1. What is the projected Compound Annual Growth Rate (CAGR) of the InGaAs SWIR Detector?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

InGaAs SWIR Detector

InGaAs SWIR DetectorInGaAs SWIR Detector by Type (Single-Element InGaAs SWIR Sensors, Line InGaAs SWIR Sensors, Area InGaAs SWIR Sensors, World InGaAs SWIR Detector Production ), by Application (Military, Surveillance, Induatrial, Medical, Scientific Research, Other Application, World InGaAs SWIR Detector Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

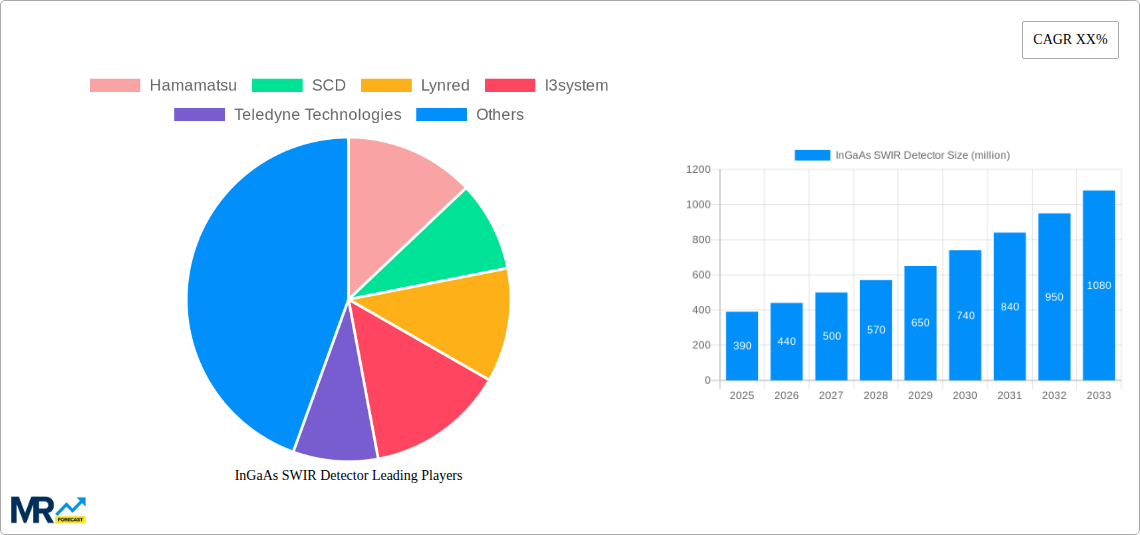

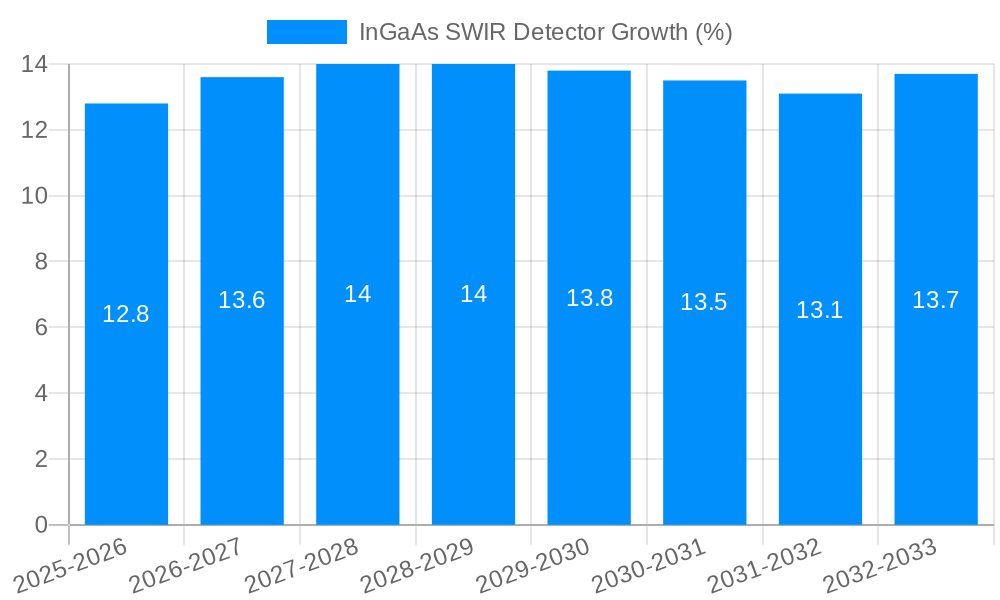

The global InGaAs SWIR (Short-Wave Infrared) detector market is projected for robust expansion, reaching an estimated USD 390 million by 2025 and exhibiting a significant Compound Annual Growth Rate (CAGR) of approximately 12-15% over the forecast period of 2025-2033. This substantial growth is primarily fueled by escalating demand across critical sectors such as military and defense for enhanced surveillance and reconnaissance capabilities, industrial applications requiring precise quality control and process monitoring, and the burgeoning fields of scientific research and medical diagnostics where SWIR imaging offers unique insights. The increasing sophistication of these applications, coupled with advancements in InGaAs detector technology leading to improved sensitivity, resolution, and cost-effectiveness, are key drivers propelling market penetration. Furthermore, the growing adoption of SWIR imaging in emerging areas like autonomous driving and hyperspectral imaging is expected to unlock new avenues for market growth.

The market landscape is characterized by a dynamic interplay of technological innovation and strategic collaborations among leading players including Hamamatsu, SCD, Lynred, and Teledyne Technologies. Competition is intensifying as companies focus on developing higher performance detectors and integrated solutions tailored to specific end-use requirements. Restraints such as the initial high cost of advanced InGaAs SWIR detectors and the need for specialized expertise in their operation and data interpretation are present, but are being gradually mitigated by technological advancements and market maturation. The market is segmented by detector type, with area and line sensors expected to see significant adoption due to their versatility. Geographically, the Asia Pacific region, led by China and Japan, is emerging as a dominant force, driven by strong industrial growth and increasing investments in defense and technology. North America and Europe remain significant markets, owing to established defense industries and strong research and development ecosystems.

Here's a comprehensive report description for InGaAs SWIR Detectors, incorporating your specified details:

