1. What is the projected Compound Annual Growth Rate (CAGR) of the InGaAs Camera Sensors?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

InGaAs Camera Sensors

InGaAs Camera SensorsInGaAs Camera Sensors by Type (InGaAs Linear Arrays, InGaAs Area Arrays, World InGaAs Camera Sensors Production ), by Application (Military, Surveillance, Industrial, Others, World InGaAs Camera Sensors Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

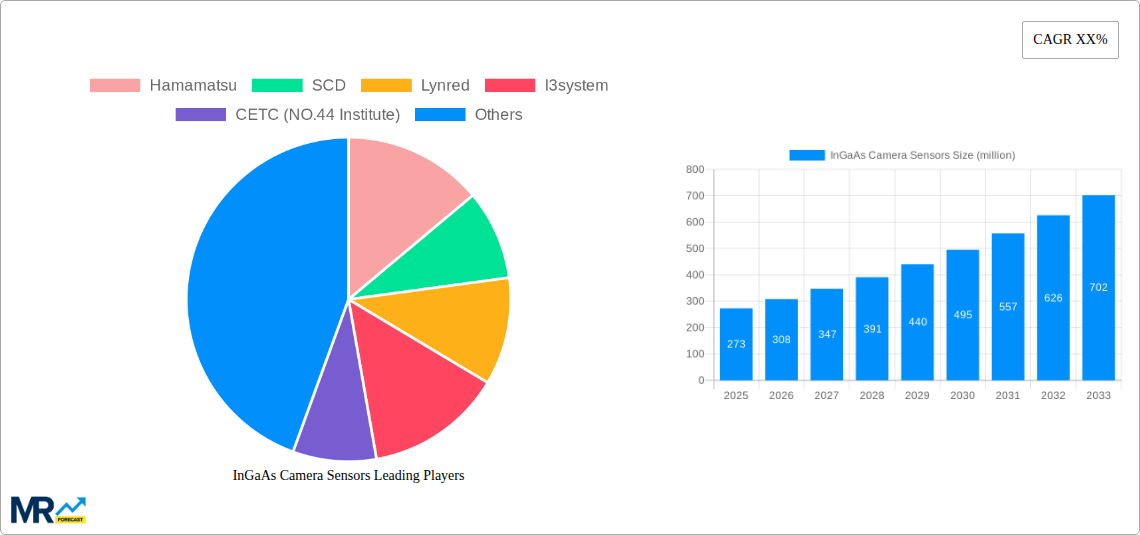

The global market for Indium Gallium Arsenide (InGaAs) camera sensors is poised for significant expansion, projected to reach approximately \$273 million by 2025. This robust growth is driven by the increasing demand for advanced imaging solutions across a spectrum of critical applications, particularly in the military and surveillance sectors. The inherent advantages of InGaAs technology, such as its ability to detect light in the near-infrared spectrum, make it indispensable for tasks requiring enhanced visibility in low-light conditions, through obscurants like fog and smoke, and for non-destructive testing. The market's trajectory is further bolstered by continuous technological advancements in sensor design and manufacturing, leading to improved performance, higher resolution, and more cost-effective solutions. The growing integration of InGaAs sensors into unmanned aerial vehicles (UAVs), advanced driver-assistance systems (ADAS), and sophisticated industrial inspection equipment are also key contributors to this positive market outlook.

