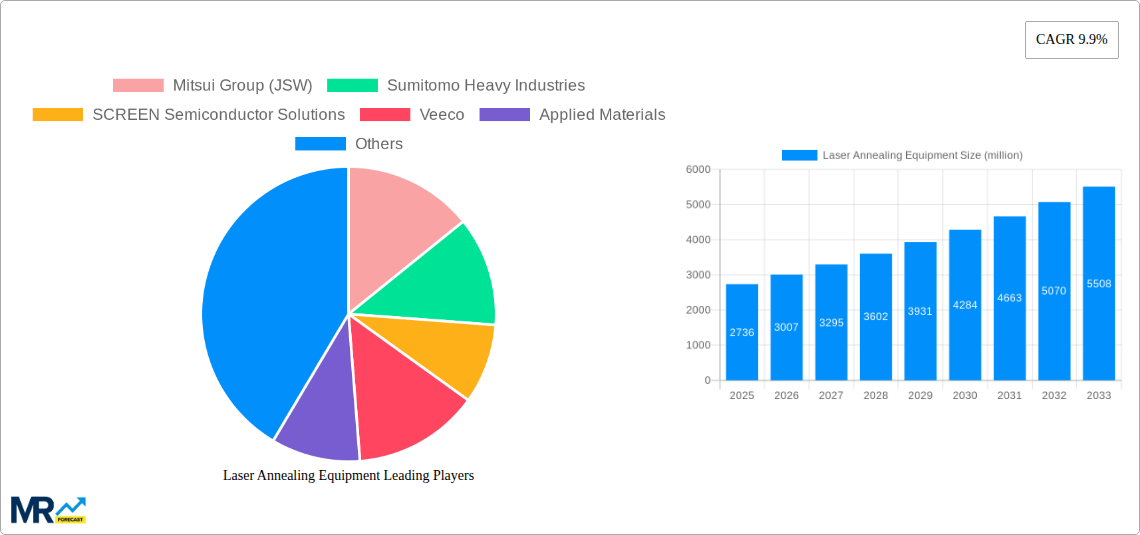

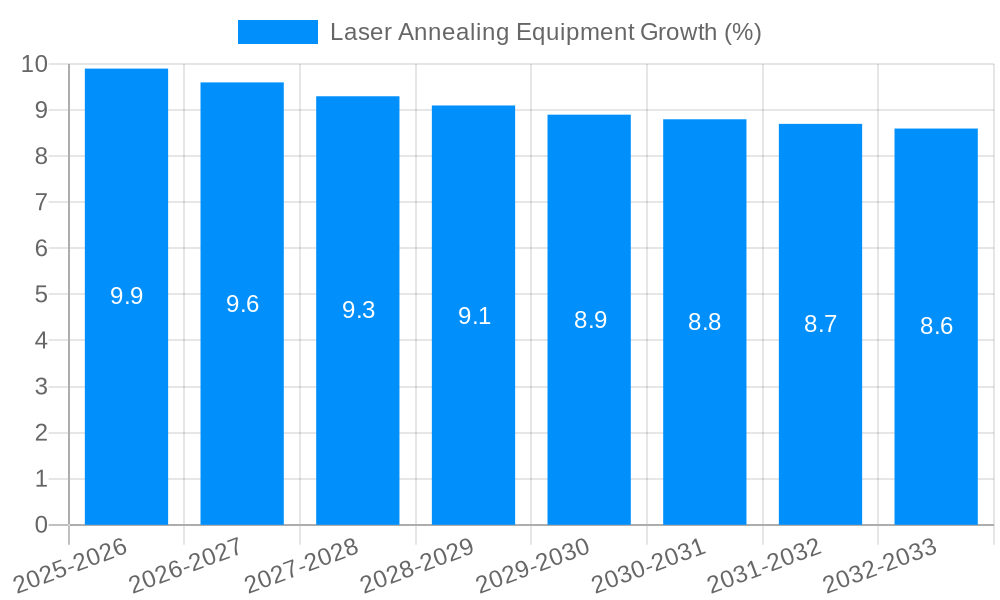

1. What is the projected Compound Annual Growth Rate (CAGR) of the Laser Annealing Equipment?

The projected CAGR is approximately 9.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Laser Annealing Equipment

Laser Annealing EquipmentLaser Annealing Equipment by Type (Power Laser Annealing Equipment, IC front-end Laser Annealing Equipment), by Application (Power Semiconductor, Advanced Process Chip), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Laser Annealing Equipment market is poised for substantial growth, projected to reach a market size of approximately $2,736 million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 9.9% during the forecast period of 2025-2033. This robust expansion is primarily fueled by the escalating demand for advanced semiconductor manufacturing processes that enhance chip performance, reliability, and power efficiency. The increasing sophistication in integrated circuits (ICs) and the burgeoning adoption of power semiconductors across various industries, including automotive, consumer electronics, and telecommunications, are key drivers. Laser annealing technology offers distinct advantages over traditional methods, such as precise thermal control, reduced processing times, and the ability to anneal at lower temperatures, thereby minimizing thermal budget and enabling the fabrication of smaller, more complex devices. The market is segmented into Power Laser Annealing Equipment and IC Front-end Laser Annealing Equipment, catering to diverse applications within power semiconductor manufacturing and advanced process chip fabrication.

