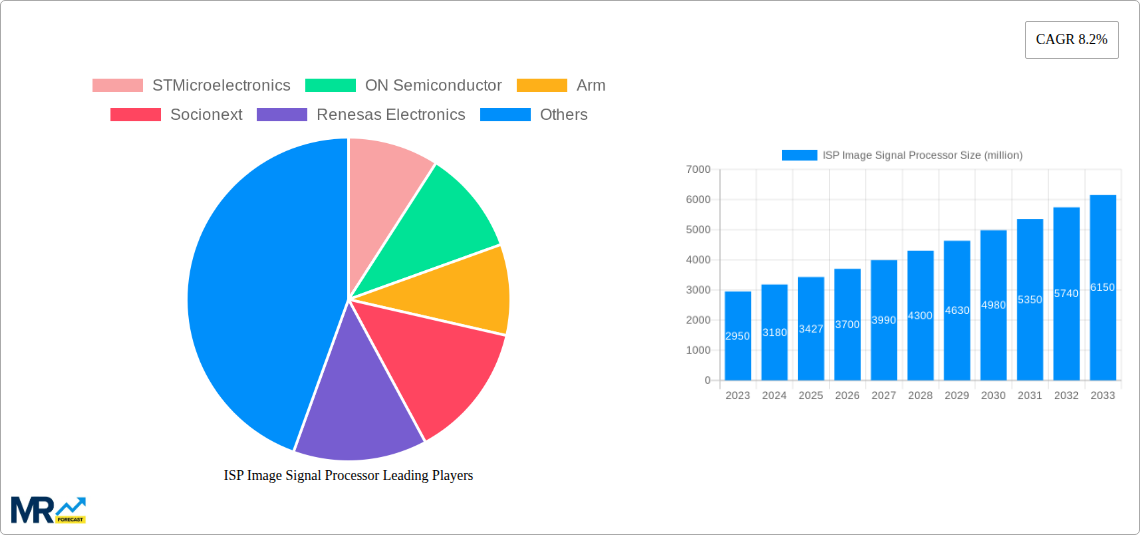

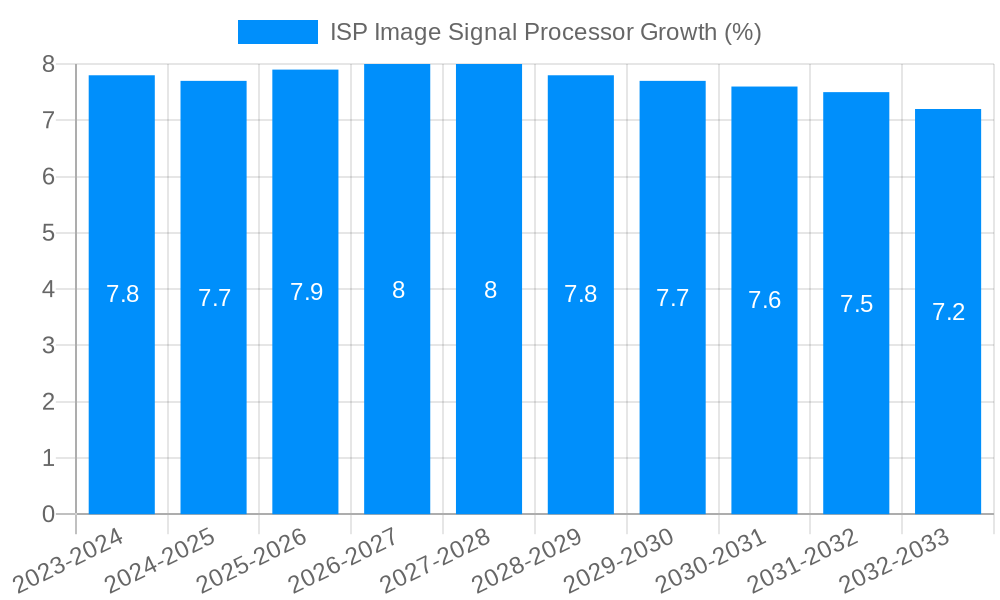

1. What is the projected Compound Annual Growth Rate (CAGR) of the ISP Image Signal Processor?

The projected CAGR is approximately 8.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