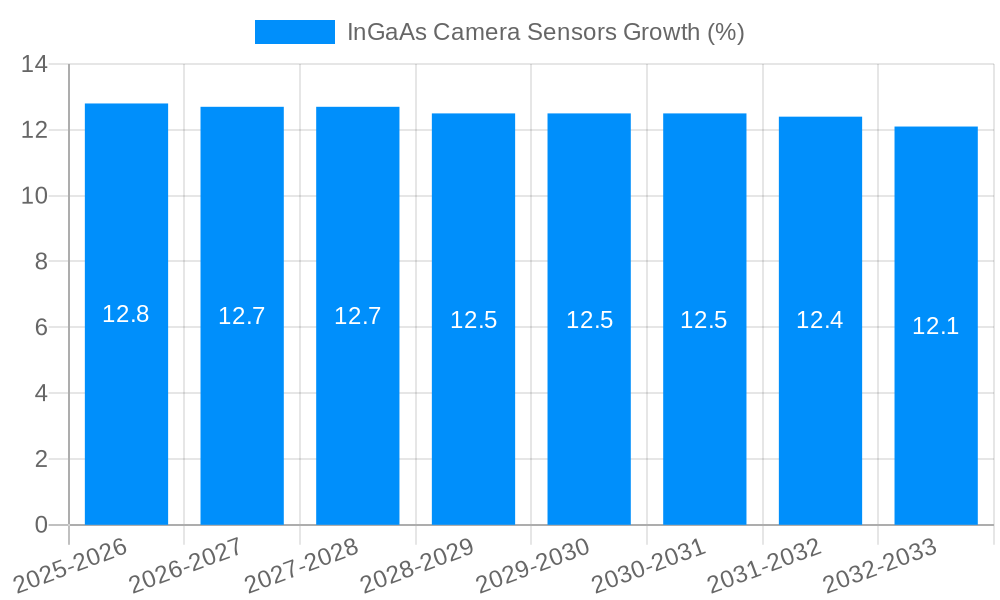

While the market exhibits strong growth potential, certain factors could influence its pace. High manufacturing costs associated with InGaAs materials and fabrication processes can present a barrier, especially for niche or emerging applications. However, ongoing research and development efforts are focused on optimizing production techniques to reduce these costs. Furthermore, the increasing complexity of imaging systems and the need for specialized expertise in integrating these sensors may pose a challenge. Despite these considerations, the strategic importance of InGaAs camera sensors in enabling next-generation surveillance, defense, and industrial automation solutions ensures their continued relevance and market penetration. The market is characterized by a competitive landscape featuring both established players and emerging innovators, all vying to capture market share through product differentiation and strategic partnerships. The forecast period, extending to 2033, anticipates sustained double-digit compound annual growth rate (CAGR), highlighting the enduring demand for these advanced imaging technologies.

Here's a unique report description for InGaAs Camera Sensors, incorporating your specified elements:

This report offers an in-depth exploration of the global InGaAs camera sensors market, a rapidly evolving sector driven by its unique ability to capture light beyond the visible spectrum. Our comprehensive analysis spans the Historical Period (2019-2024), the Base Year (2025), and a robust Forecast Period (2025-2033), providing stakeholders with invaluable insights into market dynamics, growth trajectories, and emerging opportunities. We delve into the technological advancements, application expansions, and the intricate interplay of market forces that are shaping the future of InGaAs camera sensor technology, projecting its market value to reach hundreds of millions by the end of the study period.

The global InGaAs camera sensor market is experiencing a significant surge, driven by an insatiable demand for enhanced imaging capabilities across a multitude of industries. A key trend is the remarkable progression in sensor resolution and pixel pitch, enabling the capture of finer details and the detection of subtler spectral signatures. This technological leap is directly fueling the adoption of InGaAs sensors in applications previously underserved by traditional imaging solutions. Furthermore, the miniaturization and cost reduction of InGaAs sensor components are making these advanced imaging solutions more accessible to a broader range of industrial and commercial users. We anticipate a substantial growth in the World InGaAs Camera Sensors Production figures, with the market value projected to reach hundreds of millions in the coming years. The increasing integration of AI and machine learning algorithms with InGaAs sensor data is another pivotal trend, unlocking sophisticated image analysis capabilities for autonomous systems, quality control, and advanced scientific research. The development of novel material science and fabrication techniques is also contributing to improved performance characteristics, such as higher quantum efficiency and reduced noise levels, further solidifying InGaAs’s position as a critical technology for next-generation imaging. The convergence of these trends points towards a dynamic and expanding market, poised for continued innovation and market penetration across diverse application segments. The market is on track to witness a significant increase, potentially crossing the hundreds of millions mark in total production value.

