1. What is the projected Compound Annual Growth Rate (CAGR) of the InGaAs Area Arrays?

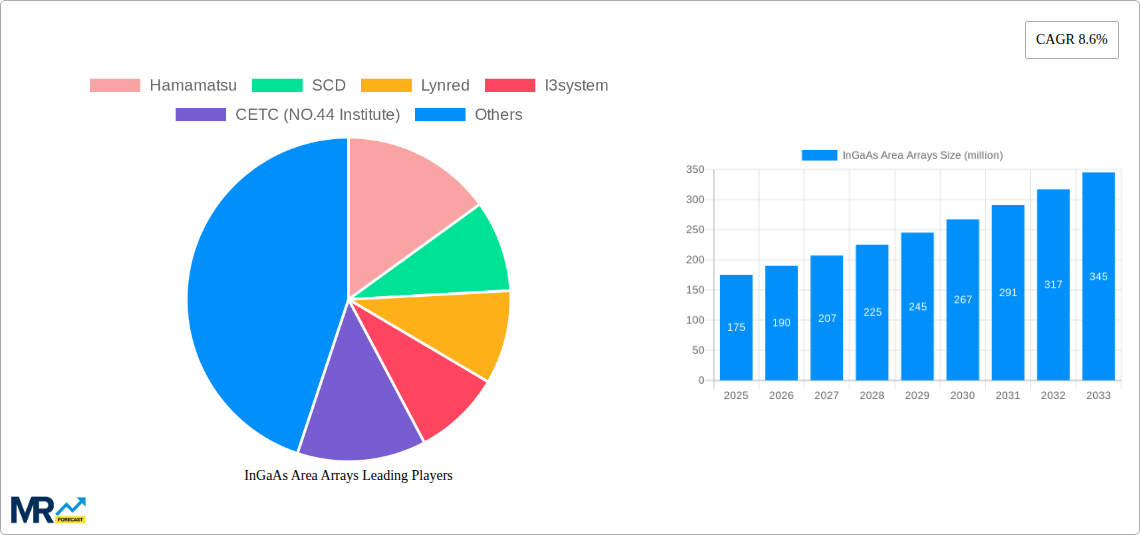

The projected CAGR is approximately 8.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

InGaAs Area Arrays

InGaAs Area ArraysInGaAs Area Arrays by Type (320×256, 640×512, 1280×1026, Others), by Application (Military, Surveillance, Industrial, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The InGaAs (Indium Gallium Arsenide) Area Arrays market is poised for robust expansion, projected to reach an estimated $175 million in 2025, driven by a compelling Compound Annual Growth Rate (CAGR) of 8.6% over the forecast period. This significant growth is fueled by the increasing demand for advanced infrared imaging solutions across a spectrum of critical applications. The military sector stands out as a primary driver, leveraging InGaAs area arrays for enhanced situational awareness, target acquisition, and surveillance in diverse operational environments, including low-light and adverse weather conditions. Surveillance applications, encompassing border security, public safety, and critical infrastructure monitoring, are also exhibiting substantial uptake due to the technology's ability to penetrate obscurants and detect heat signatures. Furthermore, the industrial segment, which includes applications in quality control, non-destructive testing, and process monitoring, is gradually contributing to market expansion as businesses increasingly adopt advanced imaging for operational efficiency and product integrity. The evolving technological landscape, with continuous improvements in sensor sensitivity, resolution, and cost-effectiveness, further bolsters market confidence.

Key trends shaping the InGaAs Area Arrays market include the miniaturization and integration of these sensors into portable and unmanned systems, catering to the growing needs of defense and commercial drone operations. Advancements in SWIR (Short-Wave Infrared) imaging technology are enabling higher resolution and wider spectral range capabilities, opening up new application avenues in areas such as agricultural monitoring, food inspection, and material sorting. The market is also witnessing a rising interest in cost-effective solutions and custom-designed arrays to meet specific application requirements. However, certain restraints, such as the high initial cost of some advanced InGaAs sensor systems and the stringent technical expertise required for their implementation and maintenance, may temper the pace of adoption in certain segments. Geographically, Asia Pacific, particularly China, is expected to be a significant market due to its substantial investments in defense modernization and industrial automation, while North America and Europe remain key markets for advanced surveillance and military applications.

This comprehensive report delves into the dynamic InGaAs (Indium Gallium Arsenide) area array market, providing an in-depth analysis of its trajectory from the historical period of 2019-2024 through to a projected future up to 2033. With the base year set at 2025, the report offers precise estimations for the estimated year 2025 and outlines a detailed forecast for the crucial period of 2025-2033. The market landscape is meticulously examined, considering various key segments including array types such as 320×256, 640×512, 1280×1026, and others, alongside critical applications spanning Military, Surveillance, Industrial, and other sectors. The analysis leverages significant market data, including projections where relevant in the millions of units, to paint a clear picture of market size, growth, and future potential.

