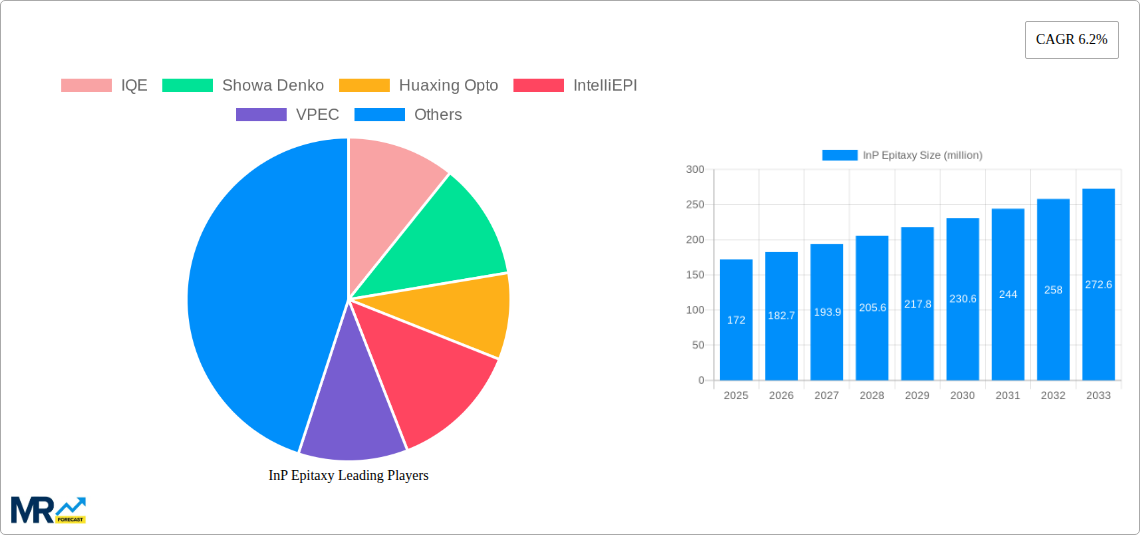

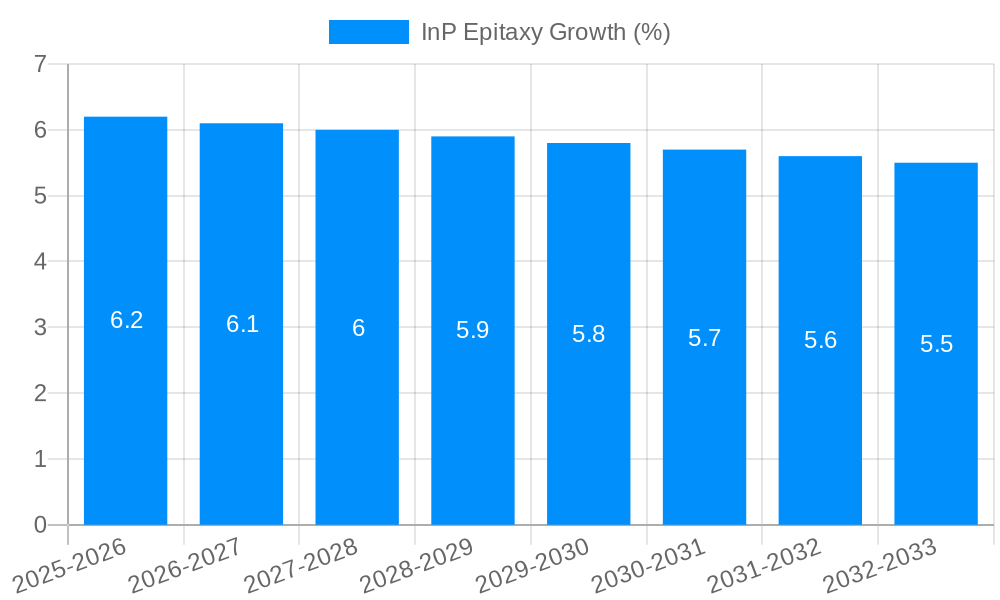

1. What is the projected Compound Annual Growth Rate (CAGR) of the InP Epitaxy?

The projected CAGR is approximately 6.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

