1. What is the projected Compound Annual Growth Rate (CAGR) of the Infrared Thermal Imager Core Modules?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Infrared Thermal Imager Core Modules

Infrared Thermal Imager Core ModulesInfrared Thermal Imager Core Modules by Type (Cooled Type, Non-cooled Type), by Application (Industrial, Aerospace, Automotive, Medical, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

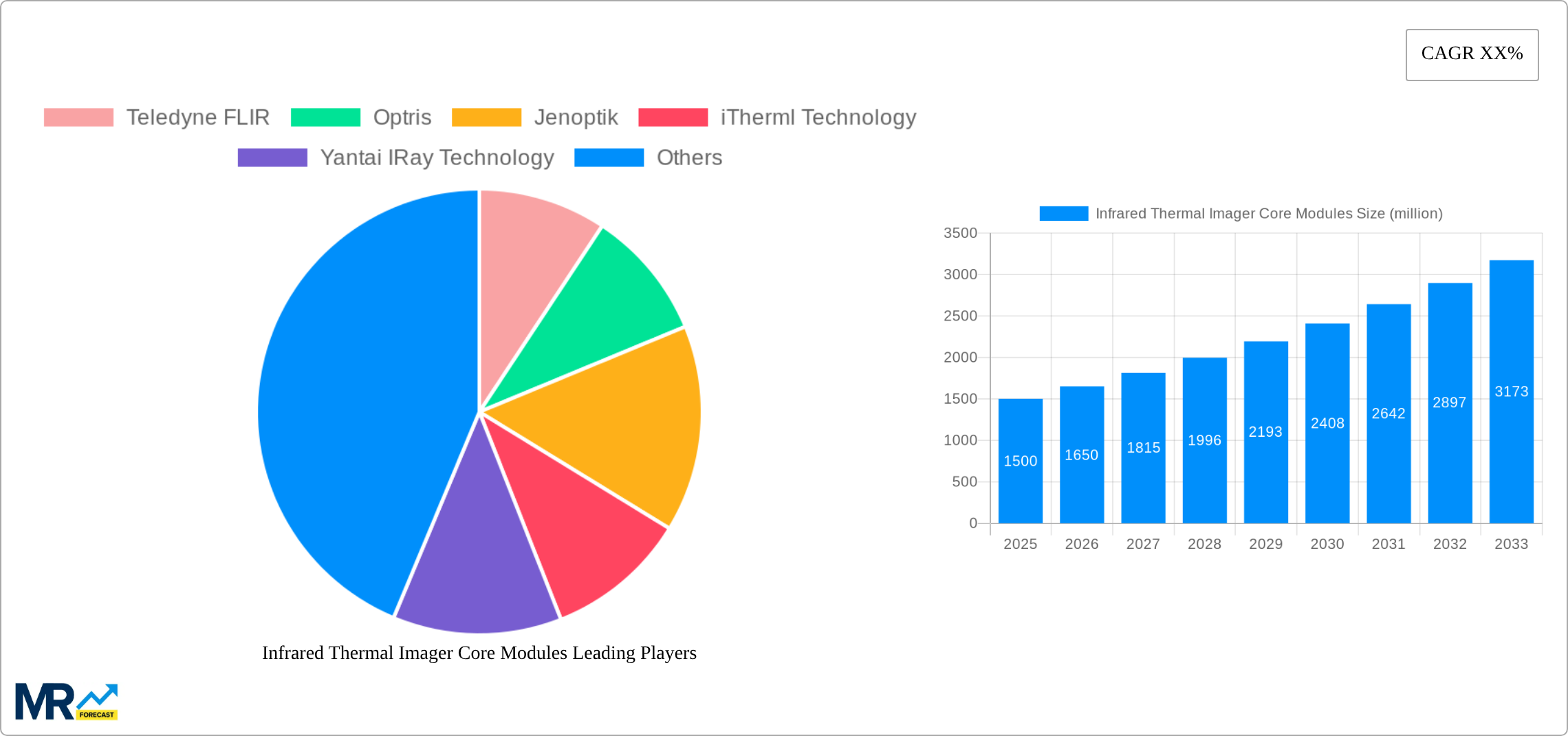

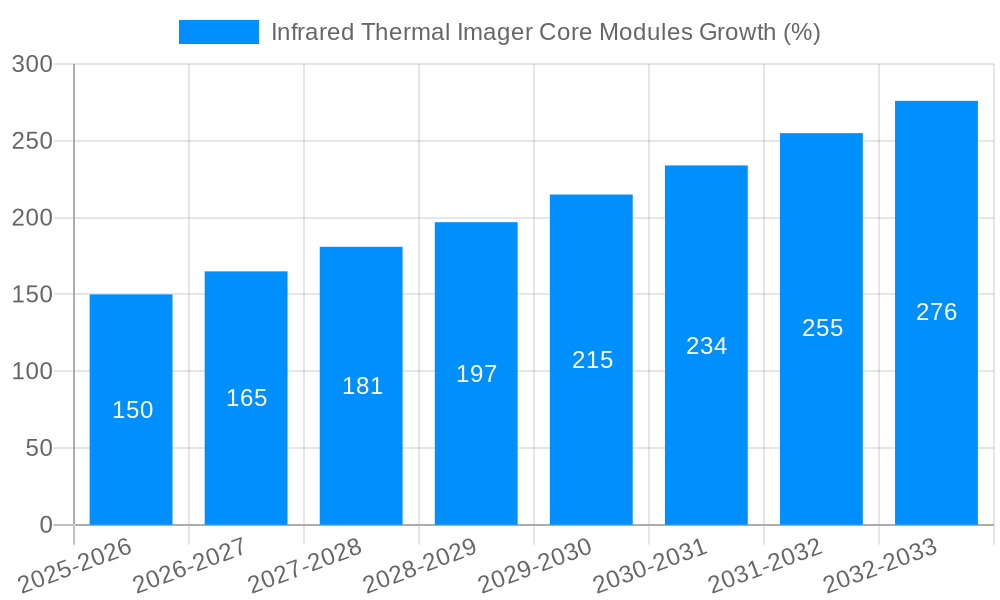

The Infrared Thermal Imager Core Modules market is poised for significant expansion, with an estimated market size of USD 2.5 billion in 2025, projected to grow at a robust Compound Annual Growth Rate (CAGR) of 10.5% through 2033. This impressive growth is propelled by a confluence of escalating demand across diverse industrial sectors, a heightened awareness of the benefits of non-destructive testing and predictive maintenance, and continuous technological advancements leading to more compact, cost-effective, and high-performance imager modules. Key drivers include the increasing adoption of thermal imaging in industrial automation for quality control and process monitoring, the growing need for advanced surveillance and security solutions, and the expanding applications in the automotive sector for enhanced driver-assistance systems and autonomous driving capabilities. Furthermore, the medical industry's utilization of thermal imaging for diagnostics and patient monitoring is also contributing to market momentum.