The InGaAs area array market is experiencing robust growth driven by increasing demand across a multitude of advanced applications. The global market for InGaAs area arrays is projected to reach approximately 3.5 million units by 2025, with a significant expansion anticipated to exceed 8.0 million units by 2033, showcasing a compound annual growth rate (CAGR) of around 10.5% during the forecast period. This impressive expansion is fueled by the unique spectral response of InGaAs sensors, which excel in the Short-Wave Infrared (SWIR) spectrum (0.9 to 2.5 micrometers), enabling them to "see" through atmospheric obscurants like fog, smoke, and haze, and to detect spectral signatures invisible to the human eye. Consequently, the military and surveillance sectors remain dominant consumers, with an estimated 45% of the market share attributed to these areas in 2025, driven by homeland security, border surveillance, and advanced targeting systems. The industrial segment is rapidly emerging as a key growth driver, projected to capture approximately 30% of the market by 2033, as InGaAs arrays find indispensable roles in process control, quality inspection, and material sorting. Emerging applications in scientific research, environmental monitoring, and autonomous vehicle navigation are also contributing to market diversification and sustained upward momentum. The increasing sophistication of imaging technologies and the continuous miniaturization and cost reduction of InGaAs sensor manufacturing processes are further accelerating market penetration. Furthermore, the growing emphasis on non-destructive testing and remote sensing across various industries is creating a fertile ground for the widespread adoption of InGaAs area arrays, solidifying their position as a critical component in modern optoelectronic systems.

The surging demand for InGaAs area arrays is primarily propelled by the relentless pursuit of enhanced imaging capabilities in challenging environments. The inherent ability of InGaAs sensors to operate effectively in the Short-Wave Infrared (SWIR) spectrum is a paramount advantage, allowing them to penetrate atmospheric conditions like fog, dust, and smoke, which severely degrade the performance of visible light cameras. This capability is crucial for applications where clear imaging is essential, irrespective of environmental obscurants. The escalating global security concerns and the need for advanced surveillance and reconnaissance systems are significantly boosting the military and defense sectors' adoption of InGaAs technology for applications ranging from target acquisition to night vision and perimeter monitoring. Similarly, the surveillance market, encompassing homeland security, border patrol, and critical infrastructure protection, benefits immensely from the SWIR imaging prowess of InGaAs arrays, enabling round-the-clock monitoring and threat detection. Beyond defense, the industrial sector is increasingly leveraging InGaAs arrays for a variety of quality control, process monitoring, and inspection tasks. Their ability to detect subtle spectral differences allows for the identification of material defects, impurities, and variations that are imperceptible to other imaging technologies. The growing implementation in areas like hyperspectral imaging for material analysis, food quality inspection, and pharmaceutical production further underpins this growth.

Despite the promising growth trajectory, the InGaAs area array market faces several challenges and restraints that could temper its expansion. One of the most significant hurdles remains the high manufacturing cost associated with InGaAs materials and fabrication processes. Compared to silicon-based sensors, the production of InGaAs arrays is inherently more complex and resource-intensive, leading to higher unit prices. This cost factor can limit widespread adoption in price-sensitive applications and emerging markets. Furthermore, while advancements are being made, yield rates in large-format, high-resolution InGaAs array production can still be a concern, impacting overall supply and contributing to elevated costs. Another restraint is the limited availability of specialized technical expertise for the design, integration, and application of InGaAs-based systems. Developing and deploying sophisticated SWIR imaging solutions requires a deep understanding of the technology and its nuances, which may not be readily available across all industries. Additionally, competition from alternative imaging technologies, such as uncooled microbolometers or other emerging infrared sensor types, although operating in different spectral ranges, can pose a competitive challenge in specific niche applications where cost or specific performance parameters are prioritized. The ongoing development of improved SWIR detectors based on other materials could also present future competition. Finally, developing standardized interfaces and data processing algorithms for InGaAs area arrays can be complex, requiring significant investment in research and development for various end-user applications.

The InGaAs area array market is characterized by a strong regional concentration and a clear dominance of specific segments, particularly in terms of application and type.

Key Dominating Regions/Countries:

Key Dominating Segments:

The InGaAs area arrays industry is experiencing robust growth fueled by several key catalysts. The escalating global demand for advanced surveillance and defense systems, driven by geopolitical factors, is a primary driver. Furthermore, the expanding adoption of SWIR imaging in industrial automation, quality control, and process monitoring, where subtle spectral differences are critical, significantly contributes to market expansion. Technological advancements leading to improved sensor performance, miniaturization, and cost reduction are making InGaAs arrays more accessible and attractive for a wider range of applications.

This report offers an unparalleled and in-depth exploration of the InGaAs area array market. It provides meticulous market sizing, utilizing millions of units as a key metric, and forecasts for the period 2019-2033, with a precise base year of 2025. The analysis dissects the market by array type (320×256, 640×512, 1280×1026, Others) and application (Military, Surveillance, Industrial, Others), offering granular insights into segment-specific growth and demand. Key players, significant market developments, and the driving forces and challenges shaping the industry are comprehensively covered. This report is designed to equip stakeholders with the strategic intelligence necessary to navigate this rapidly evolving technological landscape, from identifying key regional and segmental dominance to understanding the growth catalysts and competitive dynamics.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.6% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.6%.

Key companies in the market include Hamamatsu, SCD, Lynred, I3system, CETC (NO.44 Institute), NORINCO GROUP (Kunming Institute of Physics), Jiwu Optoelectronic, Sony, GHOPTO, ZKDX, XenICs, Xi'an Leading Optoelectronic Technology.

The market segments include Type, Application.

The market size is estimated to be USD 175 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "InGaAs Area Arrays," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the InGaAs Area Arrays, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.