InP Epitaxy

InP EpitaxyInP Epitaxy by Type (MOCVD, MBE, Others), by Application (Photoelectric, Radio Frequency, Power Electronics), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global InP Epitaxy market is poised for robust expansion, projected to reach a significant value of $172 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 6.2% anticipated between 2025 and 2033. This sustained growth trajectory is primarily fueled by the escalating demand for advanced semiconductor materials in high-performance applications. Key drivers include the burgeoning photoelectric sector, particularly for high-speed optical communication and advanced sensing technologies, and the critical role of InP epitaxy in enabling next-generation radio frequency (RF) devices for 5G and beyond wireless infrastructure. Furthermore, the increasing adoption of power electronics in electric vehicles, renewable energy systems, and industrial automation is creating a substantial uplift for InP epitaxy solutions, which offer superior performance characteristics like high breakdown voltage and low switching losses.

The market is segmented by Type, with Metal-Organic Chemical Vapor Deposition (MOCVD) anticipated to dominate due to its versatility and scalability for producing high-quality InP wafers. Molecular Beam Epitaxy (MBE) will also hold a significant share, driven by its precision for specialized applications requiring atomic-level control. In terms of Application, Photoelectric devices will continue to be the largest segment, propelled by the relentless growth in data centers, fiber optic networks, and LiDAR technology. The Radio Frequency segment is expected to witness the fastest growth, driven by the rollout of advanced wireless communication standards. While the market benefits from strong technological advancements and increasing application breadth, potential restraints could include the high cost of manufacturing equipment and raw materials, as well as the need for highly specialized expertise in InP epitaxy processes. Nonetheless, the strategic importance of InP in enabling cutting-edge technologies ensures a favorable outlook for market participants.

The InP epitaxy market is poised for significant expansion, with a projected market size reaching over 1,500 million USD by 2033. The historical period, from 2019 to 2024, has witnessed steady growth, laying the groundwork for an accelerated trajectory. The base year of 2025 is estimated to be a pivotal point, with the market already exceeding 1,000 million USD in value. This growth is fueled by the insatiable demand for advanced semiconductor materials that offer superior performance characteristics compared to traditional silicon-based alternatives. Indium Phosphide (InP) epitaxy, in particular, has emerged as a critical technology for next-generation electronic and optoelectronic devices. Its exceptional properties, including high electron mobility, direct bandgap, and excellent thermal conductivity, make it indispensable for a wide array of high-performance applications. The forecast period from 2025 to 2033 anticipates a compound annual growth rate (CAGR) that will drive the market to its projected zenith. Key market insights reveal a strong shift towards integration, miniaturization, and increased functionality in electronic components, all of which InP epitaxy is uniquely positioned to enable. Furthermore, advancements in fabrication techniques, particularly in MOCVD and MBE growth methods, are improving material quality and reducing production costs, thereby expanding the addressable market. The increasing adoption of InP in 5G infrastructure, high-speed data communication, and advanced sensing technologies are significant drivers of this upward trend. The intricate development of complex epitaxial layers with precise control over composition and thickness is a testament to the sophistication of current manufacturing processes. The market's growth is not merely a function of increased production volume but also of the evolving complexity and value of the epitaxially grown InP wafers. As research and development continue to push the boundaries of what is possible with InP, its strategic importance in the semiconductor landscape will only deepen, solidifying its position as a cornerstone of future technological innovation. The market's value is intrinsically linked to the quality and performance of the epitaxially grown layers, which are critical for meeting the stringent requirements of cutting-edge applications. The ongoing refinement of deposition techniques ensures that the delivered material consistently meets the high standards demanded by industries such as telecommunications and aerospace.

