1. What is the projected Compound Annual Growth Rate (CAGR) of the Head-up Display PGU Module?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Head-up Display PGU Module

Head-up Display PGU ModuleHead-up Display PGU Module by Type (TFT-LCD, DLP, LBS Laser Scanning, LCOS, World Head-up Display PGU Module Production ), by Application (Passenger Vehicles, Commercial Vehicles, World Head-up Display PGU Module Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

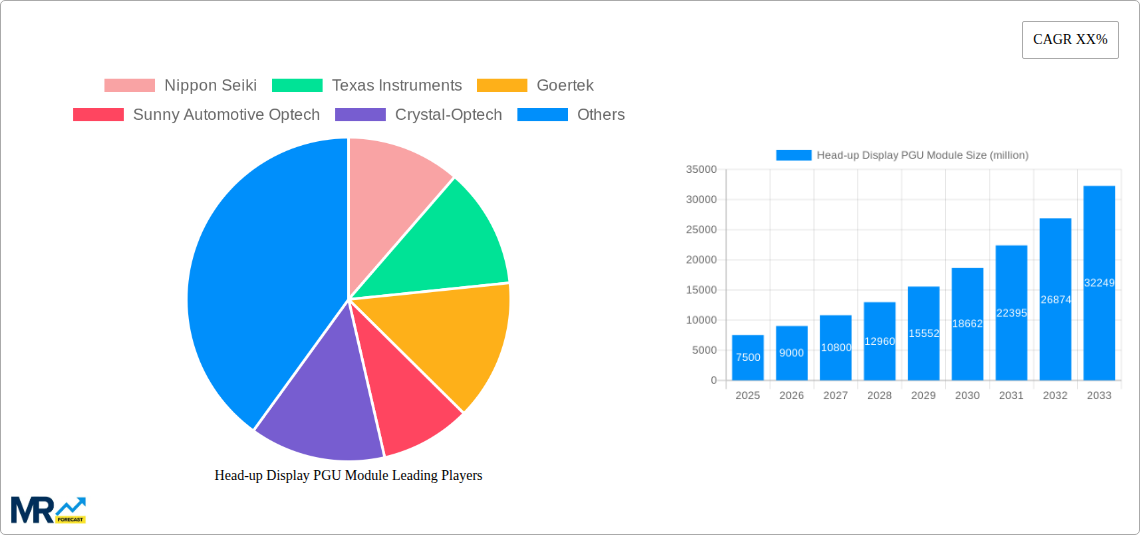

The global Head-up Display (HUD) PGU Module market is poised for significant expansion, projected to reach approximately $7,500 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of around 20% through 2033. This impressive growth is primarily fueled by the increasing demand for advanced driver-assistance systems (ADAS) and enhanced in-car user experiences. Passenger vehicles are the dominant application segment, accounting for a substantial portion of the market, while commercial vehicles are emerging as a key growth area, particularly with the integration of navigation and safety features. The primary technological drivers include the ongoing miniaturization and cost reduction of projection technologies, alongside advancements in augmented reality (AR) capabilities for HUDs. This allows for richer, more intuitive information display for drivers, significantly improving safety and convenience. The market is witnessing a technological race among leading players to develop more sophisticated and energy-efficient PGU modules.