The global InGaAs SWIR (Short-Wave Infrared) detector market is poised for robust expansion, driven by an escalating demand for advanced imaging solutions across a multitude of sectors. Our comprehensive analysis, spanning the Study Period 2019-2033, with a Base Year of 2025 and projecting to 2033, reveals a dynamic landscape shaped by technological innovation and burgeoning application areas. During the Historical Period 2019-2024, the market witnessed steady growth, fueled by initial adoption in specialized military and industrial applications. As we move into the Forecast Period 2025-2033, we anticipate a significant acceleration in market value, potentially reaching several million units annually, as the capabilities of InGaAs SWIR detectors become more widely recognized and cost-effective.

The fundamental advantage of InGaAs SWIR detectors lies in their ability to capture light in the 0.9 to 2.5-micrometer wavelength range, enabling them to "see" through obscurants like fog, smoke, and dust, and to detect thermal signatures invisible to the naked eye. This inherent capability translates into critical improvements in surveillance, inspection, and diagnostic functionalities. Furthermore, the continuous miniaturization and enhanced performance of these detectors are making them viable for a broader spectrum of applications, from consumer electronics to sophisticated scientific instrumentation. The increasing investment in research and development by key players, aiming to improve quantum efficiency, reduce noise levels, and expand spectral ranges, is a testament to the perceived long-term growth potential of this technology. The market is expected to see a healthy CAGR, pushing the total market value into the multi-million unit range by the end of the forecast period, a testament to its increasing indispensability. The trend towards higher resolution, faster frame rates, and lower power consumption further solidifies the upward trajectory of this vital technology.

The significant growth observed and projected for the InGaAs SWIR detector market is propelled by a confluence of powerful driving forces. Foremost among these is the escalating global demand for enhanced surveillance and security capabilities. Governments and private organizations worldwide are increasingly investing in sophisticated monitoring systems to counter threats, secure borders, and ensure public safety, where InGaAs SWIR detectors excel due to their ability to penetrate atmospheric obscurants and detect heat signatures. Simultaneously, the industrial sector is a major growth engine, driven by the need for non-destructive testing, quality control, and process monitoring. Applications such as plastic sorting, food inspection, pharmaceutical quality assurance, and molten metal temperature monitoring are all benefiting from the unique spectral information provided by SWIR imaging.