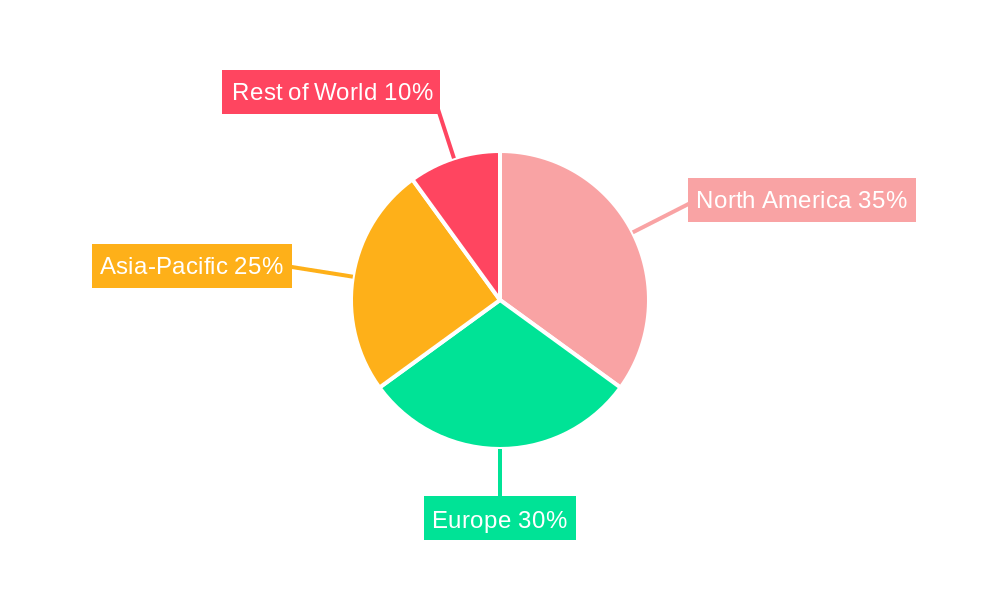

The market landscape is characterized by a dynamic interplay of innovation and competition. The "Cooled Type" segment, while historically dominant due to its superior performance for highly demanding applications like aerospace and defense, is witnessing increasing innovation in "Non-cooled Type" modules, offering a compelling balance of performance and cost-effectiveness for a wider array of industrial and commercial uses. Geographically, Asia Pacific, particularly China, is emerging as a powerhouse in both production and consumption, driven by its massive manufacturing base and rapid adoption of advanced technologies. North America and Europe remain mature markets with sustained demand from established industrial and defense sectors. However, the market is not without its challenges. High initial investment costs for advanced cooled modules and the need for specialized expertise in interpreting thermal data can act as restraints. Nevertheless, ongoing miniaturization, improvements in resolution and sensitivity, and the integration of artificial intelligence for enhanced data analysis are expected to overcome these barriers and fuel sustained market growth.

Here's a unique report description for Infrared Thermal Imager Core Modules, incorporating your specified details and format:

XXX Market Insights: The global Infrared Thermal Imager Core Modules market is projected to experience robust expansion, driven by a confluence of technological advancements and burgeoning application demands. Valued in the hundreds of millions, the market witnessed significant growth during the historical period of 2019-2024, fueled by increasing adoption in industrial automation, security, and emerging fields like autonomous driving. The base year of 2025 serves as a pivotal point, with projections indicating continued upward momentum through the forecast period of 2025-2033. This growth trajectory is intrinsically linked to the decreasing cost and increasing performance of uncooled thermal sensor technology, making infrared imaging more accessible across a wider spectrum of industries. The demand for higher resolution, greater sensitivity, and miniaturized form factors continues to shape product development, pushing manufacturers to innovate relentlessly. Furthermore, the integration of artificial intelligence and machine learning algorithms with thermal imaging data is unlocking new analytical capabilities, thereby expanding the potential applications and market penetration of these core modules. Emerging economies are also playing a crucial role, with rising industrialization and infrastructure development creating substantial demand for advanced inspection and monitoring solutions. The study period of 2019-2033 encapsulates both historical performance and future potential, providing a comprehensive view of the market's dynamic evolution. The Estimated Year of 2025 highlights the current market standing and the immediate outlook for the industry. The intricate interplay between technological innovation, cost-effectiveness, and expanding application frontiers will continue to define the market's landscape in the coming years, with significant opportunities for both established players and new entrants. The overall market size, measured in millions of dollars, is expected to see substantial increments, reflecting the increasing reliance on non-contact thermal measurement and analysis across diverse sectors.

