1. What is the projected Compound Annual Growth Rate (CAGR) of the Integrated Air Quality Sensors?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Integrated Air Quality Sensors

Integrated Air Quality SensorsIntegrated Air Quality Sensors by Type (Portable, Stationary, Embedded, World Integrated Air Quality Sensors Production ), by Application (Household, Industrial, Commercial, World Integrated Air Quality Sensors Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

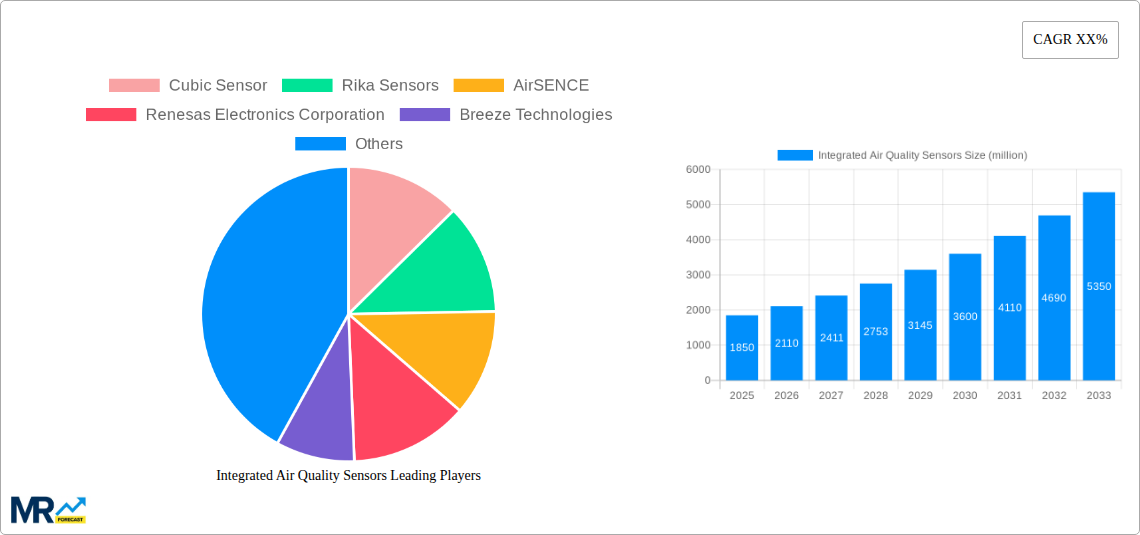

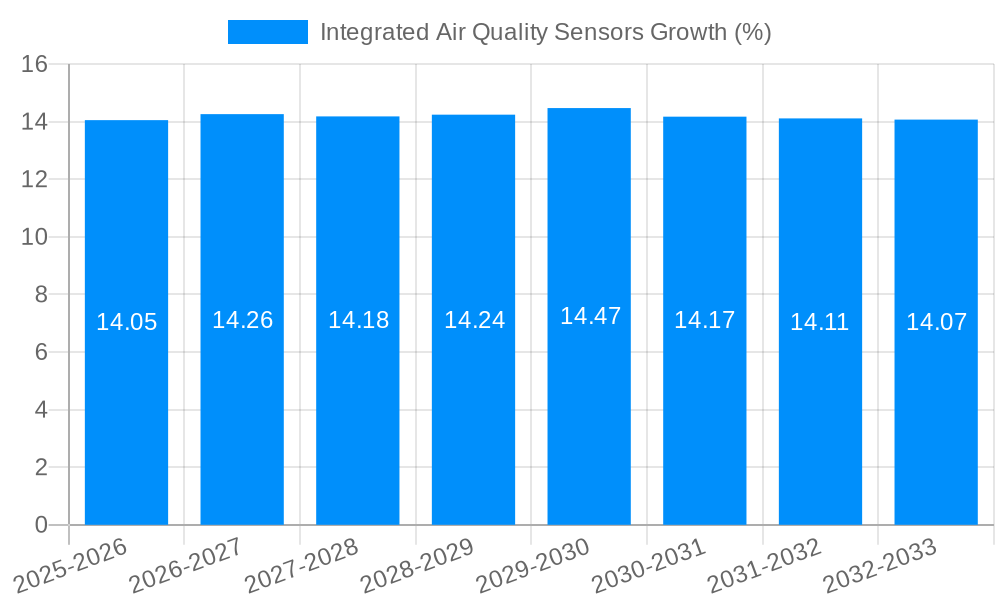

The global integrated air quality sensors market is experiencing robust growth, projected to reach an estimated market size of approximately $1,850 million by 2025, with a compound annual growth rate (CAGR) of roughly 14.5% anticipated from 2025 to 2033. This expansion is primarily fueled by increasing global awareness of air pollution's detrimental health effects and the subsequent demand for sophisticated monitoring solutions across residential, industrial, and commercial sectors. The rising adoption of smart home devices, coupled with stringent government regulations and initiatives aimed at improving urban air quality, are significant growth drivers. Furthermore, advancements in sensor technology, leading to more accurate, cost-effective, and miniaturized integrated air quality sensors, are propelling market penetration. The market encompasses a variety of sensor types, including portable, stationary, and embedded solutions, catering to diverse application needs.