ISP Image Signal Processor

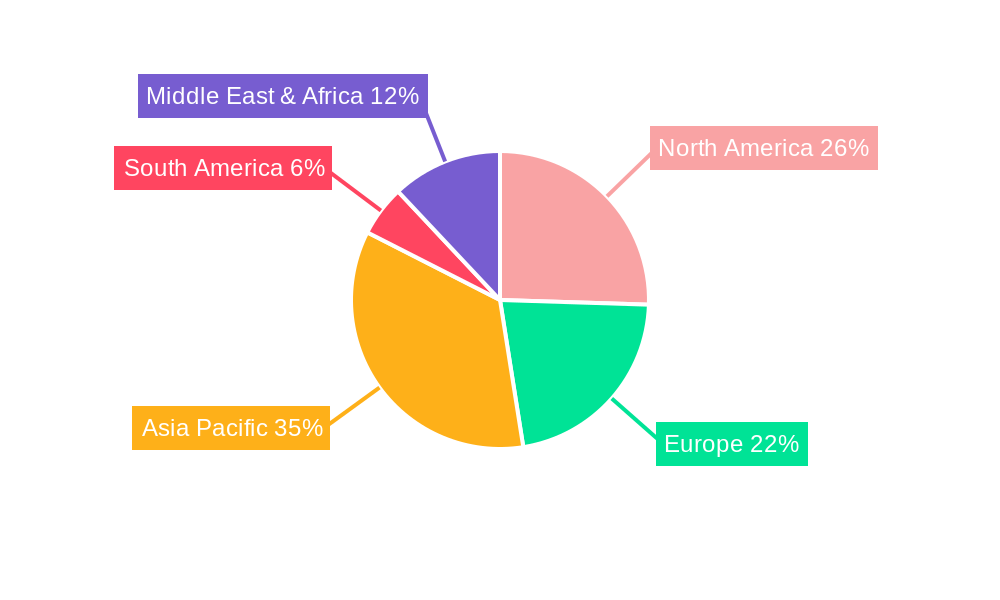

ISP Image Signal ProcessorISP Image Signal Processor by Type (Up to 10 MP, Greater than 10 MP), by Application (Automotive, Consumer Electronics, Security and Monitoring, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Image Signal Processor (ISP) market is poised for robust expansion, projected to reach \$3,427 million by 2025 and demonstrate a Compound Annual Growth Rate (CAGR) of 8.2% through 2033. This significant growth is propelled by the escalating demand for advanced imaging capabilities across a multitude of sectors. The automotive industry stands out as a primary driver, fueled by the proliferation of Advanced Driver-Assistance Systems (ADAS) and the increasing integration of sophisticated camera technologies for enhanced safety and autonomous driving features. Consumer electronics, particularly smartphones and digital cameras, continue to demand higher resolution and superior image quality, pushing innovation in ISP technology. Furthermore, the growing adoption of smart surveillance systems and the expanding Internet of Things (IoT) ecosystem are creating substantial opportunities for ISPs in security and monitoring applications.

The market's trajectory is further shaped by evolving technological trends such as the integration of AI and machine learning directly within ISPs for real-time image enhancement, noise reduction, and object recognition. The development of smaller, more power-efficient ISPs is also crucial, especially for mobile and embedded applications. While the market exhibits strong growth, potential restraints include the increasing complexity and cost associated with developing next-generation ISPs, along with the ongoing semiconductor supply chain challenges that can impact production volumes and lead times. Key players like STMicroelectronics, ON Semiconductor, Arm, and Samsung Electronics are at the forefront of this innovation, investing heavily in research and development to capture market share and address the diverse needs of applications ranging from low-resolution sensors (up to 10 MP) to higher-resolution segments (greater than 10 MP).

The ISP (Image Signal Processor) market is poised for substantial expansion, driven by an insatiable demand for higher-quality imaging across a multitude of applications. XXX, the global ISP market is projected to witness a remarkable compound annual growth rate (CAGR) of 12.5% from the historical period of 2019-2024 to the forecast period of 2025-2033. By the estimated year of 2025, the market is anticipated to reach a valuation of USD 5,500 million, showcasing a significant surge from its 2019 baseline. This upward trajectory is intrinsically linked to the proliferation of advanced imaging technologies, including higher pixel counts, enhanced dynamic range, and sophisticated AI-powered image enhancement algorithms. The consumer electronics segment, particularly smartphones and digital cameras, continues to be a primary volume driver, with consumers increasingly prioritizing camera performance. However, the automotive sector is emerging as a critical growth engine, fueled by the increasing adoption of advanced driver-assistance systems (ADAS), autonomous driving technologies, and in-cabin monitoring solutions, all of which rely heavily on robust and real-time image processing capabilities. The “Greater than 10 MP” segment is expected to witness the fastest growth within the 'Type' classification, reflecting the industry's relentless pursuit of higher resolution and detail capture. Furthermore, the integration of ISPs with AI and machine learning capabilities is becoming a de facto standard, enabling features such as object recognition, semantic segmentation, and predictive image stabilization. This evolution signifies a shift from basic image processing to intelligent vision systems, where ISPs are no longer mere components but foundational elements of smart devices. The cybersecurity and privacy concerns surrounding visual data are also indirectly spurring innovation in ISP functionalities, leading to the development of more secure and privacy-preserving image processing techniques.