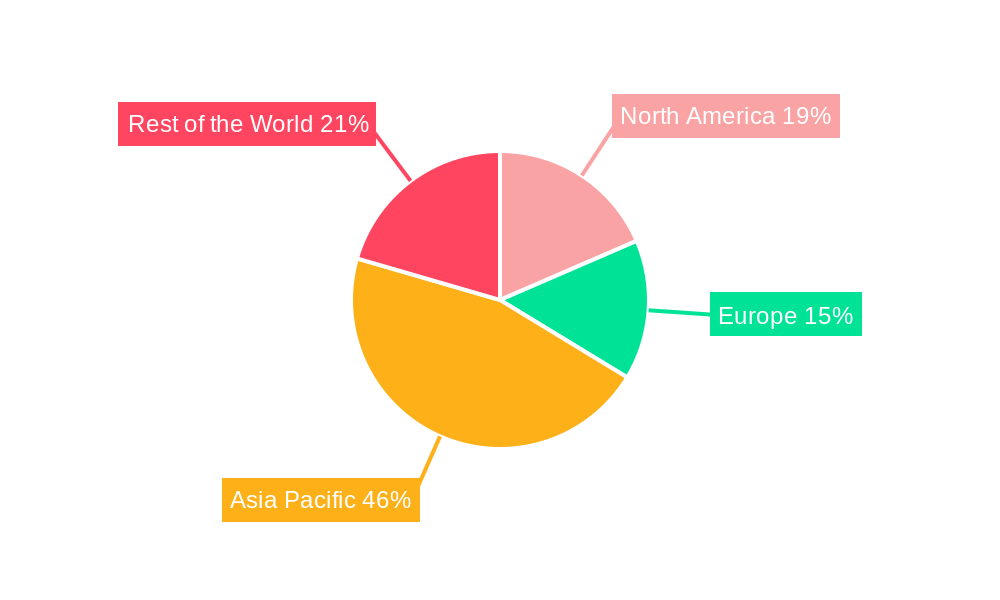

The competitive landscape is characterized by the presence of established global players and emerging regional manufacturers, all vying for market share through continuous innovation and strategic collaborations. Key companies like Mitsui Group (JSW), Sumitomo Heavy Industries, SCREEN Semiconductor Solutions, Veeco, and Applied Materials are at the forefront, investing heavily in research and development to introduce next-generation laser annealing solutions. The Asia Pacific region, particularly China, Japan, and South Korea, is expected to lead market growth due to its dominance in semiconductor manufacturing and significant investments in advanced technology. While the market demonstrates strong growth prospects, potential restraints such as high initial investment costs for advanced laser annealing systems and the need for skilled workforce to operate and maintain these sophisticated machines could pose challenges. However, ongoing technological advancements and the relentless pursuit of miniaturization and enhanced performance in electronics are expected to outweigh these limitations, ensuring sustained market momentum.

This comprehensive report delves into the dynamic landscape of the global Laser Annealing Equipment market, projecting its trajectory from 2019 to 2033, with a keen focus on the Base Year of 2025 and an extensive Forecast Period from 2025 to 2033. The study meticulously examines historical trends between 2019 and 2024, providing a robust foundation for understanding current market conditions and future potential. The market is segmented by Type into Power Laser Annealing Equipment and IC front-end Laser Annealing Equipment, and by Application into Power Semiconductor and Advanced Process Chip. With an estimated market size projected to reach several million units by the forecast period, this report offers invaluable insights for stakeholders seeking to navigate this rapidly evolving sector.