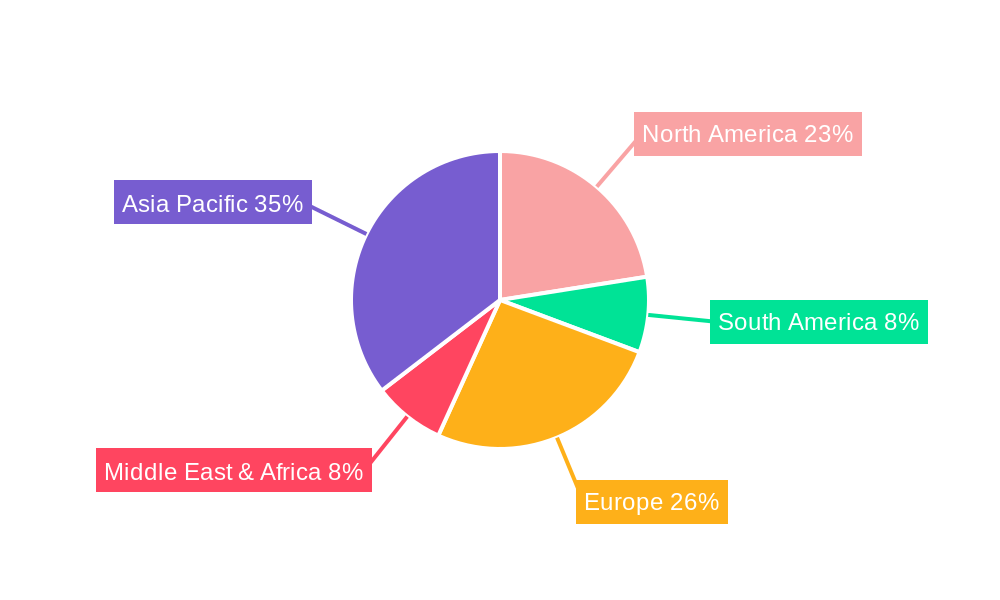

The market is characterized by a dynamic competitive landscape, with key players like Cubic Sensor, Rika Sensors, Renesas Electronics Corporation, Bosch Sensortec, and Vaisala actively innovating and expanding their product portfolios. Geographically, the Asia Pacific region, particularly China and India, is emerging as a dominant force due to rapid industrialization, increasing urbanization, and growing environmental concerns. North America and Europe also represent substantial markets, driven by proactive regulatory frameworks and a high level of technological adoption. While the market presents immense opportunities, challenges such as the need for standardization in sensor calibration and data interpretation, and the initial cost of advanced systems in certain applications, may pose some restraints. However, the overall trajectory points towards continued substantial growth, driven by the indispensable need for real-time, accurate air quality data for public health and environmental protection.

Here's a unique report description for Integrated Air Quality Sensors, incorporating your specified elements:

The global integrated air quality sensors market is poised for substantial expansion, with projections indicating a surge from approximately 1.5 million units in the Base Year of 2025 to an estimated 2.8 million units by the end of the Forecast Period in 2033. This growth trajectory reflects a profound shift in societal awareness and regulatory focus concerning environmental health. The Study Period, encompassing 2019-2033, has witnessed a significant ramp-up in demand, driven by increasing urbanization, industrialization, and a growing understanding of the detrimental effects of poor air quality on human health and ecosystems. During the Historical Period (2019-2024), initial market penetration was largely concentrated in developed regions, with early adopters investing in advanced monitoring solutions. However, the Estimated Year of 2025 marks a pivotal point where wider adoption across diverse applications and emerging economies begins to accelerate. Key market insights reveal a growing preference for miniaturized, multi-parameter sensors that can simultaneously detect a range of pollutants such as PM2.5, CO2, VOCs, and ozone. This trend is fueled by the increasing demand for real-time, granular data that empowers informed decision-making for individuals, businesses, and governments. The market is also seeing a rise in smart and connected devices, where integrated air quality sensors are embedded within broader IoT ecosystems, enabling sophisticated data analytics and proactive interventions. Furthermore, the growing concern over indoor air quality (IAQ) in residential and commercial spaces, particularly post-pandemic, is a significant driver. Innovations in sensor technology, leading to improved accuracy, lower power consumption, and reduced costs, are further democratizing access to effective air quality monitoring solutions. The expectation is that the market will continue to evolve, with an increasing emphasis on AI-powered predictive analytics and personalized air quality management strategies.