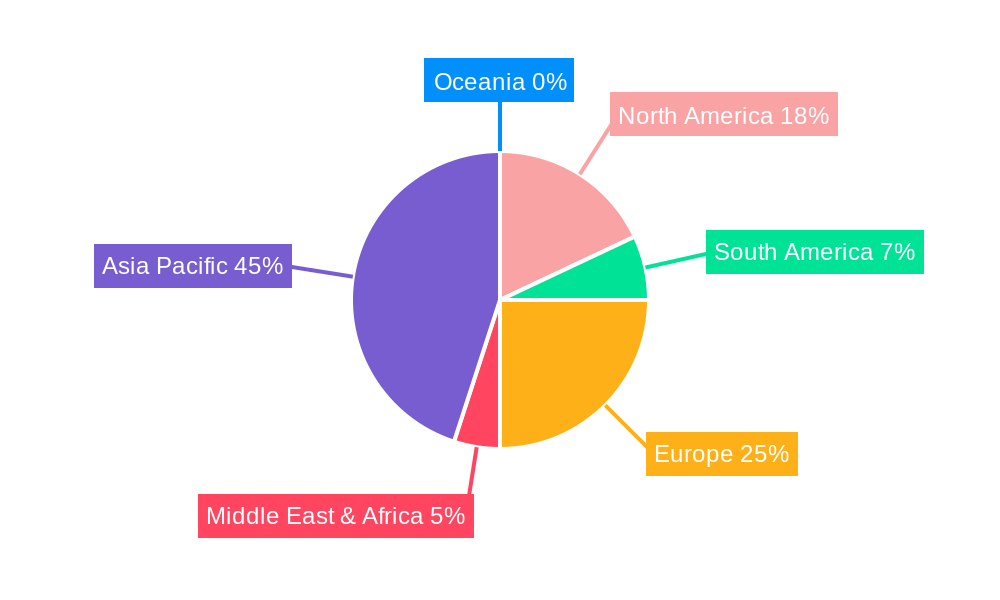

The competitive landscape is characterized by a blend of established automotive suppliers and technology innovators. Key players like Nippon Seiki, Texas Instruments, and Goertek are investing heavily in research and development to enhance display clarity, expand the field of view, and integrate AI-powered features. Emerging trends include the shift towards digital light processing (DLP) and laser scanning (LBS) technologies due to their superior brightness and contrast ratios compared to traditional TFT-LCDs. LCOS technology is also gaining traction for its potential in high-resolution and compact designs. However, challenges such as high initial manufacturing costs for advanced modules and the need for standardization across different vehicle platforms present potential restraints. Geographically, the Asia Pacific region, led by China and Japan, is expected to dominate the market due to its large automotive production base and rapid adoption of new automotive technologies.

This comprehensive report delves into the intricate dynamics of the global Head-up Display (HUD) PGU Module market, providing a forward-looking analysis from 2019 to 2033. With a Base Year of 2025 and an Estimated Year also of 2025, the report meticulously forecasts market trajectories through the Forecast Period of 2025-2033, building upon a robust understanding of the Historical Period from 2019-2024. The market is poised for substantial expansion, driven by technological advancements and increasing consumer demand for sophisticated automotive experiences. The World Head-up Display PGU Module Production is expected to witness significant growth, fueled by its critical role in enhancing driver safety and convenience.

The global Head-up Display PGU Module market is on a trajectory of rapid evolution, fundamentally reshaping the automotive cockpit experience. A key trend defining this landscape is the burgeoning adoption of advanced display technologies, moving beyond basic monochrome projections to vibrant, augmented reality-capable displays. We are witnessing a significant shift towards higher resolutions, enhanced brightness, and wider fields of view, enabling the projection of more detailed and immersive information, such as navigation cues overlaid directly onto the driver's line of sight, speed, and critical vehicle warnings. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into HUD systems is another prominent trend, allowing for personalized information delivery based on driver behavior, environmental conditions, and real-time traffic data. For instance, AI algorithms can predict potential hazards and proactively highlight them on the HUD, thereby enhancing driver awareness and accident prevention.

Furthermore, the miniaturization and cost reduction of PGU (Projection Guidance Unit) modules are democratizing HUD technology, making it accessible for a broader range of vehicle segments, not just premium offerings. This trend is crucial for driving widespread adoption. The report forecasts that by 2025, the market will see a substantial increase in the penetration of HUDs in mid-range and even some economy vehicles. The increasing sophistication of underlying optical components, such as advanced lens arrays and light sources, is also contributing to improved image quality and reduced power consumption, making HUDs a more viable and attractive feature for automakers. The study anticipates that the increasing demand for connected car features will further propel the HUD market, as these displays become the primary interface for delivering crucial data from the vehicle's infotainment and connectivity systems. The evolving regulatory landscape, with a growing emphasis on driver safety, is also indirectly supporting the growth of HUDs as a technology that can significantly reduce driver distraction. The projected market value in the millions underscores the substantial economic significance of these trends. The increasing integration of gesture control and voice command functionalities with HUDs is also creating a more intuitive and seamless user experience, further solidifying its position as a pivotal automotive technology.

The ascent of the Head-up Display PGU Module market is propelled by a confluence of powerful forces, primarily centered around enhancing driver safety and comfort. The inherent ability of HUDs to present critical information directly within the driver's field of view significantly minimizes the need for the driver to divert their gaze from the road. This reduction in eye-off-road time is a critical factor in mitigating accidents caused by momentary distractions. As vehicle speeds increase and the complexity of road infrastructure grows, the demand for intuitive and immediate information delivery systems like HUDs becomes paramount. Furthermore, the increasing prevalence of advanced driver-assistance systems (ADAS) necessitates a sophisticated display solution that can effectively communicate alerts and guidance from these systems, such as lane departure warnings, adaptive cruise control status, and blind-spot alerts.