The global Laser Annealing Equipment market is experiencing a significant surge, driven by the insatiable demand for higher performance, miniaturization, and enhanced efficiency across various semiconductor applications. In the Base Year of 2025, the market is projected to witness substantial growth, building upon the strong foundation laid during the Historical Period of 2019-2024. A key trend defining this evolution is the increasing adoption of advanced laser annealing techniques for the fabrication of next-generation power semiconductors. These devices, critical for electric vehicles, renewable energy systems, and high-power electronics, benefit immensely from the precise control and localized heating offered by laser annealing, enabling improved material properties and reduced manufacturing defects. The Power Laser Annealing Equipment segment, specifically tailored for these demanding applications, is emerging as a dominant force. Furthermore, the relentless pursuit of smaller, faster, and more energy-efficient integrated circuits (ICs) is fueling the growth of IC front-end Laser Annealing Equipment. This technology plays a crucial role in advanced process steps, such as dopant activation and defect repair, which are essential for pushing the boundaries of semiconductor performance and enabling the development of Advanced Process Chip technologies like 3D NAND and FinFETs. The market is witnessing a paradigm shift from traditional thermal annealing methods to laser-based solutions, a transition that is expected to accelerate significantly throughout the Forecast Period of 2025-2033. This shift is underpinned by the inherent advantages of laser annealing, including lower thermal budgets, reduced substrate damage, and the ability to achieve novel material structures. As semiconductor manufacturers continue to invest in cutting-edge fabrication technologies to meet the escalating demands of a digitally connected world, the Laser Annealing Equipment market is poised for sustained and robust expansion, with market insights indicating a strong upward trajectory in investment and adoption. The ability to precisely tailor material properties at the nanoscale makes laser annealing indispensable for achieving the performance benchmarks required by emerging technologies.

The exponential growth of the laser annealing equipment market is intricately linked to several powerful driving forces that are reshaping the semiconductor industry. Foremost among these is the escalating demand for high-performance Power Semiconductors. As the global transition towards electrification accelerates, with electric vehicles (EVs) and renewable energy sources taking center stage, the need for more efficient, reliable, and compact power conversion and management systems is paramount. Laser annealing plays a critical role in enabling the fabrication of advanced power semiconductor materials like Silicon Carbide (SiC) and Gallium Nitride (GaN), allowing for higher operating temperatures, lower energy losses, and increased power density. Furthermore, the relentless innovation in the realm of Advanced Process Chip fabrication is another significant propellant. The ongoing miniaturization of transistors, the development of novel architectures like FinFETs and Gate-All-Around (GAA) transistors, and the increasing complexity of 3D structures necessitate highly precise and localized thermal processing. Laser annealing offers unparalleled control over annealing processes, enabling precise dopant activation, defect annealing, and material crystallization at the nanoscale, which are vital for achieving the desired electrical characteristics and performance metrics. The industry's pursuit of higher yields and reduced manufacturing costs also contributes to the adoption of laser annealing. Its inherent efficiency and ability to perform precise, localized treatments often lead to fewer processing steps and reduced material waste compared to traditional methods. The burgeoning IoT ecosystem, coupled with the rapid advancements in artificial intelligence and 5G technology, further amplifies the demand for sophisticated semiconductor devices, thereby creating a fertile ground for laser annealing equipment.

Despite its promising growth trajectory, the Laser Annealing Equipment market faces certain challenges and restraints that could temper its full potential. One of the primary hurdles is the high initial capital investment associated with acquiring state-of-the-art laser annealing systems. These sophisticated pieces of equipment represent a significant financial outlay for semiconductor manufacturers, particularly for smaller or emerging players, thus potentially limiting widespread adoption. Another considerable challenge lies in the complexity of process integration and optimization. Implementing laser annealing effectively into existing fabrication workflows requires extensive research and development, along with specialized expertise to fine-tune parameters for different materials and device architectures. This can lead to longer ramp-up times and increased engineering costs. Furthermore, the evolving technological landscape presents a continuous challenge. As new materials and device designs emerge, laser annealing equipment and processes need to adapt and evolve in tandem. Staying at the forefront of these advancements requires ongoing R&D investment and a commitment to innovation from equipment manufacturers. The availability of skilled personnel to operate and maintain these advanced systems can also be a constraint. The specialized nature of laser annealing requires trained engineers and technicians, and a shortage of such expertise can hinder efficient deployment and utilization. Lastly, while laser annealing offers advantages, the potential for material damage or unintended thermal effects if not precisely controlled can be a concern, necessitating rigorous quality control and process validation. Overcoming these restraints will be crucial for unlocking the full market potential of laser annealing technology.

The global Laser Annealing Equipment market is poised for significant dominance by specific regions and segments, driven by concentrated semiconductor manufacturing capabilities and burgeoning technological advancements.

Dominating Regions/Countries:

East Asia (Taiwan, South Korea, China): This region is unequivocally the epicenter of semiconductor manufacturing, home to the world's leading foundries and integrated device manufacturers (IDMs). Taiwan, with its dominance in contract chip manufacturing, and South Korea, a powerhouse in memory and logic chip production, are expected to lead in the adoption of laser annealing equipment. China's rapid expansion in its domestic semiconductor industry, driven by government initiatives and significant investment, is also a major growth driver. The sheer volume of wafer fabrication and the continuous push for advanced process nodes within these countries make them prime markets for both Power Laser Annealing Equipment and IC front-end Laser Annealing Equipment. The intense competition and the constant need for performance upgrades compel manufacturers in these regions to invest in cutting-edge technologies like laser annealing to maintain their competitive edge. The concentration of R&D activities and the presence of major fab clusters further solidify their leadership.