The surge in demand for infrared thermal imager core modules is underpinned by a multifaceted array of driving forces. Foremost among these is the relentless pursuit of enhanced safety and efficiency across industrial sectors. Core modules are instrumental in predictive maintenance, enabling early detection of potential equipment failures through temperature anomalies, thus minimizing downtime and costly repairs. In the realm of security and surveillance, their ability to detect heat signatures in low-light or obscured conditions makes them indispensable for border control, infrastructure monitoring, and public safety initiatives. The burgeoning automotive industry's focus on advanced driver-assistance systems (ADAS) and autonomous driving technologies is another significant catalyst, with thermal imaging playing a critical role in pedestrian detection, animal detection, and enhanced visibility in adverse weather. Furthermore, the increasing awareness and adoption of thermal imaging in medical diagnostics, particularly for non-invasive temperature screening and early disease detection, are contributing to market expansion. The continuous innovation in detector technology, leading to smaller, more power-efficient, and higher-resolution core modules, is democratizing access to thermal imaging and driving its adoption in previously inaccessible applications.

Despite the promising growth trajectory, the infrared thermal imager core modules market is not without its challenges and restraints. A primary concern revolves around the initial cost of high-performance cooled thermal imaging core modules, which can be prohibitive for smaller enterprises or niche applications, thereby limiting widespread adoption in cost-sensitive segments. While uncooled technology has significantly reduced costs, achieving the same level of sensitivity and performance as cooled systems still presents a significant technological hurdle. Furthermore, the complexity of image processing and data interpretation can pose a barrier for some end-users who may lack the specialized expertise required to effectively leverage thermal data. Stringent regulatory compliance in certain application areas, such as medical devices, adds another layer of complexity and can prolong product development cycles. The presence of established players with strong intellectual property portfolios can also create entry barriers for new companies. Finally, market fragmentation and the need for standardization in certain interoperability aspects can sometimes hinder seamless integration and wider adoption across diverse platforms.

The Industrial segment, particularly within the Non-cooled Type of Infrared Thermal Imager Core Modules, is poised to dominate the market, with Asia-Pacific emerging as a key region.

Dominating Segments and Regions:

While other segments and regions like Aerospace, Automotive, and Medical are also crucial and experiencing growth, the sheer volume and breadth of applications within the Industrial sector, coupled with the cost-effectiveness and accessibility of Non-cooled Type modules, will solidify their dominance. The Asia-Pacific region's manufacturing prowess and its expanding industrial base will serve as a powerful engine for this market's overall expansion.

The infrared thermal imager core modules industry is experiencing accelerated growth fueled by several key catalysts. The miniaturization and cost reduction of uncooled microbolometer technology have significantly broadened accessibility, enabling integration into a wider array of devices. Growing mandates for predictive maintenance and energy efficiency across industries are creating a sustained demand for reliable thermal inspection tools. Furthermore, the advancement of AI and machine learning algorithms for image analysis enhances the value proposition by providing deeper insights and automating complex detection tasks. The expanding applications in automotive safety systems, medical diagnostics, and smart home technologies are also acting as significant growth drivers, pushing innovation and market penetration.

This comprehensive report offers an in-depth analysis of the Infrared Thermal Imager Core Modules market, spanning the study period of 2019-2033, with a base year of 2025. It delves into market trends, driving forces such as industrial automation and automotive advancements, and key challenges including cost barriers and technological limitations. The report meticulously identifies dominating segments like Industrial applications and Non-cooled types, along with key regions like Asia-Pacific, and provides detailed market share analysis. Furthermore, it highlights significant growth catalysts, lists leading industry players like Teledyne FLIR and Yantai IRay Technology, and details crucial sector developments year by year. This report is designed to equip stakeholders with critical insights for strategic decision-making in this dynamic and rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Teledyne FLIR, Optris, Jenoptik, iTherml Technology, Yantai IRay Technology, Zhejiang Dali Technology, Wuhan Yoseen Infrared, Wuhan Global Sensor Technology, Guangzhou Purpleriver Electronic Technology, Wuhan Guide Sensmart Tech, Zhejiang ULIRVISION Technology, Shenzhen Dianyang Technology, Dongguan Hampo Electronic, Hangzhou View Sheen Technology, Infrared Cameras, Wuhan Huajingkang Optoelectronics Technology, Accurate Optoelectronics, Leonardo DRS.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Infrared Thermal Imager Core Modules," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Infrared Thermal Imager Core Modules, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.