The relentless growth of the integrated air quality sensors market is propelled by a confluence of powerful drivers. A primary catalyst is the escalating public and governmental concern over the health implications of air pollution. As studies increasingly link poor air quality to respiratory illnesses, cardiovascular diseases, and even cognitive impairments, the demand for effective monitoring and mitigation strategies has surged. Regulatory bodies worldwide are implementing stricter air quality standards and mandates, compelling industries and municipalities to invest in advanced sensor technology for compliance and reporting. The burgeoning smart city initiatives globally are also a significant contributor. Integrated air quality sensors are becoming indispensable components of urban infrastructure, enabling real-time monitoring of pollution levels, traffic management optimization, and the development of data-driven environmental policies. Furthermore, the widespread adoption of the Internet of Things (IoT) has created a fertile ground for embedded and connected air quality sensors. These devices seamlessly integrate into smart homes, buildings, and industrial systems, providing continuous data streams that enhance comfort, safety, and operational efficiency. The increasing affordability and improved performance of sensor technologies, coupled with miniaturization trends, are making these solutions more accessible to a broader market, including households and smaller commercial entities.

Despite the robust growth, the integrated air quality sensors market is not without its hurdles. One significant challenge lies in the calibration and maintenance of sensor accuracy over time. Environmental conditions and the inherent nature of sensor technology can lead to drift and degradation, requiring regular recalibration or replacement, which can be a costly and complex undertaking, especially for widespread deployments. The reliability and standardization of data across different sensor types and manufacturers remain a concern. A lack of uniform performance benchmarks can lead to confusion and hinder the development of comprehensive, interoperable air quality management systems. Furthermore, the initial cost of high-precision, multi-parameter sensors can still be a barrier for some smaller businesses and households, despite ongoing price reductions. Data privacy and security also present a growing challenge, particularly as more sensors are connected to the internet and collect sensitive information about indoor environments and occupancy patterns. Ensuring robust cybersecurity measures to protect this data from unauthorized access is paramount. Finally, the market is susceptible to fluctuating raw material costs and supply chain disruptions, which can impact manufacturing and product availability, potentially slowing down adoption rates.

The Asia-Pacific region is anticipated to emerge as the dominant force in the integrated air quality sensors market, driven by a potent combination of rapid industrialization, escalating urbanization, and a growing environmental consciousness. By the end of the Forecast Period (2033), this region is expected to account for over 35% of the global market share, translating to significant unit volumes in the millions.

Key Regions/Countries Dominating:

Dominant Segments (by Application):

The dominance of Asia-Pacific stems from the sheer scale of its developing economies, where rapid infrastructure development and industrial growth are often accompanied by significant air pollution challenges. Governments are increasingly recognizing the need to address these issues proactively. China, in particular, has been a major driver due to its ambitious environmental protection policies and significant investment in smart city infrastructure. India, with its rapidly expanding urban populations and industrial base, presents another critical growth market. The increasing deployment of Stationary sensors within these regions for continuous environmental monitoring, coupled with the growing adoption of Embedded sensors in industrial machinery and smart devices, will further solidify their market leadership. The demand for accurate, real-time data from these sensors is not only for regulatory compliance but also for public health advisories, disaster management, and the promotion of sustainable urban development.

The integrated air quality sensors industry is propelled by several key growth catalysts. The escalating global awareness of air pollution's adverse health effects is a primary driver, leading to increased demand from both consumers and regulatory bodies. Government initiatives and stringent environmental regulations worldwide are mandating better air quality monitoring, fostering innovation and market expansion. The rapid advancement of IoT and smart city technologies creates a fertile ground for embedded and connected air quality sensors, integrating them into broader infrastructure for enhanced data collection and analysis. Furthermore, decreasing sensor costs and improving technological capabilities, such as miniaturization and multi-parameter detection, are making these solutions more accessible and attractive across diverse applications.

This comprehensive report delves into the intricate dynamics of the integrated air quality sensors market, providing an exhaustive analysis from the Base Year of 2025 through to the projected end of the Forecast Period in 2033. It meticulously examines market trends, identifying key shifts in demand and technology adoption, and forecasts future market sizes in terms of units, projecting a significant increase from approximately 1.5 million in 2025 to 2.8 million by 2033. The report dissects the primary drivers propelling this expansion, such as heightened health awareness and stringent regulations, while also addressing critical challenges like sensor calibration and data standardization. Furthermore, it offers an in-depth regional analysis, pinpointing the Asia-Pacific as the leading market, and explores the dominance of industrial and commercial segments. The report also highlights significant industry developments and the key players shaping the future of integrated air quality sensing technology. This comprehensive view equips stakeholders with the essential insights needed to navigate this evolving and vital market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Cubic Sensor, Rika Sensors, AirSENCE, Renesas Electronics Corporation, Breeze Technologies, Aeroqual, Verkada, Sensirion, IQAir, Atmotech, Vaisala, Bosch Sensortec.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Integrated Air Quality Sensors," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Integrated Air Quality Sensors, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.