Several potent forces are propelling the InGaAs camera sensors market to new heights. Foremost among these is the escalating demand for enhanced vision systems in applications where visible light imaging falls short. This includes critical sectors like defense and security, where the ability to see through obscurants such as fog, smoke, and haze is paramount for surveillance and target acquisition. The industrial automation sector is also a major driver, with InGaAs sensors enabling precise defect detection, quality control in manufacturing processes, and advanced spectral analysis for material identification and sorting. Furthermore, the burgeoning field of hyperspectral imaging, which relies heavily on the broader spectral range of InGaAs sensors, is opening up new avenues in agriculture for crop monitoring, in environmental science for pollution detection, and in medical diagnostics for early disease detection. The increasing global emphasis on remote sensing and monitoring for environmental, agricultural, and infrastructure management purposes further amplifies the need for InGaAs technology. The continuous innovation in chip design and manufacturing processes, leading to higher performance and more cost-effective solutions, also plays a crucial role in their widespread adoption. This confluence of technological advancements and critical application needs is creating a powerful momentum for market expansion.

Despite the promising growth trajectory, the InGaAs camera sensors market is not without its challenges and restraints. A primary hurdle is the relatively high cost of manufacturing InGaAs materials and sensors compared to their silicon-based counterparts. This cost factor can limit their adoption in price-sensitive markets or applications where the benefits of near-infrared imaging are not deemed essential enough to justify the premium. Another significant challenge is the complexity of fabrication processes, which often require specialized equipment and highly skilled personnel, contributing to higher production costs and potential supply chain bottlenecks. Furthermore, interoperability and standardization issues can arise as different manufacturers employ proprietary technologies and interfaces, hindering seamless integration into existing systems. Awareness and understanding of the full potential of InGaAs imaging can also be a restraint, particularly in emerging application areas where potential users may not be fully cognizant of its capabilities and benefits. Finally, competition from alternative imaging technologies, such as thermal imaging and advanced visible-light sensors, can pose a threat in certain niches, requiring InGaAs sensors to continually demonstrate their unique value proposition.

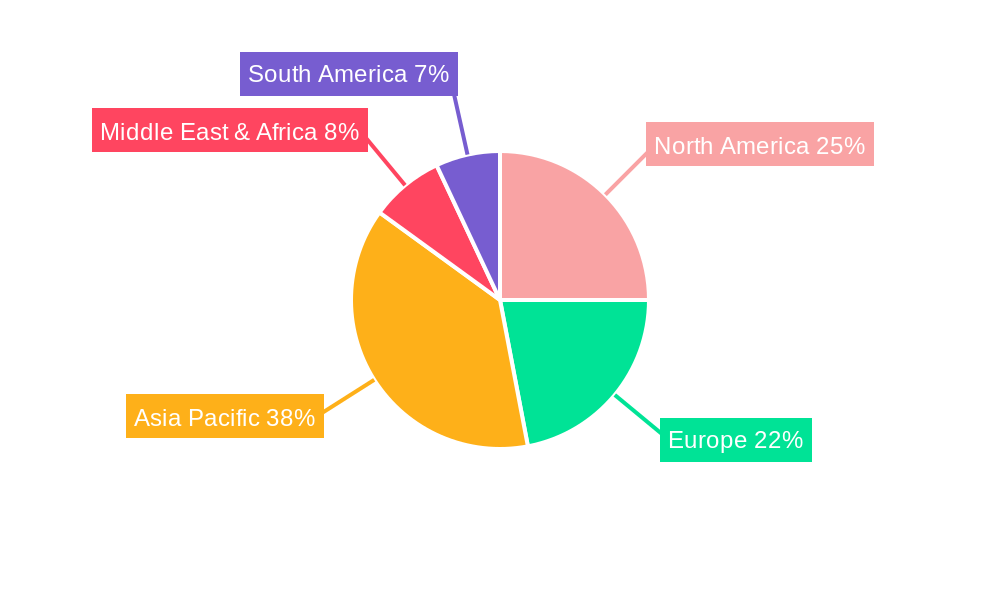

The global InGaAs camera sensors market is characterized by dynamic regional growth and a clear segmentation in terms of product types and applications.