Beyond safety, the growing consumer appetite for advanced in-car technology and a premium driving experience acts as a significant catalyst. Modern drivers expect their vehicles to be equipped with cutting-edge features that enhance convenience and entertainment. HUDs, with their ability to project not just driving information but also navigation, communication alerts, and even entertainment snippets, contribute significantly to this desired premium feel. The evolution of vehicle interiors towards more minimalist and integrated designs also favors HUDs, as they reduce the need for multiple physical displays and buttons, contributing to a cleaner and more futuristic aesthetic. The increasing connectivity of vehicles, leading to a constant influx of data from external sources, requires an effective way to present this information to the driver without overwhelming them. HUDs serve as an ideal platform for this, offering a consolidated and contextually relevant information hub. The anticipated market value in the millions reflects the significant investment and demand driven by these compelling factors.

Despite the robust growth trajectory, the Head-up Display PGU Module market is not without its hurdles. A primary challenge lies in the cost of integration and manufacturing. While prices are decreasing, the initial investment for automakers to incorporate sophisticated HUD systems, including the PGU modules, remains a significant consideration, particularly for entry-level and mass-market vehicles. This cost factor can slow down the widespread adoption in price-sensitive segments. Furthermore, the technical complexity associated with designing and manufacturing high-performance PGU modules, which require precise optics, powerful processing, and efficient heat dissipation, presents ongoing development challenges. Ensuring consistent image quality across varying lighting conditions, from bright sunlight to dark nighttime driving, without causing glare or eye strain, is a continuous area of research and development.

Another restraint stems from the potential for driver distraction. While designed to reduce distraction, poorly implemented or overly complex HUDs can inadvertently overwhelm the driver with too much information or distracting visual elements. Developing intuitive user interfaces and carefully curating the information displayed are crucial to avoid this pitfall. The standardization of display content and projection methods across different vehicle manufacturers and HUD suppliers is also a nascent challenge. A lack of standardization can lead to fragmented user experiences and hinder seamless integration with third-party applications. The durability and reliability of PGU modules in the harsh automotive environment, subjected to extreme temperatures, vibrations, and humidity, also require continuous innovation and rigorous testing. Lastly, the regulatory landscape surrounding the approval and implementation of in-car display technologies can sometimes be slow to adapt, creating a lag between technological advancements and market deployment. The impact of these challenges on the market value in the millions needs careful consideration.

The global Head-up Display PGU Module market is experiencing a significant surge, with distinct regions and segments poised to lead this expansion.

Key Dominating Segments:

Dominating Regions/Countries:

The interplay between these dominant segments and regions, driven by technological advancements and evolving consumer preferences, will shape the competitive landscape and market value in the millions throughout the forecast period.

Several key factors are acting as significant growth catalysts for the Head-up Display PGU Module industry. The continuous evolution and decreasing cost of display technologies, such as LCOS and DLP, are making HUDs more accessible across vehicle segments. The increasing integration of Augmented Reality (AR) capabilities, allowing for the overlay of virtual information onto the real world, is a major draw for consumers and automakers seeking next-generation driving experiences. Furthermore, the burgeoning demand for connected car features necessitates intuitive ways to communicate data to drivers, a role perfectly fulfilled by HUDs. The growing emphasis on driver safety by regulatory bodies worldwide and the increasing consumer awareness of the safety benefits offered by HUDs are also substantial drivers of adoption.

This report offers an in-depth exploration of the global Head-up Display PGU Module market, providing a holistic view of its current landscape and future potential. The analysis meticulously covers market segmentation by technology type (TFT-LCD, DLP, LBS Laser Scanning, LCOS), application (Passenger Vehicles, Commercial Vehicles), and global production trends. It delves into the key drivers, restraints, opportunities, and challenges that will shape the market's trajectory throughout the forecast period of 2025-2033. The report highlights the dominant regions and countries, alongside the leading market players and their strategic initiatives. With a comprehensive outlook on industry developments and future growth catalysts, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the burgeoning Head-up Display PGU Module market, valued in the millions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Nippon Seiki, Texas Instruments, Goertek, Sunny Automotive Optech, Crystal-Optech, Beijing ASU Tech, Appotronics Corporation.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Head-up Display PGU Module," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Head-up Display PGU Module, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.