The relentless advancement in sensor technology, leading to higher performance, increased sensitivity, and more compact designs, is also a critical driver. As manufacturing processes mature and economies of scale are achieved, the cost of InGaAs SWIR detectors is gradually decreasing, making them accessible for a wider range of applications that were previously cost-prohibitive. This democratization of the technology is opening up new market segments. The burgeoning fields of scientific research and medical diagnostics are also contributing significantly. In research, SWIR detectors are instrumental in spectroscopy, material science, and astronomical observations. In the medical field, they are finding applications in advanced imaging techniques for disease detection and surgical guidance. The constant push for innovation, coupled with the inherent advantages of SWIR imaging, creates a self-reinforcing cycle of demand and technological progress, ensuring a sustained upward trajectory for the InGaAs SWIR detector market, projected to exceed several million units in annual value.

Despite the promising growth trajectory, the InGaAs SWIR detector market faces several challenges and restraints that could temper its expansion. A primary concern remains the relatively high cost of manufacturing compared to other imaging technologies like visible light sensors. The intricate fabrication processes and the reliance on specialized materials contribute to a higher price point, which can be a barrier to adoption in cost-sensitive applications or emerging markets. This cost factor, while gradually improving, still limits widespread adoption, particularly for mass-market consumer applications.

Furthermore, the complexity of integration and data processing associated with SWIR imaging can present a hurdle. Extracting meaningful information from SWIR data often requires specialized algorithms and expertise, which may not be readily available in all potential user segments. This necessitates additional investment in software and skilled personnel, further increasing the total cost of ownership. The availability of alternative technologies for specific applications, such as thermal cameras for certain heat detection needs or hyperspectral imaging systems for more detailed spectral analysis, also presents competition. While InGaAs SWIR detectors offer a unique spectral band, they might not always be the most suitable or cost-effective solution for every imaging task. Lastly, awareness and education about the full capabilities and benefits of InGaAs SWIR technology are still developing in some industries, leading to a slower uptake than might otherwise be expected. Overcoming these challenges will be crucial for the InGaAs SWIR detector market to reach its full potential, with the global market value of units expected to reach several million units by the end of the forecast period.

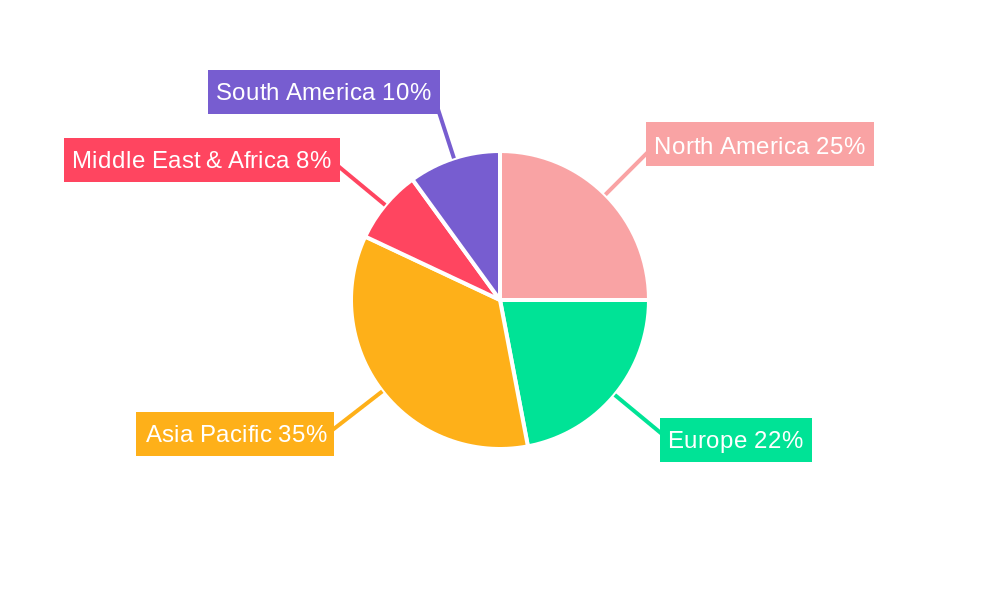

The global InGaAs SWIR detector market exhibits distinct regional strengths and segment dominance, with North America and Asia-Pacific emerging as key growth engines.