United States: While not having the same sheer volume as East Asia, the US remains a critical player, particularly in advanced logic, memory, and specialized semiconductor applications. The presence of major semiconductor giants and the significant investments in domestic chip manufacturing, spurred by government incentives like the CHIPS Act, are expected to drive demand for sophisticated laser annealing solutions, especially for Advanced Process Chip development and the fabrication of high-performance computing components. The focus on cutting-edge research and development in the US will likely see an increased demand for laser annealing equipment that enables novel materials and device structures.

Dominating Segments:

Power Semiconductor Application: The demand for Power Semiconductor applications is a key segment set to dominate the laser annealing market. The global shift towards electrification, driven by electric vehicles, renewable energy infrastructure, and advanced power grids, necessitates the production of highly efficient, robust, and compact power devices. Laser annealing is proving to be an indispensable technology for optimizing the performance of next-generation power semiconductors made from wide-bandgap materials like Silicon Carbide (SiC) and Gallium Nitride (GaN). These materials require precise annealing for dopant activation, defect reduction, and stress management, all of which can be achieved with superior control through laser annealing compared to traditional thermal methods. The ability of laser annealing to provide localized and rapid heating without damaging surrounding structures makes it ideal for the complex geometries and high power densities required in these devices. As the market for EVs and renewable energy continues its exponential growth through the Forecast Period (2025-2033), the demand for Power Laser Annealing Equipment will see a proportional surge, solidifying its position as a leading application segment.

IC front-end Laser Annealing Equipment Type: Within the equipment types, IC front-end Laser Annealing Equipment is expected to witness significant market share and growth. This segment is critical for the fabrication of advanced integrated circuits (ICs) that power modern electronics. As semiconductor nodes continue to shrink and device architectures become more complex (e.g., FinFETs, Gate-All-Around), the need for highly precise and localized annealing during front-end processing becomes paramount. Laser annealing enables precise dopant activation, junction formation, and defect annealing at extremely shallow depths and with minimal thermal budget. This is crucial for achieving the desired electrical characteristics, minimizing short-channel effects, and maximizing device performance and yield in cutting-edge chips. The ongoing race for Moore's Law and the development of increasingly sophisticated processors for AI, high-performance computing, and 5G communication will continue to fuel the demand for advanced IC front-end processing technologies, making this segment a cornerstone of the laser annealing equipment market.

The Laser Annealing Equipment industry is experiencing robust growth, catalyzed by several key factors. The insatiable demand for advanced Power Semiconductors, crucial for the electrification of vehicles and renewable energy systems, is a primary driver. Laser annealing enables superior material properties and performance in these devices. Concurrently, the relentless pursuit of miniaturization and enhanced functionality in Advanced Process Chip fabrication necessitates precise thermal processing, where laser annealing excels in dopant activation and defect control. Furthermore, significant investments in semiconductor manufacturing infrastructure globally, particularly in emerging markets and through government initiatives, are creating substantial opportunities for equipment suppliers. The increasing complexity of chip architectures and the need for higher yields are also pushing manufacturers towards more efficient and controlled annealing techniques.

This report offers an exhaustive analysis of the Laser Annealing Equipment market, encompassing every critical facet from historical performance to future projections. It meticulously examines market trends, identifying key growth drivers and emergent opportunities. The report delves into the specific segments of Power Laser Annealing Equipment and IC front-end Laser Annealing Equipment, along with their applications in Power Semiconductor and Advanced Process Chip manufacturing, providing detailed market sizing and forecast data. Furthermore, it addresses the prevailing challenges and restraints that may influence market dynamics. The geographical landscape is thoroughly analyzed, highlighting dominant regions and countries. Crucially, the report identifies the leading players and their strategic contributions, alongside a comprehensive overview of significant technological developments and their timelines. This detailed exploration ensures that stakeholders gain a holistic understanding of the market's present state and its future trajectory, enabling informed strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.9% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 9.9%.

Key companies in the market include Mitsui Group (JSW), Sumitomo Heavy Industries, SCREEN Semiconductor Solutions, Veeco, Applied Materials, Hitachi, YAC BEAM, EO Technics, Beijing U-PRECISION Tech, Shanghai Micro Electronics Equipment, Chengdu Laipu Technology, Hans DSI, ETA Semitech, Jihua Laboratory.

The market segments include Type, Application.

The market size is estimated to be USD 2736 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Laser Annealing Equipment," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Laser Annealing Equipment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.