The remarkable growth trajectory of the InP epitaxy market is primarily driven by the escalating demand for high-performance optoelectronic and radio frequency (RF) devices. The global rollout of 5G networks, with their requirement for higher frequencies and lower latency, necessitates InP-based components for critical functions like power amplifiers and transceivers. Similarly, the burgeoning data communication sector, fueled by cloud computing and the Internet of Things (IoT), demands InP epitaxy for high-speed optical components such as lasers, photodetectors, and modulators that enable faster data transmission. The unique material properties of InP, including its direct bandgap and high electron mobility, are crucial for achieving these performance benchmarks. Furthermore, the increasing prevalence of advanced sensing technologies across various industries, from automotive to healthcare, is creating new avenues for InP epitaxy. The ability of InP to operate at terahertz frequencies opens doors for novel sensing and imaging applications that are beyond the capabilities of traditional semiconductor materials. The continuous innovation in InP-based heterostructures and device architectures, facilitated by advanced epitaxy techniques like Metal-Organic Chemical Vapor Deposition (MOCVD) and Molecular Beam Epitaxy (MBE), further contributes to this growth. These advancements allow for the precise control of material properties, enabling the fabrication of highly efficient and compact devices. The strategic investments by leading semiconductor manufacturers in InP research and development signal a strong commitment to leveraging its advantages for future technological breakthroughs.

Despite its promising outlook, the InP epitaxy market faces several significant challenges that could potentially restrain its growth. One of the primary hurdles is the high cost of raw materials, particularly Indium. The limited global supply and price volatility of Indium directly impact the overall manufacturing cost of InP wafers, making them more expensive compared to silicon-based alternatives. This cost premium can be a barrier for widespread adoption in price-sensitive applications. Another significant challenge lies in the complexity and precision required for the epitaxy process. Growing high-quality InP layers with specific doping profiles and lattice matching is a demanding task that requires sophisticated equipment and highly skilled personnel. Any imperfections or defects introduced during the epitaxial growth can severely degrade device performance, leading to lower yields and increased manufacturing expenses. The specialized nature of InP epitaxy equipment also translates to higher capital investment for manufacturers. Furthermore, substrate warp and crack issues during the growth and subsequent processing steps can also lead to significant material loss and impact the overall cost-effectiveness of InP epitaxy. The development and scaling of complementary InP-based device fabrication processes also present a challenge. While epitaxy is the foundational step, the subsequent steps of device manufacturing need to be optimized for InP to fully realize its potential, which can be a time-consuming and resource-intensive endeavor. The market is also susceptible to technological obsolescence if breakthroughs in alternative materials or technologies emerge that offer comparable or superior performance at a lower cost. Lastly, the environmental impact and waste management associated with the chemical precursors used in epitaxy processes require careful consideration and adherence to increasingly stringent environmental regulations, adding another layer of complexity and potential cost.