Dominant Segments:

InGaAs Area Arrays: This segment is poised for significant market dominance due to its widespread applicability in high-resolution imaging scenarios. The ability to capture detailed 2D images makes InGaAs Area Arrays indispensable for applications requiring comprehensive scene analysis. This includes sophisticated surveillance systems, advanced industrial inspection, and detailed mapping in remote sensing. The continuous improvement in pixel count and sensitivity of area arrays directly contributes to their market leadership, enabling more nuanced and informative data capture.

Military Application: The Military segment is a foundational pillar and a consistent driver of innovation and demand within the InGaAs camera sensors market. The non-negotiable requirement for superior situational awareness in diverse operational environments, including low-light conditions and the ability to penetrate atmospheric obscurants, makes InGaAs technology a critical component. This encompasses applications such as target acquisition, night vision enhancement, border surveillance, and battlefield reconnaissance. The substantial and ongoing investments in defense modernization globally ensure a robust and sustained demand for advanced imaging solutions. The World InGaAs Camera Sensors Production figures are heavily influenced by these high-value military contracts, contributing significantly to the overall market revenue.

Dominant Regions:

North America: This region, particularly the United States, is a major force in the InGaAs camera sensors market, driven by its advanced technological infrastructure, substantial defense spending, and a thriving industrial automation sector. The presence of leading research institutions and numerous defense contractors fuels innovation and the adoption of cutting-edge imaging solutions. The demand for high-performance surveillance, industrial inspection, and scientific research applications further cements North America's leading position.

Asia Pacific: This region is emerging as a formidable contender, with rapid industrialization, increasing investments in defense modernization in countries like China and India, and a growing focus on smart manufacturing and automation. The World InGaAs Camera Sensors Production is increasingly concentrated in this region due to the presence of key manufacturers and a growing domestic demand across various application sectors. The advancements in manufacturing capabilities and the expansion of application areas like agriculture and environmental monitoring are set to propel Asia Pacific’s market share.

The synergy between the dominance of InGaAs Area Arrays and the Military application segment, particularly within the leading regions of North America and Asia Pacific, defines the current landscape and future trajectory of the global InGaAs camera sensors market. The combined value of production in these segments and regions is projected to represent a substantial portion of the hundreds of millions in the global market.

The InGaAs camera sensors industry is fueled by several key growth catalysts. The escalating demand for improved performance in low-light conditions and through obscurants in defense and security applications remains a primary driver. Furthermore, the burgeoning adoption of Industry 4.0 principles, emphasizing automation, AI, and sophisticated machine vision, is creating new opportunities for InGaAs sensors in industrial inspection and quality control. The expanding applications in hyperspectral imaging for agriculture, environmental monitoring, and medical diagnostics are also significant growth enablers. Technological advancements leading to miniaturization, cost reduction, and enhanced sensitivity are making these sensors more accessible and versatile.

This comprehensive report delves into the intricacies of the InGaAs camera sensors market, providing a detailed roadmap for stakeholders. It meticulously examines market size and value, projecting a trajectory to hundreds of millions within the study period. The report dissects key market trends, including the rise of higher resolution sensors and AI integration. It illuminates the driving forces, such as defense needs and industrial automation, while also addressing critical challenges like manufacturing costs. Furthermore, it identifies dominant regions and segments, offering strategic insights into market leadership. The report also outlines crucial growth catalysts and profiles leading industry players, alongside a chronological listing of significant developments. This in-depth analysis ensures stakeholders are equipped with the knowledge to navigate and capitalize on the evolving InGaAs camera sensors landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Hamamatsu, SCD, Lynred, I3system, CETC (NO.44 Institute), NORINCO GROUP (Kunming Institute of Physics), Jiwu Optoelectronic, Sony, GHOPTO, ZKDX, XenICs, Xi'an Leading Optoelectronic Technology.

The market segments include Type, Application.

The market size is estimated to be USD 273 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "InGaAs Camera Sensors," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the InGaAs Camera Sensors, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.