The ascent of the ISP market is predominantly fueled by the relentless consumer demand for superior visual experiences and the transformative impact of emerging technologies. In consumer electronics, the smartphone camera has evolved from a supplementary feature to a primary purchasing consideration, pushing manufacturers to equip devices with increasingly sophisticated ISP capabilities to deliver professional-grade photography and videography. This includes advancements in low-light performance, bokeh effects, and real-time video stabilization, all of which are heavily reliant on powerful ISPs. Simultaneously, the automotive industry represents a colossal and rapidly expanding frontier for ISP integration. The escalating complexity of ADAS, from adaptive cruise control and lane-keeping assist to sophisticated surround-view systems and pedestrian detection, necessitates high-performance ISPs capable of processing vast amounts of visual data in real-time and under diverse environmental conditions. The burgeoning field of autonomous driving further amplifies this demand, as self-driving vehicles will depend on an array of cameras and computationally intensive image processing for navigation and safety. Beyond these core sectors, the security and monitoring segment, encompassing surveillance cameras and drone technology, also contributes significantly, requiring ISPs to handle high-resolution imagery, advanced analytics, and efficient data compression for continuous operation.

Despite the robust growth prospects, the ISP image signal processor market grapples with several significant challenges and restraints that could temper its expansion. One of the primary hurdles is the escalating complexity and cost associated with developing and integrating advanced ISP architectures. As pixel counts surge and computational demands rise, so do the power consumption and heat dissipation requirements, necessitating innovative solutions for energy efficiency and thermal management. The industry also faces the challenge of evolving standardization, particularly in the automotive sector, where interoperability and safety certifications require rigorous adherence to evolving regulations. The tight integration required between sensors, ISPs, and downstream processing units, including AI accelerators, presents a complex design and verification process, demanding specialized expertise. Furthermore, the rapid pace of technological evolution means that obsolescence can be a concern, requiring continuous investment in R&D to remain competitive. Geopolitical tensions and supply chain disruptions can also impact the availability and cost of critical components, potentially hindering production and increasing market volatility. The sheer diversity of applications, each with unique imaging requirements, also presents a challenge for silicon vendors looking to offer scalable and cost-effective solutions across the board.

The ISP image signal processor market is characterized by a dynamic interplay of regional strengths and segment dominance. Within the 'Type' classification, the 'Greater than 10 MP' segment is poised for unparalleled growth, propelled by the relentless pursuit of higher resolution and richer detail capture across all major application areas. This segment's dominance is not only about raw pixel count but also about the sophisticated processing required to unlock the full potential of these high-resolution sensors.

In terms of regional dominance, Asia Pacific is expected to emerge as the powerhouse of the ISP market. This is driven by several converging factors:

Within the 'Application' segment, Automotive is set to be a critical driver of future growth and dominance. While Consumer Electronics will continue to represent a substantial market share, the CAGR projected for the Automotive segment is considerably higher.

Therefore, the confluence of a strong manufacturing and consumer base in Asia Pacific, coupled with the rapid technological evolution and safety imperatives within the Automotive application segment, will likely see these areas dominating the ISP image signal processor market landscape.

The ISP image signal processor industry is propelled by several key growth catalysts. The insatiable consumer appetite for higher-quality mobile photography and videography remains a primary driver. Furthermore, the accelerating adoption of advanced driver-assistance systems (ADAS) and the burgeoning autonomous driving sector in the automotive industry create immense demand for sophisticated image processing capabilities. The increasing integration of artificial intelligence and machine learning within ISPs, enabling smarter image analysis and enhancement, is another significant catalyst. The expansion of the security and monitoring sector, with its need for high-resolution surveillance and efficient data management, also contributes to market growth.

This report offers an exhaustive examination of the ISP image signal processor market. It delves into the intricate details of market segmentation by type (Up to 10 MP, Greater than 10 MP) and application (Automotive, Consumer Electronics, Security and Monitoring, Other). The study meticulously analyzes industry developments, including technological advancements, evolving application demands, and key growth drivers. Furthermore, it provides a comprehensive overview of the competitive landscape, identifying leading players and their strategic initiatives. The report also includes a thorough forecast of market size and growth projections, equipping stakeholders with the essential insights to navigate this dynamic and rapidly evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.2% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.2%.

Key companies in the market include STMicroelectronics, ON Semiconductor, Arm, Socionext, Renesas Electronics, OmniVision Technologies, Fujitsu, Samsung Electronics, VeriSilicon, THine Electronics, NXP Semiconductors, Qualcomm.

The market segments include Type, Application.

The market size is estimated to be USD 3427 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "ISP Image Signal Processor," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the ISP Image Signal Processor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.