North America continues to be a frontrunner, largely driven by significant government investments in defense and homeland security. The robust presence of leading defense contractors and research institutions fuels demand for advanced surveillance, reconnaissance, and target acquisition systems, where InGaAs SWIR detectors are indispensable. The region's strong emphasis on technological innovation and early adoption of cutting-edge solutions further solidifies its leading position. Furthermore, the expanding industrial base, particularly in sectors like advanced manufacturing, food processing, and pharmaceuticals, is increasingly recognizing the value of SWIR imaging for quality control and process optimization, contributing to the multi-million dollar unit market value.

Asia-Pacific is poised for the most substantial growth, propelled by rapid industrialization, increasing defense spending by several nations, and a burgeoning domestic technology manufacturing sector. Countries like China, South Korea, and Japan are heavily investing in developing and deploying InGaAs SWIR detector technology across various applications. China, in particular, is a significant player, with a rapidly expanding domestic market and increasing export capabilities, aiming to achieve several million units in annual production. The focus on smart city initiatives, advanced manufacturing, and sophisticated surveillance systems is creating immense demand.

Europe also holds a significant share, driven by its strong industrial base, particularly in Germany and France, and a growing interest in scientific research and medical applications. Strict quality control regulations in the automotive and manufacturing sectors are pushing for advanced inspection techniques, where SWIR imaging plays a vital role.

In terms of segment dominance, the Application: Military and Surveillance segment is projected to lead the market in terms of revenue and unit volume throughout the Forecast Period 2025-2033. The inherent capabilities of InGaAs SWIR detectors to see through obscurants, detect thermal signatures, and operate in low-light conditions make them critical for modern defense and security operations. This segment alone is expected to contribute a substantial portion to the multi-million unit market value.

The Application: Industrial segment is also experiencing rapid growth and is expected to become a significant contributor. This is driven by the increasing adoption of SWIR imaging for quality control, process monitoring, and non-destructive testing in diverse industries such as food and beverage, plastics, textiles, and electronics. The ability to detect material composition, identify contaminants, and monitor processes in real-time provides tangible benefits, leading to improved efficiency and product quality, pushing the unit market towards several million.

Looking at the Type: Area InGaAs SWIR Sensors are likely to dominate the market. These sensors, offering 2D imaging capabilities, are crucial for applications requiring detailed spatial information and scene analysis, such as advanced surveillance, robotics, and complex industrial inspection. Their versatility and ability to capture comprehensive visual data make them highly sought after, contributing significantly to the projected multi-million unit market.

The InGaAs SWIR detector industry is fueled by several key growth catalysts. The relentless pursuit of enhanced national security and border surveillance across the globe is a primary driver, necessitating advanced imaging capabilities that SWIR technology provides. Simultaneously, the growing demand for sophisticated automation and quality control in industries like food processing, pharmaceuticals, and manufacturing is creating significant opportunities. Miniaturization and cost reduction in detector manufacturing are making these advanced sensors more accessible, thereby expanding their application base into previously untapped markets. Furthermore, breakthroughs in AI and machine learning are enhancing the interpretability and value of SWIR data, creating new avenues for growth and innovation.

This comprehensive report delves into the intricate details of the global InGaAs SWIR detector market, providing an in-depth analysis of market dynamics, trends, and future projections. It offers valuable insights into the technological advancements, manufacturing landscapes, and the evolving competitive environment. The report meticulously examines the segmentation of the market by detector type (single-element, line, and area sensors), application (military, surveillance, industrial, medical, scientific research, and others), and geographical region, with a particular focus on regions like North America, Asia-Pacific, and Europe. It aims to equip stakeholders with the critical information needed to navigate this rapidly evolving sector, underscoring its potential to reach several million units in market value. The report also highlights the critical role of key industry players and their strategic initiatives in shaping the market's trajectory.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Hamamatsu, SCD, Lynred, I3system, Teledyne Technologies, Sensors Unlimited, Jiwu Optoelectronic, Sony, OSI Optoelectronics, GHOPTO, TE (First Sensor), ZKDX, XenICs, Xi'an Leading Optoelectronic Technology, CETC (NO.44 Institute), NORINCO GROUP (Kunming Institute of Physics).

The market segments include Type, Application.

The market size is estimated to be USD 390 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "InGaAs SWIR Detector," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the InGaAs SWIR Detector, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.