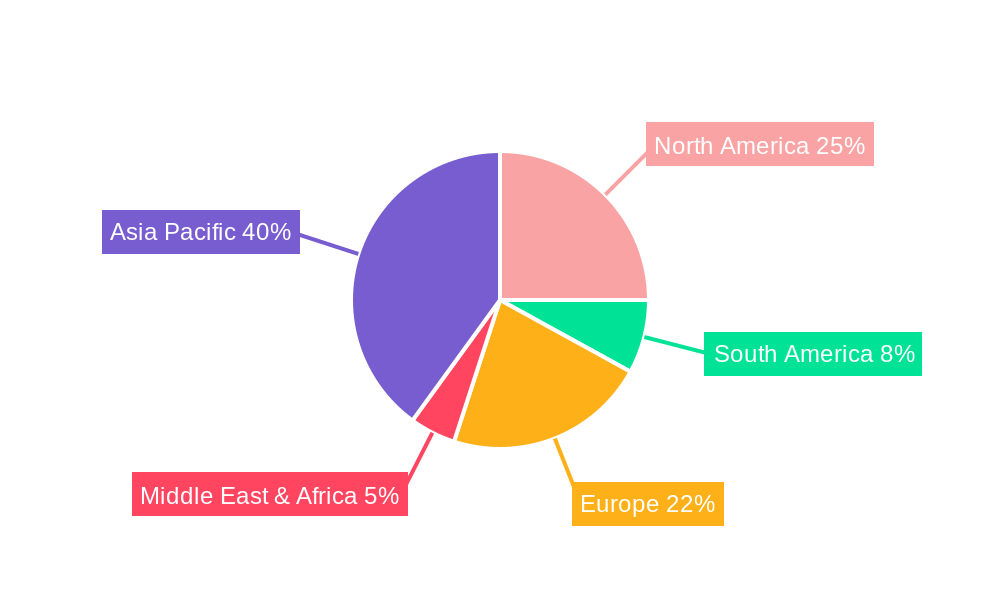

The InP epitaxy market is characterized by a dynamic interplay of dominant regions and strategically important segments, each contributing to the overall market expansion and innovation. From a regional perspective, Asia Pacific is poised to exert significant influence, driven by a robust manufacturing ecosystem and a burgeoning demand for advanced electronics and telecommunications infrastructure. Countries like China are making substantial investments in semiconductor manufacturing, including InP epitaxy capabilities, to reduce reliance on foreign suppliers and to cater to the immense domestic market for 5G devices, data centers, and consumer electronics. South Korea and Taiwan also remain pivotal players, leveraging their established expertise in semiconductor fabrication and their strong presence in the global electronics supply chain. The presence of leading InP wafer manufacturers and foundries in these regions, coupled with government support for technological advancement, positions Asia Pacific as a formidable force.

In terms of dominant segments, the Radio Frequency (RF) application segment is expected to witness substantial growth, underpinning the market's expansion. The relentless advancement of wireless communication technologies, particularly the widespread deployment of 5G and the anticipated arrival of 6G, is a primary catalyst. InP's superior electron mobility and high breakdown voltage make it an ideal material for high-frequency power amplifiers, low-noise amplifiers, and transceivers that are critical components in mobile devices, base stations, and satellite communication systems. The efficiency, speed, and reduced signal loss offered by InP-based RF components are indispensable for meeting the ever-increasing data throughput and connectivity demands.

The Photoelectric segment is also a significant driver, propelled by the insatiable growth in data communication and the expansion of fiber optic networks. InP epitaxy is fundamental to the fabrication of high-speed lasers, photodetectors, and modulators used in optical transceivers for data centers, telecommunications infrastructure, and even emerging applications like optical interconnects in high-performance computing. The direct bandgap nature of InP allows for efficient light emission and detection, crucial for high-bandwidth optical communication. The increasing volume of data being transmitted globally necessitates faster and more efficient optical components, a demand that InP epitaxy is uniquely equipped to fulfill.

Furthermore, the MOCVD (Metal-Organic Chemical Vapor Deposition) type segment is expected to dominate due to its established position as the leading epitaxy technique for producing high-quality InP layers. MOCVD offers excellent control over layer thickness, composition, and doping profiles, which are critical for fabricating complex InP heterostructures required for advanced RF and photoelectric devices. While other techniques like MBE might offer superior material quality for niche applications, MOCVD's scalability, throughput, and cost-effectiveness make it the preferred choice for mass production. The continuous improvements in MOCVD reactor design and process control are further solidifying its dominance in the InP epitaxy landscape.

The InP epitaxy industry is propelled by several key growth catalysts. The rapid expansion of 5G and future wireless communication technologies demands InP's superior RF performance. The insatiable growth of data centers and high-speed optical communication fuels the need for InP-based optoelectronic components. Advancements in terahertz technology are opening new frontiers for InP in sensing and imaging. Continued technological innovation in epitaxy techniques, like MOCVD and MBE, is improving material quality and cost-effectiveness. Finally, strategic investments and R&D efforts by leading players are driving the development of next-generation InP devices.

This comprehensive InP epitaxy report offers an in-depth analysis of market dynamics, trends, and future projections. It delves into the intricate details of MOCVD, MBE, and other epitaxy types, alongside their applications in photoelectric, radio frequency, and power electronics segments. The report meticulously examines the historical performance from 2019-2024, provides a detailed market estimation for 2025, and forecasts the market trajectory from 2025-2033, projecting a market size exceeding 1,500 million USD. Key industry developments, challenges, growth catalysts, and leading players like IQE, Showa Denko, and VIGO System SA are comprehensively covered, offering valuable insights for stakeholders aiming to navigate this dynamic and rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.2% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.2%.

Key companies in the market include IQE, Showa Denko, Huaxing Opto, IntelliEPI, VPEC, VIGO System SA.

The market segments include Type, Application.

The market size is estimated to be USD 172 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "InP Epitaxy," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the InP Epitaxy, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.